Well, that was a week and a half!

U.S. stocks sank, with the Dow Jones Industrial Average capping its biggest weekly drop in three years, as oil continued to slide and Chinese industrial data raised concern over a global economic slowdown.

Materials stocks declined the most in the Standard & Poor’s 500 Index, losing 2.9 percent as a group, while energy shares dropped 2.2 percent. International Business Machines Corp., DuPont Co. and Exxon Mobil Corp. sank at least 2.9 percent to lead declines in all 30 Dow stocks.

The S&P 500 lost 1.6 percent to 2,002.33 at 4 p.m. in New York, extending losses in the final hour to cap a weekly drop of 3.5 percent. The Dow sank 315.51 points, or 1.8 percent, to 17,280.83. The Dow slid 3.8 percent for the week, its biggest decline since November 2011.

Canada did worse:

Canadian stocks tumbled with equities around the world, capping the worst week in three years, as the continuing selloff in oil fueled concerns over a global economic slowdown.

Energy stocks dropped with oil prices as RMP Energy Inc. and Pacific Rubiales Energy Corp. slid at least 7.9 percent. Consumer-discretionary stocks sank as Amaya Inc. plunged 18 percent. Talisman Energy Inc. soared 17 percent on speculation of a deal with Repsol SA.

The Standard & Poor’s/TSX Composite Index (SPTSX) fell 173.22 points, or 1.3 percent, to 13,731.9 at 4 p.m. in Toronto. The equity gauge dropped 5.1 percent over five days, its worst weekly decline since September 2011. Trading in S&P/TSX stocks was 12 percent above the 30-day average at this time of day.

But it’s an ill wind…:

Inflation is moribund and bond buyers love it.

As crude oil leads a collapse in commodity prices, a German gauge of the outlook for inflation over the next five years has fallen below zero. With no increases in consumer prices in sight, bondholders’ interest and repayments are worth more, inflaming demand for fixed income. The longest maturities are setting the pace from Europe to the U.S.

The rush for bonds pushed yields in Germany and six other euro-area nations to record lows today, while in the U.S, 30-year yields closed at the lowest level since 2012, according to data compiled by Bloomberg. Adding to the momentum is the prospect that central-bank measures to rekindle inflation would involve efforts to keep down borrowing costs, including so-called quantitative easing from the European Central Bank

… and Treasuries…:

Treasuries rallied, with 10-year yields reaching the lowest in eight weeks, as a plunge in crude oil raised concern global inflation is slipping further below central-bank targets before the Federal Reserve meets next week.

The notes posted the biggest weekly decline in yield since June 2012 as crude oil futures fell below $58 a barrel in New York. Fed policy makers will review whether to retain the vow to hold interest rates at virtually zero for a “considerable time.” The biggest U.S. jobs gains in November since January 2012 fueled speculation last week of quicker interest-rate increases, while reports showing slowing factory output in China’s and financial turmoil in Greece represent additional economic headwinds for the U.S.

…

Treasury 10-year note yields fell eight basis points, or 0.08 percentage point, to 2.08 percent at 5 p.m. in New York, according to Bloomberg Bond Trader prices, after reaching the lowest level since Oct. 16. The 2.25 percent security rose 23/32 or $7.19 per $1,000 face amount, to 101 15/32. The yield has fallen 22 basis points this week, the most since June 2012.

So it seems as if the CSE is introducing market-makers:

Following the successful completion of a pilot project with two symbols, the CSE is now accepting applications for Market Makers for all CSE-listed securities. As outlined in the November 14 notice the CSE is modifying its market making programme to improve execution quality and service for retail investors. Market Makers will have the following responsibilities in their assigned stocks:

- •Maintain a bid/ask spread goal

- •Provide a Guaranteed Minimum Fill for eligible orders

- •Provide automatic odd lot execution, so that all incoming market or better limit odd lot orders will be auto traded at the bid/ask if they cannot be filled by booked odd lot orders;

- •Ensure a reasonable bid/ask in the context of current market conditions

- •Undergo periodic performance reviews

If the Toronto Stock Exchange is any guide, then:

- The bid/ask spread goal will neither be publicized nor enforced

- The size of the Guaranteed Minimum Fill will be top secret information, available only to those who pay for it

- Automatic odd lot execution will be fine. Yay!

- A reasonable bid/ask spread will be good fodder for jokes

- performance reviews will not be public and nobody will ever lose their assignment

DBRS downgraded Timmy’s:

DBRS Limited (DBRS) has today downgraded the Issuer Rating of Tim Hortons Inc. (THI or the Company) to BB (low) and its Senior Unsecured Debt to B, with a recovery rating of RR6; the trends are Stable. This action follows the Company’s announcement that it has received regulatory approval for and its shareholders have voted in favour of the proposed transaction to create a new global quick-service restaurant leader that would own both THI and Burger King Worldwide, Inc. (Burger King) under a new parent company, Restaurant Brands International (RBI). DBRS has removed the ratings from Under Review with Negative Implications.

…

Financial Risk Profile

In terms of financial profile, RBI is expected to have balance sheet debt of over $9 billion and preferred shares of $3 billion. Combined with pro forma earnings, DBRS estimates the combined entity will have lease-adjusted debt-to-EBITDAR excluding the preferred shares of approximately 6.23 times (x) and fixed-charge coverage of 1.96x, including the preferred dividend, credit metrics considered at the lower-end of the B range of ratings. That said, the combined entity should nevertheless generate meaningful levels of free cash flow (based on solid operating cash flow and low maintenance capex) beginning in 2016 and could deleverage significantly through a combination of debt repayment and earnings growth.

But, wonder of wonders, the Canadian preferred share market had a very good day, with PerpetualDiscounts up 8bp, FixedResets rocketing up 62bp and DeemedRetractibles gaining 3bp. Not surprisingly, given the averages, the lengthy Performance Highlights table is dominated by FixedReset winners. Volume was high.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

- based on Implied Volatility Theory only

- are relative only to other FixedResets from the same issuer

- assume constant GOC-5 yield

- assume constant Implied Volatility

- assume constant spread

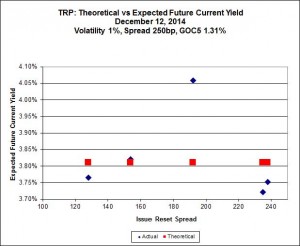

Here’s TRP:

So according to this, TRP.PR.A, bid at 19.90, is $1.29 cheap, but it has already reset. TRP.PR.B, bid at 17.20, resetting 2015-6-30 is about 0.21 rich and TRP.PR.C, bid at 18.65, resetting 2016-1-30 is fairly priced. The TRP issues seem to be steadily rationalizing, but there continues to be pressure on TRP.PR.A.

It looks like we’re back in the situation in which eight of the nine issues are well-behaved in accordance with theory, but extraordinary pressure on the lowest-spread issue, MFC.PR.F, is distorting the whole calculation. According to the distorted fit, MFC.PR.F, resetting at +141 on 2016-6-19 is about $0.62 cheap, while MFC.PR.L, resetting at +216 on 2019-6-19, is about $0.61 rich.

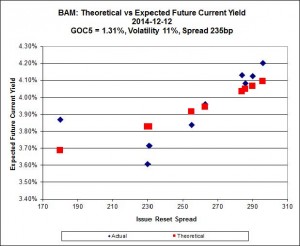

BAM is a little difficult to figure out:

As with MFC, it looks as if extraordinary cheapness in the lowest-spread issue, BAM.PR.X, resetting at +180bp on 2017-6-30, may be throwing off the Implied Volatility calculation; be that as it may, BAM.PR.X is bid at 20.10 and appears to be $0.99 cheap, while BAM.PR.R, resetting at +230bp 2016-6-30 is bid at 25.02 and appears to be $1.43 rich.

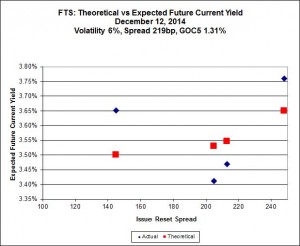

This is just weird because the middle is expensive and the ends are cheap but anyway … FTS.PR.H, with a spread of +145bp, and bid at 18.90, looks $0.81 cheap and resets 2015-6-1. FTS.PR.K, with a spread of +205bp, and bid at 24.62, looks $0.82 expensive and resets 2019-3-1

And now it’s time for PrefLetter!

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.8015 % | 2,501.7 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.8015 % | 3,960.6 |

| Floater | 3.03 % | 3.13 % | 61,910 | 19.42 | 4 | -0.8015 % | 2,659.4 |

| OpRet | 4.41 % | -5.72 % | 28,284 | 0.08 | 2 | -0.1369 % | 2,752.0 |

| SplitShare | 4.30 % | 4.07 % | 44,928 | 3.72 | 5 | -0.1096 % | 3,175.2 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1369 % | 2,516.4 |

| Perpetual-Premium | 5.44 % | 1.31 % | 74,566 | 0.08 | 20 | 0.0137 % | 2,475.1 |

| Perpetual-Discount | 5.23 % | 5.15 % | 111,129 | 15.21 | 15 | 0.0750 % | 2,632.9 |

| FixedReset | 4.28 % | 3.64 % | 224,047 | 16.51 | 75 | 0.6184 % | 2,516.2 |

| Deemed-Retractible | 5.00 % | 1.32 % | 97,795 | 0.21 | 40 | 0.0279 % | 2,600.9 |

| FloatingReset | 2.56 % | 2.12 % | 64,801 | 3.53 | 5 | -0.3147 % | 2,533.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| TRP.PR.A | FixedReset | -2.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 19.90 Evaluated at bid price : 19.90 Bid-YTW : 4.07 % |

| TRP.PR.C | FixedReset | -2.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 18.65 Evaluated at bid price : 18.65 Bid-YTW : 3.98 % |

| BAM.PR.C | Floater | -1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 16.70 Evaluated at bid price : 16.70 Bid-YTW : 3.14 % |

| BAM.PR.B | Floater | -1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 16.61 Evaluated at bid price : 16.61 Bid-YTW : 3.15 % |

| FTS.PR.H | FixedReset | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 18.90 Evaluated at bid price : 18.90 Bid-YTW : 3.70 % |

| CU.PR.C | FixedReset | 1.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 23.56 Evaluated at bid price : 25.25 Bid-YTW : 3.60 % |

| BNS.PR.R | FixedReset | 1.02 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.65 Bid-YTW : 3.25 % |

| IFC.PR.C | FixedReset | 1.10 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2016-09-30 Maturity Price : 25.00 Evaluated at bid price : 25.80 Bid-YTW : 2.26 % |

| MFC.PR.C | Deemed-Retractible | 1.10 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.90 Bid-YTW : 5.62 % |

| BAM.PR.R | FixedReset | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 23.72 Evaluated at bid price : 25.02 Bid-YTW : 3.64 % |

| BNS.PR.Q | FixedReset | 1.26 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2018-10-25 Maturity Price : 25.00 Evaluated at bid price : 25.70 Bid-YTW : 2.97 % |

| FTS.PR.K | FixedReset | 1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 23.09 Evaluated at bid price : 24.62 Bid-YTW : 3.44 % |

| ENB.PR.T | FixedReset | 1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 22.12 Evaluated at bid price : 22.69 Bid-YTW : 4.23 % |

| BAM.PF.F | FixedReset | 1.31 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-09-30 Maturity Price : 25.00 Evaluated at bid price : 25.53 Bid-YTW : 3.98 % |

| NA.PR.S | FixedReset | 1.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 23.35 Evaluated at bid price : 25.45 Bid-YTW : 3.60 % |

| TRP.PR.E | FixedReset | 1.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 23.24 Evaluated at bid price : 25.20 Bid-YTW : 3.67 % |

| IFC.PR.A | FixedReset | 1.72 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.00 Bid-YTW : 4.39 % |

| MFC.PR.L | FixedReset | 1.87 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.04 Bid-YTW : 3.66 % |

| BMO.PR.M | FixedReset | 1.91 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.12 Bid-YTW : 3.15 % |

| MFC.PR.F | FixedReset | 1.93 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.15 Bid-YTW : 4.92 % |

| BAM.PF.A | FixedReset | 1.96 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2018-09-30 Maturity Price : 25.00 Evaluated at bid price : 25.51 Bid-YTW : 3.87 % |

| BNS.PR.P | FixedReset | 2.15 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2018-04-25 Maturity Price : 25.00 Evaluated at bid price : 25.70 Bid-YTW : 2.60 % |

| BAM.PF.B | FixedReset | 2.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 23.18 Evaluated at bid price : 24.88 Bid-YTW : 3.90 % |

| GWO.PR.N | FixedReset | 2.54 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.16 Bid-YTW : 5.19 % |

| MFC.PR.H | FixedReset | 2.93 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-03-19 Maturity Price : 25.00 Evaluated at bid price : 26.01 Bid-YTW : 2.72 % |

| PWF.PR.T | FixedReset | 5.47 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 23.37 Evaluated at bid price : 25.44 Bid-YTW : 3.61 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| IAG.PR.E | Deemed-Retractible | 148,462 | Nesbitt crossed 148,400 at 25.98. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 26.00 Evaluated at bid price : 25.97 Bid-YTW : 4.43 % |

| ENB.PR.Y | FixedReset | 122,022 | RBC crossed 97,800 at 21.90. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 21.58 Evaluated at bid price : 21.91 Bid-YTW : 4.30 % |

| FTS.PR.M | FixedReset | 106,445 | Scotia crossed blocks of 53,200 and 40,000, both at 25.15. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 23.23 Evaluated at bid price : 25.20 Bid-YTW : 3.71 % |

| MFC.PR.N | FixedReset | 71,890 | Recent new issue. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.01 Bid-YTW : 3.74 % |

| TRP.PR.A | FixedReset | 53,405 | Will reset at 3.266%. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2044-12-12 Maturity Price : 19.90 Evaluated at bid price : 19.90 Bid-YTW : 4.07 % |

| CM.PR.E | Perpetual-Premium | 48,584 | Called for redemption 2015-1-31. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-11 Maturity Price : 25.00 Evaluated at bid price : 25.30 Bid-YTW : -0.97 % |

| There were 45 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| NEW.PR.D | SplitShare | Quote: 32.47 – 33.35 Spot Rate : 0.8800 Average : 0.6946 YTW SCENARIO |

| PWF.PR.P | FixedReset | Quote: 20.60 – 21.18 Spot Rate : 0.5800 Average : 0.4300 YTW SCENARIO |

| TRP.PR.D | FixedReset | Quote: 24.59 – 25.16 Spot Rate : 0.5700 Average : 0.4215 YTW SCENARIO |

| TRP.PR.C | FixedReset | Quote: 18.65 – 19.10 Spot Rate : 0.4500 Average : 0.3112 YTW SCENARIO |

| IGM.PR.B | Perpetual-Premium | Quote: 26.05 – 26.50 Spot Rate : 0.4500 Average : 0.3421 YTW SCENARIO |

| TRP.PR.B | FixedReset | Quote: 17.20 – 17.49 Spot Rate : 0.2900 Average : 0.1856 YTW SCENARIO |

Longtime reader, first time commenter, so I’ll start with thanks for the great resource on preferred shares as well as your amusingly sardonic commentary on issues of the day. It’s been very helpful in learning the ins and outs of the preferred markets the past couple years.

In the charts that you’ve been including recently, can you clarify exactly what the “Spread” is? From eyeballing the TRP chart, it looks like it’s the (Implicit?) Spread for the Issuer, since GOC5+TRP Spread=131+250=381 which is the where the theoretical dots line up. But the others Issues have very different curves, so I’m not sure.

Tanks again

MW, thanks for the compliments and welcome to PrefBlog!

The “Spread” is the Spread over five-year Canadas at which a pure annuity would trade – i.e., if a company were to issue a non-callable, perpetual instrument with the same terms. Note that this is subject to the same approximations as all the rest of the theory – e.g., GOC-5 doesn’t change, et cetera.

This can get a little silly at times – the indicated spread for MFC in today’s charts is 98bp (I’ve seen lower figures), which implies that they could issue a true annuity today at 2.29% … I don’t think they’d get many takers! However, the unreasonableness of the answer means that an inherent assumption in the calculation is wrong, which is useful information in itself. In the case of MFC, the Implied Volatility is very high at 34%; unreasonably high, and I believe that in turn the reason for that is that the market is implicitly pricing in some directionality in the pricing, which contradicts the assumptions of the Black-Scholes model used in the calculation.

This directionality, in turn, could mean two things: (i) investors are saying to themselves, ‘well, golly, MFC is a fine company, anything they have ever sold at $25.00 will be worth $25.00 some day (this rationale is seen for banks a lot), or (ii) investors are saying to themselves, ‘well, golly, MFC will be subject to the NVCC rules some day because it says so on PrefBlog, and therefore MFC will redeem all its non-compliant issues at some point because it won’t make sense to leave them outstanding if they can’t be counted as Tier 1 Capital’.

You can choose between the alternatives yourself, or a mixture of the two, or think up a different explanation altogether – but if you ever come up with a better theory than Implied Volatility to explain the variations in market pricing according to coupon, I want to hear it!

Generally speaking, Implied Volatility rises with price … which is to say that when the entire series is priced in the range of 24.00 to 26.00 (say), the market will assume a high probability that the end price for everything will be about 25.00. However, when market yields change and everything is priced in the range of 21.00 to 23.00, the market gets depressed and assumes that nothing will ever get better and nothing will ever be called and the current price impairment for each instrument is permanent. This makes no sense, but that’s the way it is!

Following the arguments above requires a little understanding of option theory; if what I have written is just so much gibberish, let me know.

Another way of putting it is that the difference between the “Spread” and the actual Expected Future Current Yield is the price of the options … for TRP, the market is essentially saying that the options are of no value, while, for example, with MFC.PR.F the spread is 98bp while the GOC-5 yield is 1.31% (so a non-callable perpetual should yield 2.29%) and the Expected Future Current Yield is about 3.20%, so the market is saying that MFC’s right to call the issue at $25.00 is worth 91bp of yield, each and every year.

Sometimes the market says silly things.

Thanks for the detailed answer. Not gibberish at all, after reading through a few times I’m pretty sure I’ve got my head around the whole approach.

I have mainly just been looking at low spread Fixed Resets, which are mostly below par so mentally I had essentially but the call value at zero since they’re so far out of the money (and if they moved so far up they got called for a nice capital gain, great). When I saw the charts and puled up the IV spreadsheet (again, thanks for that!), I couldn’t figure out why you were building in synthetic options. In hindsight, was quite obvious.

The other thing was I didn’t understand why the theoretical curves would change slope according to the reset, but that too is clear: higher reset more likely to be called, so higher option value for the issuer, so investors (should) demand more yield. Likewise, higher IV increases the option value.

One question: looking at the spreadsheet, when you run these charts you’re using the “raw/dirty” bid. In the (very simple) analysis I’ve done, I’ve adjusted prices for “accrued” dividends embedded in the price and the income differential to reset, and used a “clean” price for calculating future current yield. Using these adjusted prices for TRP and the same parameters above, the B/C/D are essentially in line, TRP-A 1.37 cheap, TRP-C 0.73 cheap. If a re-run the heat map I get a 257 spread so things change some, but A and C still cheap with B/D/E slightly expensive.

Thanks for your indulgence in explaining things.

when you run these charts you’re using the “raw/dirty” bid

Yes; there are many possible enhancements:

(i) income differential to reset (see the table under “We can make some approximate adjustments to the theoretical prices” in the post MAPF Performance: November 2014) – I think you’ve already done this.

(ii) accounting for time until the next dividend payment

(iii) accounting for time until the next call date (currently, all calculations are done as if the issues are callable in three years. It would be better if the actual time to call was accounted for, but this will require the estimation of another parameter that adjusts volatility according to time)

I believe that you have tried implementing ##1-2 and found no substantial difference in the results.

I may implement such enhancements in the future, but have not done so because

(i) the objective is to keep things reasonably simple for users who do not necessarily work full time on these things, and

(ii) there’s so much noise in the market that the effect of these enhancements is overwhelmed anyway.