Pembina Pipeline Corporation has announced:

that it has closed its previously announced public offering of 10,000,000 cumulative redeemable minimum rate reset class A preferred shares, Series 13 (the “Series 13 Preferred Shares”) for aggregate gross proceeds of $250 million (the “Offering”). The Offering was announced on April 18, 2016 when Pembina entered into an agreement with a syndicate of underwriters co-led by RBC Capital Markets and Scotiabank.

The Company intends to use the net proceeds from the Offering for capital expenditures and working capital requirements in connection with the Company’s 2016 capital program and to reduce indebtedness under the Company’s credit facilities.

The Series 13 Preferred Shares will begin trading on the Toronto Stock Exchange today under the symbol PPL.PR.M.

Dividends on the Series 13 Preferred Shares are expected to be $1.4375 per share annually, payable quarterly on the 1st day of March, June, September and December, as and when declared by the Board of Directors of Pembina, for the initial fixed rate period to but excluding June 1, 2021. The first dividend, if declared, will be payable September 1, 2016, in the amount of $0.5002 per share.

All of Pembina’s dividends are designated “eligible dividends” for Canadian income tax purposes.

PPL.PR.M is a FixedReset, 5.75%+496M575, announced April 18. The issue will be tracked by HIMIPref™ but relegated to the Scraps index on credit concerns.

The issue traded 1,037,730 shares today (consolidated exchanges) in a range of 24.93-10 before closing at 24.99-04, 1×105. This should be considered “soft”, given that the TXPL total return index returned +1.45% from April 18 to April 27. Vital statistics are:

| PPL.PR.M | FixedReset | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-04-27 Maturity Price : 23.15 Evaluated at bid price : 24.99 Bid-YTW : 5.79 % |

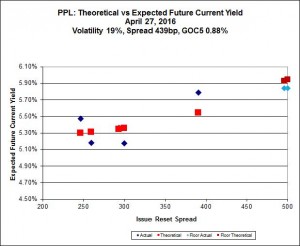

Implied Volatility analysis continues to show a high level of Implied Volatility, with the spread widening since announcement day: