Think we’ve got it tough in the Canadian preferred share market? Be grateful you’re not holding Greek bonds!

U.S. and European stocks fell, led by commodity producers as oil and copper dropped, while the premium investors demand to hold Greek bonds widened to the most since 1998 on speculation the nation may default.

…

Greece’s 10-year bond yields rose 0.16 percentage point to 7.14 percent and the yield premium to German debt widened to 4.03 percentage points, the most since before the euro was introduced in 1999.

How bad is it? CDSs on Greece are now trading above terrorist levels:

Swaps tied to Greece rose to 415 basis points today while those on Iceland traded at about 400 basis points, according to Markit data. The North American Markit index climbed the most since March 22 amid investor concern that contagion from a Greece default could spread to other assets, said Gavan Nolan, an analyst at Markit Group in London.

Remember Jim Kelsoe, proud portfolio manager of the worst bond fund in the history of the universe (so far)? He was last mentioned on PrefBlog on May 9, 2008. Now the SEC is alleging that his fund returns were, in fact, overstated:

The SEC’s Division of Enforcement alleges that Morgan Keegan failed to employ reasonable procedures to internally price the portfolio securities in five funds managed by Morgan Asset, and consequently did not calculate accurate “net asset values” (NAVs) for the funds. Morgan Keegan recklessly published these inaccurate daily NAVs, and sold shares to investors based on the inflated prices.

“This scheme had two architects — a portfolio manager responsible for lies to investors about the true value of the assets in his funds, and a head of fund accounting who turned a blind eye to the fund’s bogus valuation process,” said Robert Khuzami, Director of the SEC’s Division of Enforcement.

William Hicks, Associate Director in the SEC’s Atlanta Regional Office, said, “This misconduct masked from investors the true impact of the subprime mortgage meltdown on these funds.”

According to the Commission’s order instituting administrative proceedings, the SEC’s Enforcement Division alleges that James C. Kelsoe, Jr., the portfolio manager of the funds and an employee of Morgan Asset and Morgan Keegan, arbitrarily instructed the firm’s Fund Accounting department to make “price adjustments” that increased the fair values of certain portfolio securities. The price adjustments ignored lower values for those same securities quoted by various dealers as part of the pricing validation process. The Enforcement Division further alleges that Kelsoe actively screened and manipulated the pricing quotes obtained from at least one broker-dealer. With many of the funds’ securities backed by subprime mortgages, Kelsoe’s actions fraudulently prevented a reduction in the NAVs of the funds that otherwise should have occurred as a result of the deterioration in the subprime securities market.

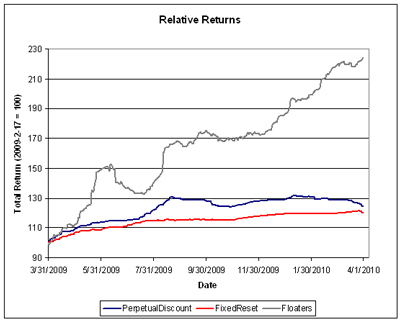

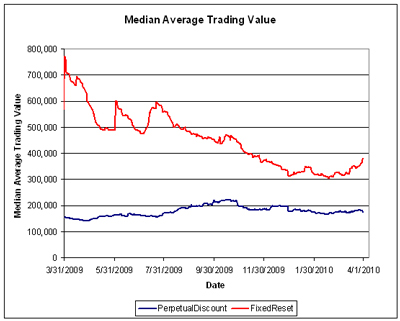

Lots of winners and losers on a volatile day of continued heavy volume in which selling pressure on PerpetualDiscounts eased off a bit … they were down only 2bp today which, considering recent returns, is practically a win! It is interesting to speculate that the buying came from switches out of FixedResets, as they were down 16bp on the day to take yields up to 3.74%. FixedResets again scored a shut-out on the volume table.

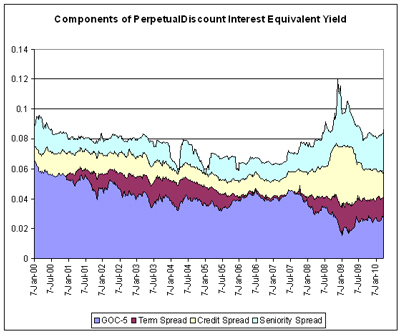

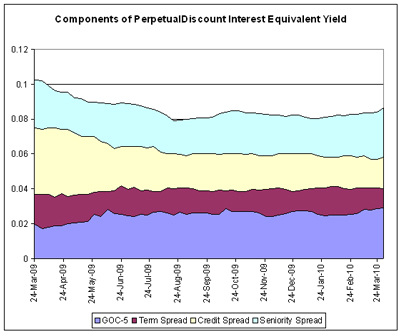

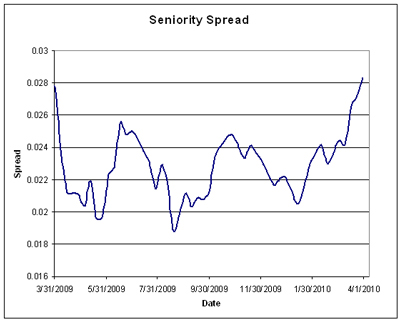

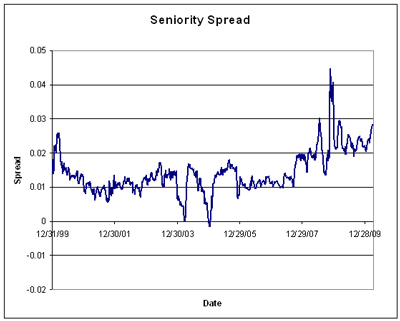

PerpetualDiscounts now yield 6.30%, equivalent to 8.82% interest at the standard equivalency factor of 1.4x. Long Corporates continue their insouciance towards whatever it is that’s causing the current paroxysm in the preferred share market, having returned +8bp (total return) on the month-to-date and are now yielding about 5.7% (maybe a bit over?). Thus, the pre-tax interest-equivalent spread (also called the Seniority Spread) stands at about 310bp, rocketting upwards from the +285 bp reported March 31 and pushing well over what had been until recently the one-year high in the low 290s.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 2.63 % | 2.67 % | 55,865 | 20.78 | 1 | -2.4091 % | 2,105.2 |

| FixedFloater | 4.92 % | 3.04 % | 48,473 | 20.10 | 1 | -0.3157 % | 3,212.9 |

| Floater | 1.91 % | 1.66 % | 46,075 | 23.43 | 4 | -0.0605 % | 2,421.2 |

| OpRet | 4.88 % | 3.57 % | 107,784 | 1.11 | 10 | 0.0733 % | 2,312.2 |

| SplitShare | 6.37 % | -2.63 % | 135,348 | 0.08 | 2 | -0.1097 % | 2,141.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0733 % | 2,114.3 |

| Perpetual-Premium | 5.86 % | 3.14 % | 33,377 | 0.64 | 2 | -0.3511 % | 1,840.7 |

| Perpetual-Discount | 6.26 % | 6.30 % | 188,334 | 13.51 | 76 | -0.0210 % | 1,700.9 |

| FixedReset | 5.44 % | 3.74 % | 422,758 | 3.68 | 43 | -0.1569 % | 2,182.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.E | Ratchet | -2.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 21.80 Evaluated at bid price : 21.47 Bid-YTW : 2.67 % |

| IAG.PR.E | Perpetual-Discount | -2.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 23.35 Evaluated at bid price : 23.51 Bid-YTW : 6.43 % |

| IAG.PR.A | Perpetual-Discount | -1.89 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 18.20 Evaluated at bid price : 18.20 Bid-YTW : 6.38 % |

| HSB.PR.E | FixedReset | -1.68 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 27.50 Bid-YTW : 4.16 % |

| HSB.PR.C | Perpetual-Discount | -1.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 20.50 Evaluated at bid price : 20.50 Bid-YTW : 6.28 % |

| PWF.PR.H | Perpetual-Discount | -1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 21.81 Evaluated at bid price : 22.28 Bid-YTW : 6.45 % |

| HSB.PR.D | Perpetual-Discount | -1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 20.02 Evaluated at bid price : 20.02 Bid-YTW : 6.30 % |

| GWO.PR.G | Perpetual-Discount | -1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 20.56 Evaluated at bid price : 20.56 Bid-YTW : 6.38 % |

| CU.PR.A | Perpetual-Discount | -1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 23.73 Evaluated at bid price : 24.03 Bid-YTW : 6.11 % |

| TRP.PR.A | FixedReset | -1.13 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.31 Bid-YTW : 4.36 % |

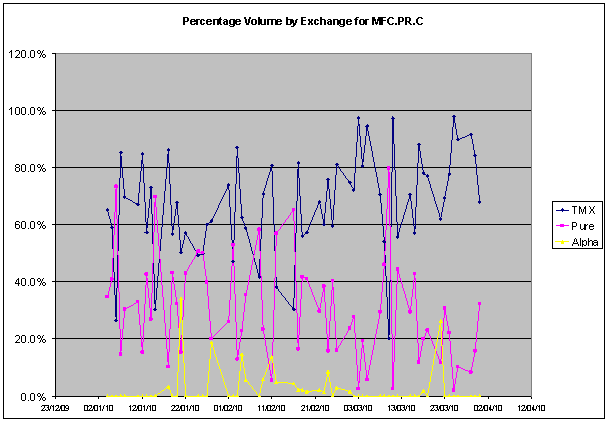

| MFC.PR.C | Perpetual-Discount | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 17.90 Evaluated at bid price : 17.90 Bid-YTW : 6.36 % |

| SLF.PR.E | Perpetual-Discount | 1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 17.71 Evaluated at bid price : 17.71 Bid-YTW : 6.41 % |

| BAM.PR.R | FixedReset | 1.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 23.11 Evaluated at bid price : 25.03 Bid-YTW : 5.13 % |

| SLF.PR.D | Perpetual-Discount | 1.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 17.55 Evaluated at bid price : 17.55 Bid-YTW : 6.40 % |

| MFC.PR.B | Perpetual-Discount | 1.59 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 18.57 Evaluated at bid price : 18.57 Bid-YTW : 6.33 % |

| RY.PR.C | Perpetual-Discount | 1.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 18.95 Evaluated at bid price : 18.95 Bid-YTW : 6.17 % |

| SLF.PR.C | Perpetual-Discount | 1.85 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 17.60 Evaluated at bid price : 17.60 Bid-YTW : 6.38 % |

| CL.PR.B | Perpetual-Discount | 1.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-07 Maturity Price : 24.09 Evaluated at bid price : 24.40 Bid-YTW : 6.45 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.S | FixedReset | 404,505 | Nesbitt crossed 400,000 at 25.80. Nice ticket! YTW SCENARIO Maturity Type : Call Maturity Date : 2013-08-30 Maturity Price : 25.00 Evaluated at bid price : 25.76 Bid-YTW : 3.96 % |

| TD.PR.G | FixedReset | 216,205 | Nesbitt crossed 200,000 at 27.50. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 27.58 Bid-YTW : 3.53 % |

| TD.PR.K | FixedReset | 130,956 | Nesbitt crossed 100,000 at 27.61. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.65 Bid-YTW : 3.56 % |

| RY.PR.P | FixedReset | 124,140 | RBC bought 25,000 from anonymous at 27.48, then crossed 37,400 at 27.50. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 27.50 Bid-YTW : 3.78 % |

| TD.PR.I | FixedReset | 122,598 | Nesbitt crossed 100,000 at 27.61. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.63 Bid-YTW : 3.58 % |

| TRP.PR.A | FixedReset | 120,075 | RBC bought 33,300 from anonymous at 25.51; Scotia bought 13,000 from anonymous at 25.50. RBC crossed 28,400 at 25.51. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.31 Bid-YTW : 4.36 % |

| SLF.PR.F | FixedReset | 108,165 | RBC bought 15,000 from anonymous at 27.10; RBC crossed two blocks of 30,000 each at 27.20; Desjardins crossed 20,000 at 27.20. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 27.17 Bid-YTW : 3.88 % |

| BMO.PR.P | FixedReset | 101,068 | Scotia crossed blocks of 58,300 and 30,000 at 26.55. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-03-27 Maturity Price : 25.00 Evaluated at bid price : 26.55 Bid-YTW : 4.16 % |

| There were 69 other index-included issues trading in excess of 10,000 shares. | |||