Bloomberg highlighted a study by A. Joseph Warburton, Deniz Anginer and Viral V. Acharya titled The End of Market Discipline? Investor Expectations of Implicit State Guarantees:

We find that bondholders of major financial institutions have an expectation that the government will shield them from losses and, as a result, they do not accurately price risk. While bond credit spreads are sensitive to risk for most financial institutions, credit spreads lack risk sensitivity for the largest institutions. This expectation of public support constitutes a subsidy to large financial institutions, allowing them to borrow at government-subsidized rates. The implicit subsidy provided large institutions an annual funding cost advantage of approximately 28 basis points on average over the 1990-2010 period, peaking at more than 120 basis points in 2009. The total value of the subsidy amounted to about $20 billion per year, topping $100 billion in 2009. Passage of Dodd-Frank did not eliminate expectations of government support. The cost of this implicit insurance could be internalized by imposing a corrective tax. Requiring financial institutions to shoulder the full cost of their debt would help create a more stable and efficient financial system.

I don’t like the taxation idea – that’s just going to lead to a hopeless mess, and there won’t be anything in the kitty when it’s needed. I have previously advocated, and continue to advocate, a progressive increase in capital requirements based on size and, perhaps, other measures of systemic importance if these can be measured objectively. Thus, a $20-billion bank might have required CET1 Capital of 8%, but at $200-billion bank might have a 10% requirement. Such a regime has the same objectives as the surcharges for G-SIBs and D-SIBs, but is less prone to regulatory corruption.

The situation with respect to Chesapeake’s junk bond redemption (that I mentioned on March 18) has been resolved:

Prices on the second-biggest U.S. natural gas producer’s notes have fallen by as much as 9 cents on the dollar, erasing $117 million, after a judge ruled May 8 that Chesapeake could redeem the securities at par. Investors including the hedge-fund firm run by former Lehman Brothers Holdings Inc. President Bart McDade were betting the Oklahoma City-based company had missed a deadline and would have to pay as much as $400 million to retire the debt early.

A search for returns has highlighted the dangers implicit in wagering on disputes in which borrowers traditionally had the upper hand after yields on junk debt dropped to a record 5.98 percent and prices soared to an unprecedented 107.2 cents on the dollar on May 9.

…

Any company that drafts ambiguous deal documents may receive similar legal treatment to the “get out of jail free card” that U.S. District Judge Paul Engelmayer in Manhattan handed to Chesapeake, according to Brian Gibbons Jr., an analyst at debt researcher CreditSights Inc. in New York.“The assumption now will be that indenture readers need to be on the lookout for sections of documents where they might

need ‘time to apply thoughtfully the canons of contractual interpretations,’” Gibbons wrote in a May 8 report. “The risks

are to be laid on the bondholder for bad drafting.”

Transmission of monetary policy is – somewhat surprisingly – getting media attention after a blog post by Mark Dow:

We’re all, to varying degrees, slaves to our experiences. Their formative experiences, almost to a man, were in the early 80s. This is when they built their knowledge and assembled their financial playbooks. They learned words like Milton Freidman, money multiplier, Paul Volcker, Ronald Reagan, and the superneutrality of money. Above all, they internalized one dictum: real men have hard money.

This understanding implies that an increase in bank reserves deposited at the Fed (i.e. “printing”) eventually feeds credit growth and thereby inflationary pressures; in other words, no base money increase, no credit growth. Only one problem: reality disagrees.

From 1981 to 2006 total credit assets held by US financial institutions grew by $32.3 trillion (744%). How much do you think bank reserves at the Federal Reserve grew by over that same period? They fell by $6.5 billion.

…

How is that possible? I thought in a fractional reserve system base money had to grow for credit to expand?The answer is structural. The financial deregulation that began in the early 80s (significantly, the abolition of regulation Q) and the consequent development of repo markets fundamentally changed the transmission mechanism of monetary policy. Collateral lending is now king. Today, length of collateral chains and haircut rates—neither of which are determined by the Fed—define the upper bounds of the money supply, not base money and reserve requirements.

Assiduous Readers will doubtless remember my mockery of HAMP in 2009. I just stumbled across some S&P Commentary dated 2013-4-26:

In June of last year, Standard & Poor’s Ratings Services contended that principal forgiveness was more likely to keep U.S. mortgage borrowers current than more commonly used modification tools (see “The Best Way to Limit U.S. Mortgage Redefaults May Be Principal Forgiveness,” June 15, 2012). Data gathered since then not only support this view but also demonstrate servicers’ growing adoption of this form of loss mitigation. (Watch the related CreditMatters TV segment titled, “Principal Forgiveness Remains The Best Way To Limit U.S. Mortgage Redefaults,” dated May 7, 2013.)

As of February of this year, more than 1.5 million homeowners have received a permanent modification through the U.S. federal government’s Home Affordable Modification Program (HAMP). Since the publication of our June 2012 article, there have been more than 400,000 additional modifications on outstanding mortgages (as of March 2013). This translates to roughly a 22% rate of growth in the number of modifications on an additional $2.4 billion in mortgage debt.

Under the HAMP Principal Reduction Alternative (PRA) program, which provides monetary incentives to servicers that reduce principal, borrowers have received approximately $9.6 billion in principal forgiveness as of March 2013. Interestingly, servicers have ramped up their use of principal forgiveness on loans that don’t necessarily qualify for PRA assistance. Indeed, among the top five servicers for non-agency loans, we’ve noted that principal forgiveness, as a percentage of average modifications performed on a monthly basis, has increased by about 200% since the latter half of 2011 (see Chart 1). We attribute part of this to the $25 billion settlement in February 2012 with 49 state attorneys general and these same five servicers: Ally/GMAC, Bank of America, Citi, JPMorgan Chase, and Wells Fargo). In fact, although principal reduction remains the least common type of loan modification among servicers, the percentage of non-agency modified loans that have received principal forgiveness has increased by 3% since June 2012 (see Chart 2). Since 2009, servicers have forgiven principal on approximately $45 billion of outstanding non-agency mortgages.

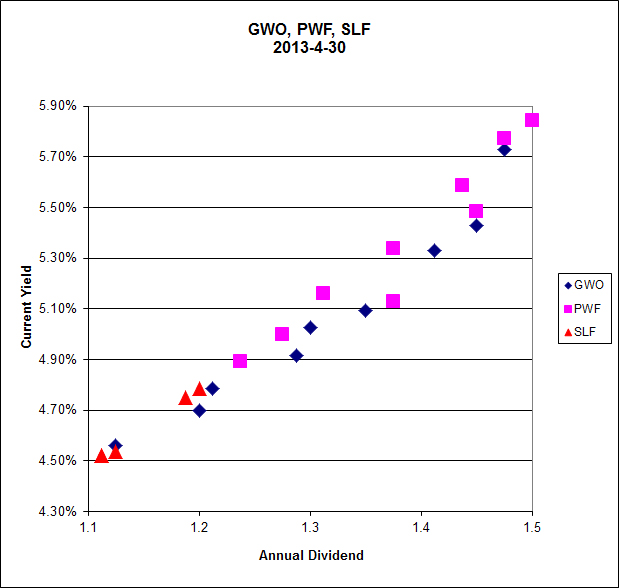

It was a modestly negative day for the Canadian preferred share market, with PerpetualPremiums down 10bp, FixedResets flat and DeemedRetractibles off 4bp. Volatility was average. Volume was below average.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2954 % | 2,572.5 |

| FixedFloater | 3.89 % | 3.11 % | 33,575 | 18.84 | 1 | 0.5766 % | 4,223.3 |

| Floater | 2.71 % | 2.93 % | 83,213 | 19.87 | 4 | -0.2954 % | 2,777.6 |

| OpRet | 4.81 % | -0.88 % | 67,362 | 0.13 | 5 | -0.1083 % | 2,609.8 |

| SplitShare | 4.79 % | 4.10 % | 105,817 | 4.06 | 5 | -0.0548 % | 2,968.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1083 % | 2,386.4 |

| Perpetual-Premium | 5.22 % | 2.29 % | 91,536 | 0.42 | 31 | -0.0977 % | 2,378.6 |

| Perpetual-Discount | 4.85 % | 4.88 % | 199,117 | 15.64 | 4 | 0.1932 % | 2,684.3 |

| FixedReset | 4.87 % | 2.61 % | 251,327 | 3.15 | 81 | -0.0010 % | 2,522.9 |

| Deemed-Retractible | 4.87 % | 3.49 % | 132,658 | 1.32 | 44 | -0.0432 % | 2,459.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| HSB.PR.D | Deemed-Retractible | -1.77 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-12-31 Maturity Price : 25.00 Evaluated at bid price : 25.52 Bid-YTW : 4.06 % |

| CIU.PR.C | FixedReset | -1.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-05-13 Maturity Price : 23.44 Evaluated at bid price : 25.21 Bid-YTW : 2.61 % |

| BAM.PR.C | Floater | -1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-05-13 Maturity Price : 17.81 Evaluated at bid price : 17.81 Bid-YTW : 2.97 % |

| MFC.PR.H | FixedReset | 1.25 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-03-19 Maturity Price : 25.00 Evaluated at bid price : 26.81 Bid-YTW : 2.50 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| RY.PR.X | FixedReset | 72,455 | RBC crossed blocks of 10,000 shares, 25,000 and 33,000, all at 26.20. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-24 Maturity Price : 25.00 Evaluated at bid price : 26.21 Bid-YTW : 2.27 % |

| ELF.PR.H | Perpetual-Premium | 52,710 | National crossed 32,000 at 26.15. YTW SCENARIO Maturity Type : Call Maturity Date : 2021-04-17 Maturity Price : 25.00 Evaluated at bid price : 26.02 Bid-YTW : 4.96 % |

| ENB.PR.N | FixedReset | 46,025 | Nesbitt crossed 30,000 at 25.85. YTW SCENARIO Maturity Type : Call Maturity Date : 2018-12-01 Maturity Price : 25.00 Evaluated at bid price : 25.80 Bid-YTW : 3.34 % |

| PWF.PR.F | Perpetual-Premium | 39,950 | Nesbitt crossed 24,200 at 25.20. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-06-12 Maturity Price : 25.00 Evaluated at bid price : 25.27 Bid-YTW : -5.50 % |

| POW.PR.C | Perpetual-Premium | 37,608 | Nesbitt crossed 23,000 at 25.45. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-06-12 Maturity Price : 25.00 Evaluated at bid price : 25.41 Bid-YTW : -8.46 % |

| GWO.PR.R | Deemed-Retractible | 36,495 | Fidelity Clearing Canada ULC (who?) bought 15,000 from RBC at 25.55. YTW SCENARIO Maturity Type : Call Maturity Date : 2021-12-31 Maturity Price : 25.00 Evaluated at bid price : 25.60 Bid-YTW : 4.57 % |

| There were 26 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| HSB.PR.D | Deemed-Retractible | Quote: 25.52 – 25.99 Spot Rate : 0.4700 Average : 0.2938 YTW SCENARIO |

| BAM.PR.J | OpRet | Quote: 26.63 – 26.89 Spot Rate : 0.2600 Average : 0.1730 YTW SCENARIO |

| IAG.PR.A | Deemed-Retractible | Quote: 24.64 – 24.88 Spot Rate : 0.2400 Average : 0.1766 YTW SCENARIO |

| GWO.PR.L | Deemed-Retractible | Quote: 26.50 – 26.70 Spot Rate : 0.2000 Average : 0.1371 YTW SCENARIO |

| BAM.PR.C | Floater | Quote: 17.81 – 17.97 Spot Rate : 0.1600 Average : 0.1039 YTW SCENARIO |

| MFC.PR.F | FixedReset | Quote: 25.11 – 25.49 Spot Rate : 0.3800 Average : 0.3244 YTW SCENARIO |