Nothing much happened today in the continuing saga of the Lisa Cook – Trump lawsuit:

An emergency court hearing over President Donald Trump’s attempt to fire Federal Reserve Governor Lisa Cook ended with no immediate ruling from the judge overseeing the high-stakes legal battle.

US District Judge Jia Cobb spent more than two hours Friday morning hearing arguments over Cook’s request to keep her job on the prominent board while her legal challenge plays out.

…

Cobb has asked for more written arguments to be submitted to her by next Tuesday. It’s possible she rules after then, or takes additional time to sift through how to best proceed with the case. Her options include setting it on an expedited track for a prompt resolution of Cook’s underlying claims.Though Cobb, an appointee of former President Joe Biden, held off for now on making an initial ruling in the case, she also made clear that she wasn’t prepared to fully buy into arguments pushed by either Cook or Trump.

The judge pushed back on a suggestion by Justice Department attorney Yaakov Roth that federal courts have no authority to second-guess a decision by a president to fire a member of the Federal Reserve “for cause.” But even with that judicial power, Cobb said, there still may be some level of deference by a court to the president’s decision-making.

“Deferential doesn’t mean that there’s no probing of it,” the judge said. “You just assume good faith, you defer.”

But Cobb also appeared sympathetic to arguments pushed by Cook’s lawyer, Abbe Lowell, that Cobb wasn’t given adequate notice of Trump’s reason for removing her, as well as an opportunity to defend herself against the fraud allegations underpinning the president’s decision.

“You’re not suggesting what happened here would satisfy due process requirements?” the judge asked Roth at one point.

“Was anything sent to her directly?” she added, referring to the fact that Trump’s had only posted a letter addressed to Cook announcing her firing on social media. “You still have to serve someone. You have to give them information.”

But Lowell ran into issues with Cobb over his argument that Trump’s decision to lean on the fraud allegations was pretextual since he has been vocal about his desire to install members on the board who are more aligned with him on monetary policy.

“I’m unconformable with the pretext argument,” the judge said at one point.

Canada 25Q2 GDP showed a contraction:

The Canadian economy contracted sharply in the second quarter as trade tensions with the United States hammered exports and weighed on business investment.

Real gross domestic product declined 1.6 per cent at an annualized rate, the first quarterly contraction in nearly two years, Statistics Canada reported on Friday.

The result was in line with the Bank of Canada’s projection but considerably worse than Bay Street analysts were anticipating. A Reuters poll ahead of the data expected a 0.6-per-cent decline.

…

The downturn in the second quarter was led by a massive 26.8-per-cent annualized drop in exports as U.S. President Donald Trump’s levies began to bite and tariff front-running in the first quarter went into reverse. Automobile and industrial machinery exports were hit particularly hard. Imports declined 5.1 per cent.The uncertainty created by the trade war also weighed on business investment, which fell at an annualized pace of 10.1 per cent in the second quarter, the worst result since 2016, outside of the COVID-19 pandemic.

Naturally, there was an effect on the market:

Market-implied odds of a quarter-point rate cut by the Bank of Canada next month shot up in the wake of this morning’s weaker-than-expected GDP reading for the second quarter.

…

Money markets were predicting chances of a rate cut on Sept. 17 at close to 40% before the GDP figures were released. They shot up to about 47% after the data were released, implying almost equal odds of whether there will be a rate cut next month or not.Monthly employment and CPI data will still be released before the Bank of Canada will make its decision on a September rate cut.

The Canadian dollar immediately reacted to the data, falling by two-tenths of a cent to 72.55 cents US. It didn’t take long for it, however, to recover.

…

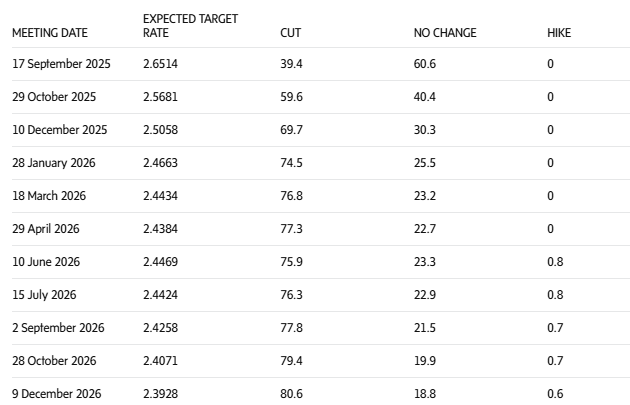

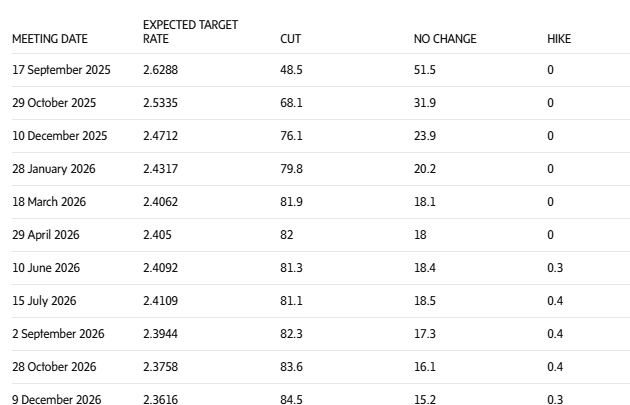

Here’s how implied probabilities of future interest rate moves stood in swaps markets moments [before and] after the 8:30 a.m. data, according to LSEG data. The current overnight rate is 2.75%. While the bank moves in quarter-point increments, credit market implied rates fluctuate more fluidly and are constantly changing. Columns to the right are percentage probabilities of future rate moves.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.83 % | 7.26 % | 37,474 | 13.21 | 1 | -0.6154 % | 2,413.4 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.5826 % | 4,643.0 |

| Floater | 6.54 % | 6.87 % | 46,116 | 12.63 | 3 | 0.5826 % | 2,675.8 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0226 % | 3,651.9 |

| SplitShare | 4.79 % | 4.21 % | 54,454 | 2.36 | 7 | 0.0226 % | 4,361.2 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0226 % | 3,402.8 |

| Perpetual-Premium | 5.80 % | 4.77 % | 68,533 | 0.08 | 2 | 0.0000 % | 3,070.3 |

| Perpetual-Discount | 5.59 % | 5.69 % | 40,993 | 14.32 | 30 | 0.1133 % | 3,350.6 |

| FixedReset Disc | 5.68 % | 6.16 % | 125,174 | 13.36 | 36 | 0.3416 % | 3,030.4 |

| Insurance Straight | 5.47 % | 5.49 % | 54,732 | 14.63 | 18 | -0.4162 % | 3,301.5 |

| FloatingReset | 5.18 % | 3.15 % | 41,880 | 0.09 | 1 | 1.4458 % | 3,809.5 |

| FixedReset Prem | 5.89 % | 5.06 % | 119,952 | 2.45 | 17 | -0.0434 % | 2,626.1 |

| FixedReset Bank Non | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3416 % | 3,097.6 |

| FixedReset Ins Non | 5.26 % | 5.56 % | 71,169 | 14.30 | 15 | 0.6916 % | 3,045.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BN.PF.C | Perpetual-Discount | -2.72 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 20.77 Evaluated at bid price : 20.77 Bid-YTW : 5.95 % |

| BN.PR.M | Perpetual-Discount | -1.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 20.61 Evaluated at bid price : 20.61 Bid-YTW : 5.87 % |

| MFC.PR.B | Insurance Straight | -1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 21.36 Evaluated at bid price : 21.63 Bid-YTW : 5.37 % |

| BN.PR.K | Floater | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 12.87 Evaluated at bid price : 12.87 Bid-YTW : 6.87 % |

| BN.PF.J | FixedReset Disc | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 23.56 Evaluated at bid price : 25.15 Bid-YTW : 6.11 % |

| FFH.PR.G | FixedReset Disc | 1.21 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-09-30 Maturity Price : 25.00 Evaluated at bid price : 25.12 Bid-YTW : 2.98 % |

| ENB.PF.K | FixedReset Disc | 1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 23.40 Evaluated at bid price : 24.80 Bid-YTW : 6.19 % |

| GWO.PR.L | Insurance Straight | 1.24 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-09-28 Maturity Price : 25.00 Evaluated at bid price : 25.07 Bid-YTW : -3.75 % |

| BIP.PR.F | FixedReset Disc | 1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 23.40 Evaluated at bid price : 25.20 Bid-YTW : 5.88 % |

| FFH.PR.H | FloatingReset | 1.45 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-09-30 Maturity Price : 25.00 Evaluated at bid price : 25.26 Bid-YTW : 3.15 % |

| BN.PF.G | FixedReset Disc | 1.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 22.20 Evaluated at bid price : 22.86 Bid-YTW : 6.40 % |

| GWO.PR.G | Insurance Straight | 1.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 23.03 Evaluated at bid price : 23.30 Bid-YTW : 5.57 % |

| BIP.PR.E | FixedReset Prem | 1.74 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 23.47 Evaluated at bid price : 25.04 Bid-YTW : 6.01 % |

| GWO.PR.N | FixedReset Ins Non | 2.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 16.25 Evaluated at bid price : 16.25 Bid-YTW : 6.52 % |

| SLF.PR.H | FixedReset Ins Non | 2.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 21.61 Evaluated at bid price : 22.00 Bid-YTW : 5.67 % |

| MFC.PR.N | FixedReset Ins Non | 3.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 22.56 Evaluated at bid price : 23.47 Bid-YTW : 5.56 % |

| GWO.PR.P | Insurance Straight | 3.48 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 23.99 Evaluated at bid price : 24.24 Bid-YTW : 5.56 % |

| MFC.PR.F | FixedReset Ins Non | 3.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 18.07 Evaluated at bid price : 18.07 Bid-YTW : 5.95 % |

| BN.PR.R | FixedReset Disc | 3.67 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 20.32 Evaluated at bid price : 20.32 Bid-YTW : 6.44 % |

| CU.PR.D | Perpetual-Discount | 10.47 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 21.91 Evaluated at bid price : 22.15 Bid-YTW : 5.55 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| FFH.PR.G | FixedReset Disc | 472,827 | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-09-30 Maturity Price : 25.00 Evaluated at bid price : 25.12 Bid-YTW : 2.98 % |

| TD.PF.E | FixedReset Disc | 119,556 | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-10-31 Maturity Price : 25.00 Evaluated at bid price : 25.02 Bid-YTW : 4.26 % |

| PWF.PR.Z | Perpetual-Discount | 115,800 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 22.31 Evaluated at bid price : 22.68 Bid-YTW : 5.73 % |

| MFC.PR.B | Insurance Straight | 46,565 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 21.36 Evaluated at bid price : 21.63 Bid-YTW : 5.37 % |

| BN.PR.R | FixedReset Disc | 29,100 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 20.32 Evaluated at bid price : 20.32 Bid-YTW : 6.44 % |

| PWF.PR.T | FixedReset Disc | 26,600 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-29 Maturity Price : 23.01 Evaluated at bid price : 24.21 Bid-YTW : 5.58 % |

| There were 12 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| See TMX DataLinx: ‘Last’ != ‘Close’ and the posts linked therein for an idea of why these quotes are so horrible. | ||

| Issue | Index | Quote Data and Yield Notes |

| MFC.PR.B | Insurance Straight | Quote: 21.63 – 23.36 Spot Rate : 1.7300 Average : 1.0696 YTW SCENARIO |

| SLF.PR.D | Insurance Straight | Quote: 21.38 – 22.95 Spot Rate : 1.5700 Average : 0.9770 YTW SCENARIO |

| BN.PF.E | FixedReset Disc | Quote: 21.55 – 25.00 Spot Rate : 3.4500 Average : 3.1151 YTW SCENARIO |

| BN.PF.J | FixedReset Disc | Quote: 25.15 – 26.15 Spot Rate : 1.0000 Average : 0.6971 YTW SCENARIO |

| BN.PF.C | Perpetual-Discount | Quote: 20.77 – 21.56 Spot Rate : 0.7900 Average : 0.4879 YTW SCENARIO |

| GWO.PR.M | Insurance Straight | Quote: 24.73 – 25.35 Spot Rate : 0.6200 Average : 0.4115 YTW SCENARIO |

[…] continue to yield slightly more, in general, than PerpetualDiscounts; on August 29, I reported median YTWs of 6.16% and 5.69%, respectively, for these two indices; compare with mean […]