It has been a good year for corporate bond issuance:

Corporate bond sales surged to $3.3 trillion this year, challenging the record in 2009, as investors sought higher-yielding alternatives to government securities and companies took advantage of borrowing costs at all-time lows.

General Electric Co. (GE), the biggest maker of power-generation equipment, led issuers this month with a $7 billion bond offering, according to data compiled by Bloomberg. Along with software provider Oracle Corp. (ORCL)’s $5 billion sale, they paced $347 billion of bond issuance in October, a record for the month, and left sales about $116 billion shy of the $3.4 trillion reached by this time three years ago.

…

Yields on bonds sold by companies around the world fell to a record 2.676 percent on Oct. 15 from 3.981 percent at the end of last year, according to Bank of America Merrill Lynch’s Global Broad Market Corporate index.

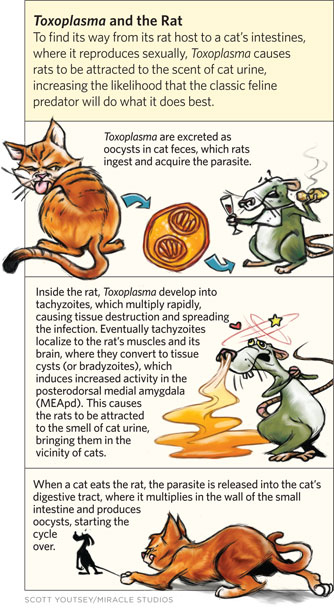

In the spirit of Hallowe’en, here’s an illustration from an absolutely fascinating article titled Animal Mind Control:

DBRS confirmed Valener at Pfd-2(low) (VNR.PR.A):

DBRS has today confirmed Valener Inc.’s (Valener) Cumulative Rate Reset Preferred Shares, Series A at Pfd-2 (low), with a Stable trend. The rating is based on the credit quality of Valener’s 29%-owned Gaz Métro Limited Partnership (GMLP), which guarantees the First Mortgage Bonds (rated “A” by DBRS) of Gaz Métro inc. (GMi). GMi owns the remaining 71% of GMLP. GMLP’s core business is regulated natural gas distribution in Québec, which generates strong cash flow due to a supportive and stable regulatory environment. GMLP also benefits from cash flow diversification from its investments in energy distribution in Vermont and the pipeline business (see the rating report on Gaz Métro inc. dated October 31, 2012). Valener’s rating is one notch lower than the rating of GMi, reflecting its structural subordination to GMLP.

The assigned provisional rating is based on the following factors: (1) Strong and predictable cash flow from GMLP to Valener. GMLP has made cash distributions to its partners in an amount of over 90% of its net income, excluding non-recurring items, for most years over the last 20 years. (2) GMLP is expected to continue to maintain its distributions of at least 85% of its net income, excluding non-recurring items, as set out under the partnership agreement between Valener and GMLP (the Partnership Agreement). In the event that GMi, as general partner of GMLP, intends to distribute less than 85% of its net income, excluding non-recurring items, it would require the approval of at least 90% of GMi’s directors. (3) Valener’s non-consolidated debt-to-capital structure is expected to remain below 20%. If its non-consolidated debt leverage ratio is above 20%, Valener is expected to issue equity to bring the ratio back under the 20% threshold in a timely manner. (4) DBRS expects that the majority of Valener’s cash flow will be derived from GMLP. Any material investment carried out by Valener and not through GMLP could have a negative rating impact. (5) DBRS expects that Valener will maintain its 29% interest in GMLP and its pro rata representation on GMi’s board of directors.

The assigned rating incorporates the limited control of Valener over GMLP due to its limited partnership status. However, this limited control is mitigated by the distribution protection clause in the Partnership Agreement, as mentioned above.

DBRS confirmed Power Corporation at Pfd-2(high) (POW.PR.A, POW.PR.B, POW.PR.C, POW.PR.D, POW.PR.F, POW.PR.G):

DBRS has today confirmed the long-term and preferred shares ratings of Power Corporation of Canada (POW or the Company) at A (high) and Pfd-2 (high), respectively. The trend on the ratings remains Stable. The credit strength of POW is directly tied to its 66.1% equity interest in Power Financial Corporation (PWF; see separate press release), which represents a substantial majority of the Company’s earnings and cash flow, as well as 82% of the Company’s estimated net asset value as of June 30, 2012. The Senior Debt rating of the Company is A (high), or one notch below the AA (low) rating on the Senior Debentures of PWF, reflecting the structural subordination of the holding company’s obligations.

The Company remains exposed to the advice-centered distribution model of protection and wealth management products and services through its indirect investment in PWF’s major subsidiaries, Great-West Lifeco Inc. (GWO) and IGM Financial Inc. (IGM). Correspondingly, it is vulnerable to the financial market and economic volatility that affects asset management fees, required actuarial reserves tied to equity markets, and the level of interest rates, as well as credit loss provisions.

…

As the controlling shareholder of PWF, and, by extension, of GWO and IGM, POW defines the strategic vision for its financial services investments, while setting the “tone from the top” in terms of conservative management style and risk analysis and tolerance. The Company’s senior officers and delegates exercise a greater degree of influence through their active participation on the respective boards and board committees of POW’s various subsidiaries than is generally the case at more widely held companies. Such an integrated management and governance approach is seldom encountered, and it has served the Company’s stakeholders well.

On a stand-alone basis, POW’s financial profile is very conservative, with debt and preferred shares representing just 13.1% of capitalization, albeit up from 7.9% at year-end 2007. There is no double leverage in the Company’s capital structure as only shareholders’ equity, and not the proceeds from debt or preferred shares, is invested in the Company’s investment portfolio. Financial leverage appears to be used to fund a portfolio of cash and short-term investments and a modest level of working capital.

DBRS confirmed PWF at Pfd-1(low) (PWF.PR.A, PWF.PR.E, PWF.PR.F, PWF.PR.G, PWF.PR.H, PWF.PR.I, PWF.PR.K, PWF.PR.L, PWF.PR.M, PWF.PR.O, PWF.PR.P and PWF.PR.R):

DBRS has today confirmed the long-term and preferred shares ratings of Power Financial Corporation (PWF, the Company or the Group) at AA (low) and Pfd-1 (low), respectively. The rating trends remain Stable. The financial strength of PWF is largely derived from its controlling interests in two of Canada’s leading financial service providers: Great-West Lifeco Inc. (GWO – senior rating of AA (low)), one of the three largest life insurance concerns in Canada, and IGM Financial Inc. (IGM – senior rating of A (high)), one of the largest mutual fund complexes in Canada as measured by long-term assets under management (AUM) on June 30, 2012. These two interests, accounting for approximately 90% of the Company’s earnings, dividends and asset value, are a source of stable recurring earnings and cash flow. Under the strategic leadership of the Company, both GWO and IGM have become increasingly diversified as they have grown both organically and by acquisition. The Company has correspondingly increased its exposure to the wealth management business in all of its chosen geographies. Both of these subsidiaries, in turn, benefit from the Company’s hands-on governance, and risk-averse culture.

…

Given an uncertain economic environment that could limit organic growth, DBRS expects that PWF will take advantage of its strong financial position to pursue small tactical acquisitions in the financial services arena. Pressures on regulatory capital adequacy could conceivably encourage a number of financial institutions to sell certain business lines at opportunistic prices, which would complement and leverage those of the Company. For example, achieving additional scale in Putnam through the acquisition of incremental AUM with a shared distribution channel would bring its financial results closer to the Company’s original target while supporting broader growth initiatives. That PWF retains the ability to consider such value-added acquisitions in the current environment is a testament to its conservative financial profile and its long-term perspective.

…

The Company’s financial leverage has been maintained at the same level for the past ten years. At a 17.6% unconsolidated total debt ratio at the end of June 2012, the Company’s capitalization remains conservative, with no double leverage when the perpetual preferred shares are treated as permanent equity. Debt service coverage ratios are similarly strong at between 13 and 15 times on an operating earnings basis and between 8 and 9 times on a cash flow basis. Liquidity is not a source of concern, with close to $1 billion in cash and short-term securities at the holding company at June 30, 2012, in addition to stores of liquidity at both GWO and IGM with which to shore up regulatory capital or to facilitate potential strategic acquisitions. Such retention of liquid assets in the current uncertain economic environment reflects a unified and consistent approach to risk management across the organization. Financial flexibility is additionally enhanced by the proven access by the Company and its investee companies to capital markets funding, notably perpetual preferred shares.

The Canadian preferred share market closed the month on a high note, with PerpetualPremiums up 12bp, FixedResets gaining 2bp and DeemedRetractibles winning 24bp. Given the surge, it was surprising that volatility was so muted. Volume was above average.

PerpetualDiscounts now yield 4.93%, equivalent to 6.41% interest at the standard equivalency factor of 1.3x. Long corporates are now at about 4.3%, so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) is now 210bp, a slight (and perhaps spurious) increase from the 205bp reported October 24.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.2132 % |

2,474.3 |

| FixedFloater |

4.16 % |

3.49 % |

35,007 |

18.36 |

1 |

0.4396 % |

3,870.3 |

| Floater |

2.79 % |

3.00 % |

57,603 |

19.71 |

4 |

0.2132 % |

2,671.6 |

| OpRet |

4.62 % |

2.03 % |

40,214 |

0.65 |

4 |

0.0667 % |

2,570.7 |

| SplitShare |

5.39 % |

4.64 % |

66,905 |

4.48 |

3 |

0.1443 % |

2,848.5 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0667 % |

2,350.7 |

| Perpetual-Premium |

5.27 % |

0.48 % |

81,723 |

0.21 |

27 |

0.1176 % |

2,314.1 |

| Perpetual-Discount |

5.01 % |

4.93 % |

42,576 |

15.47 |

4 |

-0.0512 % |

2,582.4 |

| FixedReset |

4.98 % |

3.00 % |

211,694 |

3.94 |

73 |

0.0233 % |

2,445.3 |

| Deemed-Retractible |

4.92 % |

3.14 % |

129,407 |

0.80 |

46 |

0.2415 % |

2,390.1 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| IAG.PR.A |

Deemed-Retractible |

1.11 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.65

Bid-YTW : 4.87 % |

| TRI.PR.B |

Floater |

1.44 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2042-10-31

Maturity Price : 22.25

Evaluated at bid price : 22.52

Bid-YTW : 2.31 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| TD.PR.Y |

FixedReset |

215,600 |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 25.33

Bid-YTW : 3.10 % |

| BMO.PR.K |

Deemed-Retractible |

179,622 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2012-12-25

Maturity Price : 26.00

Evaluated at bid price : 26.17

Bid-YTW : -1.57 % |

| BNS.PR.O |

Deemed-Retractible |

77,700 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-04-26

Maturity Price : 26.00

Evaluated at bid price : 26.70

Bid-YTW : -0.22 % |

| IAG.PR.E |

Deemed-Retractible |

77,640 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-12-31

Maturity Price : 26.00

Evaluated at bid price : 26.57

Bid-YTW : 4.97 % |

| BAM.PR.B |

Floater |

72,118 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2042-10-31

Maturity Price : 17.55

Evaluated at bid price : 17.55

Bid-YTW : 3.01 % |

| CU.PR.C |

FixedReset |

64,003 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2017-06-01

Maturity Price : 25.00

Evaluated at bid price : 26.09

Bid-YTW : 3.15 % |

| There were 37 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| Issue |

Index |

Quote Data and Yield Notes |

| GWO.PR.F |

Deemed-Retractible |

Quote: 25.60 – 25.90

Spot Rate : 0.3000

Average : 0.2144

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2012-11-30

Maturity Price : 25.00

Evaluated at bid price : 25.60

Bid-YTW : -16.24 % |

| IAG.PR.C |

FixedReset |

Quote: 26.19 – 26.50

Spot Rate : 0.3100

Average : 0.2257

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-12-31

Maturity Price : 25.00

Evaluated at bid price : 26.19

Bid-YTW : 2.52 % |

| PWF.PR.K |

Perpetual-Premium |

Quote: 25.09 – 25.30

Spot Rate : 0.2100

Average : 0.1370

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-10-31

Maturity Price : 25.00

Evaluated at bid price : 25.09

Bid-YTW : 4.79 % |

| BAM.PF.B |

FixedReset |

Quote: 25.42 – 25.64

Spot Rate : 0.2200

Average : 0.1501

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2042-10-31

Maturity Price : 23.23

Evaluated at bid price : 25.42

Bid-YTW : 3.86 % |

| RY.PR.H |

Deemed-Retractible |

Quote: 26.50 – 26.80

Spot Rate : 0.3000

Average : 0.2334

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-05-24

Maturity Price : 26.00

Evaluated at bid price : 26.50

Bid-YTW : 1.33 % |

| SLF.PR.F |

FixedReset |

Quote: 26.42 – 26.70

Spot Rate : 0.2800

Average : 0.2141

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-06-30

Maturity Price : 25.00

Evaluated at bid price : 26.42

Bid-YTW : 2.83 % |