OSFI is often criticized on PrefBlog! In a recently published article I developed the theme and set six milestones for improvement.

Look for the opinion link!

I found the The Jorion-Taleb Debate from 1997 to be most interesting – particularly Taleb’s comment:

Banks have the ingrained habit of plunging headlong into mistakes together where blame-minimizing managers appear to feel comfortable making blunders so long as their competitors are making the same ones. The state of the Japanese and French banking systems, the stories of lending to Latin America, the chronic real estate booms and busts, and the S&L debacle provide us with an interesting cycle of communal irrationality. I believe that the VAR is the alibi bankers will give shareholders (and the bailing-out taxpayer) to show documented due diligence, and will express that their blow-up came from truly unforeseeable circumstances and events with low probability-not from taking large risks they did not understand. But my sense of social responsibility will force me to point my finger menacingly. I maintain that the due-diligence VAR tool encourages untrained people to take misdirected risk with shareholders’, and ultimately the taxpayers’, money.

There’s also a debate between David Einhorn & Aaron Brown from the summer of 2008 that is of great interest.

And straight line from CAPM through VaR to Basel II is drawn by Kaplanski, Guy and Levy, Haim,Value-at-Risk Capital Requirement Regulation and Asset Allocation: A Mean-Variance Analysis(August 2007). Available at SSRN: http://ssrn.com/abstract=1081288

The January edition of Canadian Moneysaver included my latest effort – “Where Are We Now?”, a review of 2008 … the most horrific year for preferreds in recent memory, at any rate.

Look for the research link!

I complained on January 19 that the political leverage given to politicians by the TARP funds would lead to calls to expand non-economic but politically attractive business methodologies. Dealbreaker passes along more commentary on this subject:

Surprise! Now anyone with public money is bathing in the gelatinous “squish” of a million squirming appetites, forced to submit to a literal morass of legislative tentacle sex with hundreds of pet projects, social theory experiments and personal causes (from the left and the right), not to mention the utter chaos and unpredictability of having every idiot in the House pop off about what new rule you should be following this week. Predicting what is or will be expected of you (or what you may or may not be paid) is a nightmarish prospect.

Dealbreaker also comments on the Caballero Insurance Plan that I have previously written about:

Typically when Congress can’t get the political backing to actually pass a bill to pay for something, they do the next best thing: get the political backing to guarantee something, or insure any losses. At the very least this reduces the cost of capital for the activity. Throw some tax benefits in and you go a long way to encouraging the behavior you are trying to stimulate. So potent can the effect be that you don’t even necessarily need a direct guarantee. (The “too big to fail” condition and the “implicit guarantee” of a Fannie Mae is a good example here).

…

The problem with this level of insurance is that while it preserves public capital (and prevents dilution) you can write a lot of insurance before anyone starts to notice that you are on the hook for, well, a lot of insurance. (See e.g., Fannie and Freddie).

An interesting day in the preferred market! Split shares got hurt, presumably due to continued equity weakness – a lot of the January 22 NAVs are coming out and don’t look very pretty. FBS.PR.B is now valued below the preferred par value, but is still rated Pfd-2(low) by DBRS, and has been under review negative for three months now.

Fixed-Resets got hurt, presumably due to continued heavy issuance: a new CIBC fixed-reset 650+447 was announced today, bringing the total number of pending issues to five. Amidst all this, PerpetualDiscounts were up on the day, albeit marginally and with a certain sloppiness.

TD went into a frenzy of activity, trading a huge number of blocks after the close – remember that after hours trading is fine, but it all has to occur at the same price as the last trade of a board lot.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.93 % | 7.70 % | 40,130 | 13.38 | 2 | -0.7405 % | 848.4 |

| FixedFloater | 7.34 % | 6.91 % | 162,168 | 13.74 | 8 | 0.6072 % | 1,395.4 |

| Floater | 5.57 % | 4.75 % | 34,686 | 15.98 | 4 | -2.4838 % | 943.4 |

| OpRet | 5.31 % | 4.76 % | 154,215 | 4.04 | 15 | -0.0195 % | 2,023.4 |

| SplitShare | 6.32 % | 9.75 % | 76,264 | 4.13 | 15 | -0.6945 % | 1,760.2 |

| Interest-Bearing | 7.14 % | 8.23 % | 35,281 | 0.89 | 2 | 0.5865 % | 1,980.5 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1236 % | 1,552.4 |

| Perpetual-Discount | 6.91 % | 6.95 % | 230,184 | 12.61 | 71 | 0.1236 % | 1,429.7 |

| FixedReset | 6.06 % | 5.40 % | 788,333 | 14.34 | 22 | -0.8178 % | 1,790.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| PWF.PR.A | Floater | -8.07 % | A flurry of activity (insofar as 800 shares may be considered a “flurry”) took out the bid and the closing quote was 11.05-12.49 (!) 10×1, after trading 800 shares in a range of 11.02-12.01. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 11.05 Evaluated at bid price : 11.05 Bid-YTW : 4.75 % |

| FFN.PR.A | SplitShare | -4.73 % | Asset coverage of 1.1+:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 7.25 Bid-YTW : 12.14 % |

| RY.PR.L | FixedReset | -4.64 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 22.56 Evaluated at bid price : 22.60 Bid-YTW : 5.45 % |

| FBS.PR.B | SplitShare | -3.99 % | Asset coverage of 1.0-:1 as of January 22, according to TD Securities. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2011-12-15 Maturity Price : 10.00 Evaluated at bid price : 7.45 Bid-YTW : 16.58 % |

| NA.PR.N | FixedReset | -3.78 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 21.35 Evaluated at bid price : 21.65 Bid-YTW : 4.89 % |

| CM.PR.K | FixedReset | -2.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 21.79 Evaluated at bid price : 22.25 Bid-YTW : 4.96 % |

| PWF.PR.L | Perpetual-Discount | -1.96 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 18.04 Evaluated at bid price : 18.04 Bid-YTW : 7.12 % |

| SBN.PR.A | SplitShare | -1.67 % | Asset coverage of 1.7-:1 as of January 15 according to Mulvihill. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.81 Bid-YTW : 7.90 % |

| POW.PR.C | Perpetual-Discount | -1.67 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 21.19 Evaluated at bid price : 21.19 Bid-YTW : 6.92 % |

| CM.PR.H | Perpetual-Discount | -1.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 16.50 Evaluated at bid price : 16.50 Bid-YTW : 7.34 % |

| SLF.PR.E | Perpetual-Discount | -1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 15.50 Evaluated at bid price : 15.50 Bid-YTW : 7.37 % |

| PWF.PR.K | Perpetual-Discount | -1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 17.53 Evaluated at bid price : 17.53 Bid-YTW : 7.12 % |

| BMO.PR.K | Perpetual-Discount | -1.48 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 19.31 Evaluated at bid price : 19.31 Bid-YTW : 6.95 % |

| BCE.PR.Y | Ratchet | -1.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 25.00 Evaluated at bid price : 14.15 Bid-YTW : 7.70 % |

| BCE.PR.Z | FixedFloater | -1.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 25.00 Evaluated at bid price : 15.01 Bid-YTW : 7.49 % |

| BNS.PR.P | FixedReset | -1.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 22.57 Evaluated at bid price : 22.65 Bid-YTW : 4.57 % |

| SLF.PR.C | Perpetual-Discount | -1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 15.41 Evaluated at bid price : 15.41 Bid-YTW : 7.33 % |

| RY.PR.F | Perpetual-Discount | -1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 17.06 Evaluated at bid price : 17.06 Bid-YTW : 6.54 % |

| RY.PR.I | FixedReset | -1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 22.47 Evaluated at bid price : 22.51 Bid-YTW : 4.69 % |

| BNS.PR.K | Perpetual-Discount | -1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 18.86 Evaluated at bid price : 18.86 Bid-YTW : 6.41 % |

| GWO.PR.J | FixedReset | -1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 24.46 Evaluated at bid price : 24.51 Bid-YTW : 5.40 % |

| BCE.PR.C | FixedFloater | -1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 25.00 Evaluated at bid price : 16.06 Bid-YTW : 7.09 % |

| SLF.PR.D | Perpetual-Discount | -1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 15.37 Evaluated at bid price : 15.37 Bid-YTW : 7.35 % |

| MFC.PR.A | OpRet | -1.10 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2015-12-18 Maturity Price : 25.00 Evaluated at bid price : 24.34 Bid-YTW : 4.65 % |

| BNS.PR.J | Perpetual-Discount | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 19.81 Evaluated at bid price : 19.81 Bid-YTW : 6.68 % |

| RY.PR.B | Perpetual-Discount | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 18.01 Evaluated at bid price : 18.01 Bid-YTW : 6.54 % |

| BNS.PR.N | Perpetual-Discount | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 20.11 Evaluated at bid price : 20.11 Bid-YTW : 6.58 % |

| TD.PR.Q | Perpetual-Discount | 1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 21.25 Evaluated at bid price : 21.25 Bid-YTW : 6.64 % |

| CM.PR.E | Perpetual-Discount | 1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 19.52 Evaluated at bid price : 19.52 Bid-YTW : 7.24 % |

| RY.PR.W | Perpetual-Discount | 1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 18.91 Evaluated at bid price : 18.91 Bid-YTW : 6.50 % |

| GWO.PR.I | Perpetual-Discount | 1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 15.72 Evaluated at bid price : 15.72 Bid-YTW : 7.26 % |

| BAM.PR.N | Perpetual-Discount | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 12.01 Evaluated at bid price : 12.01 Bid-YTW : 10.09 % |

| TCA.PR.Y | Perpetual-Discount | 1.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 43.61 Evaluated at bid price : 44.50 Bid-YTW : 6.31 % |

| BMO.PR.H | Perpetual-Discount | 1.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 20.47 Evaluated at bid price : 20.47 Bid-YTW : 6.61 % |

| BCE.PR.F | FixedFloater | 1.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 25.00 Evaluated at bid price : 15.75 Bid-YTW : 6.31 % |

| CU.PR.A | Perpetual-Discount | 1.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 21.91 Evaluated at bid price : 21.91 Bid-YTW : 6.75 % |

| BAM.PR.K | Floater | 1.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 7.49 Evaluated at bid price : 7.49 Bid-YTW : 7.11 % |

| BCE.PR.I | FixedFloater | 1.84 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 25.00 Evaluated at bid price : 16.07 Bid-YTW : 6.91 % |

| PWF.PR.H | Perpetual-Discount | 2.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 20.73 Evaluated at bid price : 20.73 Bid-YTW : 6.99 % |

| BNA.PR.C | SplitShare | 2.09 % | Asset coverage of 1.8+:1 as of December 31 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 11.24 Bid-YTW : 15.64 % |

| NA.PR.M | Perpetual-Discount | 2.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 21.50 Evaluated at bid price : 21.50 Bid-YTW : 7.01 % |

| RY.PR.C | Perpetual-Discount | 2.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 17.85 Evaluated at bid price : 17.85 Bid-YTW : 6.46 % |

| PWF.PR.E | Perpetual-Discount | 2.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 20.25 Evaluated at bid price : 20.25 Bid-YTW : 6.84 % |

| GWO.PR.G | Perpetual-Discount | 2.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 18.75 Evaluated at bid price : 18.75 Bid-YTW : 7.03 % |

| BAM.PR.M | Perpetual-Discount | 3.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 12.37 Evaluated at bid price : 12.37 Bid-YTW : 9.79 % |

| BAM.PR.G | FixedFloater | 4.66 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 25.00 Evaluated at bid price : 11.00 Bid-YTW : 9.99 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| PWF.PR.K | Perpetual-Discount | 283,255 | TD crossed 277,000 after hours at 17.85. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 17.53 Evaluated at bid price : 17.53 Bid-YTW : 7.12 % |

| HSB.PR.C | Perpetual-Discount | 269,940 | TD crossed 257,400 after hours at 17.23. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 17.23 Evaluated at bid price : 17.23 Bid-YTW : 7.51 % |

| SLF.PR.A | Perpetual-Discount | 224,950 | TD crossed 215,800 after hours at 16.95. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 16.77 Evaluated at bid price : 16.77 Bid-YTW : 7.19 % |

| SLF.PR.E | Perpetual-Discount | 208,615 | TD crossed 198,700 after hours at 15.50. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 15.50 Evaluated at bid price : 15.50 Bid-YTW : 7.37 % |

| TD.PR.E | FixedReset | 201,785 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 24.95 Evaluated at bid price : 25.00 Bid-YTW : 6.27 % |

| BNS.PR.K | Perpetual-Discount | 190,250 | TD crossed 189,800 after hours at 19.05. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 18.86 Evaluated at bid price : 18.86 Bid-YTW : 6.41 % |

| TD.PR.R | Perpetual-Discount | 190,003 | TD crossed 184,500 at 21.20. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 20.92 Evaluated at bid price : 20.92 Bid-YTW : 6.74 % |

| BMO.PR.K | Perpetual-Discount | 184,160 | TD crossed 180,000 after hours at 19.62. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 19.31 Evaluated at bid price : 19.31 Bid-YTW : 6.95 % |

| IAG.PR.A | Perpetual-Discount | 181,830 | TD crossed 180,600 after hours at 16.62. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 16.61 Evaluated at bid price : 16.61 Bid-YTW : 7.02 % |

| TD.PR.O | Perpetual-Discount | 173,480 | TD crossed 164,800 after hours at 18.88. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 18.81 Evaluated at bid price : 18.81 Bid-YTW : 6.49 % |

| RY.PR.P | FixedReset | 167,217 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 24.95 Evaluated at bid price : 25.00 Bid-YTW : 6.14 % |

| GWO.PR.H | Perpetual-Discount | 164,810 | TD crossed 162,100 at 16.71. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 16.71 Evaluated at bid price : 16.71 Bid-YTW : 7.37 % |

| RY.PR.C | Perpetual-Discount | 145,660 | TD crossed 142,800 after hours at 17.91. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 17.85 Evaluated at bid price : 17.85 Bid-YTW : 6.46 % |

| BNS.PR.T | FixedReset | 132,590 | National crossed 40,000 at 25.03. TD crossed 30,100 after hours at 25.05. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 24.98 Evaluated at bid price : 25.03 Bid-YTW : 6.09 % |

| BCE.PR.A | FixedFloater | 131,405 | TD crossed 126,100 after hours at 17.01. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 25.00 Evaluated at bid price : 16.93 Bid-YTW : 6.73 % |

| MFC.PR.C | Perpetual-Discount | 123,880 | TD crossed 118,100 after hours at 16.85. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 16.85 Evaluated at bid price : 16.85 Bid-YTW : 6.79 % |

| CL.PR.B | Perpetual-Discount | 121,975 | Nesbitt crossed 18,800 at 21.81. TD crossed 94,100 after hours at 22.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 21.90 Evaluated at bid price : 21.90 Bid-YTW : 7.24 % |

| CM.PR.H | Perpetual-Discount | 115,284 | TD crossed 95,000 after hours at 16.55. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 16.50 Evaluated at bid price : 16.50 Bid-YTW : 7.34 % |

| WFS.PR.A | SplitShare | 115,100 | Desjardins crossed 100,000 at 8.62. Asset coverage of 1.2-:1 as of January 15 according to Mulvihill. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2011-06-30 Maturity Price : 10.00 Evaluated at bid price : 8.52 Bid-YTW : 12.82 % |

| SLF.PR.B | Perpetual-Discount | 111,859 | TD crossed 105,300 after hours at 16.85. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 16.62 Evaluated at bid price : 16.62 Bid-YTW : 7.33 % |

| RY.PR.H | Perpetual-Discount | 110,530 | TD crossed 103,700 after hours at 21.42. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 21.42 Evaluated at bid price : 21.42 Bid-YTW : 6.61 % |

| PWF.PR.G | Perpetual-Discount | 110,246 | TD crossed 109,500 after hours at 21.67. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 21.30 Evaluated at bid price : 21.30 Bid-YTW : 6.98 % |

| BNS.PR.O | Perpetual-Discount | 109,740 | TD crossed 108,500 after hours at 21.04. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 21.01 Evaluated at bid price : 21.01 Bid-YTW : 6.72 % |

| BNS.PR.P | FixedReset | 109,700 | Nesbitt crossed 50,000 at 23.00, then another 57,600 at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 22.57 Evaluated at bid price : 22.65 Bid-YTW : 4.57 % |

| SLF.PR.C | Perpetual-Discount | 104,709 | RBC bought 22,000 from National at 15.60; TD crossed 66,800 after hours at 15.47. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 15.41 Evaluated at bid price : 15.41 Bid-YTW : 7.33 % |

| MFC.PR.B | Perpetual-Discount | 103,083 | Nesbitt crossed 40,000 at 17.85; TD crossed 51,900 after hours at 16.21. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-26 Maturity Price : 17.55 Evaluated at bid price : 17.55 Bid-YTW : 6.73 % |

| There were 65 other index-included issues trading in excess of 10,000 shares. | |||

I have had occasion to review asset class correlation – among the things I have read was: Li, Lingfeng, Macroeconomic Factors and the Correlation of Stock and Bond Returns(November 2002). Yale ICF Working Paper No. 02-46; AFA 2004 San Diego Meetings. Available at SSRN: http://ssrn.com/abstract=363641:

This paper examines the correlation between stock and bond returns. It first documents that the major trends in stock-bond correlation for G7 countries follow a similar reverting pattern in the past forty years. Next, an asset pricing model is employed to show that the correlation of stock and bond returns can be explained by their common exposure to macroeconomic factors. The link between the stock-bond correlation and macroeconomic factors is examined using three successively more realistic formulations of asset return dynamics. Empirical results indicate that the major trends in stock-bond correlation are determined primarily by uncertainty about expected inflation. Unexpected inflation and the real interest rate are significant to a lesser degree. Forecasting this stock-bond correlation using macroeconomic factors also helps improve investors’ asset allocation decisions. One implication of this link between trends in stock-bond correlation and inflation risk is the Murphy’s Law of Diversification: diversification opportunities are least available when they are most needed.

In light of the widely held view that Benjamin Graham is so famous his pronouncements should not be questioned, it is amusing to read the first footnote:

In the first version of The Intelligent Investor, published in the 1950s, the author, then investment guru Benjamin Graham, claims that the correlation between stock and bond returns is negative. His argument provides the basis for the asset allocation advice of 50-50 split in stocks and bonds. However, in the second version of this book published in the 1970s, the correlation structure has changed and the argument is dropped. Today, one can randomly search the term “stock and bond correlation” on the internet, and easily find sharply contradictory opinions among market participants. When it comes to story-telling, one man’s story is just as good as others. Most of these opinions are based on causal observations and lack the support of concrete evidence.

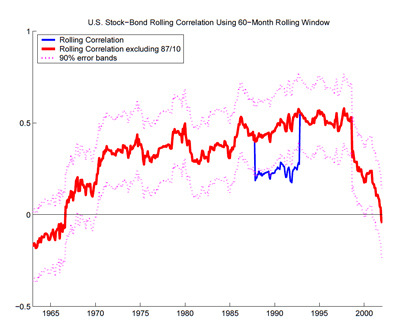

Figure 1: U.S. Rolling Stock-Bond Correlations, 1961-2001 This figure shows U.S. rolling stock-bond correlations using 60-month rolling window. The thick line is the rolling correlation excluding October 1987. The two dashed lines are the 90% upper and lower error bands. The thin line includes October 1987. Stock returns are calculated using the broad market total return indices. Bond returns are calculated using the long-term government bond total return indices. All returns are monthly, from January 1958 to December 2001.

Our analysis sheds light on the reverting trend observed in G7 stock-bond correlations. The 1970s saw an oil crisis and a subsequent economic stagflation in major industrial countries, which caused high and persistent inflation expectations for over a decade. Investors’ concern for inflation strongly affected the valuation of financial assets during this period and resulted in high comovement between stock and bond returns. The sharp decline in stock-bond correlations in the 1990s can be partially attributed to the lower inflation risk during this period.

Stocks and bonds are two major asset classes for ordinary investors. A lower stock-bond correlation indicates better diversification opportunities. The fact that stock-bond correlation is positively related to inflation risk is a disturbing message for investors. During the periods when inflation risk is high, asset returns tend to be more volatile. This gives investors a stronger incentive to diversify the investment risk. Unfortunately, these are also the periods when stock-bond correlations are high and diversification opportunities are meager. This observation leads to the Murphy’s Law of Diversification: diversification opportunities are least available when they are most needed.

CIBC has announced:

that it had entered into an agreement with a group of underwriters led by CIBC World Markets Inc. for an issue of 8 million non-cumulative Rate Reset Class A Preferred Shares, Series 35 (the “Series 35 Shares”) priced at $25.00 per Series 35 Share to raise gross proceeds of $200 million.

CIBC has granted the underwriters an option, exercisable in whole or in part prior to closing, to purchase an additional 3 million Series 35 Shares at the same offering price. Should the underwriters’ option be fully exercised, the total gross proceeds of the financing will be $275 million.

The Series 35 Shares will yield 6.5% per annum, payable quarterly, as and when declared by the Board of Directors of CIBC, for an initial period ending April 30, 2014. On April 30, 2014 and on April 30 every five years thereafter, the dividend rate will reset to be equal to the then current five-year Government of Canada bond yield plus 4.47%.

Holders of the Series 35 Shares will have the right to convert their shares into non-cumulative Floating Rate Class A Preferred Shares, Series 36 (the “Series 36 Shares”), subject to certain conditions, on April 30, 2014 and on April 30 every five years thereafter. Holders of the Series 36 Shares will be entitled to receive a quarterly floating rate dividend, as and when declared by the Board of Directors of CIBC, equal to the three-month Government of Canada Treasury Bill yield plus 4.47%.

Holders of the Series 36 Shares may convert their Series 36 Shares into Series 35 Shares, subject to certain conditions, on April 30, 2019 and on April 30 every five years thereafter.

The expected closing date is February 4, 2009. The net proceeds of this offering will be used for general purposes of CIBC.

Update, 2009-2-3: CIBC announced on January 27:

that as a result of strong investor demand for its domestic public offering of non-cumulative Rate Reset Class A Preferred Shares, Series 35 (the “Series 35 Shares”), the size of the offering has been increased to 10 million shares. The gross proceeds of the offering will now be $250 million.

In addition, CIBC has granted the underwriters an option, exercisable in whole or in part prior to closing, to purchase up to an additional 3 million Series 35 Shares at a price of $25.00 per share. Should the underwriters’ option be fully exercised, the total gross proceeds of the financing will be $325 million.

The issue is set to close tomorrow and trade with the symbol CM.PR.L

The first dividend will be payable April 28 for $0.37842 based on closing Feb. 4

Inflation is down, according to Statistics Canada:

The Bank of Canada’s core index advanced 2.4% over the 12 months to December, identical to the rise in November. The main contributors to the increase in the core index were higher prices for bread, cereal products and meat products. Price declines for purchasing and leasing passenger vehicles remained the primary downward contributor.

The seasonally adjusted monthly core index posted no change from November to December, after rising 0.6% from October to November.

PerpetualDiscounts were off again today, reducing their month-to-date return to +5.65%, having peaked on January 13 at +7.51%. The median pre-tax bid-YTW is now 6.95%, equivalent to 9.73% interest at the standard conversion factor of 1.4x, compared to long corporates, still steady at 7.5%. The pre-tax interest-equivalent spread is thus 223bp.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.91 % | 7.62 % | 37,348 | 13.47 | 2 | -1.5620 % | 854.7 |

| FixedFloater | 7.39 % | 7.02 % | 150,619 | 13.69 | 8 | -0.9992 % | 1,386.9 |

| Floater | 5.43 % | 4.61 % | 35,389 | 16.22 | 4 | -1.3023 % | 967.5 |

| OpRet | 5.31 % | 4.76 % | 142,780 | 4.05 | 15 | 0.2877 % | 2,023.8 |

| SplitShare | 6.28 % | 9.84 % | 79,275 | 4.14 | 15 | -0.2689 % | 1,772.5 |

| Interest-Bearing | 7.18 % | 8.50 % | 36,685 | 0.90 | 2 | -0.1172 % | 1,968.9 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2455 % | 1,550.5 |

| Perpetual-Discount | 6.92 % | 6.95 % | 231,379 | 12.62 | 71 | -0.2455 % | 1,427.9 |

| FixedReset | 6.01 % | 4.98 % | 817,266 | 14.88 | 22 | -0.1483 % | 1,805.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| PWF.PR.A | Floater | -7.54 % | Bids disappeared, with four trades totalling 4,200 in a range of 12.50-00; closing at 12.02-50, 2×8. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 12.02 Evaluated at bid price : 12.02 Bid-YTW : 4.36 % |

| ELF.PR.G | Perpetual-Discount | -4.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 14.50 Evaluated at bid price : 14.50 Bid-YTW : 8.29 % |

| BAM.PR.G | FixedFloater | -4.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 25.00 Evaluated at bid price : 10.51 Bid-YTW : 10.46 % |

| ELF.PR.F | Perpetual-Discount | -4.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 15.26 Evaluated at bid price : 15.26 Bid-YTW : 8.79 % |

| PPL.PR.A | SplitShare | -3.62 % | Asset coverage of 1.4+:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.53 Bid-YTW : 9.76 % |

| SBC.PR.A | SplitShare | -3.45 % | Asset coverage of 1.3-:1 as of January 22, according to Brompton Group. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-11-30 Maturity Price : 10.00 Evaluated at bid price : 7.83 Bid-YTW : 12.67 % |

| BCE.PR.R | FixedFloater | -3.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 25.00 Evaluated at bid price : 15.76 Bid-YTW : 7.08 % |

| BCE.PR.Y | Ratchet | -2.97 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 25.00 Evaluated at bid price : 14.36 Bid-YTW : 7.62 % |

| RY.PR.E | Perpetual-Discount | -2.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 17.40 Evaluated at bid price : 17.40 Bid-YTW : 6.48 % |

| RY.PR.A | Perpetual-Discount | -2.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 17.09 Evaluated at bid price : 17.09 Bid-YTW : 6.52 % |

| BNS.PR.O | Perpetual-Discount | -2.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 20.90 Evaluated at bid price : 20.90 Bid-YTW : 6.75 % |

| TD.PR.Y | FixedReset | -2.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 21.96 Evaluated at bid price : 22.00 Bid-YTW : 4.22 % |

| CU.PR.A | Perpetual-Discount | -2.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 21.53 Evaluated at bid price : 21.53 Bid-YTW : 6.87 % |

| BAM.PR.K | Floater | -1.87 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 7.36 Evaluated at bid price : 7.36 Bid-YTW : 7.23 % |

| FFN.PR.A | SplitShare | -1.81 % | Asset coverage of 1.1+:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 7.61 Bid-YTW : 11.07 % |

| TD.PR.C | FixedReset | -1.78 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 23.68 Evaluated at bid price : 23.72 Bid-YTW : 4.93 % |

| BNS.PR.Q | FixedReset | -1.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 21.12 Evaluated at bid price : 21.12 Bid-YTW : 4.40 % |

| SBN.PR.A | SplitShare | -1.75 % | Asset coverage of 1.7-:1 as of January 15 according to Mulvihill. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.96 Bid-YTW : 7.53 % |

| RY.PR.L | FixedReset | -1.74 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 23.66 Evaluated at bid price : 23.70 Bid-YTW : 4.98 % |

| GWO.PR.I | Perpetual-Discount | -1.71 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 15.51 Evaluated at bid price : 15.51 Bid-YTW : 7.36 % |

| FTN.PR.A | SplitShare | -1.65 % | Asset coverage of 1.3-:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2015-12-01 Maturity Price : 10.00 Evaluated at bid price : 7.76 Bid-YTW : 9.99 % |

| CM.PR.E | Perpetual-Discount | -1.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 19.29 Evaluated at bid price : 19.29 Bid-YTW : 7.32 % |

| RY.PR.C | Perpetual-Discount | -1.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 17.47 Evaluated at bid price : 17.47 Bid-YTW : 6.60 % |

| BCE.PR.I | FixedFloater | -1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 25.00 Evaluated at bid price : 15.78 Bid-YTW : 7.06 % |

| GWO.PR.H | Perpetual-Discount | -1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 16.57 Evaluated at bid price : 16.57 Bid-YTW : 7.42 % |

| MFC.PR.B | Perpetual-Discount | -1.40 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 17.58 Evaluated at bid price : 17.58 Bid-YTW : 6.72 % |

| IAG.PR.A | Perpetual-Discount | -1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 16.61 Evaluated at bid price : 16.61 Bid-YTW : 7.02 % |

| SLF.PR.D | Perpetual-Discount | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 15.55 Evaluated at bid price : 15.55 Bid-YTW : 7.26 % |

| PWF.PR.I | Perpetual-Discount | 1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 21.75 Evaluated at bid price : 21.75 Bid-YTW : 6.95 % |

| PWF.PR.M | FixedReset | 1.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 24.95 Evaluated at bid price : 25.00 Bid-YTW : 5.22 % |

| POW.PR.D | Perpetual-Discount | 1.79 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 18.23 Evaluated at bid price : 18.23 Bid-YTW : 6.93 % |

| BAM.PR.B | Floater | 2.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 7.77 Evaluated at bid price : 7.77 Bid-YTW : 6.84 % |

| NA.PR.N | FixedReset | 2.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 22.44 Evaluated at bid price : 22.50 Bid-YTW : 4.49 % |

| SLF.PR.A | Perpetual-Discount | 2.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 16.65 Evaluated at bid price : 16.65 Bid-YTW : 7.23 % |

| BNA.PR.B | SplitShare | 2.38 % | Asset coverage of 1.8+:1 as of December 31 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2016-03-25 Maturity Price : 25.00 Evaluated at bid price : 21.50 Bid-YTW : 7.69 % |

| BNA.PR.C | SplitShare | 2.42 % | Asset coverage of 1.8+:1 as of December 31 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 11.01 Bid-YTW : 15.94 % |

| BAM.PR.J | OpRet | 3.34 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 17.62 Bid-YTW : 10.65 % |

| TRI.PR.B | Floater | 4.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 11.50 Evaluated at bid price : 11.50 Bid-YTW : 4.61 % |

| DFN.PR.A | SplitShare | 4.44 % | Asset coverage of 1.7-:1 as of January 15 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.70 Bid-YTW : 8.22 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BNS.PR.T | FixedReset | 103,166 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 25.00 Evaluated at bid price : 25.05 Bid-YTW : 5.91 % |

| RY.PR.P | FixedReset | 85,318 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 24.97 Evaluated at bid price : 25.02 Bid-YTW : 5.96 % |

| BNS.PR.P | FixedReset | 83,680 | Nesbitt crossed 60,000 at 23.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 22.87 Evaluated at bid price : 22.95 Bid-YTW : 4.29 % |

| ELF.PR.F | Perpetual-Discount | 71,647 | RBC bought 21,000 from National at 16.00; Scotia bought two blocks of 10,000 each at 10.90; one from anonymous, the other from National. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 15.26 Evaluated at bid price : 15.26 Bid-YTW : 8.79 % |

| TD.PR.E | FixedReset | 60,545 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 25.09 Evaluated at bid price : 25.14 Bid-YTW : 6.06 % |

| MFC.PR.B | Perpetual-Discount | 43,800 | Nesbitt crossed 30,000 at 17.63, then another 10,000 at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-23 Maturity Price : 17.58 Evaluated at bid price : 17.58 Bid-YTW : 6.72 % |

| There were 29 other index-included issues trading in excess of 10,000 shares. | |||

Ricardo Cabellero is the Ford International Professor of Economics at MIT, Co-Director of the World Economic Laboratory, and Head of the Economics Department. He has just written a pair of columns for VoxEU, liberally sprinkled with accessible references addressing first the causes of the credit crunch and secondly his prescriptions for future policy.

I was immediately impressed by his rejection of currently fashionable scapegoating:

There is an emerging consensus on the causes of the crisis which essentially rehashes an old list of complaints about potential excesses committed in the phase prior to the crisis. The sins include uncontrolled global imbalances, unscrupulous lenders, and an insatiable Wall Street, all of them lubricated by an ever expansionary Federal Reserve.

It follows from this perspective that the appropriate policy response is to focus on reducing global imbalances, boosting financial regulation, bringing down leverage ratios, and adding bubble-control to the Fed’s mandate.

I do not share this consensus view and its policy prescriptions

I have often complained – e.g., yesterday – that the targetting of “perverse incentives” as the root of all evil misses the point. You have to sell what you manufacture. If you can’t sell it, no profit for the company, no bonus. Targetting Wall Street and its 30-year-old traders implicitly absolves the grey-haired financial managers and regulators who created the demand, bought the product, and demanded more.

I will point out that it is very difficult to talk an investor out of making money. You can convince them that a future investment making $1 a month has $10 worth of risk and should be avoided. You can commiserate with them after they’ve lost their $10. But in between, don’t try telling somebody who has just made $1 that he was lucky, not smart.

For quite some time, but in particular since the late 1990s, the world has experienced a chronic shortage of financial assets to store value. The reasons behind this shortage are varied. They include the rise in savings needs by aging populations in Japan and Europe, the fast growth and global integration of high saving economies, the precautionary response of emerging markets to earlier financial crises, and the intertemporal smoothing of commodity producing economies.

…

Moreover, because of the US’s role as the centre of world capital markets, much of the large global demand for financial assets has been channelled toward US assets. This has been the main reason for the large global “imbalances” observed in recent years. The large current account deficits experienced by the US are simply the counterpart of the large demand for its assets.

I once asked an economist I respect about the US current account deficit and financing by US debt. Could the root cause, I asked, be a demand for US debt by the rest of the world, rather than US demand for foreign goods? I didn’t get much of an answer … I should have asked Cabellero!

However, there was one important caveat that would prove crucial later on. The global demand for assets was particularly for very safe assets – assets with AAA credit ratings. This is not surprising in light of the importance of central banks and sovereign wealth funds in creating this high demand for assets. Moreover, this trend toward safety became even more pronounced after the NASDAQ crash.

Soon enough, US banks found a “solution” to this mismatch between the demand for safe assets and the expansion of supply through the creation of risky subprime assets; the market moved to create synthetic AAA instruments.

Wall Street met the demand of blind investors. What’s unusual about that? I have also noted some academic experimental work indicating that the price of an asset tends to increase to the money available to buy it, regardless of intrinsic quality.

The AAA tranches so created were held by the non-levered sector of the world economy, including central banks, sovereign wealth funds, pension funds, etc. They were also held by a segment of the highly-levered sector, especially foreign banks and domestic banks that kept them on their books, directly and indirectly, as they provided attractive “safe” yields. The small toxic component was mostly held by agents that could handle the risk, although highly levered investment banks also were exposed.

Much of the focus on the regulatory and credit agency mistakes highlights the fact that the AAA tranch seems to have been too large relative to the “true” capacity of the underlying risky instruments to create such a tranch. While I agree with this assessment, I believe it is incomplete and, because of this, it does not point to the optimal policy response.

Instead, I believe the key issue is that even if we give the benefit of the doubt to the credit agencies and accept that these instruments were indeed AAA from an unconditional probability of default perspective (the only one that counts for credit agencies), they were not so with respect to severe macroeconomic risk.

This created a highly volatile concoction where highly levered institutions of systemic importance were holding assets that were very vulnerable to aggregate shocks. This was an accident waiting to happen.

It’s very hard to forecast a paradigm shift. If the people being advised are making good money, they won’t listen to such a forecast anyway. Even if they do acknowledge the possibility of such an event, they will be serenely confident of their ability to recognize the turning point when it happens and cash out at the top.

To paraphrase a recent secretary of defence, risk refers to situations where the unknowns are known, while uncertainty refers to situations where the unknowns are unknown. This distinction is not only linguistically interesting, but also has significant implications for economic behaviour and policy prescriptions.

There is extensive experimental evidence that economic agents faced with (Knightian) uncertainty become overly concerned with extreme, even if highly unlikely, negative events. Unfortunately, the very fact that investors behave in this manner make the dreaded scenarios all the more likely.

Worsening the situation, until very recently, the policy response from the US Treasury exacerbated rather than dampened the uncertainty problem.

Early on in the crisis, there was a nagging feeling that policy was behind the curve; then came the “exemplary punishment” (of shareholders) policy of Secretary Paulson during the Bear Stearns intervention, which significantly dented the chance of a private capital solution to the problem; and finally, the most devastating blow came during the failure to support Lehman. The latter unleashed a very different kind of recession, where uncertainty ravaged all forms of explicit and implicit financial insurance markets.

In the second column, Dr. Cabellero developes the “financial insurance” theme:

An economy with no financial insurance operates very differently from the standard modern economies we are accustomed to in the developed world.

- There is limited uncollateralized or long-term credit (since such loans always have an insurance built in through the possibility of default),

- the risk premium sky-rockets,

- economic agents hoard massive amount of resources for self-insurance and real investment purposes.

During the last quarter of 2008 we witnessed the beginning of a transition from an economy with insurance to one without it.

Fair enough! That’s as good a summary as any I’ve seen. But what are the implications?

At this juncture of the crisis there are mountains of investment-ready cash waiting for some indication that the time to enter the market has arrived. But investors are frozen staring at each other, and by so doing, they are further dragging the economy downward. The normal speculative forces that trigger a recovery are for everybody to want to arrive first, to “make a killing.” But with so much fear around us, investors have changed the paradigm and they are now content with letting somebody else try his or her luck first, so we are stuck.

…

We need to reverse this mechanism by restoring the appetite for arriving first.

…

My sense is that, to a first order of approximation, the correct policy response should build on the following three observations:

- Many of the ex-ante “imbalances” are more structural in nature than is implied in the consensus view, and hence will remain with us long after the crisis is over.

- They stem from a global excess demand for financial assets and, especially, for AAA financial assets.

- The main policy mistakes took place during rather than prior to the crisis.

…

Contrary to what investors thought at the peak of the boom, the (private) financial sector in the US is not able to satisfy the global demand for AAA assets when large negative aggregate events take place. However, the US government does have the capacity to fill this gap, especially because it is the recipient of flight-to-quality capital.

…

As long as the government becomes the explicit insurer for generalised panic-risk, we can in the medium run go back to a world not too different from the one we had before the crisis (aside from real estate prices and the construction sector).

…

This must be acknowledged in advance, and paid for by the insured institutions. Reasonable concerns about transparency, complexity, and incentives can be built into the insurance premia. Collective deleveraging, as currently being done, should not constitute the core response; macroeconomic insurance should.

…

The recent government intervention with respect to Citi – with its mixture of (paid) insurance and capital – is a promising precedent. So too was the second government package for AIG.These interventions need to be scaled up to the whole financial system (banks and beyond), and it is better to do it all at once, for in this case the likelihood of the government ever having to disburse funds for its insurance provision becomes remote.

…

In all these contexts, trimming the (lower) tail-risk offers the biggest bang-for-the-buck. In this sense, capital injections are not a particularly efficient way of dealing with the problem unless the government is willing to invest massive amounts of capital, certainly much more than the current TARP. The reason is that Knightian uncertainty generates a sort of double-(or more)-counting problem, where scarce capital is wasted insuring against impossible events (Caballero and Krishnamurthy 2008b).

…

Does this mean that there is no role for capital injections? Certainly not. Knightian uncertainty is not the only problem in financial markets, and capital injections are needed for conventional reasons as well. The point is simply that these injections need to be supplemented by insurance contracts, unless the government is willing to increase the TARP by an order of magnitude (i.e. measure it in trillions).

Very well argued!

It is amusing to note – given the tendency to blame complexity nowadays – that the “insurance contract” represents a Credit Default Swap on the equity tranche of a tiered product made up of other tiered products, ie. CDO-squared. Ha-ha!

And, as it happens, there is a manner in which private companies can apply this prescription – more or less – on the public markets.

Assiduous Readers will remember that Manulife got into difficulty with its seg-fund guarantees. The problem is that they are – as managers – ascribing a very low probability to those guarantees being required, while at the same time they are – as regulated bodies – ascribing a higher probability to the melt-down scenario. Sound familiar?

So here’s a modest proposal … and I’ll use Manulife as an example, but any institution with any clearly definable tail-risk will do:

MFC has the money to do this. According to their Annual Report, they spent $2.245-billion on share buybacks in 2007 and $1.631-billion in 2006. Just divert some money from that.

With this plan, MFC reduces its vulnerability to tail risk, while at the same time giving the shareholders the benefit of the positive (as perceived by management) net present value of the insurance. As a bonus, the risk has been unbundled for investors to retain or dump, as they see fit.

Update, 2009-1-26: Aleablog supports the Caballero plan. Dealbreaker is somewhat suspicious.

OSFI has advised that it:

is in the process of revising Guideline B-6 on Liquidity to take account of the Principles recommended by the Basel Committee and to incorporate any additional guidance that is appropriate for domestic application. Similar deliberations are taking place across jurisdictions through the BCBS and other regulatory fora. A consultation draft of the revised Guideline is targeted for release in the summer of 2009.

There is, surprisingly, a request for submissions:

As part of our development of new guidance on liquidity, OSFI welcomes submissions as to how to best give effect to the BCBS Principles on a consistent and measurable basis.

… but no indication that these submissions will be publicly disclosed and discussed.

The Basel Committee on Banking Supervisions’s September ’08 Principles for Sound Liquidity Risk Management and Supervision include:

Principle 13: A bank should publicly disclose information on a regular basis that enables market participants to make an informed judgement about the soundness of its liquidity risk management framework and liquidity position.

… with the exhortation:

As part of its periodic financial reporting, a bank should provide quantitative information about its liquidity position that enables market participants to form a view of its liquidity risk. Examples of quantitative disclosures currently disclosed by some banks include information regarding the size and composition of the bank’s liquidity cushion, additional collateral requirements as the result of a credit rating downgrade, the values of internal ratios and other key metrics that management monitors (including regulatory metrics that may exist in the bank’s jurisdiction), the limits placed on the values of those metrics, and balance sheet and off-balance sheet items broken down into a number of short-term maturity bands and the resultant cumulative liquidity gaps. A bank should provide sufficient qualitative discussion around its metrics to enable market participants to understand them, eg the time span covered, whether computed under normal or stressed conditions, the organisational level to which the metric applies (group, bank or non-bank subsidiary), and other assumptions utilised in measuring the bank’s liquidity position, liquidity risk and liquidity cushion.

As an example of current reporting the RBC 2008 Annual Report contains a three page section (pp. 109-112 of the report, 111-114 of the PDF) on liquidity risk, comprised largely of ‘don’t worry, trust us’ blather and precious little quantitative data.

Ed Clark, CEO of TD Bank, has gotten himself into a little trouble over some remarks made at the RBC Capital Markets Canadian Bank CEO Conference, Jan. 8, 2009, in Toronto.

He began by deprecating TARP:

I think we have the capital, but, as I said when I do the little arithmetic, that’s an issue. As you know – I mean, I have strong views on this. The United States comes along and it puts this TARP in and adds three points to the Tier 1 ratio. If we were in the United States today, our Tier 1 ratio would be about 12.5%, so you sit there and you say this is just a con game, a five-year retractable pref we’re going to call common equity, because the US government says, Basel was an interesting thought, but we overrule Basel. And so if we look at Wells Fargo, USB and PNC, our tangible common equity is 40% or 50% bigger than theirs. And that’s the way I run the bank, is everything starts with tangible common equity, and then you leverage that up in different structures and that’s – so you get that and then you try to maximize your return on risk-weighted assets, which means you maximize your operating ROE.

… which was interesting enough, but his comments on the safety of TD preferred shares – and by implication, other Canadian banks – have attracted attention:

I think Mr. Bernanke’s going to win. He’s going to say to the market, I’m going to make it so expensive for you to hold riskless assets that you will finally wake up and say you can take some risk.

And that’s really what happened in our preferred share issue, is that the average consumer sat there and said, well, this is 6.25%, but it’s actually 8% pretax, effectively government guaranteed, maybe not explicitly, but what are the chances that TD Bank is going to not be bailed out if it did something stupid? And so where else do I get 8% government investments right now? And I think suddenly the retail market came back in January and said, give me more of this, and so when we did our issue, they said, could you give us some more of this piece of paper?

And so I do think that we are going to be able to emerge out of this and say the Canadian bank will not only redefine Canadian banking, I think it will redefine Canada as to say, somehow you guys did it right. It’s not obvious, you don’t look that smart when we look at you, but somehow you stumbled your way through here and did this right.

And so, I think that’s worth fighting hard for, and if that means that when the shorts from the US arrive in Toronto and swagger down Bay Street and say, we’re going to short all the Canadian banks and teach you guys a lesson, we’re going to put you out of business, you have to take them seriously, fight back. But you don’t fight back by going on the market. And so if that means we have to raise non-common Tier 1 ratio to look pretty, I’ll do that. It’s stupid, but it’s good to the interests of my shareholders.

It’s an interesting passage. I certainly agree with the characterization of Bernanke’s strategy for fighting the credit crunch. I have recently highlighted the enormous build-up in excess reserves in the US, that are currently held at basically no interest at the Fed; a hopeful sign is a recent shrinking of the Fed’s balance sheet; and if the Fed keeps spreads where they are – or follows my recommendation to slowly increase them – then at some point greed will overcome fear.

The last part of the passage deals with the eternal financial markets question: lucky or smart? He obviously has a conflict of interest in being so firmly in the “smart” school and buttresses it with a little nationalist swagger; I’m going to retain my opinion of “lucky”. But you never really know.

It’s the middle piece of the passage, where he states in so many words that there’s an implicit government guarantee on TD’s (and presumably the rest of the Big 6) preferred shares.

It’s a shockingly irresponsible statement; one may hope that at the very least he has a highly uncomfortable meeting with the regulators (he won’t, of course, but it’s always pleasant to hope).

I will go so far as to agree that at this particular time, if any of the Big 6 disclosed that they were far too close to insolvency for comfort, there would almost certainly be a bail-out (although I’m less certain that preferred shareholders would get off scot-free). I think the global response to the Lehman insolvency has convinced policy makers that now is not the right time to apply doctrinaire free market principles.

But. But! These preferreds Mr. Clark is flogging are perpetual. Interest rate may be mitigated – with corresponding increase in reinvestment risk – but the credit risk is perpetual. Twenty years ago, Mr. Clark’s smart bank was on the verge of insolvency, having hired too many MBAs to accumulate More Bad Assets in Mexico, Brazil and Argentina.

Could it happen again? Why not? Even if we allow Mr. Clark’s assertion that TD is very smart, I’m reminded of an investment aphorism (source unknown, at least to me): Only buy businesses that an idiot could run, because eventually an idiot will.

If, ten years forward, TD Bank does something stupid at a time when the collapse of a rinky-dink little Canadian bank will not have global systemic implications … it could fail. And I will remind investors that Tier-1 eligible preferred shares are perpetual, and the word “perpetual” includes “ten years forward”.

So anyway, he’s been taken to the woodshed by a bravely anonymous “government official”, reports Bloomberg:

Toronto-Dominion Bank Chief Executive Officer Ed Clark was “absolutely wrong” to suggest the bank had the implicit promise of a bailout under any circumstances, a senior Canadian government official said.

There are “no guarantees” for companies that make “stupid decisions,” said the official yesterday in Ottawa, who spoke on condition he not be identified.

… or, at least, as close to the woodshed as we’re likely to get.

Why isn’t Spend-Every-Penny making this statement? Why aren’t the regulators demanding an instant and grovelling retraction?