Talisman Energy Inc. has announced:

•A cash price of C$25 plus accrued and unpaid dividends per Talisman preferred share if holders approve their participation in the transaction

…

that it has entered into a definitive agreement (the “Arrangement Agreement”) with Repsol S.A. under which Repsol will acquire all of the outstanding common shares of Talisman for US$8.00 (C$9.33) per share in cash.

…

Following an extensive review and analysis of the proposed transaction and other available alternatives, the Talisman Board has unanimously approved the transaction and recommends that Talisman’s common shareholders and preferred shareholders vote in favor of the arrangement at a special meeting of shareholders to be held mid February 2015. In addition, certain of the directors and all of the executive officers of Talisman have signed agreements to vote their shares in favor of the transaction.

…

The transaction is to be effected pursuant to an arrangement under the Canada Business Corporations Act. The Arrangement Agreement between Talisman and Repsol provides for, among other things, a non-solicitation covenant on the part of Talisman, subject to customary “fiduciary out” provisions, that entitles Talisman to consider and accept a superior proposal if Repsol does not match the superior proposal. If the Arrangement Agreement is terminated in certain circumstances, including if Talisman enters into an agreement with respect to a superior proposal, Repsol is entitled to a termination payment of US$270 million.Completion of the transaction is subject to customary closing conditions, including court approval of the Arrangement Agreement, approval of two-thirds of the votes cast by holders of common shares at the special meeting, and applicable government and regulatory approvals. The transaction is targeted to close in the second quarter of 2015.

Under the Arrangement Agreement, if approved by the holders in a separate class vote, Repsol will acquire the outstanding preferred shares of Talisman. However, closing of the Arrangement Agreement is not conditioned on approval by the holders of the Talisman preferred shares. If the requisite preferred shareholder approval is not obtained, the preferred shares will be excluded from the arrangement and will remain outstanding following completion of the arrangement.

Tim Kiladze comments in the Globe:

Combined, the two companies are expected to have net debt that amounts to 1.9 times earnings before interest, taxes, depreciation and amortization next year, which could fall to 1.2 times by 2017. However, that’s the base case scenario, which assumes $85 oil next year, and $99 oil in 2017. In a stress case with $71 oil next year and $79 oil in 2017, net debt is 2.3 times EBITDA next year and 1.7 times EBITDA in 2017.

As for the broad strategy, Repsol is willing to bet against the market. Most energy firms were punished for tacking on too many assets and projects as oil prices soared, and they are now scrambling to shed non-core positions and slash capital spending. Repsol believes adding diversity will help it through this energy downturn – so long as the assets are in politically safe regions like the Americas.

Rebecca Penty of Bloomberg notes:

Analysts widely recommended that shareholders accept Repsol’s bid, including those from BMO Capital Markets, CIBC World Markets Inc. and Raymond James Ltd.

TLM.PR.A was on fire today, rocketing up from yesterday’s closing quote of 19.60-20 to 23.70-72 today.

So what’s going on? First, I suggest that the discount to par represented by today’s quote is an uncertainty discount; if either common or preferred shareholders reject the deal, the price will tank again, since any credit improvement of the combined company will be minimal. DBRS comments:

Overall, DBRS expects this transaction to have a minimal impact on Talisman’s ratings. From a business risk perspective, the acquisition would be a net positive for Talisman given Repsol’s significant size and scale of integrated and geographically well-diversified operations. From a financial risk perspective, the pro forma financial metrics are expected to be reasonable to support an investment-grade rating.

Note that when DBRS talks about “investment grade” they are talking about the bonds, which are BBB. There is subordination notching for the preferreds, which are junk.

In May 2014, S&P affirmed Repsol at BBB- [Outlook Positive]:

- •Spain-based energy company Repsol S.A. has executed its debt reduction measures by completing the sale of its liquefied natural gas (LNG) division. In addition, Repsol has sold its remaining stake in Argentina-based YPF and the related restitution bonds.

- •Following this, the new higher level of Repsol’s credit ratios will depend on its uses of the cash and our forecast of growing production.

- •We are therefore revising our outlook on Repsol to “positive” from “stable,” and affirming our ‘BBB-‘ long-term corporate credit rating on the company.

- •The positive outlook mostly reflects our belief that the company will be able to generate higher operating cash flows, and have an increased ability to internally fund ongoing investments in exploration and development.

… and downgraded TLM to BBB- in October:

- •We expect Talisman Energy Inc.’s operating performance, specifically its production and cost profile, to show limited improvement in the next 18-24 months, constraining any significant cash-flow growth.

- •At the same time, we expect Talisman to significantly outspend internally generated cash flow through 2015. Even if the company meets its US$2 billion asset sale target in the next 12-18 months, we do not think its credit profile is commensurate with that of its ‘BBB’ rated peers.

- •As a result, we are lowering our long-term corporate credit and senior unsecured debt ratings on Talisman to ‘BBB-‘ from ‘BBB’.

- •We are also lowering our global scale rating on its preferred stock to ‘BB’ from ‘BB+’ and its Canada scale rating on the preferred stock to ‘P-3’ from ‘P-3 (High)’.

- •The stable outlook reflects our view that Talisman’s cash flow from its increasing liquids production combined with any asset sales will allow the company to maintain its funds from operations-to-debt at more than 30% through 2015.

…

At the same time, Standard & Poor’s lowered its global scale rating on its preferred stock to ‘BB’ from ‘BB+’ and its Canada scale rating on the stock to ‘P-3’ from ‘P-3 (High)’.

…

The outlook is stable.

The latter action was reported on PrefBlog.

This is a tricky one. Remember the BCE Plan of Arrangement with its huge prices for the preferred shares? And remember how Prefs plunged when the deal got into trouble? And then the deal died? All this could – conceivably – happen again with the TLM.PR.A deal. Even if the deal is simply replaced by a better deal for common shareholders – a bid by the CPPIB has been mooted – the new plan might not necessarily involve taking out the preferreds.

So I don’t really have any advice for investors on this one. On December 10 the issue was quoted at 15.95-24 and oil hasn’t exactly rebounded since then. So if common shareholders reject the deal, the price will be … pick a number. If common shareholders accept the deal but preferred shareholders reject it (a very low probability scenario, according to me!) then the issue will remain outstanding and the price will be … pick a number. And if both common and preferred shareholders accept the deal, the price will be $25.00.

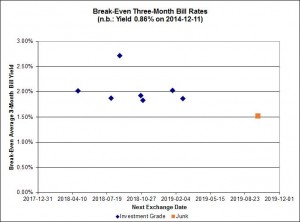

So there’s huge deal risk here, and I do preferred shares and yield curves. Deal risk is for charlatans magicians wiser heads than mine. My own inclination is that investors should unload the deal risk to speculators and try not to obsess too much about the potential upside being given up. But it’s all up to you.

TLM.PR.A is tracked by HIMIPref™ but is relegated to the Scraps index on credit concerns.