Manulife Financial Corporation has announced:

that it does not intend to exercise its right to redeem all or any of its currently outstanding 8,000,000 Non-cumulative Rate Reset Class 1 Shares Series 3 (the “Series 3 Preferred Shares”) (TSX: MFC.PR.F) on June 19, 2016. As a result, subject to certain conditions described in the prospectus supplement dated March 7, 2011 relating to the issuance of the Series 3 Preferred Shares (the “Prospectus”), the holders of the Series 3 Preferred Shares have the right, at their option, to convert all or part of their Series 3 Preferred Shares on a one-for-one basis into Non-cumulative Floating Rate Class 1 Shares Series 4 of Manulife (the “Series 4 Preferred Shares”) on June 20, 2016. This date is the first business day following the conversion date of June 19, 2016, identified in the Prospectus, which falls on a Sunday. A formal notice of the right to convert Series 3 Preferred Shares into Series 4 Preferred Shares will be sent to the registered holders of the Series 3 Preferred Shares in accordance with the share conditions of the Series 3 Preferred Shares. Holders of Series 3 Preferred Shares are not required to elect to convert all or any part of their Series 3 Preferred Shares into Series 4 Preferred Shares. Holders who do not exercise their right to convert their Series 3 Preferred Shares into Series 4 Preferred Shares on such date will retain their Series 3 Preferred Shares, unless automatically converted in accordance with the conditions below.

The foregoing conversion right is subject to the conditions that: (i) if, after June 6, 2016, Manulife determines that there would be less than 1,000,000 Series 3 Preferred Shares outstanding on June 20, 2016, then all remaining Series 3 Preferred Shares will automatically be converted into an equal number of Series 4 Preferred Shares on June 20, 2016, and (ii) alternatively, if, after June 6, 2016, Manulife determines that there would be less than 1,000,000 Series 4 Preferred Shares outstanding on June 20, 2016, then no Series 3 Preferred Shares will be converted into Series 4 Preferred Shares. In either case, Manulife will give written notice to that effect to any registered holders of Series 3 Preferred Shares affected by the preceding minimums on or before June 13, 2016.

The dividend rate applicable to the Series 3 Preferred Shares for the 5-year period commencing on June 20, 2016, and ending on June 19, 2021, and the dividend rate applicable to the Series 4 Preferred Shares for the 3-month period commencing on June 20, 2016, and ending on September 19, 2016, will be determined and announced by way of a news release on May 24, 2016. Manulife will also give written notice of these dividend rates to the registered holders of Series 3 Preferred Shares.

Beneficial owners of Series 3 Preferred Shares who wish to exercise their right of conversion should instruct their broker or other nominee to exercise such right before 5:00 p.m. (EDT) on June 6, 2016. Conversion inquiries should be directed to Manulife’s Registrar and Transfer Agent, CST Trust Company, at 1-800-387-0825.

Subject to certain conditions described in the Prospectus, Manulife may redeem the Series 3 Preferred Shares, in whole or in part, on June 19, 2021 and on June 19 every five years thereafter and may redeem the Series 4 Preferred Shares, in whole or in part, after June 20, 2016.

The Toronto Stock Exchange (“TSX”) has conditionally approved the listing of the Series 4 Preferred Shares effective upon conversion. Listing of the Series 4 Preferred Shares is subject to Manulife fulfilling all the listing requirements of the TSX and, upon approval, the Series 4 Preferred Shares will be listed on the TSX under the trading symbol “MFC.PR.P”.

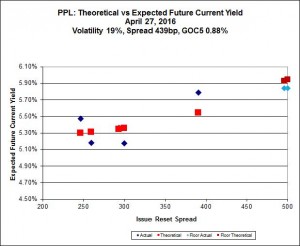

This is not a surprise given the low Issue Reset Spread of 141bp. I will report the reset rate when this is announced May 24.