TransCanada Corporation has announced:

that it has completed its public offering of cumulative redeemable minimum rate reset first preferred shares, series 13 (the “Series 13 Preferred Shares”). TransCanada issued 20 million Series 13 Preferred Shares for aggregate gross proceeds of $500 million through a syndicate of underwriters co-led by TD Securities Inc., BMO Capital Markets and Scotiabank.

The net proceeds of the offering will be used for general corporate purposes and to reduce short-term indebtedness of TransCanada and its affiliates, which short-term indebtedness was used to fund TransCanada’s capital program and for general corporate purposes.

The Series 13 Preferred Shares will begin trading today on the TSX under the symbol TRP.PR.J.

TRP.PR.J is a FixedReset, 5.50%+469M550, announced April 13.

The issue traded 1,623,504 shares today (consolidated exchanges) in a range of 25.50-72 before closing at 25.66-68, 5×5. Given that the TXPL Total Return index is basically flat since announcement date, this is very good performance. Vital statistics are:

| TRP.PR.J | FixedReset | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-05-31 Maturity Price : 25.00 Evaluated at bid price : 25.66 Bid-YTW : 4.94 % |

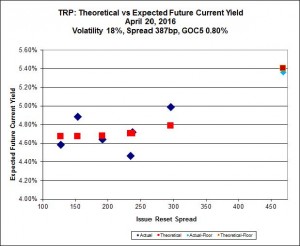

Implied Volatility shows some change since announcement day:

Since announcement day, implied volatility appears to have declined, but this may be simply an artefact of the data: the high-spread TRP.PR.J has an enormous influence on the calculation and since it has increased in price, reducing the Expected Future Current Yield, this results in a reduction of the slope between the many lower-spread and the single higher-spread issue, leading to reduced implied volatility. We need more data!