Lowe’s Companies, Inc. and its subsidiary RONA inc. have announced:

that Lowe’s, through a wholly owned subsidiary, and RONA have entered into a definitive agreement for the acquisition of RONA’s outstanding Cumulative 5-Year Rate Reset Series 6 Class A Preferred Shares and Cumulative Floating Rate Series 7 Class A Preferred Shares (collectively, the “Preferred Shares”) for C$24 per share in cash pursuant to a plan of arrangement under the Business Corporations Act (Québec).

The board of directors of RONA, after consultation with its financial and legal advisors, has unanimously approved the transaction and has resolved to unanimously recommend that holders of the Preferred Shares (the “Preferred Shareholders”) vote in favour of the transaction at a meeting of Preferred Shareholders to be held to consider the transaction. RBC Capital Markets has provided a fairness opinion to RONA’s board of directors that, subject to the assumptions, limitations and qualifications set out in such fairness opinion, and as of the date of such opinion, the consideration under the transaction is fair from a financial point of view to the Preferred Shareholders.

The transaction is subject to court approval and the requisite approval of the Preferred Shareholders. Assuming the required approvals are received, the transaction is expected to be consummated before the end of the year.

Fidelity Investments Canada ULC, a large institutional investor that owns a significant portion of the Preferred Shares, has agreed to vote its Preferred Shares in favour of the transaction.

The terms and conditions of the transaction will be disclosed in further detail in the information circular to be mailed to Preferred Shareholders in advance of their meeting to approve the transaction. In addition, a copy of the definitive agreement and the information circular and certain related documents will be filed with the Canadian securities regulatory authorities and will be available under RONA’s profile at www.sedar.com.

So first of all: mea culpa. It looks like my recommendation at the time of the takeover was not optimal:

I don’t understand the rationale that might support a higher offer. The post suggests it is because of “emails and phone calls from pissed off retail investors making a big stink about the whole situation.” Now, in this day and age of governance by Internet meme it may well be that the Public Relations department is perturbed. But from a hard-headed point of view, who cares? RON.PR.A represents cheap financing, it is unlikely that Lowe’s will be issuing equity of any kind in Canada in the future, and the $34.5-million additional cost to acquire at par isn’t chump change.

I’ve been wrong before and I’ll be wrong again, but in this case I suggest that the rational course of action is to vote in favour of the Preferred Share Resolution. Be quick though, voting closes very soon! The safest course of action is, however, to sell on the market – the price is very close to $20 and such a sale would eliminate the potential for nasty consequences should either the common or preferred shareholders vote against their respective resolutions.

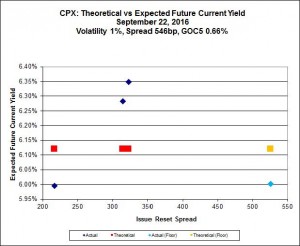

When we take another look at the comparators I cited in that post:

| Ticker | Issue Reset Spread |

Bid 2016-2-3 |

Bid 2016-3-8 |

Bid 2016-3-24 |

Bid 2016-10-8 |

| MFC.PR.J | +261 | 17.89 | 17.00 | 17.95 | 19.15 |

| RY.PR.M | 262 | 18.45 | 17.70 | 19.25 | 19.95 |

| TD.PF.D | 279 | 19.00 | 18.85 | 19.45 | 20.14 |

| SLF.PR.I | 273 | 17.45 | 17.10 | 18.00 | 18.99 |

| BAM.PF.B | 263 | 16.46 | 16.88 | 17.47 | 17.51 |

| BMO.PR.Y | 271 | 19.35 | 18.56 | 19.90 | 20.93 |

So, while there have been gains in the market since 2016-3-24, these pale beside the $4 pickup in the price of RON.PR.A.

What I don’t understand is why Lowe’s is doing this. At today’s closing bid of 23.95, RON.PR.A yield 3.34% to perpetuity, the equivalent of 4.34% interest at the standard conversion factor of 1.3x. Perhaps the requirement to be a reporting issuer in Canada adds enough cost to make this a good financing play for them; perhaps there is also concern about not having a capital structure that US investors will consider ‘clean’. I don’t know.

But one way or another, RON.PR.A (and the FloatingReset RON.PR.B) has provided a great deal of entertainment and food for thought this year!