The Federal Deposit Insurance Corporation has announced the release of the 4Q08 Banking Profile, containing two feature articles:

The guts of the full report is the report of banking system statistical information, which begins with the cheery sentence:

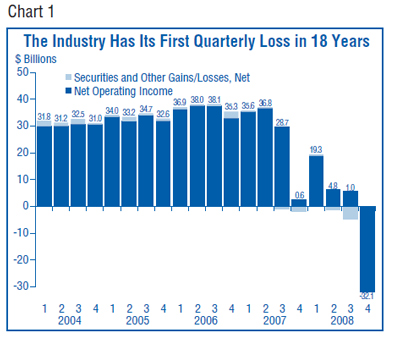

FDIC-insured institutions reported a net loss of $32.1 billion in the fourth quarter of 2008, a decline of $32.7 billion from the $575 million that the industry earned in the fourth quarter of 2007 and the first quarterly loss since 1990. Rising loan loss provisions, large writedowns of goodwill and other assets, and sizable losses in trading accounts all contributed to the industry’s net loss. More than two-thirds of all insured institutions were profitable in the fourth quarter, but their earnings were outweighed by large losses at a number of big banks.

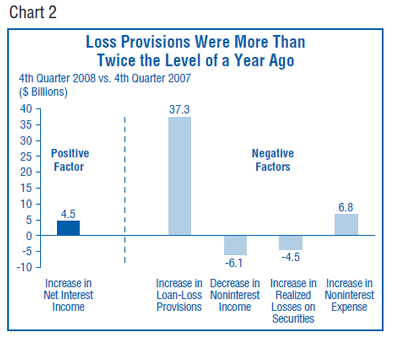

Chart 2 looks like it was prepared by a graphic artist who didn’t really know what the data meant, but the important information can be puzzled out:

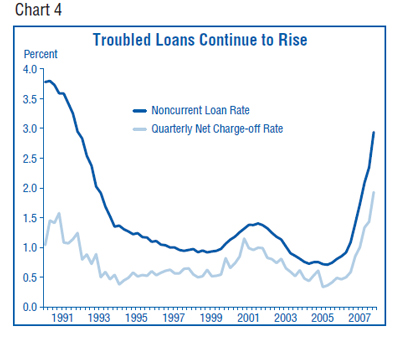

Assiduous Readers will remember I have taken a certain amount of glee in pointing out that the story so far is still not as bad as the Recession of 1990 (you young whipper-snappers) … but we’re getting there, at least in the States:

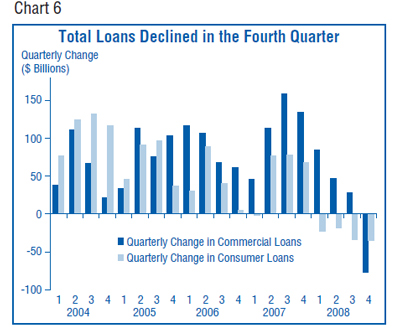

… with the result that those who blithely assumed refinancing risk are feeling a little nervous:

Note that the release of the statistical data has been previously discussed on PrefBlog.