Holders of Lehman PPNs are getting 80% of their principal back:

Most Hong Kong holders of structured financial notes linked to Lehman Brothers Holdings Inc. (LEHMQ) will get more than 80 percent of their investment in the latest settlement, receiver PricewaterhouseCoopers LLP said.

The agreement, which covers most issues of the minibonds, will offer holders “significant recoveries” on their investment, according to statements by PricewaterhouseCoopers and 16 banks involved issued at a Bank of China Ltd. (3988) briefing in the city today.

About 43,000 investors in Hong Kong bought an estimated $1.8 billion of Lehman minibonds that were sold by commercial lenders before the New York-based investment bank’s 2008 collapse.

…

BOC Hong Kong (Holdings) Ltd., the Bank of China’s Hong Kong unit, and 15 other banks agreed to pay at least 60 cents on the dollar, for a total of HK$6.3 billion, in a settlement reached with the Securities and Futures Commission and the Hong Kong Monetary Authority.BOC, the biggest seller of the notes in the city, offered in July 2009 to pay HK$3.11 billion ($400 million) to the Lehman minibond investors, almost half the total compensation extended by the 16 banks, while two units of Dah Sing Financial Holdings Ltd. will pay HK$444 million.

The notes have been characterized as almost worthless, so this is just another case of regulatory extortion. For a good laugh, try a Google search of “Lehman structured Notes” – it’s a good way of getting a list of ambulance-chasing legal firms.

In other adventures of the BooHooHoo Brigade, interest rate swaps are in the news again:

Faced with shrinking income and growing expenses, Italian cities bought swaps that would typically offer lower interest expenses in the near-term, while exposing the buyers to the risk of increased interest costs in later years. Italian cities faced losses of at least 1.2 billion euros from the transactions as of June, data compiled by the central bank show.

Cassino entered a seven-year swap with Bear Stearns in 2003 to adjust payments on about 22 million euros of debt. The swap switched the city’s 4.7 percent fixed interest rate payment for a variable rate, according to a June 2009 report by Italy’s financial police.

The city paid a floating rate based on the U.S.-dollar London interbank offered rate, an “extremely risky” bet given that Libor was at a record low, the police said in testimony to the Italian Senate in 2009.

Who needs investment managers when you’ve got the police? Fortunately, there’s a good laugh later in the story:

Bloomberg News sued the European Central Bank in December to make it release documents showing how Greece used derivatives to hide its fiscal deficit and helped trigger the region’s sovereign debt crisis. The case is pending.

Why, I’m sure the ECB knew nothing about it! It was a complete surprise! It was all Goldman’s fault!

The New York Fed’s blog has a piece by Beverly Hirtle addressing the question How Were the Basel 3 Minimum Capital Requirements Calibrated?. The blog itself, newly inaugurated and titled Liberty Street Economics, has been added to the blogroll.

I can’t help talking about the Toronto Community Housing Corporation thing, because it’s so illustrative of bad government and politics by sound-bite. A Toronto Star piece titled TCHC fête featured chocolate fountain and crème brulee makes the startling revelation:

The 2008 party for TCHC staff featured a chocolate fountain, an Italian spumante and strawberries station, crème brulee and a deluxe antipasto bar that included hot grilled calamari, mussels and smoked salmon.

In attendance were 760 guests, and the final bill from the Montecassino banquet hall in North York came to $47,715. Throw in costs for entertainment and other items, and TCHC forked out $53,500.

It was a significant change from the year prior. The 2007 celebration was a smaller scale event — 420 TCHC guests attended — and featured a less elaborate menu. Guests ate from an antipasto bar with no seafood, while chicken and pasta dishes were served at their tables.

The bill from Montecassino was $22,368.

OK, so this shocking news means that in 2008 the TCHC spent $70/head, while in 2007 the tab was $53/head. Hands up everybody who works for a major corporation that spent less than $100/head on their Christmas party! Don’t be shy … well, I didn’t think so.

Don’t get me wrong. There’s a lot wrong with the civil service in general and the TCHC in particular – but my desire for the efficient provision of services does not extend to treating staff like dirt on a permanent basis. When you treat your employees like shit, guess what kind of employees you get? I want them fired for incompetence, sure – that alone will save enough money to fund a hundred Christmas parties annually – but when it comes to governance I’d much rather talk about the single-source contracts that never get talked about.

It was another good day on the Canadian preferred share market, with PerpetualDiscounts up 10bp, FixedResets gaining 17bp and DeemedRetractibles winning 3bp. Not much volatility, with only two entries on the Performance Highlights table. Volume exploded and was very heavy … window dressing for quarter end?

The quote for CM.PR.K listed in the Wide Spreads table is a disgrace. Readers will remember that the reported value is the Last Quote, which may be wider than the Close. I have attempted to purchase Trades and Quotes for the issue, but all I get are trades. The TMX has been queried regarding this apparent shortcoming in their software. [See Update, below]

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3350 % | 2,402.6 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3350 % | 3,613.5 |

| Floater | 2.50 % | 2.31 % | 40,867 | 21.47 | 4 | 0.3350 % | 2,594.2 |

| OpRet | 4.87 % | 3.72 % | 57,385 | 1.13 | 9 | 0.1807 % | 2,406.5 |

| SplitShare | 5.08 % | 2.71 % | 134,683 | 0.98 | 5 | -0.0608 % | 2,488.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1807 % | 2,200.5 |

| Perpetual-Premium | 5.73 % | 5.57 % | 145,150 | 1.20 | 10 | 0.0674 % | 2,038.6 |

| Perpetual-Discount | 5.50 % | 5.54 % | 127,225 | 14.51 | 14 | 0.1001 % | 2,134.0 |

| FixedReset | 5.15 % | 3.44 % | 238,089 | 2.94 | 57 | 0.1703 % | 2,287.7 |

| Deemed-Retractible | 5.22 % | 5.14 % | 330,630 | 8.27 | 53 | 0.0265 % | 2,089.0 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BNA.PR.E | SplitShare | -1.01 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2017-12-10 Maturity Price : 25.00 Evaluated at bid price : 24.50 Bid-YTW : 5.29 % |

| BNS.PR.N | Deemed-Retractible | 1.03 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-02-26 Maturity Price : 25.00 Evaluated at bid price : 25.62 Bid-YTW : 4.96 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CM.PR.D | Deemed-Retractible | 65,801 | Nesbitt crossed 50,000 at 25.35. YTW SCENARIO Maturity Type : Call Maturity Date : 2011-05-30 Maturity Price : 25.25 Evaluated at bid price : 25.35 Bid-YTW : 0.41 % |

| BMO.PR.M | FixedReset | 54,601 | TD crossed 41,100 at 26.30. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-09-24 Maturity Price : 25.00 Evaluated at bid price : 26.26 Bid-YTW : 3.04 % |

| HSB.PR.E | FixedReset | 52,234 | RBC bought 11,500 from HSBC at 27.40; Desjardins bought 25,000 from Scotia at 27.42. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 27.40 Bid-YTW : 3.59 % |

| BMO.PR.Q | FixedReset | 50,825 | Recent new issue. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.96 Bid-YTW : 3.89 % |

| TCA.PR.Y | Perpetual-Premium | 49,917 | Nesbitt crossed 40,000 at 50.45. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-28 Maturity Price : 46.89 Evaluated at bid price : 50.41 Bid-YTW : 5.56 % |

| NA.PR.O | FixedReset | 41,235 | Issuer bid. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-17 Maturity Price : 25.00 Evaluated at bid price : 28.32 Bid-YTW : 2.28 % |

| There were 67 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| CM.PR.K | FixedReset | Quote: 26.62 – 28.83 Spot Rate : 2.2100 Average : 1.2223 See Update, below YTW SCENARIO |

| FTS.PR.E | OpRet | Quote: 26.40 – 26.91 Spot Rate : 0.5100 Average : 0.3079 YTW SCENARIO |

| IAG.PR.C | FixedReset | Quote: 27.00 – 28.25 Spot Rate : 1.2500 Average : 1.0770 YTW SCENARIO |

| CU.PR.A | Perpetual-Premium | Quote: 25.14 – 25.42 Spot Rate : 0.2800 Average : 0.1830 YTW SCENARIO |

| BNA.PR.E | SplitShare | Quote: 24.50 – 24.89 Spot Rate : 0.3900 Average : 0.3104 YTW SCENARIO |

| RY.PR.G | Deemed-Retractible | Quote: 23.76 – 24.00 Spot Rate : 0.2400 Average : 0.1669 YTW SCENARIO |

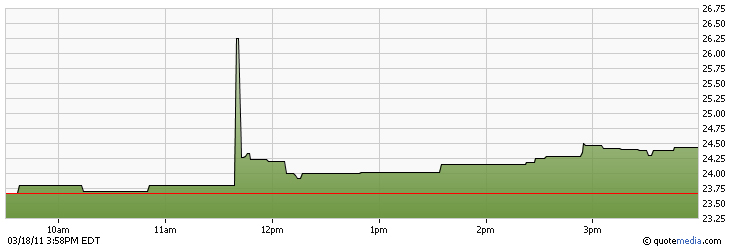

Update, 2011-3-30: The TMX has sent me the Trades and Quotes report that I attempted to purchase. They are trying to determing why my attempt was unsuccessful and desperately clinging to the hope that it was somehow all my fault.

The last trade was at 15:56:27, for 100 shares at the offer price of 26.70. There were then 12 quotes prior to the close as algorithms jockeyed for position; the bid changed once, from 800@26.62 to 200@26.63; the offer bounced mainly lower, from 100@26.70 to 200@26.68. The closing quote was 26.63-68, 2×2. The offer was cancelled at 16:16:01 and the bid at 16:16:09, resulting in a Last Quote of 26.62-28.83, 800×400.