The new issue of LBS / LBS.PR.A was priced today at 19.60, compared to its March 26 NAVPU of 18.74. Nice work if you can get it! I have updated the post announcing the offering.

Brookfield Renewable Power Preferred Equity Inc., proud issuer of BRF.PR.A, BRF.PR.C, BRF.PR.E and BRF.PR.F, was confirmed at Pfd-3(high) by DBRS:

DBRS Limited (DBRS) has confirmed the Issuer Rating and the rating on the Senior Unsecured Debentures and Notes of Brookfield Renewable Energy Partners L.P. (BREP or the Company) at BBB (high), and the Class A Preference Shares at Pfd-3 (high), all with Stable trends. The rating actions reflect DBRS’s expectation that BREP will continue to prudently finance its growth initiatives to maintain its deconsolidated key credit metrics in line with the current rating. BREP’s ratings reflect its geographic and resource diversification, and highly contracted portfolio with investment-grade counterparties, while also factoring in the inherent renewable resource risk.

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts off 5bp, FixedResets down 23bp and DeemedRetractibles gaining 6bp. The Performance Highlights table was of normal (for the past four months) size and comprised entirely of FixedResets. Volume was average.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

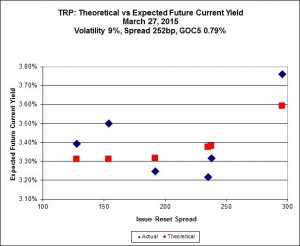

Here’s TRP:

TRP.PR.E, which resets 2019-10-30 at +235, is bid at 24.41 to be $1.16 rich, while TRP.PR.G, resetting 2020-11-30 at +296, is $1.17 cheap at its bid price of 24.93.

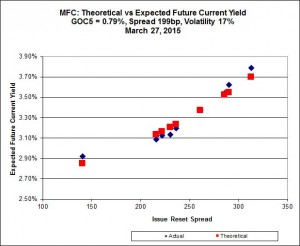

Another excellent fit, but the numbers are perplexing. Implied Volatility for MFC continues to be a conundrum, although it declined substantially today. It is still too high if we consider that NVCC rules will never apply to these issues; it is still too low if we consider them to be NVCC non-compliant issues (and therefore with Deemed Maturities in the call schedule).

Most expensive is MFC.PR.N, resetting at +230 on 2020-3-19, bid at 24.64 to be $0.53 rich, while MFC.PR.H, resetting at +313bp on 2017-3-19, is bid at 25.87 to be $0.64 cheap.

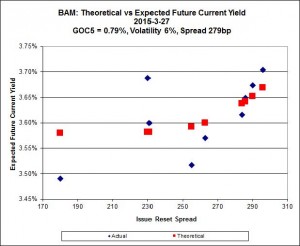

The fit on this series is actually quite reasonable – it’s the scale that makes it look so weird.

The cheapest issue relative to its peers is BAM.PR.R, resetting at +230bp on 2016-6-30, bid at 20.95 to be $0.62 cheap. BAM.PF.E, resetting at +255bp 2020-3-31 is bid at 23.74 and appears to be $0.49 rich.

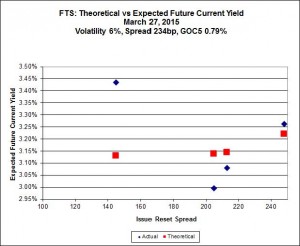

This is just weird because the middle is expensive and the ends are cheap but anyway … FTS.PR.H, with a spread of +145bp, and bid at 16.30, looks $1.59 cheap and resets 2015-6-1. FTS.PR.K, with a spread of +205bp and resetting 2019-3-1, is bid at 23.71 and is $1.08 rich.

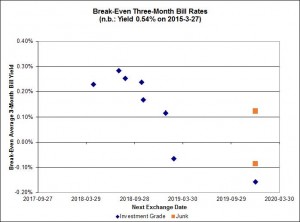

Investment-grade pairs predict an average over the next five years of about 0.20% after a big increase today.TRP.PR.A / TRP.PR.F remains an outlier at -0.16%. The DC.PR.B / DC.PR.D pair is still off the charts and now predicts an average bill rate over the next 4 3/4 years of -2.06%.

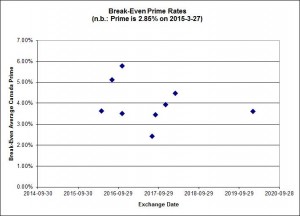

Shall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0644 % | 2,363.0 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0644 % | 4,131.5 |

| Floater | 3.21 % | 3.22 % | 64,992 | 19.19 | 3 | 0.0644 % | 2,512.0 |

| OpRet | 4.07 % | 1.01 % | 110,149 | 0.23 | 1 | 0.1192 % | 2,765.8 |

| SplitShare | 4.36 % | 4.03 % | 32,793 | 3.48 | 4 | 0.2102 % | 3,213.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1192 % | 2,529.1 |

| Perpetual-Premium | 5.31 % | 2.61 % | 58,333 | 0.09 | 25 | 0.0094 % | 2,523.6 |

| Perpetual-Discount | 4.97 % | 4.99 % | 158,961 | 15.21 | 9 | -0.0465 % | 2,815.4 |

| FixedReset | 4.40 % | 3.39 % | 235,021 | 16.75 | 85 | -0.2263 % | 2,423.0 |

| Deemed-Retractible | 4.89 % | -1.13 % | 110,808 | 0.14 | 37 | 0.0629 % | 2,662.9 |

| FloatingReset | 2.42 % | 2.78 % | 80,666 | 6.30 | 8 | 0.2229 % | 2,356.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PF.E | FixedReset | -2.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-27 Maturity Price : 22.66 Evaluated at bid price : 23.74 Bid-YTW : 3.66 % |

| TRP.PR.C | FixedReset | -2.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-27 Maturity Price : 16.64 Evaluated at bid price : 16.64 Bid-YTW : 3.49 % |

| ENB.PR.H | FixedReset | -1.89 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-27 Maturity Price : 18.20 Evaluated at bid price : 18.20 Bid-YTW : 4.23 % |

| ENB.PR.F | FixedReset | -1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-27 Maturity Price : 19.50 Evaluated at bid price : 19.50 Bid-YTW : 4.35 % |

| MFC.PR.M | FixedReset | -1.24 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.65 Bid-YTW : 3.69 % |

| BAM.PR.R | FixedReset | -1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-27 Maturity Price : 20.95 Evaluated at bid price : 20.95 Bid-YTW : 3.79 % |

| MFC.PR.I | FixedReset | -1.07 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-09-19 Maturity Price : 25.00 Evaluated at bid price : 25.77 Bid-YTW : 3.15 % |

| CU.PR.C | FixedReset | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-27 Maturity Price : 23.37 Evaluated at bid price : 24.56 Bid-YTW : 3.19 % |

| CIU.PR.C | FixedReset | 1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-27 Maturity Price : 17.70 Evaluated at bid price : 17.70 Bid-YTW : 3.09 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| MFC.PR.N | FixedReset | 93,275 | Desjardins crossed 26,800 at 24.64. Scotia crossed 40,000 at the same price and bought 15,100 from RBC at 24.60. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.64 Bid-YTW : 3.64 % |

| TRP.PR.D | FixedReset | 76,905 | Nesbitt crossed 66,900 at 24.10. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-27 Maturity Price : 22.80 Evaluated at bid price : 23.90 Bid-YTW : 3.33 % |

| BNS.PR.Y | FixedReset | 63,080 | RBC crossed 40,300 at 22.16. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.17 Bid-YTW : 3.66 % |

| RY.PR.D | Deemed-Retractible | 50,650 | Nesbitt crossed 50,000 at 25.59. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-04-26 Maturity Price : 25.25 Evaluated at bid price : 25.53 Bid-YTW : -4.35 % |

| RY.PR.J | FixedReset | 42,220 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-27 Maturity Price : 23.15 Evaluated at bid price : 25.01 Bid-YTW : 3.39 % |

| TRP.PR.E | FixedReset | 40,392 | Desjardins crossed 25,000 at 24.60. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-27 Maturity Price : 22.98 Evaluated at bid price : 24.41 Bid-YTW : 3.28 % |

| There were 31 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| TRP.PR.F | FloatingReset | Quote: 19.35 – 22.00 Spot Rate : 2.6500 Average : 1.4486 YTW SCENARIO |

| BAM.PF.E | FixedReset | Quote: 23.74 – 24.35 Spot Rate : 0.6100 Average : 0.3693 YTW SCENARIO |

| CGI.PR.D | SplitShare | Quote: 25.30 – 26.10 Spot Rate : 0.8000 Average : 0.6403 YTW SCENARIO |

| SLF.PR.I | FixedReset | Quote: 25.36 – 25.74 Spot Rate : 0.3800 Average : 0.2607 YTW SCENARIO |

| ENB.PR.F | FixedReset | Quote: 19.50 – 19.89 Spot Rate : 0.3900 Average : 0.2729 YTW SCENARIO |

| RY.PR.K | FloatingReset | Quote: 24.17 – 24.45 Spot Rate : 0.2800 Average : 0.1800 YTW SCENARIO |