Econbrowser‘s James Hamilton has put together a very good collection of links regarding the Credit Crisis.

Treasuries got hit today, with a Bloomberg story suggesting a cyclical shift:

“Money is rotating out of Treasuries and into other areas,” said Thomas Roth, head of U.S. government-bond trading in New York at Dresdner Kleinwort, one of 16 primary dealers that trade with the Federal Reserve. “There has been a tremendous flight into Treasuries over the past year and if things get better we will see a flight out.”

The yield on the benchmark 10-year note rose 20 basis points, or 0.20 percentage points, to 3.67 percent at 4:03 p.m. in New York, according to BGCantor Market Data. The yield earlier rose as much as 27.74 basis points, the most since advancing 32.97 basis points on Oct. 8. The 3.125 percent security due in May 2019 dropped 1 5/8, or $16.25 per $1,000 face value, to 95 1/2.

Ten-year yields have risen more than 165 basis points since falling to a record low of 2.03 percent last year.

The yield on the 30-year bond climbed 18 basis points to 4.53 percent.

… and Across the curve agrees:

I also believe that we are seeing a reversal of the flight to quality. Investors had piled into risk averse government bonds and they are now fleeing them for equities and investment grade corporate bonds. The change of heart could not come at a worse time as it collides with the massive financing needs of the US Government.

Place yer bets, gents!

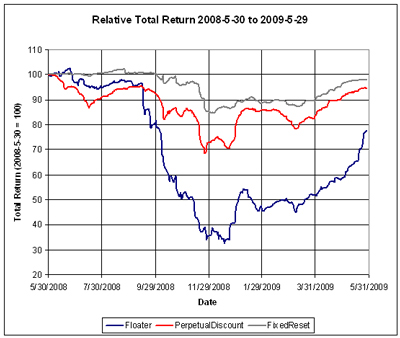

June got off to a strong start on continued high volume.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.6173 % | 1,300.6 |

| FixedFloater | 7.15 % | 5.72 % | 29,687 | 15.98 | 1 | 0.8626 % | 2,108.5 |

| Floater | 2.90 % | 3.37 % | 78,817 | 18.76 | 3 | 0.6173 % | 1,624.9 |

| OpRet | 5.02 % | 4.18 % | 144,696 | 2.56 | 14 | -0.0655 % | 2,165.4 |

| SplitShare | 5.92 % | 6.37 % | 52,666 | 4.27 | 3 | 0.7671 % | 1,841.4 |

| Interest-Bearing | 6.00 % | 7.42 % | 27,384 | 0.56 | 1 | 0.4016 % | 1,987.2 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2772 % | 1,725.1 |

| Perpetual-Discount | 6.36 % | 6.33 % | 162,708 | 13.47 | 71 | 0.2772 % | 1,588.8 |

| FixedReset | 5.72 % | 4.92 % | 490,511 | 4.44 | 37 | 0.2742 % | 1,984.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| CU.PR.B | Perpetual-Discount | -2.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 24.10 Evaluated at bid price : 24.40 Bid-YTW : 6.18 % |

| GWO.PR.G | Perpetual-Discount | -1.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 20.56 Evaluated at bid price : 20.56 Bid-YTW : 6.33 % |

| NA.PR.L | Perpetual-Discount | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 20.01 Evaluated at bid price : 20.01 Bid-YTW : 6.13 % |

| CM.PR.G | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 20.81 Evaluated at bid price : 20.81 Bid-YTW : 6.58 % |

| TD.PR.Y | FixedReset | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 24.86 Evaluated at bid price : 24.91 Bid-YTW : 4.26 % |

| TRI.PR.B | Floater | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 17.25 Evaluated at bid price : 17.25 Bid-YTW : 2.30 % |

| BNS.PR.O | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 23.05 Evaluated at bid price : 23.20 Bid-YTW : 6.11 % |

| CM.PR.D | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 21.94 Evaluated at bid price : 22.26 Bid-YTW : 6.54 % |

| RY.PR.A | Perpetual-Discount | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 18.50 Evaluated at bid price : 18.50 Bid-YTW : 6.07 % |

| GWO.PR.F | Perpetual-Discount | 1.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 21.73 Evaluated at bid price : 22.01 Bid-YTW : 6.70 % |

| RY.PR.H | Perpetual-Discount | 1.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 23.16 Evaluated at bid price : 23.32 Bid-YTW : 6.11 % |

| IAG.PR.A | Perpetual-Discount | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 16.25 Evaluated at bid price : 16.25 Bid-YTW : 7.09 % |

| GWO.PR.H | Perpetual-Discount | 1.51 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 18.20 Evaluated at bid price : 18.20 Bid-YTW : 6.68 % |

| BMO.PR.J | Perpetual-Discount | 1.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 18.58 Evaluated at bid price : 18.58 Bid-YTW : 6.11 % |

| PWF.PR.L | Perpetual-Discount | 1.56 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 19.51 Evaluated at bid price : 19.51 Bid-YTW : 6.63 % |

| NA.PR.M | Perpetual-Discount | 1.71 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 24.14 Evaluated at bid price : 24.34 Bid-YTW : 6.22 % |

| BNA.PR.C | SplitShare | 2.43 % | Asset coverage of 1.8-:1 as of April 30 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 14.75 Bid-YTW : 11.58 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CM.PR.H | Perpetual-Discount | 188,105 | Nesbitt crossed 100,000 at 18.80, then bought 19,500 from National at 18.69. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 18.67 Evaluated at bid price : 18.67 Bid-YTW : 6.52 % |

| TD.PR.M | OpRet | 96,100 | RBC crossed 95,000 at 26.10. YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-10-30 Maturity Price : 25.00 Evaluated at bid price : 26.05 Bid-YTW : 3.78 % |

| MFC.PR.D | FixedReset | 48,879 | Brockhouse (who?) bought 10,000 from RBC at 26.59. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-19 Maturity Price : 25.00 Evaluated at bid price : 26.65 Bid-YTW : 5.10 % |

| SLF.PR.D | Perpetual-Discount | 46,129 | Scotia crossed 16,100 at 16.70; anonymous crossed (?) 15,700 at 17.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 16.95 Evaluated at bid price : 16.95 Bid-YTW : 6.58 % |

| CM.PR.E | Perpetual-Discount | 40,896 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-06-01 Maturity Price : 21.26 Evaluated at bid price : 21.26 Bid-YTW : 6.68 % |

| BMO.PR.O | FixedReset | 35,120 | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-06-24 Maturity Price : 25.00 Evaluated at bid price : 26.88 Bid-YTW : 5.14 % |

| There were 41 other index-included issues trading in excess of 10,000 shares. | |||