AIG bonuses are all over the news; I haven’t commented on them (specifically) due to the total absence of facts. But some people like to talk about it. Econbrowser‘s James Hamilton labels them “outrageous” and “one of the very factors that caused our current problems” without, as far as I can tell, having any more idea about what is going on than I do.

I have no idea what the functions of these exectuives are, what decisions they made, and how much responsibility they should take for decisions made by their boss’ boss’ boss.

There’s a bit more news today:

The head of battered insurance giant AIG told Congress on Wednesday that “we’ve heard the American people loudly and clearly” in their rage over executive bonuses and appealed to employees to voluntarily return at least half of the money.

Voluntarily, eh?

This is a very simple problem to solve, if you feel the game is worth the candle (Matthew, 16:26). All you need to do is threaten each executive with an army of accountants and lawyers, going over everything they’ve ever done in the course of their employment looking for an undotted “i” or an uncrossed “t”. Anything that’s found becomes fodder for just-cause dismissal, lawsuits, regulatory action and/or criminal charges.

Easy. All it takes is a total absence of business ethics.

Another day of solid across-the-board gains, on decent volume. PerpetualDiscounts now yield 7.41%, equivalent to 10.37% interest at the standard equivalency factor of 1.4x. Long Corporates still yield 7.5% (bor-ring!) so the pre-tax interest-equivalent spread has come in a bit to a “mere” 287bp.

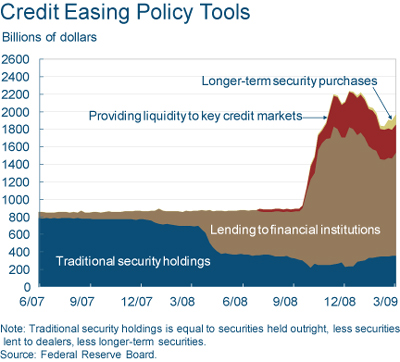

Also of interest was the fact that Five-Year Canadas came in 18bp today and now yield 1.55%; this is presumably an arbitrage-thing against Treasuries on the back of the Fed quantitative easing. And rate resets went up anyway. I guess investors are discounting the current turmoil as transient … or something.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.1202 % | 816.3 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.1202 % | 1,320.1 |

| Floater | 4.85 % | 5.97 % | 57,879 | 13.97 | 3 | 1.1202 % | 1,019.8 |

| OpRet | 5.26 % | 4.88 % | 129,652 | 3.90 | 15 | 0.4829 % | 2,057.4 |

| SplitShare | 6.90 % | 9.73 % | 53,468 | 4.80 | 6 | 0.6213 % | 1,609.9 |

| Interest-Bearing | 6.18 % | 11.44 % | 33,870 | 0.75 | 1 | -0.5123 % | 1,900.3 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2868 % | 1,485.7 |

| Perpetual-Discount | 7.27 % | 7.41 % | 154,510 | 12.04 | 71 | 0.2868 % | 1,368.3 |

| FixedReset | 6.17 % | 5.84 % | 618,569 | 13.74 | 30 | 0.2139 % | 1,792.8 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| SBN.PR.A | SplitShare | -2.06 % | Asset coverage of 1.6-:1 as of March 12 according to Mulvihill. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.10 Bid-YTW : 9.73 % |

| POW.PR.B | Perpetual-Discount | -2.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 17.30 Evaluated at bid price : 17.30 Bid-YTW : 7.92 % |

| HSB.PR.C | Perpetual-Discount | -1.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 17.30 Evaluated at bid price : 17.30 Bid-YTW : 7.41 % |

| CU.PR.A | Perpetual-Discount | -1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 20.80 Evaluated at bid price : 20.80 Bid-YTW : 7.06 % |

| PWF.PR.F | Perpetual-Discount | -1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 17.06 Evaluated at bid price : 17.06 Bid-YTW : 7.85 % |

| BNS.PR.O | Perpetual-Discount | -1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 20.95 Evaluated at bid price : 20.95 Bid-YTW : 6.81 % |

| SLF.PR.D | Perpetual-Discount | -1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 14.03 Evaluated at bid price : 14.03 Bid-YTW : 7.98 % |

| RY.PR.I | FixedReset | -1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 22.47 Evaluated at bid price : 22.51 Bid-YTW : 4.45 % |

| BMO.PR.J | Perpetual-Discount | -1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 16.27 Evaluated at bid price : 16.27 Bid-YTW : 7.01 % |

| MFC.PR.A | OpRet | -1.02 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2015-12-18 Maturity Price : 25.00 Evaluated at bid price : 24.26 Bid-YTW : 4.64 % |

| RY.PR.C | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 17.03 Evaluated at bid price : 17.03 Bid-YTW : 6.85 % |

| RY.PR.A | Perpetual-Discount | 1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 16.72 Evaluated at bid price : 16.72 Bid-YTW : 6.75 % |

| BNA.PR.A | SplitShare | 1.10 % | Asset coverage of 1.7-:1 as of February 28 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2010-09-30 Maturity Price : 25.00 Evaluated at bid price : 23.05 Bid-YTW : 12.19 % |

| TD.PR.O | Perpetual-Discount | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 18.37 Evaluated at bid price : 18.37 Bid-YTW : 6.72 % |

| BMO.PR.H | Perpetual-Discount | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 20.25 Evaluated at bid price : 20.25 Bid-YTW : 6.63 % |

| PWF.PR.G | Perpetual-Discount | 1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 19.00 Evaluated at bid price : 19.00 Bid-YTW : 7.93 % |

| SLF.PR.C | Perpetual-Discount | 1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 14.11 Evaluated at bid price : 14.11 Bid-YTW : 7.94 % |

| SLF.PR.E | Perpetual-Discount | 1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 14.21 Evaluated at bid price : 14.21 Bid-YTW : 7.97 % |

| BAM.PR.H | OpRet | 1.52 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2012-03-30 Maturity Price : 25.00 Evaluated at bid price : 23.35 Bid-YTW : 8.23 % |

| BAM.PR.O | OpRet | 1.72 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 20.75 Bid-YTW : 9.98 % |

| DFN.PR.A | SplitShare | 1.73 % | Asset coverage of 1.5+:1 as of March 13 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.25 Bid-YTW : 9.41 % |

| PWF.PR.I | Perpetual-Discount | 1.74 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 19.90 Evaluated at bid price : 19.90 Bid-YTW : 7.69 % |

| SLF.PR.A | Perpetual-Discount | 1.78 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 14.86 Evaluated at bid price : 14.86 Bid-YTW : 8.04 % |

| CM.PR.E | Perpetual-Discount | 1.78 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 18.86 Evaluated at bid price : 18.86 Bid-YTW : 7.58 % |

| CM.PR.G | Perpetual-Discount | 1.78 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 18.25 Evaluated at bid price : 18.25 Bid-YTW : 7.55 % |

| PWF.PR.J | OpRet | 1.83 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-07-30 Maturity Price : 25.00 Evaluated at bid price : 25.00 Bid-YTW : 4.88 % |

| CM.PR.D | Perpetual-Discount | 2.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 19.81 Evaluated at bid price : 19.81 Bid-YTW : 7.40 % |

| SLF.PR.B | Perpetual-Discount | 2.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 15.31 Evaluated at bid price : 15.31 Bid-YTW : 7.89 % |

| TD.PR.C | FixedReset | 2.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 24.29 Evaluated at bid price : 24.34 Bid-YTW : 4.93 % |

| BAM.PR.J | OpRet | 2.58 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 17.86 Bid-YTW : 10.38 % |

| GWO.PR.H | Perpetual-Discount | 2.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 15.39 Evaluated at bid price : 15.39 Bid-YTW : 7.93 % |

| MFC.PR.C | Perpetual-Discount | 2.75 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 14.93 Evaluated at bid price : 14.93 Bid-YTW : 7.60 % |

| BAM.PR.B | Floater | 3.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 7.35 Evaluated at bid price : 7.35 Bid-YTW : 5.97 % |

| GWO.PR.J | FixedReset | 3.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 23.95 Evaluated at bid price : 23.99 Bid-YTW : 5.32 % |

| LFE.PR.A | SplitShare | 3.65 % | Asset coverage of 1.1-:1 as of March 13 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-12-01 Maturity Price : 10.00 Evaluated at bid price : 7.10 Bid-YTW : 16.16 % |

| GWO.PR.I | Perpetual-Discount | 4.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 14.63 Evaluated at bid price : 14.63 Bid-YTW : 7.74 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.E | FixedReset | 128,070 | TD crossed 100,000 at 25.60. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 25.56 Bid-YTW : 6.03 % |

| TD.PR.I | FixedReset | 88,075 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 25.00 Evaluated at bid price : 25.05 Bid-YTW : 6.01 % |

| BNS.PR.L | Perpetual-Discount | 67,496 | Nesbitt crossed 54,000 at 16.81. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 16.81 Evaluated at bid price : 16.81 Bid-YTW : 6.82 % |

| RY.PR.T | FixedReset | 61,433 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 23.16 Evaluated at bid price : 25.08 Bid-YTW : 5.84 % |

| MFC.PR.D | FixedReset | 54,134 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 24.11 Evaluated at bid price : 24.15 Bid-YTW : 6.65 % |

| BNS.PR.T | FixedReset | 48,850 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-03-18 Maturity Price : 25.12 Evaluated at bid price : 25.17 Bid-YTW : 6.02 % |

| There were 28 other index-included issues trading in excess of 10,000 shares. | |||