Brinksmanship regarding the Greek bail-out is getting … er … brinkier:

Greek Prime Minister George Papandreou set a one-week deadline for the European Union to craft a financial aid mechanism for Greece, challenging Germany to give up its doubts about a rescue package.

Papandreou said he may turn to the International Monetary Fund to overcome Greece’s debt crisis unless leaders agree to set up a lending facility at a summit March 25-26. The IMF option has already been dismissed by European Central Bank President Jean-Claude Trichet and French President Nicolas Sarkozy, who say it would show the EU can’t solve its own crises.

…

Papandreou toyed with the idea of going to the Washington- based fund, saying today that Greece is already living in an IMF-style fiscal corset without the financing that goes along with it.

“We are under a basically IMF program,” he told a European Parliament committee earlier. “We don’t want to be in a situation where we have the worst of the IMF, if you like, and none of the advantages of the euro.”

The IMF stands ready to respond to a Greek aid appeal, which hasn’t come yet, spokeswoman Caroline Atkinson told reporters in Washington today. Papandreou said he still prefers a European solution and that the EU announcing more explicit support for Greece would be enough to bring down borrowing costs without the need to actually tap emergency funds.

That poor little boy who said the Emperor had no clothes! Now he’s a terrorist!

Germany’s Finance Minister Wolfgang Schaeuble told the Bundestag on March 16 that the country may have to consider ordering “intelligence agencies to set up surveillance of who is getting together with whom for which kinds of speculative processes, and where” to protect the euro.

“I find it sinister and silly, it is a complete overreaction,” said Philip Whyte of the Centre for European Reform, a pro-European Union research institute in London. “There is a certain school of thought in continental Europe that everything is always the fault of hedge funds.” Schaeuble’s comments reflected “a longstanding paranoia about the Anglo-Saxon model of capitalism.”

European politicians blamed speculators after the euro tumbled against the dollar and the cost of insuring Greek government debt rose by a third this year, causing budget cuts that triggered street protests in Athens. Greek Prime Minister George Papandreou and French President Nicolas Sarkozy said that trading in credit default swaps exacerbated the crisis.

I’ve previously noted international problems in bank regulatory reform … but there are also national problems:

If the Senate can produce sweeping bank-reform legislation, expect House and Senate lawmakers to continue squabbling at least a year more or longer, said House Republican Leader John Boehner on Wednesday.

“If the Senate is able to produce a bill, I think it’s just as likely that we’ll be talking about the same issue a year from now as we are right now,” Boehner, R-Ohio, told an enthusiastic crowd of bankers at the American Bankers Association government relations summit.

…

Senate Banking Committee Chairman Christopher Dodd, D-Conn., on Monday introduced a revised bank-reform bill without Republican support. He plans to have the panel vote on the bill next week and hopes to have the bill considered by the Senate in April.

“I don’t know how they ever come to an agreement on some kind of a bill they can bring back to both houses and pass,” Boehner said.

Summers has defended his staff.

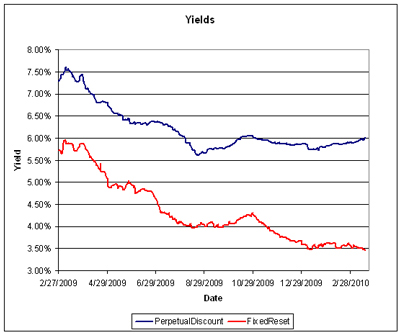

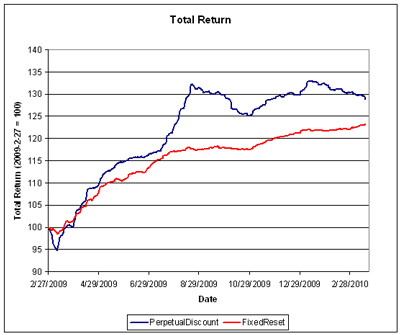

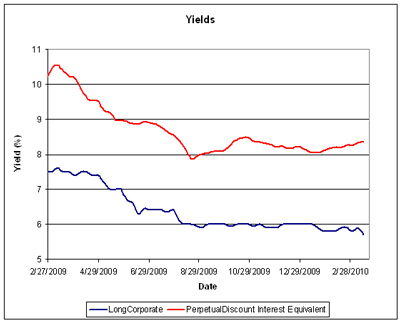

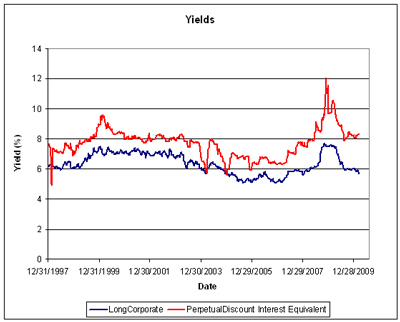

Good volume in the Canadian preferred share market today, led by the two TD OperatingRetractibles, with the selling dominated by National Bank. There was also a decent bit more price volatility, with six entries on the Performance Highlights, while PerpetualDiscounts lost 3bp at the same time as FixedResets gained 8bp. That took the FixedReset median weighted average yield down to 3.46%, equal (to five significant figures) to its all-time low on January 11.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

2.63 % |

2.78 % |

56,870 |

20.84 |

1 |

0.0000 % |

2,103.6 |

| FixedFloater |

5.11 % |

3.22 % |

44,990 |

19.91 |

1 |

0.6616 % |

3,096.6 |

| Floater |

1.93 % |

1.73 % |

48,141 |

23.22 |

4 |

-0.0734 % |

2,392.2 |

| OpRet |

4.90 % |

3.15 % |

104,193 |

0.77 |

13 |

0.0149 % |

2,309.6 |

| SplitShare |

6.38 % |

6.37 % |

125,850 |

3.69 |

2 |

0.7988 % |

2,138.0 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0149 % |

2,111.9 |

| Perpetual-Premium |

5.89 % |

5.93 % |

118,170 |

6.86 |

7 |

-0.1758 % |

1,888.1 |

| Perpetual-Discount |

5.91 % |

5.97 % |

174,516 |

13.93 |

71 |

-0.0308 % |

1,788.6 |

| FixedReset |

5.35 % |

3.46 % |

347,591 |

3.69 |

43 |

0.0824 % |

2,204.2 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| BAM.PR.H |

OpRet |

-2.11 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2012-03-30

Maturity Price : 25.00

Evaluated at bid price : 25.09

Bid-YTW : 5.48 % |

| NA.PR.M |

Perpetual-Premium |

-1.17 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2017-06-14

Maturity Price : 25.00

Evaluated at bid price : 25.30

Bid-YTW : 5.93 % |

| BNA.PR.C |

SplitShare |

1.09 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2019-01-10

Maturity Price : 25.00

Evaluated at bid price : 19.51

Bid-YTW : 7.92 % |

| HSB.PR.D |

Perpetual-Discount |

1.11 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-03-18

Maturity Price : 20.95

Evaluated at bid price : 20.95

Bid-YTW : 5.99 % |

| PWF.PR.K |

Perpetual-Discount |

1.13 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-03-18

Maturity Price : 20.50

Evaluated at bid price : 20.50

Bid-YTW : 6.14 % |

| BAM.PR.J |

OpRet |

1.37 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2018-03-30

Maturity Price : 25.00

Evaluated at bid price : 25.95

Bid-YTW : 4.82 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| TD.PR.M |

OpRet |

638,600 |

National sold 24,000 to Scotia, then 50,000 to RBC, 21,000 ato Desjardins and 25,000 to TD, 25,000 to RBC, all at 26.00. Then National crossed 200,000 at 25.98. It then sold 25,000 to Scotia, 25,000 to Desjardins and 25,000 to RBC and 20,000 to TD, all at 26.00. RBC crossed 75,000 at 26.00 and TD crossed 40,000 at the same price. National crossed 50,000 at 26.02 and RBC crossed 25,300 at 26.00. National sold blocks of 20,000 and 24,000 to Scotia at 26.00. National crossed 123,000 at 25.96 and sold 25,000 to Scotia at 26.00. Anonymous crossed 25,000 at the same price. Quite the nice day for National! The yield to the SoftMaturity 2013-10-30 is 3.68%.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2010-05-30

Maturity Price : 25.75

Evaluated at bid price : 26.02

Bid-YTW : 2.27 % |

| TD.PR.N |

OpRet |

224,800 |

National sold blocks of 20,000 and 24,000 to Scotia at 26.00. It then crossed 123,000 at 25.96. National sold 25,000 to Scotia, and anonymous crossed 25,000, both at 26.00. The yield to the SoftMaturity 2014-1-30 is 3.66%.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2010-05-30

Maturity Price : 25.75

Evaluated at bid price : 26.00

Bid-YTW : 2.50 % |

| TRP.PR.B |

FixedReset |

151,850 |

Recent new issue.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-03-18

Maturity Price : 24.94

Evaluated at bid price : 24.99

Bid-YTW : 3.93 % |

| BNS.PR.X |

FixedReset |

109,544 |

Desjardins crossed 14,800 at 28.16. Desjardins then sold 24,400 to CIBC, crossed 25,000 and sold another 25,000 to CIBC, all at 28.24.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-25

Maturity Price : 25.00

Evaluated at bid price : 28.22

Bid-YTW : 3.23 % |

| CM.PR.K |

FixedReset |

106,765 |

RBC crossed blocks of 49,800 and 15,000 and 35,000, all at 26.95.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-08-30

Maturity Price : 25.00

Evaluated at bid price : 26.95

Bid-YTW : 3.64 % |

| BAM.PR.H |

OpRet |

52,271 |

RBC crossed 21,400 and 17.300, both at 25.40.

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2012-03-30

Maturity Price : 25.00

Evaluated at bid price : 25.09

Bid-YTW : 5.48 % |

| There were 42 other index-included issues trading in excess of 10,000 shares. |