Assiduous Readers will remember that implementation of the National Securities Regulator has turned out to be an excuse for the creation of arbitrary government powers. Now some pension funds have joined the attack:

The Healthcare of Ontario Pension Plan (HOOPP), the Ontario Municipal Employees Retirement System (OMERS) and the Ontario Teachers’ Pension Plan Board submitted a joint comment letter in December to federal Finance Minister Joe Oliver urging officials to remove pension plans from the draft Capital Markets Stability Act, which is still under review and has not yet been adopted.

HOOPP chief executive officer Jim Keohane said in an interview the act gives the proposed new regulator unprecedented powers to order companies or funds under its control to do anything it deems necessary to prevent systemic risks in the financial system.

“This act, as it reads right now, gives this regulator unbelievable powers that no other regulator in the world has,” he said.

“It can prohibit or restrict any business activities that we undertake. It could force us not to trade securities. The regulator can at its discretion order us to do anything it deems necessary to address systemic risk. It’s completely open-ended,” Mr. Keohane said.

The Caisse is going to build transit in Quebec:

The Caisse de dépôt et placement du Québec is set to boost its bet on infrastructure under a new deal with Quebec that will see the pension fund take over financing and ownership of new public transit projects in the province.

The pension-fund manager, which has assets of $214-billion, has struck an agreement with Quebec’s Liberal government that will see it be the maître d’oeuvre, or project owner, for new transit projects in the French-speaking province. Details of the deal are scheduled to be made public at a news event in Montreal on Tuesday.

Sources familiar with the agreement described it as “a new way of financing and running public transportation infrastructure” for Quebec that will see the Caisse assume ownership over new transit assets and responsibility for building them. Essentially, the province is privatizing the plan for new public transportation projects but with an investor with which it has an established and privileged relationship.

It’s hard to make this out. Is it a plan for current workers to fund current retirees, by overcharging for services? Or is it a plan to pillage the fund by undercharging? All one can really say is that when Big Government jumps into bed with itself, it’s the public who gets screwed.

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts off 10bp, FixedResets up 14bp and DeemedRetractibles gaining 5bp. There is a lengthy performance highlights table notable for BAM FixedResets on the good side. Volume was very low.

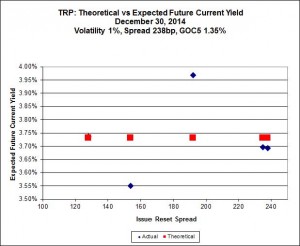

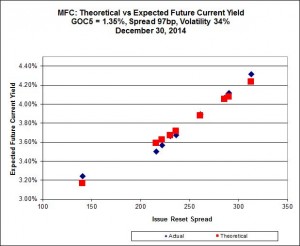

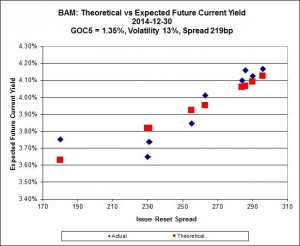

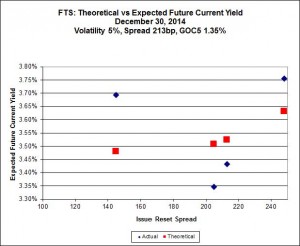

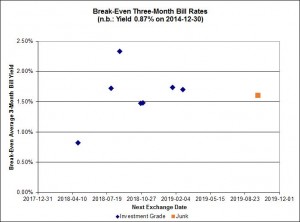

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

- based on Implied Volatility Theory only

- are relative only to other FixedResets from the same issuer

- assume constant GOC-5 yield

- assume constant Implied Volatility

- assume constant spread

Here’s TRP:

So according to this, TRP.PR.A, bid at 21.55, is $1.01 cheap, but it has already reset (at +192). TRP.PR.C, bid at 20.99 and resetting at +154bp on 2016-1-30 is $1.18 rich.

**************************************

Having reached this point in the report I lost my internet connection. There were “network problems” at Bell Highspeed and there are still problems. I have been working today using my cell phone as a Wi-Fi hotspot; not a very good substitute, but good enough. Since I don’t work for BCE, I am aware of the value of redundancy!

So this report is foreshortened. Sorry!

**************************************

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.1856 % | 2,585.7 |

| FixedFloater | 4.39 % | 3.63 % | 22,622 | 18.08 | 1 | -0.2304 % | 3,983.7 |

| Floater | 2.93 % | 3.06 % | 57,228 | 19.59 | 4 | 1.1856 % | 2,748.8 |

| OpRet | 4.04 % | 1.42 % | 96,010 | 0.43 | 1 | 0.0394 % | 2,755.3 |

| SplitShare | 4.26 % | 4.11 % | 36,378 | 3.64 | 5 | 0.1317 % | 3,205.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0394 % | 2,519.4 |

| Perpetual-Premium | 5.45 % | -3.26 % | 59,225 | 0.08 | 19 | 0.0289 % | 2,497.0 |

| Perpetual-Discount | 5.16 % | 5.01 % | 102,832 | 15.37 | 16 | -0.0977 % | 2,687.8 |

| FixedReset | 4.17 % | 3.42 % | 205,386 | 8.58 | 77 | 0.1426 % | 2,563.5 |

| Deemed-Retractible | 4.95 % | 0.31 % | 101,558 | 0.14 | 39 | 0.0498 % | 2,621.1 |

| FloatingReset | 2.68 % | 1.94 % | 60,498 | 3.40 | 7 | -0.0343 % | 2,496.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| TRP.PR.B | FixedReset | -2.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-12 Maturity Price : 17.58 Evaluated at bid price : 17.58 Bid-YTW : 3.61 % |

| CU.PR.E | Perpetual-Discount | -1.63 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-12 Maturity Price : 23.80 Evaluated at bid price : 24.20 Bid-YTW : 5.11 % |

| GWO.PR.P | Deemed-Retractible | -1.53 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.75 Bid-YTW : 5.07 % |

| BNS.PR.Y | FixedReset | -1.51 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.44 Bid-YTW : 3.26 % |

| SLF.PR.G | FixedReset | -1.46 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.90 Bid-YTW : 4.80 % |

| BAM.PR.K | Floater | 1.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-12 Maturity Price : 17.12 Evaluated at bid price : 17.12 Bid-YTW : 3.08 % |

| GWO.PR.H | Deemed-Retractible | 1.03 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.49 Bid-YTW : 5.16 % |

| BMO.PR.M | FixedReset | 1.10 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2018-08-25 Maturity Price : 25.00 Evaluated at bid price : 25.73 Bid-YTW : 2.68 % |

| FTS.PR.H | FixedReset | 1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-12 Maturity Price : 19.03 Evaluated at bid price : 19.03 Bid-YTW : 3.58 % |

| PWF.PR.A | Floater | 1.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-12 Maturity Price : 20.25 Evaluated at bid price : 20.25 Bid-YTW : 2.61 % |

| BAM.PF.F | FixedReset | 1.33 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-09-30 Maturity Price : 25.00 Evaluated at bid price : 25.87 Bid-YTW : 3.75 % |

| IAG.PR.G | FixedReset | 1.65 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-30 Maturity Price : 25.00 Evaluated at bid price : 26.47 Bid-YTW : 1.91 % |

| BAM.PR.B | Floater | 1.71 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-12 Maturity Price : 17.24 Evaluated at bid price : 17.24 Bid-YTW : 3.06 % |

| MFC.PR.C | Deemed-Retractible | 1.93 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.80 Bid-YTW : 5.19 % |

| BAM.PR.R | FixedReset | 2.05 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2016-06-30 Maturity Price : 25.00 Evaluated at bid price : 25.86 Bid-YTW : 3.12 % |

| BAM.PR.T | FixedReset | 2.06 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-03-31 Maturity Price : 25.00 Evaluated at bid price : 25.75 Bid-YTW : 3.17 % |

| BAM.PR.X | FixedReset | 2.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-12 Maturity Price : 21.53 Evaluated at bid price : 21.91 Bid-YTW : 3.65 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| NA.PR.W | FixedReset | 83,650 | Nesbitt crossed 40,000 at 25.05. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-12 Maturity Price : 23.16 Evaluated at bid price : 25.03 Bid-YTW : 3.42 % |

| CM.PR.P | FixedReset | 78,370 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-12 Maturity Price : 23.17 Evaluated at bid price : 25.05 Bid-YTW : 3.41 % |

| BMO.PR.P | FixedReset | 76,400 | RBC crossed 75,000 at 25.40. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-02-25 Maturity Price : 25.00 Evaluated at bid price : 25.39 Bid-YTW : -1.63 % |

| TD.PF.C | FixedReset | 75,186 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-12 Maturity Price : 23.17 Evaluated at bid price : 25.05 Bid-YTW : 3.42 % |

| TRP.PR.D | FixedReset | 31,400 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-12 Maturity Price : 23.26 Evaluated at bid price : 25.13 Bid-YTW : 3.53 % |

| PWF.PR.H | Perpetual-Premium | 28,300 | Scotia crossed 25,000 at 25.40. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-02-11 Maturity Price : 25.00 Evaluated at bid price : 25.36 Bid-YTW : -14.91 % |

| There were 16 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| IFC.PR.A | FixedReset | Quote: 22.65 – 25.00 Spot Rate : 2.3500 Average : 1.3535 YTW SCENARIO |

| MFC.PR.I | FixedReset | Quote: 26.16 – 27.20 Spot Rate : 1.0400 Average : 0.5801 YTW SCENARIO |

| BAM.PR.T | FixedReset | Quote: 25.75 – 26.75 Spot Rate : 1.0000 Average : 0.5876 YTW SCENARIO |

| CU.PR.E | Perpetual-Discount | Quote: 24.20 – 24.81 Spot Rate : 0.6100 Average : 0.3575 YTW SCENARIO |

| MFC.PR.H | FixedReset | Quote: 26.13 – 26.69 Spot Rate : 0.5600 Average : 0.3310 YTW SCENARIO |

| TRP.PR.B | FixedReset | Quote: 17.58 – 18.19 Spot Rate : 0.6100 Average : 0.4003 YTW SCENARIO |