CIT has launched its restructuring:

Under the plan, CIT Group Inc. and CIT Group Funding Company of Delaware LLC (Delaware Funding) are launching exchange offers for certain unsecured notes. If the Company does not achieve the objectives of the exchange offers, it may decide to initiate a voluntary filing under Chapter 11 of the U.S. Bankruptcy Code. Therefore, the Company is concurrently soliciting bondholders and other holders of CIT debt to approve a prepackaged plan of reorganization. The Company has been informed by advisors to the Steering Committee that, subject to review of the offering memorandum, approximately $10 billion of outstanding unsecured indebtedness have already indicated their intention to participate in the exchange offer or vote for the prepackaged plan of reorganization.

…

CIT has initiated a series of voluntary exchange offers designed to recapitalize its balance sheet and significantly reduce its debt in an out-of-court restructuring. Successful completion of the exchange offers will generate significant capital and provide multi-year liquidity through the material reduction of CIT’s outstanding debt.

Under the terms of the exchange offers, a tendering holder of an existing debt security would receive a pro rata portion of each of five series of newly issued secured notes, with maturities ranging from four to eight years, and/or shares of newly issued voting preferred stock. Consideration offered varies in amount and type based on issuer, maturity and position in the capital structure.

The exchange offers are conditioned upon achieving acceptable liquidity and leverage. These conditions require that the exchange offers cannot be consummated if the face amount of the Company’s total debt is not reduced by at least $5.7 billion in aggregate, with specific debt reduction targets for the periods from 2009 to 2012, as more fully described in the offering memorandum.

The offering memorandum has been released: in essence, bond holders are being offered a discounted number of New Notes and a variable number of preferred shares. The proportion of notes to shares decreases as the term lengthens; bonds maturing after 2018-12-31 are not included in the Exchange offer (with two exceptions). The New Notes will each carry a coupon of 7%, be in USD, and will have maturities ranging between 2013 and 2017.

If the whole transaction – including conversion of the preferred shares into common – proceeds as planned, current bond-holders will own 94% of the newly outstanding common. Wipe-out! Of perhaps more long-term interest is the fact that current preferred shareholders will own 3.5% of the new common.

Here’s where it gets interesting. All classes of preferred stock will be converted into new common proportionately to their liquidation preference, but the New Preferred Stock has a ludicrous liquidation value of $1,300. Note that, for instance, holders of the Canadian Maple bonds, 4.72% of 2011-2-10, will receive $800 in New Notes and 2.03746 New Preferred, so the notional liquidation value of the total New Preferred will be almost $2,650 for which they are “paying” (via reduction of bond principal value) $200. Applying this gearing ratio to the value the Old Preferreds, it looks like the Old Preferred shareholders are, basically, also getting wiped out, getting 1/13 of their claim value back in common.

To put it another way, the pro-forma balance sheets (page 289 of the OM PDF) lists the current claims of preferred shareholders as $3,171-million and the post-reorg common equity at $8,000-million, of which the current preferred shareholders will own 3.5%, or $280-million. Ouch! One may presume that this will be a coercive exchange offer!

CIT is maintaining a restructuring web page, which probably won’t change all that much. Bloomberg has a story on market reaction:

CIT Group Inc. bond and credit- default swap prices show that investors are speculating the 101- year-old commercial lender’s debt exchange won’t prevent it from filing for bankruptcy.

Bonds due within the next few months dropped, moving closer in price to longer-dated obligations, a sign that bondholders aren’t convinced the company will be able to restructure outside of bankruptcy court as $1.15 billion of debt comes due by year- end.

…

“We believe CIT may need to reduce its debt burden by approximately $9.3 billion to regain access to the unsecured capital markets,” CreditSights Inc. analyst Adam Steer said in an e-mail yesterday. By targeting $5.7 billion, “we question whether CIT is improving its profile enough,” he said.

…

CIT’s $300 million of 6.875 percent notes maturing on Nov. 1 dropped 5.9 cents to 71.6 cents on the dollar as of 11:13 a.m. in New York, according to Trace, the bond-price reporting system of the Financial Industry Regulatory Authority. The company’s $750 million of 4.25 percent notes due in February fell 2.5 cents to 68.5 cents on the dollar at 11:05, and the $675 million of 5 percent bonds maturing in February 2015 fell 0.5 cent to 64.25 cents on the dollar at 9:55 a.m.

…

Credit-default swaps protecting against a default through Dec. 20 have jumped 8 percentage points in the past three days to 30 percent upfront, according to CMA DataVision, while contracts for five years have climbed 4.4 percentage points to 38.4 percent.

And it looks like the heavyweights in the bondholders’ steering committee (PIMCO, inter alia) are dead serious about avoiding bankruptcy problems:

CIT Group Inc., the 101-year-old lender seeking to avoid collapse, may receive a loan of about $6 billion as soon as next week from bondholders that provided $3 billion of emergency financing in July, according to a person familiar with the matter.

The funds are intended to finance a prepackaged bankruptcy in case New York-based CIT’s debt exchange offer fails, said the person, who declined to be identified because the loan hasn’t been completed. The original loan pays annual interest of at least 13 percent. The new financing may have a lower interest rate, the person said.

DBRS had some comments:

DBRS’s view this exchange offer as default under DBRS’s definition. The current debt is being exchanged for debt with less advantageous characteristics and an equity component, which DBRS does not view as full and like compensation. Moreover, given the sizable amount of the debt that is offered to be exchanged and the inclusion of the prepackaged bankruptcy plan option, DBRS views this proposal as coercive. Accordingly, the Long-Tern debt ratings have been lowered to “C” reflecting DBRS expectation that, upon completion of the exchange, the debt that is exchanged will be placed in a default status in accordance with DBRS policy. Conversely, should the exchange offer not be completed and CIT pursues bankruptcy, DBRS would place all debt and the Issuer Rating of CIT in a default status in accordance with DBRS policy. In the case that the Company is successful in executing the proposed exchange, any untendered Existing Notes will be rated at a level commensurate with the deeply subordinated position as any untendered notes would rank below the New Notes, the existing $3.00 billion secured credit facility, and a potentially enlarged secured credit facility. Upon completion of the restructure the New Notes will be assigned a rating by DBRS.

One very important and instructive thing about the whole affair is that there is no premium being paid for issues with a high coupon – only principal value is considered, the same way as in a regular bankruptcy. Remember this when investing in corporate debt! Low Coupons = Good.

Senator Warner is lithping that twaderth thould be thenthitive:

Goldman Sachs Group Inc. must be cautious about handing out record bonuses while the banking industry is still under distress or risk spurring an outcry from Congress, U.S. Senator Mark Warner said.

“I do hope that Goldman Sachs will be a little more sensitive to the optics of their actions,” Warner, a member of the Senate Banking Committee, said today in an interview on Bloomberg Television’s “Political Capital with Al Hunt,” to be broadcast today.

“They ought to be sensitive to the fact that the whole industry is still under a great deal of scrutiny,” said Warner, a Virginia Democrat. “You can end up seeing a reaction on the Hill if there’s not some of that sensitivity.”

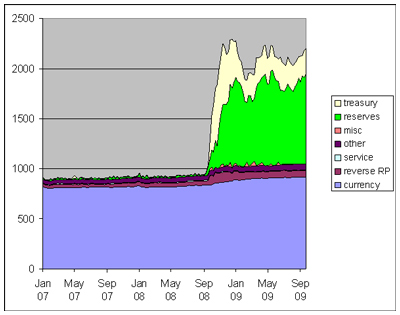

There’s been a lot of talk about inflation lately – misplaced, I think, because fiscal deficits will not affect inflation until they’re monetized, while all the cash that the Fed is laying out (for financial assets) is remaining on its balance sheet. If the private banks start spending that cash without the Fed immunizing this activities … well, then we might have problems. Until then, I’m listening more to deflation talk:

Executives at Kroger Co., the largest U.S. supermarket chain, blamed deflation for a 7 percent drop in earnings in the second quarter, while falling prices for food, gasoline, and electronics left August sales unchanged at Costco Wholesale Corp.

…

“Deflation is definitely a threat right now,” Nobel laureate Joseph Stiglitz, 66, a professor at Columbia University in New York, said in a Sept. 22 interview. “The combination of the deflation threat and the sluggish recovery should keep the Fed on hold for quite a while.”

Consumer prices are experiencing deflation, with the consumer price index sliding for six straight months from year- earlier levels, the longest stretch of declines since a 12-month drop from September 1954 to August 1955, according to the Labor Department.

So far, the core consumer-price index, which excludes food and energy, is facing disinflation, a slowing in the pace of increase. The core index rose 1.4 percent in August from a year earlier, down from 2.5 percent in September 2008.

Ignoring the very attractive possibility of deflation, the preferred share market had another crummy day today, with no winners in the performance highlights, PerpetualDiscounts losing 15bp and FixedResets down 2bp. Volume was also off considerably, with only 28 index included issues trading 10,000 shares or more … still quite respectable, according to long term averages, but a sharp decline from what we’ve been getting used to lately.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.2608 % |

1,514.7 |

| FixedFloater |

5.69 % |

3.94 % |

47,371 |

18.67 |

1 |

0.0524 % |

2,698.7 |

| Floater |

2.57 % |

2.97 % |

100,325 |

19.83 |

3 |

-0.2608 % |

1,892.2 |

| OpRet |

4.89 % |

-6.02 % |

127,176 |

0.09 |

15 |

-0.1409 % |

2,278.8 |

| SplitShare |

6.38 % |

6.59 % |

736,761 |

4.00 |

2 |

0.1984 % |

2,072.6 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.1409 % |

2,083.7 |

| Perpetual-Premium |

5.81 % |

5.75 % |

146,011 |

13.83 |

11 |

-0.1082 % |

1,870.4 |

| Perpetual-Discount |

5.80 % |

5.84 % |

211,278 |

14.18 |

61 |

-0.1476 % |

1,782.3 |

| FixedReset |

5.48 % |

4.06 % |

444,070 |

4.08 |

41 |

-0.0173 % |

2,109.5 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| HSB.PR.D |

Perpetual-Discount |

-1.31 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-10-02

Maturity Price : 21.02

Evaluated at bid price : 21.02

Bid-YTW : 5.99 % |

| IGM.PR.A |

OpRet |

-1.30 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2009-11-01

Maturity Price : 26.00

Evaluated at bid price : 26.52

Bid-YTW : -17.42 % |

| CU.PR.A |

Perpetual-Premium |

-1.25 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2012-03-31

Maturity Price : 25.00

Evaluated at bid price : 25.18

Bid-YTW : 5.75 % |

| POW.PR.D |

Perpetual-Discount |

-1.16 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-10-02

Maturity Price : 21.29

Evaluated at bid price : 21.29

Bid-YTW : 5.90 % |

| GWO.PR.E |

OpRet |

-1.09 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2010-04-30

Maturity Price : 25.25

Evaluated at bid price : 25.41

Bid-YTW : 3.63 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| GWO.PR.L |

Perpetual-Discount |

148,165 |

New issue settled today.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-10-02

Maturity Price : 24.30

Evaluated at bid price : 24.50

Bid-YTW : 5.80 % |

| TRP.PR.A |

FixedReset |

126,930 |

Recent new issue.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-10-02

Maturity Price : 25.07

Evaluated at bid price : 25.12

Bid-YTW : 4.47 % |

| TD.PR.K |

FixedReset |

53,000 |

RBC crossed 25,000 at 27.80.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-08-30

Maturity Price : 25.00

Evaluated at bid price : 27.80

Bid-YTW : 4.01 % |

| TD.PR.I |

FixedReset |

42,870 |

TD crossed 30,000 at 27.90.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-08-30

Maturity Price : 25.00

Evaluated at bid price : 27.80

Bid-YTW : 4.01 % |

| BNS.PR.R |

FixedReset |

40,546 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2019-02-25

Maturity Price : 25.00

Evaluated at bid price : 25.45

Bid-YTW : 4.42 % |

| BNS.PR.P |

FixedReset |

26,595 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-05-25

Maturity Price : 25.00

Evaluated at bid price : 25.76

Bid-YTW : 3.98 % |

| There were 28 other index-included issues trading in excess of 10,000 shares. |