Canadian Utilities Limited has announced:

it has entered into an agreement with a syndicate of underwriters co-led by BMO Capital Markets and RBC Capital Markets, and including TD Securities Inc., Scotiabank, CIBC Capital Markets, National Bank Financial Inc. and ATB Capital Markets. The underwriters have agreed to buy 7,000,000 5.60% Cumulative Redeemable Second Preferred Shares Series JJ at a price of $25.00 per share for aggregate gross proceeds of $175,000,000. The proceeds will be used for capital expenditures and for other general corporate purposes.

Canadian Utilities has granted the Underwriters an option, exercisable, in whole or in part, at any time until and including 30 days following the closing of the offering, to purchase, at the offering price, an additional 1,050,000 Series JJ Preferred Shares, to cover over-allotments, if any. Should the over-allotment option be fully exercised, the total gross proceeds of the Series JJ Preferred Share offering will be $201,250,000.

The Series JJ Preferred Shares will be issued to the public at a price of $25.00 per share and holders will be entitled to receive fixed cumulative preferential cash dividends, payable quarterly, as and when declared by the Board of Directors of the Corporation, at an annual rate of $1.40 per share, to yield 5.60% annually. On or after March 1, 2031, the Corporation may redeem the Series JJ Preferred Shares in whole or in part from time to time, at $26.00 per share if redeemed during the 12 months commencing March 1, 2031, at $25.75 per share if redeemed during the 12 months commencing March 1, 2032, at $25.50 per share if redeemed during the 12 months commencing March 1, 2033, at $25.25 per share if redeemed during the 12 months commencing March 1, 2034, and at $25.00 per share if redeemed on or after March 1, 2035, in each case together with all accrued and unpaid dividends up to, but excluding, the date fixed for redemption.

The offering is being made in all of the provinces of Canada by means of a short form prospectus. The closing date of the offering is expected to be on or about November 27, 2025.

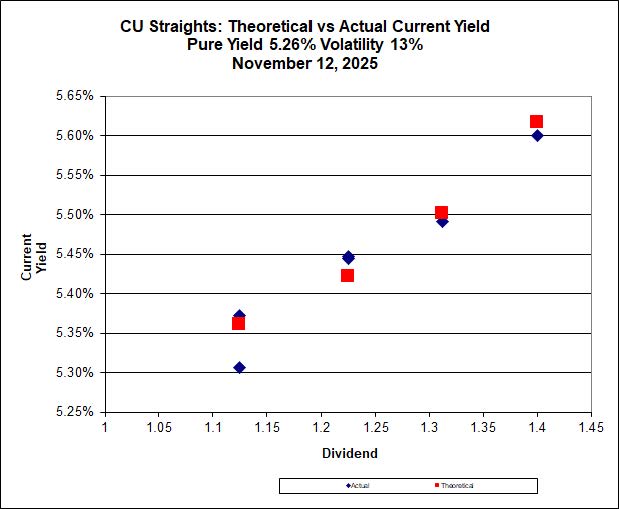

The issue looks fairly priced according to Implied Volatility Theory:

Thanks to Assiduous Reader skeptical111 for bringing this to my attention!

Update 2025-11-27 The prospectus is available on SEDAR+, but I am not permitted to link to this public document because this might hurt profits of the regulators’ future employers. Search for:

Canadian Utilities Limited / Canadian Utilities Limited (000005556)

Final short form prospectus – English.pdf

25 Nov 2025 13:33 ESTNovember 25 2025 at 13:33:59 Eastern Standard Time

Alberta

551 KB

Generate URL

Redemption provisions are:

The Series JJ Preferred Shares will not be redeemable prior to March 1, 2031. On or after March 1, 2031, the Corporation may, on not less than 30 nor more than 60 days’ notice, redeem the Series JJ Preferred Shares in whole or in part, at the Corporation’s option, by the payment in cash of $26.00 per Series JJ Preferred Share if redeemed on or after March 1, 2031 and prior to March 1, 2032, at $25.75 per Series JJ Preferred Share if redeemed on or after March 1, 2032 and prior to March 1, 2033, at $25.50 per Series JJ Preferred Share if redeemed on or after March 1, 2033 and prior to March 1, 2034, at $25.25 per Series JJ Preferred Share if redeemed on or after March 1, 2034 and prior to March 1, 2035 and at $25.00 per Series JJ Preferred Share if redeemed on or after March 1, 2035, in each case together with all accrued and unpaid dividends up to but excluding the date fixed for redemption. See “Details of the Offering”.

and:

Assuming an issue date of November 27, 2025 the initial dividend, if declared, will be payable on March 1, 2026 and will be $0.36055 per Series JJ Preferred Share.

Another one from power corp @5.65%.

Wealthsimple investments better work out well.

https://finance.yahoo.com/news/power-corporation-announces-issue-preferred-145300198.html

[…] CU.PR.K is a Straight Perpetual, 5.60%, announced 2025-11-12. […]