Great-West Lifeco Inc. has announced:

that it has entered into an agreement with a syndicate of underwriters led by BMO Capital Markets, RBC Capital Markets, and Scotiabank pursuant to which the underwriters have agreed to purchase, on a bought deal basis, 6,000,000 Non-Cumulative First Preferred Shares, Series Z (the “Series Z Shares”) from Lifeco for sale to the public at a price of C$25.00 per Series Z Share (the “Issue Price”), representing aggregate gross proceeds of C$150 million. The Series Z Shares will yield 5.70% per annum, payable quarterly, as and when declared by the Lifeco Board of Directors.

Lifeco has also granted the underwriters an option, exercisable up to 48 hours prior to closing, to purchase up to an additional 2,000,000 Series Z Shares (C$50 million) at the Issue Price. Should the underwriters’ option be exercised in full, the total gross proceeds of the offering will be C$200 million.

The net proceeds of the offering will be used for general corporate purposes. The offering is expected to close on or about September 24, 2025 and is subject to customary closing conditions.

There is also a note that:

THE BASE SHELF PROSPECTUS IS ACCESSIBLE, AND THE SHELF PROSPECTUS SUPPLEMENT FOR THE PUBLIC OFFERING AND ANY AMENDMENT TO THE DOCUMENTS WILL BE ACCESSIBLE, WITHIN TWO BUSINESS DAYS, THROUGH SEDAR+

Update, 2025-9-19: The prospectus is available on sedarplus if you search for:

Great-West Lifeco Inc. / Great-West Lifeco Inc. (000003274)

Prospectus (non pricing) supplement (other than ATM) – English.pdf

19 Sep 2025 16:48 EDTSeptember 19 2025 at 16:48:56 Eastern Daylight Time

Manitoba

211 KB

Generate URL

I regret that the regulators will not allow me to link to the prospectus directly. This makes this public information more valuable to the private publisher, thus giving them more money with which to hire ex-regulators.

Vital bits from the prospectus are:

The initial dividend, if declared, will be payable on December 31, 2025 and will be $0.38260 per share, based on the anticipated closing date of this Offering of September 24, 2025. Thereafter, dividends will be payable quarterly on the last day of March, June, September and December in each year at a rate of $0.35625 per share.

…

On or after September 30, 2030, Lifeco may, on not less than 30 nor more than 60 days’ notice, redeem for cash the Series Z First Preferred Shares in whole or in part, at the Corporation’s option, at $26.00 per share if redeemed on or after September 30, 2030 and prior to September 30, 2031, $25.75 per share if redeemed on or after September 30, 2031 and prior to September 30, 2032, $25.50 per share if redeemed on or after September 30, 2032 and prior to September 30, 2033, $25.25 per share if redeemed on or after September 30, 2033 and prior to September 30, 2034 and $25.00 per share if redeemed on or after September 30, 2034, in each case together with all declared and unpaid dividends up to but excluding the date of redemption.

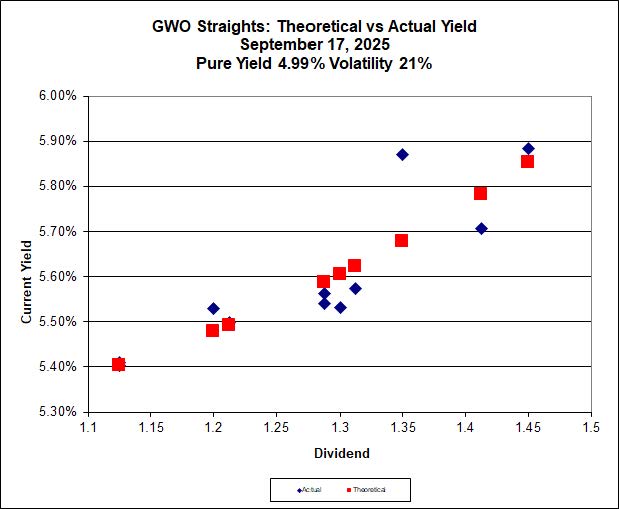

As with the the recent POW new issue the new issue seems fairly priced according to Implied Volatility theory. The closest direct comparator is GWO.PR.L, paying 1.4125 (compared to 1.425 for the new issue) quoted at 24.75-95 on 2025-09-17.

[…] the new issues from GWO and POW coming out, one has to wonder whether there will be more. But today DBRS rated some […]

[…] I have updated the post regarding the GWO new issue. […]

[…] is a Straight Perpetual paying 5.70%, announced 2025-9-17. It has been assigned to the PerpetualPremium […]