As noted in MAPF Portfolio Composition: November 2014, this year’s trend for the fund to sell Straight Perpetuals to buy FixedResets continued and even accelerated during the month.

In addition, Assiduous Reader prefQC asked:

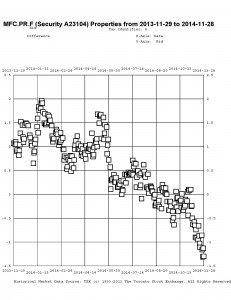

A question concerning fixed-reset DeemedRetractable MFC.PR.F:

Late 2013, as fears of imminently increasing interest rates were at a bit of a frenzy, MFC.PR.F fell to a new one-year low, recovering gradually in mid-January 2014 as fears of significant rate increases waned.

Now, as interest rates are in contrast falling to unexpected lows and the outlook for increasing interest rates is rather gloomy, MFC.PR.F appears to be on the way to testing those previous lows again.

What gives here? Of course we are one year closer to the June 2016 reset date with its modest reset spread, but other than that, the behavior of MFC.PR.F seems contradictory. Any ideas?

.

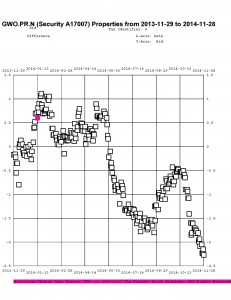

Therefore it is interesting to look at the price trend of some of these pairs. We’ll start with GWO.PR.N / GWO.PR.I; the fund sold the latter to buy the former at a takeout of about $1.00 in mid-June, 2014; relative prices over the past year are plotted as:

Given that the current take-out is $2.27, this is clearly a trade that has not worked out very well.

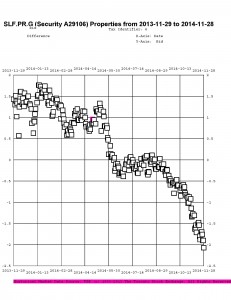

In July, 2014, I reported sales of SLF.PR.D to purchase SLF.PR.G at a take-out of about $0.15:

There were similar trades in August, 2014 (from SLF.PR.C) at a take-out of $0.35. The current take-out is $2.07, so that hasn’t worked very well either.

The trend paused in September, 2014 and, indeed, can be said to have reversed, with the fund selling SplitShares (PVS.PR.B at 25.25-30) to purchase PerpetualDiscounts (BAM.PR.M / BAM.PR.N at about 21.25), a trade which worked out favourably and has been sort-of reversed (into PVS.PR.D) in November 2014.

In October 2014 there was another bit of counterflow, as the fund sold more SplitShares (CGI.PR.D at about 25.25) to purchase more PerpetualDiscounts (CU.PR.F and CU.PR.G, at about 21.25) which again worked out well and was reversed in November, selling the CU issues at about 22.45 to purchase low-spread FixedResets (TRP.PR.A and TRP.PR.B) at about 21.50 and 18.75 (post dividend equivalent), which was basically down by transaction costs at month-end.

And November saw the third insurer-based sector swap, as the fund sold MFC.PR.C to buy the FixedReset MFC.PR.F at a post-dividend-adjusted take-out of about $0.85 … given a month-end take-out of about $1.30, that’s another regrettable trade.

This trend is not restricted to the insurance sector. Other pairs of interest are BAM.PR.X / BAM.PR.M:

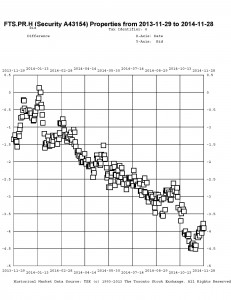

… and FTS.PR.H / FTS.PR.J:

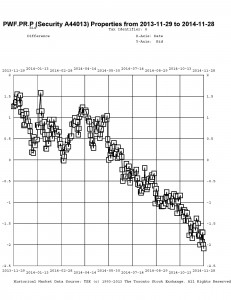

… and PWF.PR.P / PWF.PR.S:

I will agree that the fund’s trades highlighted in this post may be decried as cases of monumental bad timing, but I should point out that in May, 2014, the fund was 63.9% Straight / 9.5% FixedReset

while in November 2014 the fund was 42.6% Straight / 39.0% FixedReset. Given that the indices are roughly 30% Straight / 60% FixedReset, it is apparent that the fund was extremely overweighted in Straights / underweighted in FixedResets in May 2014 and that this qualitative tilt remains – just not quite so extreme.

Summarizing the charts above in tabular form, we see:

| FixedReset | Straight | Take-out November 2013 |

Take-out MAPF Trade |

Take-out November 2014 |

| GWO.PR.N 3.65%+130 |

GWO.PR.I 4.5% |

$0.17 | $1.00 | $2.27 |

| SLF.PR.G 4.35%+141 |

SLF.PR.D 4.45% |

($1.43) | $0.25 | $2.07 |

| MFC.PR.F 4.20%+141 |

MFC.PR.C 4.50% |

($1.07) | $0.86 | $1.30 |

| BAM.PR.X 4.60%+180 |

BAM.PR.M 4.75% |

($2.81) | $0.35 | |

| FTS.PR.H 4.25%+145 |

FTS.PR.J 4.75% |

$1.35 | $3.91 | |

| PWF.PR.P 4.40%+160 |

PWF.PR.S 4.80% |

($1.26) | $2.09 | |

| The ‘Take-Out’ is the bid price of the Straight less the bid price of the FixedReset; approximate execution prices are used for the “MAPF Trade” column. Bracketted figures in the ‘Take-Out’ columns indicate a ‘Pay-Up’ | ||||

So why is all this happening? One should take care in explaining market movements, but it is my belief that in the latter half of 2013 we were dealing with the ‘taper tantrum’ – the market’s fears that Fed tapering and subsequent tapering would lead to massive spikes in yields; this led to a great preference for FixedResets over Straights. Now, with the economic news getting less inflationary with every news story and Europe and Japan desperately trying to reflate their sluggish economies, the market seems to think that these rate increases are still a long way off … leading to a great preference for Straights over FixedResets.

James,

Does the preferred share market typically experience the sort of year end tax loss selling that the closed-end fund world experiences? I know you’re not a market timer, so I can guess at your response, but I’m curious just the same.

It can be very important – December 2008 was looking like a really awful month (just as bad as October and November 2008, which were record-setters) … until the first day of trading that was not eligible for tax-loss claims. See the market report for December 31, 2008 for some commentary.

This year I don’t think there will be much effect, since there haven’t been widespread losses, and losing issues haven’t lost much (generally speaking). Even TRP.PR.A / TRP.PR.B are down ‘only’ about $2.50, so while tax-loss selling might be exacerbating their downturn, I don’t think it can be called the decisive factor.