Maybe I’m just a suspicious person. Maybe I’m too cynical. And I always worry about cluttering up this blog with politics, which in normal times is irrelevant to real life – for which westerners in general and Canadians in particular can be very grateful.

But two stories in the Globe today were on the same page:Economists’ advice to Flaherty: Cut taxes now:

At the Economic Club of Canada’s annual outlook roundtable, economists from the country’s five biggest banks called on Mr. Flaherty to make tax cuts and well-focused infrastructure spending the centerpieces of his Jan. 27 budget, and to resist futile bailouts for dying industries.

They also called on the Bank of Canada to continue cutting its interest rates to lend further stimulus to the struggling economy and credit markets.

And they stressed that any personal tax cut – something Mr. Flaherty has already hinted could be in the budget – needs to be permanent if it’s going to be effective, and needs to be offset in future years by reining in government spending.

A permanent tax cut starting now, to be offset by spending cuts, er, later? Haven’t I seen this movie before? The very suggestion is thoroughly irresponsible.

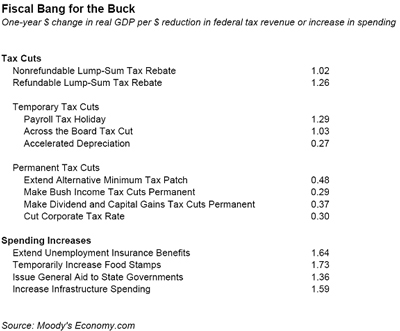

I will also point out that permanent tax cuts have very little stimulatory effect compared to other forms of stimulus:

The chart is from Moody’s Economy.com chief economist Mark Zandi’s testimony to the US House Committee on Small Business.

Why would the banks – and remember, sell-side economists are similar to sell-side analysts of any other description: sold for entertainment value only – be pushing such an lunatic plan that so conveniently fits into Spend-Every-Penny’s electoral strategy? Here’s a clue, in a story titled Loosen capital rules, banks ask watchdog:

The big banks are pushing Canada’s financial services regulator to loosen the rules about what counts as capital, a change that they say would enable them to hand out more loans.

Bank chief executive officers brought up the issue at this week’s meeting with the Finance Minister, the central bank Governor and the banking regulator, according to sources familiar with the discussion.

They want Julie Dickson, the head of the Office of the Superintendent of Financial Institutions, to let them develop new hybrid financial instruments that would count toward their capital ratios.

…

OSFI gave the banks new leeway in November, when it raised the level of preferred shares they could count as capital. As a result, the banks have been issuing a flurry of them. This week alone, Bank of Nova Scotia and Royal Bank of Canada each said they will sell $200-million worth of preferred shares, and Toronto-Dominion Bank said it is selling $300-million.But bankers say they can’t issue enough preferred shares to use up all of the room OSFI has given them, because there is not enough demand from investors. Part of the problem, they say, is that pension funds are not inclined to buy preferred shares because of tax rules. So the banks want to develop a hybrid instrument that will generate higher demand from institutional investors.

Other countries give banks more flexibility when it comes to what types of instruments count as Tier 1 capital.

It is not clear just what is meant by the last paragraph – just what, precisely, are the banks asking for that is not permitted here but permitted elsewhere? The have recently been allowed to issue cumulative Tier 1 Capital with a set maturity, something that virtually unknown anywhere else.

Remember that OSFI is not independent: I’m sure Julia Dickson remembers who’s the boss – and why that’s important.

OSFI has shown gross irresponsibility in the past year, with no more public justification that bland reassurances that they know what’s best. It would be a tragedy if Canadian banking regulation were to be gutted as part of deal for the banks to support a boneheaded electoral strategy.

Hi James, Re Pension funds not inclined to purchase pref’s due to tax laws.

I am inclined to think that this would be the best route to take and free up demand for the pref market while allowing insititutions to feed the excess demand , but must take care not to dilute existing markets.

The idea of more innovative ways to raise capital concerns me the most becuase of what that “innovation” has done to markets over the past year in the USA.

What do you think ?

Mike

Pension funds not inclined to purchase pref’s due to tax laws.

I am inclined to think that this would be the best route to take

The tax laws referred to are the dividend tax credit and gross-up rules, which make preferreds much less valuable to non-taxable institutions such as pension funds than they are to taxable individuals and corporations.

What are you proposing specifically? All I can think of is

… neither of which I would support.

“Innovative Tier 1 Capital” has been around for years, and essentially consists of interest-paying preferred-share-equivalents – see A Vale of Tiers.