The International Monetary Fund has released the (prelimary version of) the Global Financial Stability Report, October 2009, with three chapters:

- The Road to Recovery

- Restarting Securitization Markets: Policy Proposals and Pitfalls

- Market Interventions during the Financial Crisis: How Effective and How to Disengage?

I was happy to see the following in the Executive Summary:

But hard work lies ahead in devising capital penalties, insurance premiums, supervisory and resolution regimes, and competition policies to ensure that no institution is believed to be “too big to fail.” Early guidance at defining criteria for identifying systemically important institutions and markets—such as that being formulated by the International Monetary Fund, Financial Stability Board, and Bank for International Settlements for the G-20—should assist in this quest. Once identified, some form of surcharge or disincentive for marginal contributions to systemic risk will need to be formulated and applied.

A surcharge is infinitely preferable to flat prohibitions and Treasury’s special regime. The report repeatedly warns about “cliff effects” in the securitization market; such cliff effects are a sign of incompetent analysis; prohibitions and special regimes bring about cliff effects by their nature.

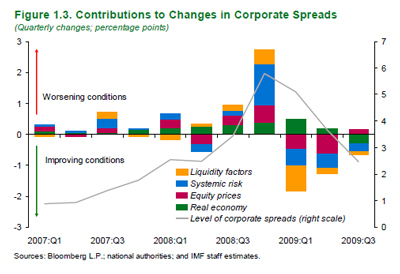

They produce an amazing chart decomposing credit spreads that I have trouble taking seriously:

There are no references cited for this decomposition. While I have great respect for IMF research and am sure they didn’t just pluck the numbers out of the air, it’s quite hard enough to decompose spreads into credit risk & liquidity (see, for example, The Value of Liquidity), without adding other factors.

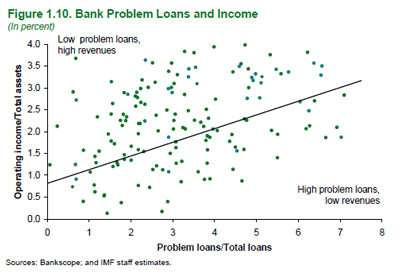

As if on purpose to reinforce my skepticism regarding connections between premises and conclusions, they publish an amazing regression analysis in the section titled “Will bank earnings be robust enough to absorb writedowns and rebuild capital cushions?”:

… with the comment:

To protect bottom line earnings, banks appear to have priced risky lending more expensively—as shown by the upward sloping trend line for European banks in Figure 1.10.

I think they’re trying too hard. Presented by the G-20 with a golden opportunity to expand their bureaucracy – after ten years of looking irrelevance in the face – I suspect that management has sent the word out to come up with the BEST conclusions and the BEST analysis and the BEST policy recommendations right away (for “best”, read “best looking”). Anybody who’s ever read a sell-side economic commentary will be very familiar with this paradigm.

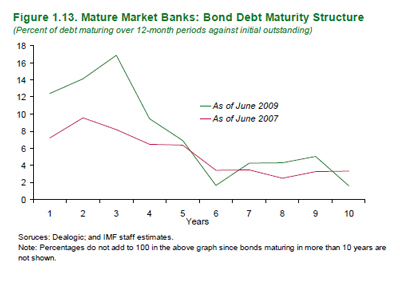

The term-shortening of bank financing was of interest:

We won’t be out of the woods until the term structure of bank liabilities returns to normal.

The second chapter provides a very good overview of securitization.