Brookfield Corporation has announced:

that it has agreed to issue 8,000,000 Class A Preference Shares, Series 54 (“Preferred Shares, Series 54”) on a bought deal basis to a syndicate of underwriters (the “Underwriters”) led by Scotiabank, BMO Capital Markets, CIBC Capital Markets, National Bank Financial Inc., RBC Capital Markets and TD Securities Inc. for distribution to the public. The Preferred Shares, Series 54 will be issued at a price of C$25.00 per share, for aggregate gross proceeds of C$200,000,000 (the “Offering”). Holders of the Preferred Shares, Series 54 will be entitled to receive a cumulative quarterly fixed dividend yielding 5.65% annually for the initial period ending December 31, 2030. Thereafter, the dividend rate will be reset every five years at a rate equal to the greater of: (i) the 5-year Government of Canada bond yield plus 2.80% and (ii) 5.65%.

In connection with the Offering, Brookfield has granted the Underwriters an option, exercisable until 48 hours prior to closing, to purchase up to an additional 2,000,000 Preferred Shares, Series 54 which, if exercised, would increase the gross offering size to C$250,000,000. The Preferred Shares, Series 54 will be offered in all provinces of Canada by way of a supplement (the “Prospectus Supplement”) to Brookfield’s existing short form base shelf prospectus dated May 31, 2024 (the “Base Shelf Prospectus”). The Preferred Shares, Series 54 may not be offered or sold in the United States or to U.S. persons absent registration or an applicable exemption from the registration requirements under the U.S. Securities Act.

…

The Offering is expected to close on or about November 26, 2025.

Proceeds will be used to redeem BN.PF.H, either in whole or in part; this is discussed in the dedicated post BN.PF.H To Be (Partly?) Redeemed.

The initial dividend (it could reasonably be either a long or short first coupon) has not yet been specified.

It’s a pity that this issue comes with (an expensive!) minimum reset guarantee. This may indicate that these awful things have become standard.

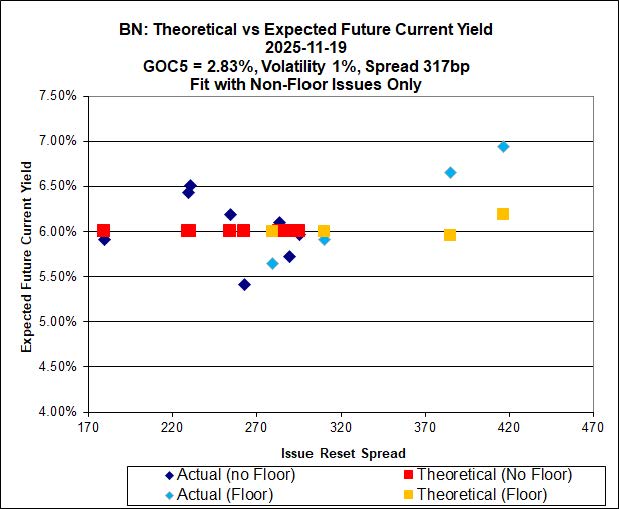

Expensive? Have a look at the Implied Volatility for FixedResets chart:

Implied Volatility Theory, as it currently stands, assigns no value to the minimum rate guarantee. Whatever one’s views might be regarding the value of a guarantee that dividends will be based on a minimum basis level of 1% (as a substitute for GOC-5, if it is higher), it is clear that a guarantee of 2.85% is much more meaningful … so, until I figure out some way of estimating that value, we’ll all have to guess!

However, one can see at a glance that at market prices (assigning a 25.00 market value to the new issue) the rate guarantee costs about 35bp of yield when compared to the average for the BN FixedResets, and more like 85bp of yield when compared to the cheap ones, BN.PR.R and BN.PR.T. That’s a lot!

S&P has announced:

S&P Global Ratings today assigned its ‘BBB/P-2′ issue rating to Brookfield Corp.’s proposed class A preferred shares, series 54. We expect that the issuance size will be up to C$250 million, inclusive of a C$50 million underwriters’ option.

Brookfield intends to use the proceeds to redeem a minimum of C$200 million of its outstanding class A preference shares, series 44 for cash on Dec. 31, 2025. If the underwriters’ option is exercised in full, Brookfield intends to redeem all of the series 44 preference shares.

The proposed series 54 preference shares have a five-year noncall, and together with Brookfield’s existing hybrids, they make up less than 15% of total capitalization. We assigned intermediate (50%) equity credit to this issuance. In our calculation of Brookfield’s key ratios, we will treat half of the issued amount as debt and half as equity, and half of the interest as interest expense and half as dividends.

Pro forma for the proposed issuance, we estimate that Brookfield’s weighted (20% for 2024, 40% for 2025, and 40% for 2026) net debt to EBITDA will be approximately 2.2x, within our expected range of 2.0x-3.0x and with a solid cushion to our downside threshold of 3.5x.

Thanks to Assiduous Reader P_I for bringing this to my attention!

Update, 2025-11-26: The issue has settled, with the ticker BN.PF.M, as noted by Assiduous Reader Brian in the comments.

The prospectus supplement can be found on Sedar+ by searching for “Brookfield Corporation / Brookfield Corporation (000007472)

Prospectus (non pricing) supplement (other than ATM) – English.pdf

21 Nov 2025 18:11 ESTNovember 21 2025 at 18:11:31 Eastern Standard Time

Ontario

266 KB

Generate URL”

I am not permitted to link directly to this public document, as the Canadian Securities Administrators want to help their future employers at the Toronto Stock Exchange with its profits by restricting access as much as might be plausibly justified.

Anyway, the immediately important information in this document is:

- The initial dividend will (presumably) be payable 2026-3-31 at 0.4837. A long first coupon can occasionally lead to trading opportunities!

- The first Exchange Date (which, by my definition, is the first date that a reset rate becomes effective) is 2031-1-1

The ticker for this new Brookfield issue is BN.pf.M. It started trading today (currently $25.25).

Interesting to note that the shares appeared in my TD account yesterday (before they were trading) with a price of $24.63. Perhaps this is what TD paid Brookfield for the shares??

[…] BN.PF.M is a FixedReset, 5.65%+280M565, announced 2025-11-19. […]