Power Corporation of Canada has announced:

that Power Corporation has agreed to issue 6,000,000 Non-Cumulative First Preferred Shares, Series H in the capital of Power Corporation (the “Series H Shares”) on a bought deal basis, for gross proceeds of $150 million. The Series H Shares will be priced at $25.00 per share (the “Issue Price”) and will carry an annual dividend yield of 5.75%. Closing is expected on or about September 22, 2025. The issue will be underwritten by a syndicate of underwriters led by BMO Capital Markets, RBC Capital Markets and Scotiabank.

Power Corporation has granted the underwriters an option, exercisable up to 48 hours prior to closing, to purchase up to an additional 2,000,000 Preferred Shares ($50 million) at the Issue Price. Should the underwriters’ option be exercised fully, the total gross proceeds of the offering will be $200 million.

The net proceeds of this offering will be used by Power Corporation for general corporate purposes.

The Series H Shares will be offered in each of the provinces and territories of Canada by way of a prospectus supplement (the “Prospectus Supplement”) to the short form base shelf prospectus (the “Shelf Prospectus”) of the Company dated November 19, 2024.

Access to the Prospectus Supplement, the Shelf Prospectus and any amendments to the documents is provided in accordance with securities legislation relating to procedures for providing access to a prospectus supplement, a base shelf prospectus and any amendment. The Shelf Prospectus is, and the Prospectus Supplement will be (within two business days of the date hereof), accessible on SEDAR+ at www.sedarplus.ca. An electronic or paper copy of the Prospectus Supplement, the Shelf Prospectus and any amendment to the documents may be obtained, without charge, from any of the joint bookrunners by contacting BMO Capital Markets by email at torbramwarehouse@datagroup.ca, RBC Capital Markets by email at Distribution.RBCDS@rbccm.com, and Scotiabank by email at equityprospectus@scotiabank.com, and by providing the contact with an email address or address, as applicable. The Shelf Prospectus and Prospectus Supplement contain important, detailed information about PCC and the proposed offering of Series H Shares. Prospective investors should read the Shelf Prospectus and Prospectus Supplement (when filed) before making an investment decision.

The press release is on SEDARPlus, but not the Prospectus Supplement. The existence or lack of a nice long redemption lock-out period is of interest!

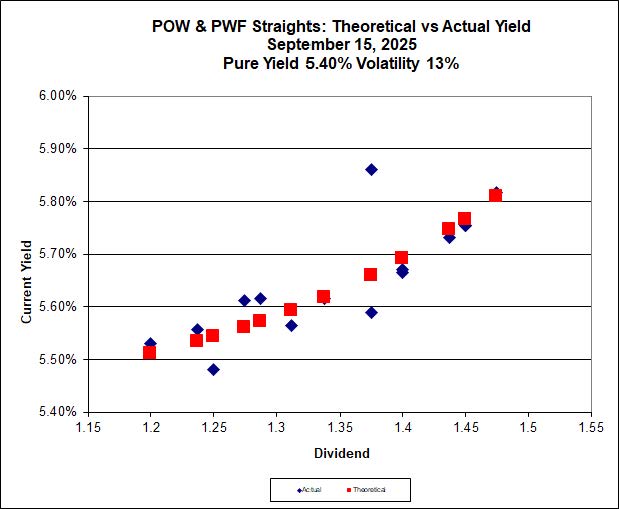

I am gratified to see that the new issue is fairly priced according to Implied Volatility theory – and that’s without accounting for the redemption lock-out, assuming it exists:

The annual dividend rate is 1.4375, the same as PWF.PR.H, which was quoted at 25.08-21 today and is currently redeemable at par.

Update, 2025-09-17: The prospectus supplement has been released on sedarplus and while forbidden to give you any kind of URL, will tell you to search for:

Power Corporation of Canada / Power Corporation du Canada (000001575)

Prospectus (non pricing) supplement (other than ATM) – English.pdf

17 Sep 2025 18:26 EDTSeptember 17 2025 at 18:26:03 Eastern Daylight Time

Québec

520 KB

Generate URL

Vital bits from the prospectus include:

The initial dividend, if declared, will be payable on January 15, 2026 and will be $0.45291 per share, based upon an anticipated issue date of September 22, 2025. Thereafter, dividends will be payable quarterly on the 15th day of January, April, July and October in each year at a rate of $0.359375 per share.

…

On and after October 15, 2030, the Corporation may, on not less than 30 nor more than 60 days’ notice, redeem for cash the Series H First Preferred Shares in whole or in part, at the Corporation’s option, at $26.00 per share if redeemed prior to October 15, 2031, $25.75 if redeemed on or after October 15, 2031 and prior to October 15, 2032, $25.50 if redeemed on or after October 15, 2032 and prior to October 15, 2033, $25.25 if redeemed on or after October 15, 2033 and prior to October 15, 2034 and $25.00 if redeemed on or after October 15, 2034, in each case together with all declared and unpaid dividends to but excluding the date of redemption. See “Details of the Offering”.

So, the redemption lockout is standard, which is nice to confirm.

[…] post regarding the POW new issue has been […]

[…] with the the recent POW new issue the new issue seems fairly priced according to Implied Volatility theory. The closest direct […]

[…] is a 5.75% Straight Perpetual announced 2025-9-15. It has been added to the PerpetualPremium […]

Another new issue today, https://www.globenewswire.com/news-release/2025/11/13/3187528/0/en/Power-Corporation-Announces-Issue-of-Preferred-Shares.html

MONTRÉAL, Nov. 13, 2025 (GLOBE NEWSWIRE) — Power Corporation of Canada (“Power Corporation” or the “Corporation” or “Power”) (TSX: POW) announced today that it has agreed to issue 6,000,000 Non-Cumulative First Preferred Shares, Series I in the capital of the Corporation (the “Series I Shares”) on a bought deal basis, for gross proceeds of $150 million. The Series I Shares will be priced at $25.00 per share (the “Issue Price”) and will carry an annual dividend yield of 5.65%. Closing is expected on or about November 20, 2025. The issue will be underwritten by a syndicate of underwriters led by BMO Capital Markets, RBC Capital Markets and Scotiabank.