The SEC is continuing to tiptoe around Money Market Mutual Fund reforms in an effort to please their future employers at the fundcos:

The SEC’s proposal includes two principal alternative reforms that could be adopted alone or in combination. One alternative would require a floating net asset value (NAV) for prime institutional money market funds. The other alternative would allow the use of liquidity fees and redemption gates in times of stress. The proposal also includes additional diversification and disclosure measures that would apply under either alternative.

…

The public comment period for the proposal will last for 90 days after its publication in the Federal Register.

Gating will accelerate runs, as investors rush to redeem before they are imposed. Similarly for liquidity fees, in which case it’s devil take hindmost.

What is gating? The

The second alternative proposal would require money market funds to impose a liquidity fee (unless the fund’s board determines that it is not in the best interest of the fund) if a fund’s liquidity levels fell below a specified threshold and would permit the funds to suspend redemptions temporarily, i.e., to “gate” the fund under the same circumstances.

It will be recalled, by those who retain the brains they were born with, that MMFs can only break the buck if there is a default and the only way to protect against such an occurrence is capital. However:

In the sections that follow, we discuss our evaluation of a NAV buffer requirement and an MBR requirement for money market funds. We also discuss comments FSOC received on these recommendations. For the reasons discussed below, the Commission is not pursuing these alternatives because we presently believe that the imposition of either a NAV buffer combined with a minimum balance at risk or a stand-alone NAV buffer, while advancing some of our goals for money market fund reform, might prove costly for money market fund shareholders and could result in a contraction in the money market fund industry that could harm the short-term financing markets and capital formation to a greater degree than the proposals under consideration.

One of the ‘reasons against’ is completely devoid of logic:

In addition, a NAV buffer does not protect shareholders completely from the possibility of heightened rapid redemption activity during periods of market stress, particularly in periods where the buffer is at risk of depletion. As the buffer becomes impaired (or if shareholders believe the fund may suffer a loss that exceeds the size of its NAV buffer), shareholders have an incentive to redeem shares quickly because, once the buffer fails, the fund will no longer be able to maintain a stable value and shareholders will suddenly lose money on their investment.504 Such rapid severe redemptions could impair the fund’s business model and viability.

Naturally, the buffer size most susceptible to these ill-effects is the buffer size of …. zero! So the SEC wants to maximize the incentive for shareholders to redeem shares quickly.

Equally moronic is:

The most significant direct cost of a NAV buffer is the opportunity cost associated with maintaining a NAV buffer. Those contributing to the buffer essentially deploy valuable scarce resources to maintain a NAV buffer rather than being able to use the funds elsewhere. The cost of diverting funds for this purpose represents a significant incremental cost of doing business for those providing the buffer funding. We cannot provide estimates of these opportunity costs because the relevant data is not currently available to the Commission.

The purpose of a market is to find a clearing price. The amount of buffer capital available will be determined by the excess yield it receives. The excess yield paid to buffer capital will determine the yield reduction to the normal unitholders. The yield reduction to the normal unitholders will determine the size of the fund. The size of the fund will determine the amount of buffer capital required.

It all works out, as long as you’re not afraid of free markets.

And then they get to the nub:

Taken together, the demand by investors for some yield and the incentives for fund managers to reduce portfolio risk may impact competition and capital formation in two ways. First, investors seeking higher yield may move their funds to other alternative investment vehicles resulting in a contraction in the money market fund industry.

Naturally, a contraction in the MMF industry would impair employment prospects for regulators.

In his opening statement Commissioner Troy A. Paredes demonstrated that it is possible to have lived through the Credit Crunch and not learnt a damned thing:

It has been suggested that some investors might redeem preemptively before a fee is imposed or a gate comes down. I think that this concern is overstated. Boards have discretion over whether a fee or gate will be instituted. Because fund investors do not know what the board will decide, they may find it difficult to redeem preemptively with any confidence that their timing is correct. In any event, to reduce the potential skittishness of investors, fund managers have an incentive to operate money market funds even more conservatively than Rule 2a-7’s risk-limiting conditions require. On the remote chance that preemptive redemptions are heavy enough to stress a fund, then the liquidity fee would be triggered and the board could decide to gate, the corrective effects of which I just described.

In the midst of a panic with several possible outcomes investors will (i) assign higher than realistic probabilities to their worst-case scenario and (ii) double it.

The basic theme is that MMFs should be allowed to endanger financial stability because a more conservative stance might harm their business.

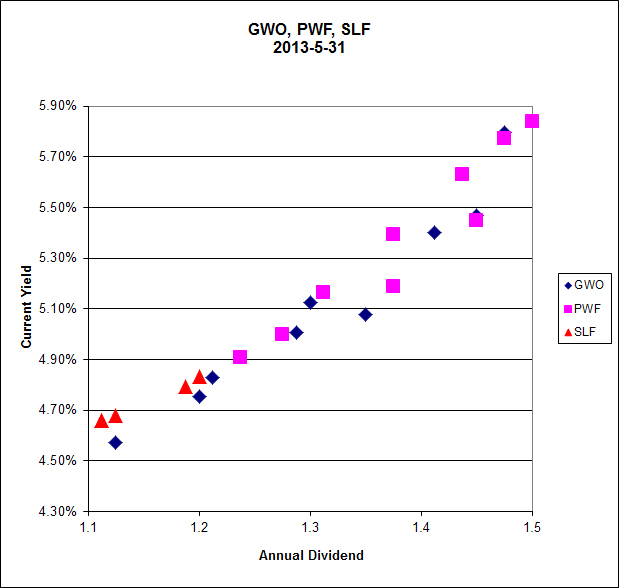

It was another mixed day for the Canadian preferred share market, with PerpetualPremiums losing 21bp, FixedResets gaining 3bp and DeemedRetractibles down 20bp. The relatively lengthy performance highlights table is comprised entirely of losers, mostly straight perpetuals with a couple of low-coupon DeemedRetractibles thrown in. Volume was high.

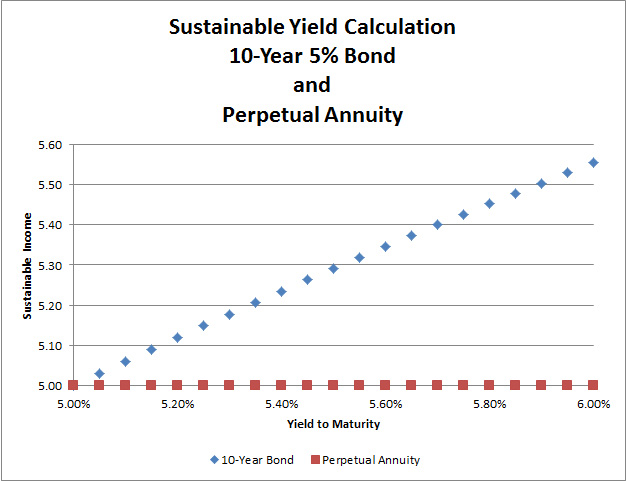

PerpetualDiscounts now yield 4.98%, equivalent to 6.47% interest at the standard conversion factor of 1.3x. Long corporates now yield 4.21%, so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) is now about 225bp, unchanged from the figure reported May 29.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0000 % | 2,550.1 |

| FixedFloater | 4.04 % | 3.37 % | 41,905 | 18.57 | 1 | -0.0425 % | 4,066.0 |

| Floater | 2.61 % | 2.97 % | 77,167 | 19.74 | 5 | 0.0000 % | 2,753.4 |

| OpRet | 4.82 % | 1.79 % | 65,146 | 0.08 | 5 | 0.1088 % | 2,615.2 |

| SplitShare | 4.64 % | 4.20 % | 99,672 | 4.05 | 6 | -0.1834 % | 2,980.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1088 % | 2,391.3 |

| Perpetual-Premium | 5.27 % | 3.90 % | 88,793 | 0.71 | 32 | -0.2082 % | 2,358.8 |

| Perpetual-Discount | 4.86 % | 4.98 % | 382,094 | 15.45 | 6 | -0.5714 % | 2,607.4 |

| FixedReset | 4.91 % | 2.87 % | 240,767 | 3.28 | 81 | 0.0303 % | 2,509.5 |

| Deemed-Retractible | 4.93 % | 3.93 % | 141,397 | 1.65 | 44 | -0.2014 % | 2,442.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| POW.PR.G | Perpetual-Premium | -1.57 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-04-15 Maturity Price : 25.00 Evaluated at bid price : 26.29 Bid-YTW : 4.95 % |

| PWF.PR.R | Perpetual-Premium | -1.25 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-04-30 Maturity Price : 25.00 Evaluated at bid price : 26.17 Bid-YTW : 4.89 % |

| BAM.PF.C | Perpetual-Discount | -1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-06-05 Maturity Price : 23.72 Evaluated at bid price : 24.06 Bid-YTW : 5.11 % |

| SLF.PR.E | Deemed-Retractible | -1.13 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.69 Bid-YTW : 5.09 % |

| BAM.PR.N | Perpetual-Discount | -1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-06-05 Maturity Price : 23.47 Evaluated at bid price : 23.75 Bid-YTW : 5.07 % |

| GWO.PR.I | Deemed-Retractible | -1.04 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.90 Bid-YTW : 4.99 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.I | FixedReset | 204,511 | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-31 Maturity Price : 25.00 Evaluated at bid price : 26.30 Bid-YTW : 2.22 % |

| SLF.PR.D | Deemed-Retractible | 148,310 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.62 Bid-YTW : 5.08 % |

| TD.PR.S | FixedReset | 127,909 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.10 Bid-YTW : 3.00 % |

| RY.PR.X | FixedReset | 84,500 | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-24 Maturity Price : 25.00 Evaluated at bid price : 26.23 Bid-YTW : 2.32 % |

| BNS.PR.A | FixedReset | 70,215 | YTW SCENARIO Maturity Type : Call Maturity Date : 2013-07-05 Maturity Price : 25.50 Evaluated at bid price : 25.85 Bid-YTW : -14.56 % |

| PWF.PR.O | Perpetual-Premium | 69,580 | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-31 Maturity Price : 26.00 Evaluated at bid price : 26.60 Bid-YTW : 4.30 % |

| There were 46 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| CU.PR.C | FixedReset | Quote: 26.06 – 26.50 Spot Rate : 0.4400 Average : 0.3258 YTW SCENARIO |

| MFC.PR.G | FixedReset | Quote: 26.10 – 26.34 Spot Rate : 0.2400 Average : 0.1644 YTW SCENARIO |

| BNS.PR.P | FixedReset | Quote: 25.60 – 25.87 Spot Rate : 0.2700 Average : 0.2022 YTW SCENARIO |

| FTS.PR.G | FixedReset | Quote: 24.75 – 24.94 Spot Rate : 0.1900 Average : 0.1227 YTW SCENARIO |

| BAM.PF.C | Perpetual-Discount | Quote: 24.06 – 24.31 Spot Rate : 0.2500 Average : 0.1861 YTW SCENARIO |

| CIU.PR.A | Perpetual-Premium | Quote: 24.94 – 25.13 Spot Rate : 0.1900 Average : 0.1333 YTW SCENARIO |