More evidence that the credit markets are mending, this time from the CDO market:

A “remarkable change” in investor sentiment has doubled the price of some collateralized loan obligation securities in the past month, according to Morgan Stanley analysts.

CLOs are a type of collateralized debt obligation that pool high-yield, high-risk, or junk, loans and slice them into securities of varying risk and return. Pieces graded AA, the third highest-level of investment grade, rose from 23 cents on the dollar to 47 cents in the past month, Morgan Stanley analysts led by Vishwanath Tirupattur wrote in a June 5 report. Securities ranked A have gained 13 cents from 10 cents since the end of last month, the report said.

Ares Management LLC and Boston-based Sankaty Advisors LLC are among investors that started bidding on CLO securities in late April and the first week of May. Prices for the single-A portions had dropped 90 percent since the financial crisis began in 2007 even as the loans packaged in them had regained some their value. The S&P/LSTA U.S. Leveraged Loan 100, an index of loans rated below investment grade, rose 12 cents from Dec. 31 to 73.6 cents on the dollar on May 1. Loans have since increased in value to 79 cents.

“The continuing rally in underlying leveraged loans has been a major driver of this change in investor sentiment,” on CLOs, the analysts wrote in the report. A “fierce rally” is under way, they wrote.

The top-rated CLO bonds have risen from 71 cents on the dollar to 77 cents since May, the report said.

At the same time, hedge fund financing is getting a little harder:

HSBC Holdings Plc’s U.S. securities division will no longer extend structured financing to hedge-fund investors to leverage their investments, a person familiar with the company’s plans said.

The bank is halting the financing by its structured-funds products division and eliminating an unspecified number of jobs in New York, said the person, who asked not to be identified because the information hasn’t been made public. The group reports to Steven Phan, global head of the investment access and solutions groups in London, the person said. Phan declined to comment.

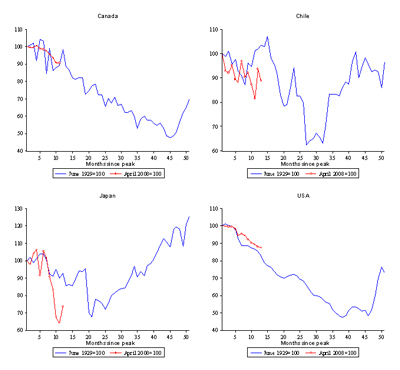

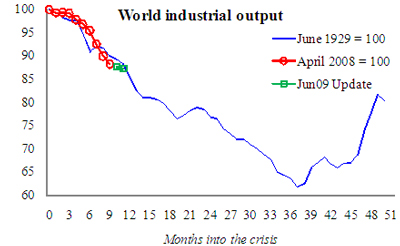

Remember those charts comparing the current bear to others? They’re looking a lot better now, but into the breach step Barry Eichengreen & Kevin H. O’Rourke, just in case anybody’s feeling cheerful, with a piece on VoxEU A Tale of Two Depressions:

This is an update of the authors’ 6 April 2009 column comparing today’s global crisis to the Great Depression. World industrial production, trade, and stock markets are diving faster now than during 1929-30. Fortunately, the policy response to date is much better. The update shows that trade and stock markets have shown some improvement without reversing the overall conclusion — today’s crisis is at least as bad as the Great Depression.

On a brighter note, equities were rescued from a bad day by Nobel Laureate Paul Krugman:

The U.S. economy probably will emerge from the recession by September, Nobel Prize-winning economist Paul Krugman said.

“I would not be surprised if the official end of the U.S. recession ends up being, in retrospect, dated sometime this summer,” he said in a lecture today at the London School of Economics. “Things seem to be getting worse more slowly. There’s some reason to think that we’re stabilizing.”

FixedResets had another good day, bringing the median YTW down to 4.81%. Since 5-Year Canadas have now gapped up to 2.69%, it is interesting to speculate on the terms of the next FixedReset issue. Could a bank do something at 5.00%+230?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0973 % | 1,313.4 |

| FixedFloater | 7.20 % | 5.72 % | 30,134 | 16.00 | 1 | 0.0000 % | 2,094.7 |

| Floater | 2.87 % | 3.31 % | 79,559 | 18.89 | 3 | 0.0973 % | 1,640.8 |

| OpRet | 5.00 % | 3.80 % | 137,033 | 2.54 | 14 | -0.0596 % | 2,173.5 |

| SplitShare | 5.91 % | 5.80 % | 51,469 | 4.25 | 3 | -0.0620 % | 1,844.3 |

| Interest-Bearing | 5.99 % | 7.49 % | 25,292 | 0.54 | 1 | -1.2821 % | 1,989.2 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0125 % | 1,731.3 |

| Perpetual-Discount | 6.34 % | 6.35 % | 163,873 | 13.46 | 71 | -0.0125 % | 1,594.5 |

| FixedReset | 5.69 % | 4.81 % | 568,541 | 4.36 | 39 | 0.1293 % | 2,005.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| ELF.PR.F | Perpetual-Discount | -2.87 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-08 Maturity Price : 18.26 Evaluated at bid price : 18.26 Bid-YTW : 7.41 % |

| STW.PR.A | Interest-Bearing | -1.28 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2009-12-31 Maturity Price : 10.00 Evaluated at bid price : 10.01 Bid-YTW : 7.49 % |

| RY.PR.W | Perpetual-Discount | -1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-08 Maturity Price : 19.76 Evaluated at bid price : 19.76 Bid-YTW : 6.27 % |

| BAM.PR.I | OpRet | -1.19 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-12-30 Maturity Price : 25.00 Evaluated at bid price : 24.02 Bid-YTW : 6.83 % |

| NA.PR.K | Perpetual-Discount | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-08 Maturity Price : 23.28 Evaluated at bid price : 23.55 Bid-YTW : 6.27 % |

| POW.PR.C | Perpetual-Discount | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-08 Maturity Price : 21.97 Evaluated at bid price : 22.24 Bid-YTW : 6.63 % |

| PWF.PR.L | Perpetual-Discount | 1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-08 Maturity Price : 19.52 Evaluated at bid price : 19.52 Bid-YTW : 6.64 % |

| BAM.PR.J | OpRet | 1.25 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 21.94 Bid-YTW : 7.54 % |

| CIU.PR.A | Perpetual-Discount | 2.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-08 Maturity Price : 19.20 Evaluated at bid price : 19.20 Bid-YTW : 6.04 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| MFC.PR.E | FixedReset | 149,351 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-19 Maturity Price : 25.00 Evaluated at bid price : 25.15 Bid-YTW : 5.54 % |

| BAM.PR.P | FixedReset | 111,109 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-30 Maturity Price : 25.00 Evaluated at bid price : 25.36 Bid-YTW : 6.76 % |

| TD.PR.N | OpRet | 83,019 | TD crossed 41,000 at 26.06; RBC crossed 39,800 at 26.05. YTW SCENARIO Maturity Type : Call Maturity Date : 2010-05-30 Maturity Price : 25.75 Evaluated at bid price : 26.07 Bid-YTW : 3.68 % |

| TD.PR.P | Perpetual-Discount | 79,020 | TD crossed 25,000 at 21.35; RBC bought 34,800 from Nesbitt at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-08 Maturity Price : 21.25 Evaluated at bid price : 21.25 Bid-YTW : 6.27 % |

| BNS.PR.Q | FixedReset | 57,703 | Nesbitt crossed 40,000 at 24.95. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-08 Maturity Price : 24.81 Evaluated at bid price : 24.86 Bid-YTW : 4.58 % |

| PWF.PR.E | Perpetual-Discount | 47,105 | Nesbitt bought 13,000 from RBC at 21.40. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-08 Maturity Price : 21.30 Evaluated at bid price : 21.30 Bid-YTW : 6.56 % |

| There were 31 other index-included issues trading in excess of 10,000 shares. | |||