The Boston Fed has published a Current Policy Perspective by Anat Bracha and Jenny Tang titled Shaping the Future of Work: Workers’ Optimism and Pessimism about AI:

Key Takeaways:

- Only about 10% of survey respondents expected their financial well-being to worsen within the next year (2025) due to AI; 21% expected it to worsen in one to five years (through 2029).

- Roughly 11% of the workers in the survey anticipated some negative impact of AI on their job prospects; 5% were worried about job loss specifically.

- According to the survey, 49% of workers were confident they could adapt to AI with proper training; only 29% expected they could do so on their own.

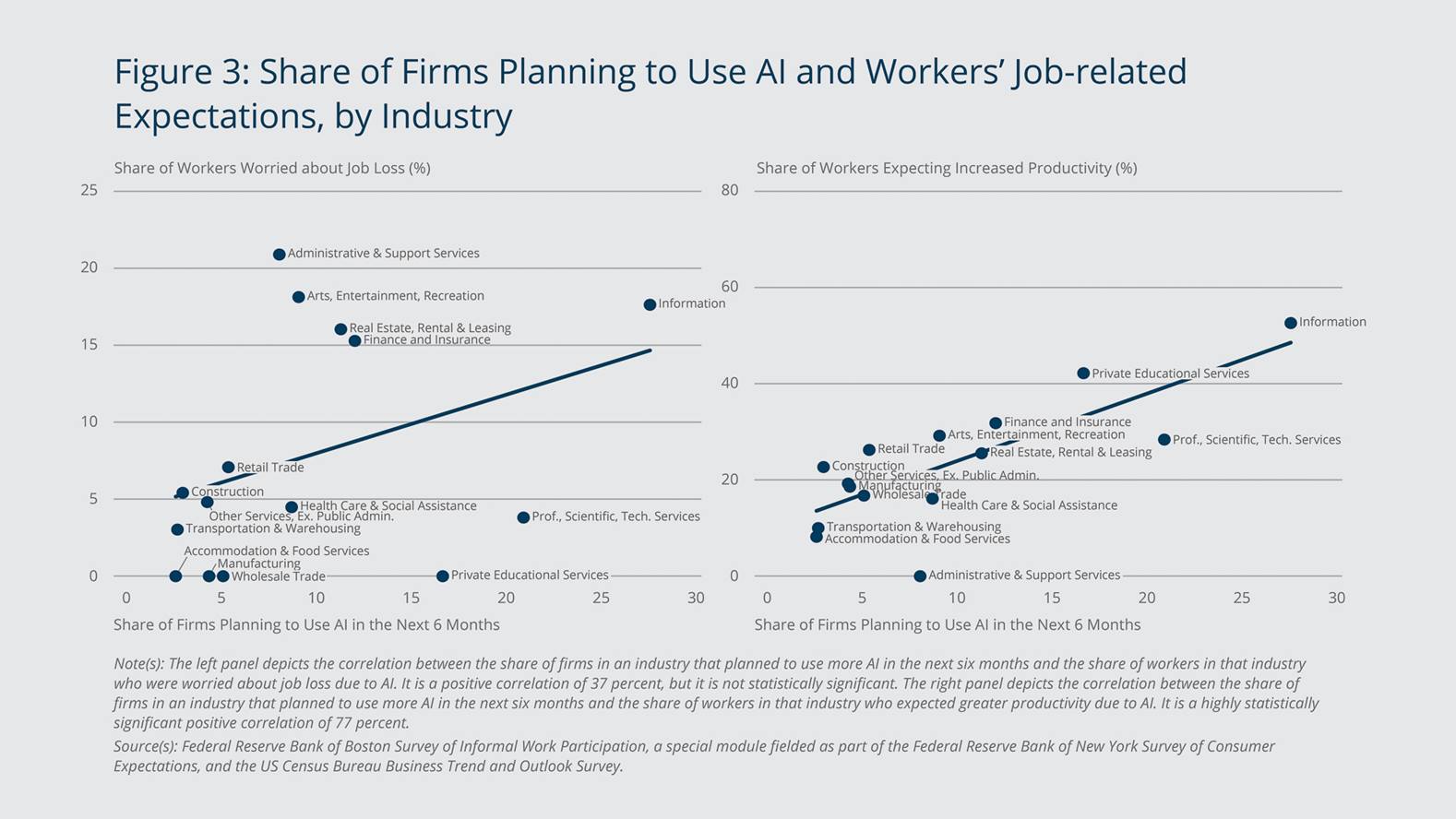

- The expected effects of AI varied considerably across industries and educational levels, with workers in industries planning to expand AI use more worried about job loss.

I liked this chart:

Collectively, the results from the two surveys indicate that while overall worry about job loss due to AI did not seem to be acute at the end of last year, the intensity varied across industries and related mildly to the extent to which an industry planned to use AI.

While many workers in our survey were worried about how AI could affect their job, others indicated that they expect it will bring increased productivity and new opportunities; 22 percent of workers anticipated boosts to productivity, and 10 percent expected to have new AI-driven job or business opportunities.

As with pessimism about AI, optimism varied substantially across industries. The shares of workers expecting AI-related productivity boosts were the largest in information (53 percent), private educational services (42 percent), and finance and insurance (32 percent). Expectations of greater productivity are related positively to the share of an industry’s firms that expected to use more AI in the next six months, as recorded in the BTOS at the end of 2024. This relationship is seen in the right panel of Figure 3. The correlation is strong at 77 percent, and it is highly statistically significant.

PerpetualDiscounts now yield 5.64%, equivalent to 7.33% interest at the standard conversion factor of 1.3x. Long corporates yielded 4.94% on 2025-12-18, while the price ZLC changed from 15.15 on 2025-12-17 to 15.21 on 2025-12-18, a gain of 40bp in price. Given a “Duration” of 12.29 for the ZLC portfolio (BMO does not specify which duration they report; I am assuming Modified), this implies that portfolio yield fell 3bp from 12/17 to 12/18, implying a yield of 4.97% on 2025-12-17. Therefore the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) has narrowed slightly (and perhaps spuriously) to 235bp from the 240bp reported December 10.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2287 % | 2,420.9 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2287 % | 4,590.3 |

| Floater | 5.95 % | 6.16 % | 63,362 | 13.73 | 3 | -0.2287 % | 2,645.4 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1334 % | 3,672.5 |

| SplitShare | 4.75 % | 4.14 % | 75,177 | 1.16 | 5 | -0.1334 % | 4,385.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1334 % | 3,421.9 |

| Perpetual-Premium | 5.66 % | 0.15 % | 86,767 | 0.09 | 7 | -0.1856 % | 3,103.5 |

| Perpetual-Discount | 5.58 % | 5.64 % | 54,612 | 14.38 | 26 | -0.5419 % | 3,391.0 |

| FixedReset Disc | 5.84 % | 6.03 % | 108,713 | 13.64 | 31 | -0.0652 % | 3,126.1 |

| Insurance Straight | 5.46 % | 5.48 % | 57,863 | 14.71 | 21 | 0.9717 % | 3,324.3 |

| FloatingReset | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0652 % | 3,718.8 |

| FixedReset Prem | 5.91 % | 4.51 % | 99,430 | 2.54 | 20 | -0.0941 % | 2,656.2 |

| FixedReset Bank Non | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0652 % | 3,195.5 |

| FixedReset Ins Non | 5.28 % | 5.56 % | 80,848 | 14.39 | 13 | -0.1460 % | 3,107.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| CU.PR.G | Perpetual-Discount | -19.98 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 16.50 Evaluated at bid price : 16.50 Bid-YTW : 6.90 % |

| CU.PR.C | FixedReset Disc | -2.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 23.47 Evaluated at bid price : 23.90 Bid-YTW : 5.67 % |

| MFC.PR.C | Insurance Straight | -1.75 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 21.59 Evaluated at bid price : 21.85 Bid-YTW : 5.16 % |

| FTS.PR.H | FixedReset Disc | -1.67 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 18.80 Evaluated at bid price : 18.80 Bid-YTW : 5.89 % |

| SLF.PR.G | FixedReset Ins Non | -1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 19.00 Evaluated at bid price : 19.00 Bid-YTW : 5.77 % |

| POW.PR.H | Perpetual-Premium | -1.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 24.82 Evaluated at bid price : 25.23 Bid-YTW : 5.81 % |

| BN.PF.E | FixedReset Disc | -1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 22.25 Evaluated at bid price : 22.88 Bid-YTW : 5.96 % |

| ENB.PF.K | FixedReset Prem | -1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 23.57 Evaluated at bid price : 25.10 Bid-YTW : 6.16 % |

| BN.PF.J | FixedReset Prem | -1.15 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2027-12-31 Maturity Price : 25.00 Evaluated at bid price : 25.90 Bid-YTW : 4.28 % |

| ENB.PR.D | FixedReset Disc | -1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 21.08 Evaluated at bid price : 21.08 Bid-YTW : 6.46 % |

| BN.PR.N | Perpetual-Discount | 1.82 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 20.71 Evaluated at bid price : 20.71 Bid-YTW : 5.76 % |

| BN.PF.F | FixedReset Disc | 2.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 23.05 Evaluated at bid price : 24.40 Bid-YTW : 5.97 % |

| MFC.PR.L | FixedReset Ins Non | 2.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 23.14 Evaluated at bid price : 24.56 Bid-YTW : 5.35 % |

| GWO.PR.M | Insurance Straight | 2.80 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2026-01-16 Maturity Price : 25.00 Evaluated at bid price : 25.70 Bid-YTW : -28.32 % |

| IFC.PR.I | Insurance Straight | 11.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 24.37 Evaluated at bid price : 24.66 Bid-YTW : 5.48 % |

| GWO.PR.Y | Insurance Straight | 13.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 20.80 Evaluated at bid price : 20.80 Bid-YTW : 5.43 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| POW.PR.I | Perpetual-Premium | 115,450 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 24.62 Evaluated at bid price : 25.02 Bid-YTW : 5.69 % |

| BN.PF.E | FixedReset Disc | 78,300 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 22.25 Evaluated at bid price : 22.88 Bid-YTW : 5.96 % |

| BN.PF.M | FixedReset Prem | 50,200 | YTW SCENARIO Maturity Type : Call Maturity Date : 2031-01-01 Maturity Price : 25.00 Evaluated at bid price : 25.86 Bid-YTW : 4.97 % |

| FFH.PR.I | FixedReset Disc | 48,000 | YTW SCENARIO Maturity Type : Call Maturity Date : 2026-01-30 Maturity Price : 25.00 Evaluated at bid price : 24.97 Bid-YTW : 5.05 % |

| ENB.PF.C | FixedReset Disc | 21,000 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 21.92 Evaluated at bid price : 22.35 Bid-YTW : 6.32 % |

| ENB.PF.E | FixedReset Disc | 20,900 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-12-17 Maturity Price : 21.87 Evaluated at bid price : 22.30 Bid-YTW : 6.32 % |

| There were 10 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| See TMX DataLinx: ‘Last’ != ‘Close’ and the posts linked therein for an idea of why these quotes are so horrible. | ||

| Issue | Index | Quote Data and Yield Notes |

| CU.PR.G | Perpetual-Discount | Quote: 16.50 – 21.12 Spot Rate : 4.6200 Average : 2.6414 YTW SCENARIO |

| ENB.PF.C | FixedReset Disc | Quote: 22.35 – 24.50 Spot Rate : 2.1500 Average : 1.2973 YTW SCENARIO |

| CU.PR.C | FixedReset Disc | Quote: 23.90 – 24.85 Spot Rate : 0.9500 Average : 0.6239 YTW SCENARIO |

| BN.PR.R | FixedReset Disc | Quote: 20.74 – 21.75 Spot Rate : 1.0100 Average : 0.8232 YTW SCENARIO |

| IFC.PR.G | FixedReset Ins Non | Quote: 25.06 – 25.68 Spot Rate : 0.6200 Average : 0.4346 YTW SCENARIO |

| FTS.PR.J | Perpetual-Discount | Quote: 22.56 – 23.10 Spot Rate : 0.5400 Average : 0.3623 YTW SCENARIO |

[…] PerpetualDiscounts now yield 5.63%, equivalent to 7.32% interest at the standard conversion factor of 1.3x. Long corporates yielded 4.88% on 2025-12-24. Therefore the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) has widened to 245bp from the 235bp reported December 17. […]