Nice to see that Banco Santander has imported North American financial advisory practices to Europe:

Branch managers channeled customers with money from property sales or inheritances to private banking salespeople, lawyers for the investors said. A retired school teacher put 300,000 euros ($388,000), half her savings, in a structured product linked to Madoff, said Jordi Ruiz de Villa, an attorney at the Barcelona law firm Jausas. The vendor invested 325,000 euros of lottery winnings in a similar product and may have to return to street sales, according to lawyers at Cremades & Calvo-Sotelo in Madrid.

…

Spanish securities law requires anyone offering investment services to “suitably evaluate” a customer’s experience and market knowledge and ensure that he or she understands the risks.

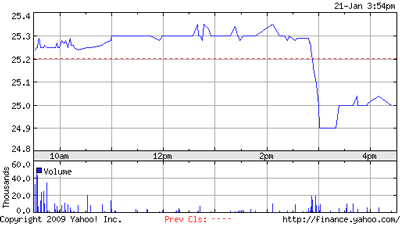

A decent day, with PerpetualDiscounts up a bit. Fixed-Resets were also up a bit, until the announcement of two new issues in the late afternoon obviated the need to buy them in the secondary market.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.87 % | 7.44 % | 38,216 | 13.63 | 2 | 0.0347 % | 868.6 |

| FixedFloater | 7.31 % | 6.92 % | 158,793 | 13.82 | 8 | 0.2684 % | 1,402.9 |

| Floater | 5.26 % | 4.74 % | 36,344 | 15.98 | 4 | -1.4294 % | 999.8 |

| OpRet | 5.31 % | 4.79 % | 142,691 | 4.06 | 15 | 0.0251 % | 2,021.2 |

| SplitShare | 6.20 % | 9.82 % | 83,443 | 4.15 | 15 | 0.1472 % | 1,793.8 |

| Interest-Bearing | 7.17 % | 8.33 % | 38,135 | 0.90 | 2 | 0.2934 % | 1,973.5 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2046 % | 1,563.3 |

| Perpetual-Discount | 6.85 % | 6.89 % | 233,941 | 12.72 | 71 | 0.2046 % | 1,439.7 |

| FixedReset | 5.95 % | 4.77 % | 833,940 | 15.28 | 22 | -0.6284 % | 1,821.5 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.K | Floater | -5.74 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 7.55 Evaluated at bid price : 7.55 Bid-YTW : 7.04 % |

| PPL.PR.A | SplitShare | -4.70 % | Asset coverage of 1.4+:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.51 Bid-YTW : 9.82 % |

| BAM.PR.N | Perpetual-Discount | -4.63 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 11.32 Evaluated at bid price : 11.32 Bid-YTW : 10.70 % |

| PWF.PR.M | FixedReset | -4.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 24.37 Evaluated at bid price : 24.42 Bid-YTW : 5.35 % |

| BAM.PR.B | Floater | -3.64 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 8.20 Evaluated at bid price : 8.20 Bid-YTW : 6.48 % |

| TD.PR.S | FixedReset | -3.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 22.20 Evaluated at bid price : 22.25 Bid-YTW : 4.04 % |

| RY.PR.N | FixedReset | -2.87 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 24.96 Evaluated at bid price : 25.01 Bid-YTW : 5.49 % |

| BAM.PR.M | Perpetual-Discount | -2.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 11.86 Evaluated at bid price : 11.86 Bid-YTW : 10.20 % |

| PWF.PR.E | Perpetual-Discount | -2.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 19.79 Evaluated at bid price : 19.79 Bid-YTW : 6.99 % |

| BMO.PR.N | FixedReset | -1.96 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 25.00 Evaluated at bid price : 25.05 Bid-YTW : 5.80 % |

| TCA.PR.Y | Perpetual-Discount | -1.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 43.02 Evaluated at bid price : 43.66 Bid-YTW : 6.44 % |

| RY.PR.P | FixedReset | -1.42 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 24.96 Evaluated at bid price : 25.01 Bid-YTW : 5.96 % |

| CM.PR.A | OpRet | -1.33 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2009-02-20 Maturity Price : 25.50 Evaluated at bid price : 25.91 Bid-YTW : -14.86 % |

| CU.PR.B | Perpetual-Discount | -1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 22.32 Evaluated at bid price : 22.50 Bid-YTW : 6.79 % |

| LFE.PR.A | SplitShare | -1.27 % | Asset coverage of 1.5-:1 as of January 15, according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-12-01 Maturity Price : 10.00 Evaluated at bid price : 9.33 Bid-YTW : 7.41 % |

| BMO.PR.L | Perpetual-Discount | -1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 21.21 Evaluated at bid price : 21.21 Bid-YTW : 6.98 % |

| BNA.PR.B | SplitShare | -1.18 % | Asset coverage of 1.8+:1 as of December 31 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2016-03-25 Maturity Price : 25.00 Evaluated at bid price : 21.00 Bid-YTW : 8.10 % |

| BMO.PR.M | FixedReset | -1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 22.45 Evaluated at bid price : 22.50 Bid-YTW : 4.10 % |

| FBS.PR.B | SplitShare | 1.12 % | Asset coverage of 1.1-:1 as of January 15 according to TD Securities. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2011-12-15 Maturity Price : 10.00 Evaluated at bid price : 8.10 Bid-YTW : 13.13 % |

| MFC.PR.C | Perpetual-Discount | 1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 17.10 Evaluated at bid price : 17.10 Bid-YTW : 6.68 % |

| TRI.PR.B | Floater | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 11.18 Evaluated at bid price : 11.18 Bid-YTW : 4.74 % |

| NA.PR.M | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 22.16 Evaluated at bid price : 22.26 Bid-YTW : 6.76 % |

| BMO.PR.H | Perpetual-Discount | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 20.25 Evaluated at bid price : 20.25 Bid-YTW : 6.68 % |

| BNS.PR.M | Perpetual-Discount | 1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 17.41 Evaluated at bid price : 17.41 Bid-YTW : 6.50 % |

| NA.PR.K | Perpetual-Discount | 1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 20.50 Evaluated at bid price : 20.50 Bid-YTW : 7.16 % |

| BCE.PR.C | FixedFloater | 1.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 25.00 Evaluated at bid price : 16.20 Bid-YTW : 7.08 % |

| BCE.PR.R | FixedFloater | 1.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 25.00 Evaluated at bid price : 16.21 Bid-YTW : 6.92 % |

| PWF.PR.L | Perpetual-Discount | 1.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 18.45 Evaluated at bid price : 18.45 Bid-YTW : 6.96 % |

| RY.PR.C | Perpetual-Discount | 1.40 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 18.05 Evaluated at bid price : 18.05 Bid-YTW : 6.50 % |

| SLF.PR.C | Perpetual-Discount | 1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 15.80 Evaluated at bid price : 15.80 Bid-YTW : 7.14 % |

| RY.PR.E | Perpetual-Discount | 1.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 18.13 Evaluated at bid price : 18.13 Bid-YTW : 6.33 % |

| SBC.PR.A | SplitShare | 1.49 % | Asset coverage of 1.4+:1 as of January 15 according to Brompton. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-11-30 Maturity Price : 10.00 Evaluated at bid price : 8.20 Bid-YTW : 11.23 % |

| LBS.PR.A | SplitShare | 1.82 % | Asset coverage of 1.4-:1 as of January 15 according to Brompton. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2013-11-29 Maturity Price : 10.00 Evaluated at bid price : 8.40 Bid-YTW : 9.53 % |

| ALB.PR.A | SplitShare | 1.93 % | Asset coverage of 1.2-:1 as of January 15 according to Scotia. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2011-02-28 Maturity Price : 25.00 Evaluated at bid price : 20.03 Bid-YTW : 16.21 % |

| PWF.PR.I | Perpetual-Discount | 2.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 22.55 Evaluated at bid price : 22.75 Bid-YTW : 6.63 % |

| POW.PR.C | Perpetual-Discount | 2.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 21.66 Evaluated at bid price : 21.66 Bid-YTW : 6.76 % |

| DFN.PR.A | SplitShare | 2.16 % | Asset coverage of 1.7-:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 9.00 Bid-YTW : 7.51 % |

| SLF.PR.D | Perpetual-Discount | 2.40 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 15.80 Evaluated at bid price : 15.80 Bid-YTW : 7.14 % |

| PWF.PR.K | Perpetual-Discount | 2.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 17.90 Evaluated at bid price : 17.90 Bid-YTW : 6.96 % |

| NA.PR.N | FixedReset | 3.47 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 21.71 Evaluated at bid price : 21.75 Bid-YTW : 4.65 % |

| BAM.PR.J | OpRet | 3.98 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 17.26 Bid-YTW : 10.96 % |

| ELF.PR.G | Perpetual-Discount | 4.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 15.50 Evaluated at bid price : 15.50 Bid-YTW : 7.74 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BNS.PR.T | FixedReset | 769,327 | New issue settled today. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 24.95 Evaluated at bid price : 25.00 Bid-YTW : 5.92 % |

| TD.PR.E | FixedReset | 275,742 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 25.02 Evaluated at bid price : 25.07 Bid-YTW : 6.07 % |

| RY.PR.P | FixedReset | 136,408 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 24.96 Evaluated at bid price : 25.01 Bid-YTW : 5.96 % |

| TD.PR.S | FixedReset | 127,435 | Nesbitt crossed 117,200 at 22.78. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 22.20 Evaluated at bid price : 22.25 Bid-YTW : 4.04 % |

| RY.PR.A | Perpetual-Discount | 78,260 | RBC crossed 55,000 at 17.75. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-21 Maturity Price : 17.79 Evaluated at bid price : 17.79 Bid-YTW : 6.38 % |

| WFS.PR.A | SplitShare | 74,550 | RBC crossed 41,700 at 8.50. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2011-06-30 Maturity Price : 10.00 Evaluated at bid price : 8.81 Bid-YTW : 11.19 % |

| There were 39 other index-included issues trading in excess of 10,000 shares. | |||