The TXPR Price Index set a new 52-week high today, of 682.97 vs. the old mark of 682.28 set 2025-10-9.

Canadian inflation ticked up:

The Consumer Price Index rose 2.4 per cent in September on an annual basis, up from August’s 1.9-per-cent pace, Statistics Canada said Tuesday. Financial analysts had expected inflation to land at 2.2 per cent. On a monthly basis and adjusted for seasonality, prices rose 0.4 per cent.

The CPI results were heavily influenced by fluctuations in fuel costs. Year over year, gasoline prices fell by 4.1 per cent in September, but that was less than a 12.7-per-cent decline in August, putting upward pressure on headline inflation.

Excluding gas, consumer prices have risen by 2.6 per cent over the past year, up from 2.4 per cent in August.

After the CPI report, investors were pricing in a 66-per-cent chance that the Bank of Canada cuts interest rates by a quarter-point on Oct. 29, according to Bloomberg data. That’s down from 75-per-cent odds before the report.

…

Inflation has picked up in various categories. For example, grocery prices have risen by 4 per cent over the past year, and growth has been trending higher since April, 2024. Statscan noted that several items – including beef and coffee – have contributed to the upturn.Still, there are signs that Canada isn’t facing a reignited inflation crisis. The Bank of Canada’s core measures of inflation – which strip out volatile movements in the CPI – rose by an annual average of 3.15 per cent in September, a tad higher than 3.1 per cent in August.

The market responded:

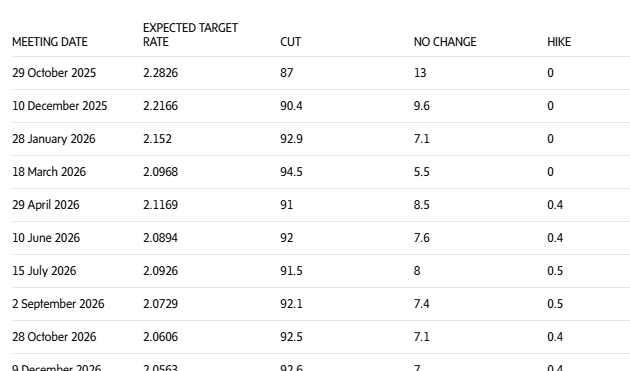

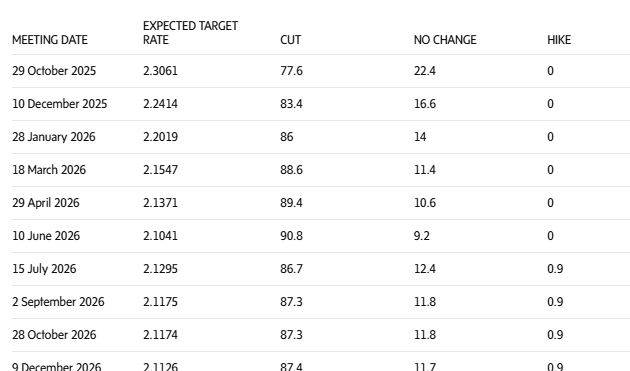

Here, in detail, is how implied probabilities of future interest rate moves stood in swaps markets after the 830 am ET inflation report. The current overnight rate is 2.50%, where it has stood since Sept. 17. While the bank moves in quarter-point increments, credit market implied rates fluctuate more fluidly and are constantly changing. Columns to the right are percentage probabilities of future rate moves.

The terminal rate edged up to 2.11% from 2.06%.

There is, of course, a lot of commentary on social media about housing prices, most of it generated by partisans who assume that the Prime Minister is responsible for every inconvenience in life. Here’s what’s being said in the States:

In the past few weeks, President Trump has blamed America’s largest homebuilders for the country’s housing affordability woes. In a social media post this month, Trump compared homebuilders to oil cartel OPEC, accusing them of sitting on empty lots to keep home prices artificially high.

…

Yet builders and economists say this supply shortage isn’t caused simply by builders sitting on empty lots. They say that building new homes has only gotten harder, slowed by regulation, labor shortages and high financing costs.

…

A study from the National Association of Homebuilders (NAHB) found that nearly 25% of the price of a typical newly built single-family home is due to regulations imposed by state, local and federal governments. The NAHB has lobbied against what it calls “regulatory burdens” around building homes.If land-use regulations were relaxed, an extra 2.5 million more housing units would likely be added over the next decade — eliminating about two-thirds of the estimated housing shortage, according to an analysis by Goldman Sachs.

The analysis also noted that large-scale reform would be “challenging” to implement because most regulations are set at the local level.

…

Oren Amir, founder of Go Home Builders in Los Angeles, said some of his rebuilding projects in Altadena, where residential areas were destroyed by January’s wildfires, have been delayed by conflicting guidance from the city on rooftop solar panel requirements.

…

For example, California Gov. Gavin Newsom, a Democrat, recently signed a bill that overrides local zoning by allowing for more density near transit stops in some California counties. Montana Gov. Greg Gianforte, a Republican, has also enacted laws aimed at increasing housing supply and cutting red tape.But it’s not only governments that slow projects down. There is often community resistance that stalls the building of homes.

That NIMBY, or “not in my back yard,” opposition is driven by a range of concerns, from overcrowding to worries about radically changing the character of communities.

NIMBY concerns are a leading obstacle to adding more housing supply, Donovan said. “We’ve got to get communities to understand we’re not talking building skyscrapers,” he said.

My views on “land use regulations” depend on what precisely is meant. If the regulations (or zoning bylaws, if you consider that different) say ‘you can’t build towers near subways stops or on arterial roads and you can’t build modest apartment buildings in residential neighborhoods’ – then I oppose such regulations. If they say ‘you can’t build sprawling suburbs on greenbelt‘ then I’m all in favour.

Trump’s lost another nominee, but what amused me was his lawyer’s defence of some very dubious social media posts:

“Looks like these texts could be manipulated or are being provided with material context omitted. However, arguendo, even if the texts are authentic, they clearly read as self-deprecating and satirical humor making fun of the fact that liberals outlandishly and routinely call MAGA supporters ‘Nazis,’” Paltzik first told Politico.

I love it! “Could be” and “arguendo” (Fancy Talk meaning ‘for the sake of an argument’)! He said absolutely nothing at all, made no claims whatsoever, but it sounded good!

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.52 % | 6.97 % | 20,781 | 13.52 | 1 | 1.5385 % | 2,465.7 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0000 % | 4,599.7 |

| Floater | 6.27 % | 6.57 % | 55,477 | 13.09 | 3 | 0.0000 % | 2,650.8 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0629 % | 3,672.5 |

| SplitShare | 4.75 % | 4.42 % | 65,854 | 3.30 | 5 | 0.0629 % | 4,385.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0629 % | 3,421.9 |

| Perpetual-Premium | 5.47 % | -9.96 % | 76,143 | 0.09 | 7 | 0.3279 % | 3,106.4 |

| Perpetual-Discount | 5.55 % | 5.58 % | 45,761 | 14.52 | 26 | 0.5152 % | 3,401.3 |

| FixedReset Disc | 5.95 % | 5.86 % | 107,783 | 13.88 | 30 | 0.4229 % | 3,067.9 |

| Insurance Straight | 5.42 % | 5.46 % | 54,190 | 14.69 | 22 | 0.5020 % | 3,355.6 |

| FloatingReset | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.4229 % | 3,649.6 |

| FixedReset Prem | 5.64 % | 4.71 % | 127,682 | 2.38 | 22 | 0.1791 % | 2,630.6 |

| FixedReset Bank Non | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.4229 % | 3,136.0 |

| FixedReset Ins Non | 5.21 % | 5.28 % | 58,544 | 14.65 | 15 | 0.1479 % | 3,073.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| CCS.PR.C | Insurance Straight | -4.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 21.86 Evaluated at bid price : 22.10 Bid-YTW : 5.71 % |

| POW.PR.G | Perpetual-Discount | -1.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 24.19 Evaluated at bid price : 24.45 Bid-YTW : 5.76 % |

| PWF.PR.Z | Perpetual-Discount | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 22.82 Evaluated at bid price : 23.10 Bid-YTW : 5.59 % |

| GWO.PR.T | Insurance Straight | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 23.73 Evaluated at bid price : 24.00 Bid-YTW : 5.41 % |

| SLF.PR.C | Insurance Straight | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 21.62 Evaluated at bid price : 21.87 Bid-YTW : 5.12 % |

| GWO.PR.P | Insurance Straight | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 24.19 Evaluated at bid price : 24.45 Bid-YTW : 5.57 % |

| ENB.PF.C | FixedReset Disc | 1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 21.34 Evaluated at bid price : 21.64 Bid-YTW : 6.24 % |

| GWO.PR.M | Insurance Straight | 1.27 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-11-20 Maturity Price : 25.00 Evaluated at bid price : 25.52 Bid-YTW : -14.68 % |

| POW.PR.D | Perpetual-Discount | 1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 22.61 Evaluated at bid price : 22.86 Bid-YTW : 5.50 % |

| GWO.PR.Q | Insurance Straight | 1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 23.25 Evaluated at bid price : 23.55 Bid-YTW : 5.51 % |

| GWO.PR.R | Insurance Straight | 1.42 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 21.88 Evaluated at bid price : 22.12 Bid-YTW : 5.47 % |

| PWF.PR.H | Perpetual-Premium | 1.53 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-11-20 Maturity Price : 25.00 Evaluated at bid price : 25.29 Bid-YTW : -9.96 % |

| BN.PF.K | Ratchet | 1.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 22.00 Evaluated at bid price : 16.50 Bid-YTW : 6.97 % |

| GWO.PR.G | Insurance Straight | 1.62 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 23.61 Evaluated at bid price : 23.88 Bid-YTW : 5.49 % |

| GWO.PR.H | Insurance Straight | 1.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 22.10 Evaluated at bid price : 22.38 Bid-YTW : 5.46 % |

| PWF.PR.K | Perpetual-Discount | 3.93 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 22.22 Evaluated at bid price : 22.50 Bid-YTW : 5.51 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| FTS.PR.H | FixedReset Disc | 426,800 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 18.86 Evaluated at bid price : 18.86 Bid-YTW : 5.53 % |

| IFC.PR.F | Insurance Straight | 215,300 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 23.80 Evaluated at bid price : 24.10 Bid-YTW : 5.54 % |

| BN.PR.R | FixedReset Disc | 150,000 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 19.96 Evaluated at bid price : 19.96 Bid-YTW : 6.12 % |

| PWF.PR.A | Floater | 110,802 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 14.02 Evaluated at bid price : 14.02 Bid-YTW : 5.99 % |

| ENB.PR.B | FixedReset Disc | 54,300 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 20.51 Evaluated at bid price : 20.51 Bid-YTW : 6.26 % |

| BN.PR.T | FixedReset Disc | 50,600 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-21 Maturity Price : 19.93 Evaluated at bid price : 19.93 Bid-YTW : 6.12 % |

| There were 15 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| See TMX DataLinx: ‘Last’ != ‘Close’ and the posts linked therein for an idea of why these quotes are so horrible. | ||

| Issue | Index | Quote Data and Yield Notes |

| ENB.PR.Y | FixedReset Disc | Quote: 20.50 – 22.00 Spot Rate : 1.5000 Average : 0.8584 YTW SCENARIO |

| MFC.PR.F | FixedReset Ins Non | Quote: 18.18 – 19.90 Spot Rate : 1.7200 Average : 1.1033 YTW SCENARIO |

| GWO.PR.T | Insurance Straight | Quote: 24.00 – 24.76 Spot Rate : 0.7600 Average : 0.5136 YTW SCENARIO |

| GWO.PR.S | Insurance Straight | Quote: 24.20 – 25.00 Spot Rate : 0.8000 Average : 0.5578 YTW SCENARIO |

| CCS.PR.C | Insurance Straight | Quote: 22.10 – 23.30 Spot Rate : 1.2000 Average : 0.9696 YTW SCENARIO |

| MFC.PR.I | FixedReset Ins Non | Quote: 25.41 – 25.98 Spot Rate : 0.5700 Average : 0.3534 YTW SCENARIO |