Canada’s economy posted a surprise 60,400 net job gains in September, almost entirely reversing the losses of the previous month, data showed on Friday, but was not enough to bring down its multiyear high unemployment rate.

The jobless rate was at 7.1 per cent, same as the prior month when the rate hit a nine-year high outside of the pandemic years.

…

The employment increase in September was completely led by full-time work and it increased in 10 out of 16 industry groups, Statscan said.

…

The unemployment rate among youth or those in the age bracket of 15 to 24 years edged up to 14.7 per cent in September, the highest rate in 15 years. The youths represent around 14 per cent of the total labour force in Canada.Also, the proportion of people working in jobs which are unrelated to their qualification as well as immigrants who were overqualified for their jobs scaled up, reflecting tough labour market conditions, the statistics agency said.

…

The average hourly wage of permanent employees – a gauge closely tracked by the Bank of Canada to ascertain inflationary trends – grew by 3.6 per cent in September on a yearly basis to $37.87, same percentage increase as last month.

So, the market reacted:

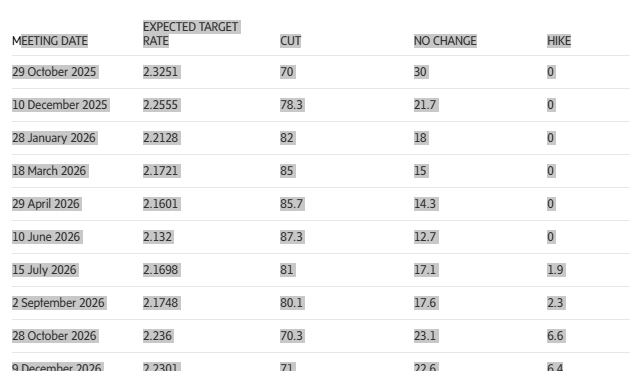

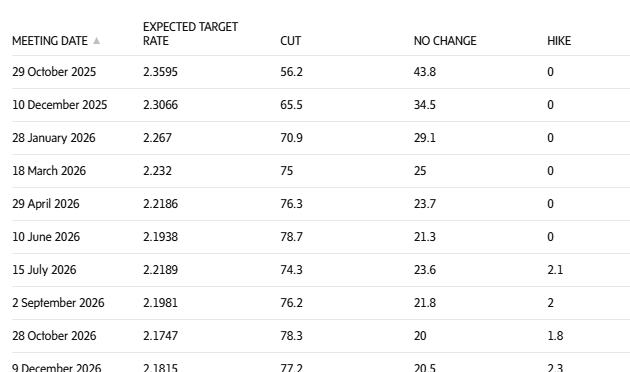

Here, in detail, is how implied probabilities of future interest rate moves stood in swaps markets after the jobs report. The current overnight rate is 2.50 per cent. While the bank moves in quarter-point increments, credit market implied rates fluctuate more fluidly and are constantly changing. Columns to the right are percentage probabilities of future rate moves.

It is interesting to see that the changes are hawkish in the near term and dovish in the longer term, with the projected terminal rate declining from 2.23% to 2.18%.

Meanwhile, The Stable Genius re-ignited the trade war with China:

President Donald Trump said Friday he would impose a 100% tariff on China “over and above any Tariff they are currently paying” effective November 1 – massively escalating his trade war amid a heated dispute over export controls on rare earths.

In a Truth Social post, Trump wrote that China had “taken an extraordinarily aggressive position on Trade in sending an extremely hostile letter to the World, stating that they were going to, effective November 1st, 2025, impose large scale Export Controls on virtually every product they make, and some not even made by them.”

“This affects ALL Countries, without exception, and was obviously a plan devised by them years ago,” he wrote. “It is absolutely unheard of in International Trade, and a moral disgrace in dealing with other Nations.”

Trump said he would impose the new tariff November 1 “or sooner, depending on any further actions or changes taken by China.”

Earlier in the day, Trump had blasted Chinese leader Xi Jinping on social media over China’s ramped-up efforts to impose export controls on critical rare earths, threatening economic retaliation and saying he no longer sees any reason to meet with Xi during a scheduled visit to the region later this month. At the time, Trump also threatened economic penalties against China, warning, “Dependent on what China says about the hostile ‘order’ that they have just put out, I will be forced, as President of the United States of America, to financially counter their move.”

“For every Element that they have been able to monopolize, we have two,” he added.

… and markets reacted to that:

The S&P 500 sank 2.7% and the S&P/TSX Composite Index dropped 1.4% in their worst day since April. The Dow Jones Industrial lost 1.9%, and the Nasdaq composite fell 3.6%.

Stocks had been heading for a slight gain in the morning, until Trump took to his social media platform and said he’s considering “a massive increase of tariffs” on Chinese imports.

…

The S&P/TSX composite index ended down 414.09 points at 29,850.89, its lowest closing level since September 26. For the week, the index was down 2%.The TSX has advanced 20.7% since the start of the year and posted a record closing high as recently as Monday.

The high-flying TSX technology sector dropped 4.3%, with shares of e-commerce company Shopify Inc dropping 8%.

The TSX energy sector was down 3.3%. Some of Friday’s strongest action was in the oil market, where the price of a barrel of benchmark U.S. crude sank 4.2% to US$58.90. It fell as a ceasefire between Israel and Hamas came into effect in Gaza. An end to the war could remove worries about disruptions to oil supplies, which had kept crude’s price higher than it otherwise would have been. Trump’s tariff threat could gum up global trade and lead the economy to burn less fuel.

…

In the absence of official data, investors looked to the U.S. Federal Reserve for clues regarding near-term interest rate cuts. Fed Governor Christopher Waller said that while private employment data continues to show labor market weakness, the central bank should act with caution when reducing the Fed funds target rate as it evaluates the economy. St. Louis Fed President Alberto Musalem echoed that sentiment, saying that another rate cut could be warranted as insurance against a weakening labor market. “I believe that we have to tread with caution” before monetary policy becomes too accommodative, he said.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.65 % | 7.10 % | 25,504 | 13.39 | 1 | 0.0000 % | 2,428.3 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.9355 % | 4,581.0 |

| Floater | 6.30 % | 6.58 % | 56,728 | 13.10 | 3 | -0.9355 % | 2,640.0 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.3382 % | 3,656.6 |

| SplitShare | 4.77 % | 4.39 % | 67,914 | 3.33 | 5 | -0.3382 % | 4,366.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.3382 % | 3,407.2 |

| Perpetual-Premium | 5.52 % | 4.93 % | 91,582 | 6.99 | 8 | -0.2769 % | 3,085.4 |

| Perpetual-Discount | 5.61 % | 5.63 % | 45,603 | 14.47 | 26 | 0.5440 % | 3,360.6 |

| FixedReset Disc | 6.00 % | 6.02 % | 102,907 | 13.66 | 30 | -0.1945 % | 3,043.2 |

| Insurance Straight | 5.48 % | 5.54 % | 55,907 | 14.58 | 21 | 0.1421 % | 3,317.8 |

| FloatingReset | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1945 % | 3,620.2 |

| FixedReset Prem | 5.64 % | 4.88 % | 131,602 | 2.79 | 22 | -0.2739 % | 2,628.0 |

| FixedReset Bank Non | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1945 % | 3,110.8 |

| FixedReset Ins Non | 5.22 % | 5.40 % | 51,747 | 14.52 | 15 | -0.1505 % | 3,070.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| FTS.PR.F | Perpetual-Discount | -6.86 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 21.75 Evaluated at bid price : 22.00 Bid-YTW : 5.63 % |

| PWF.PR.L | Perpetual-Discount | -4.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 21.42 Evaluated at bid price : 21.68 Bid-YTW : 5.88 % |

| BN.PR.M | Perpetual-Discount | -3.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 19.85 Evaluated at bid price : 19.85 Bid-YTW : 6.04 % |

| PVS.PR.L | SplitShare | -2.31 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-06-30 Maturity Price : 25.00 Evaluated at bid price : 25.40 Bid-YTW : 5.27 % |

| MFC.PR.F | FixedReset Ins Non | -1.97 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 17.95 Evaluated at bid price : 17.95 Bid-YTW : 5.73 % |

| GWO.PR.H | Insurance Straight | -1.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 21.44 Evaluated at bid price : 21.70 Bid-YTW : 5.62 % |

| PWF.PR.P | FixedReset Disc | -1.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 17.80 Evaluated at bid price : 17.80 Bid-YTW : 6.07 % |

| ENB.PR.F | FixedReset Disc | -1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 20.85 Evaluated at bid price : 20.85 Bid-YTW : 6.47 % |

| POW.PR.A | Perpetual-Discount | -1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 24.21 Evaluated at bid price : 24.50 Bid-YTW : 5.73 % |

| BN.PR.B | Floater | -1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 12.50 Evaluated at bid price : 12.50 Bid-YTW : 6.65 % |

| GWO.PR.Y | Insurance Straight | -1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 20.45 Evaluated at bid price : 20.45 Bid-YTW : 5.55 % |

| PWF.PR.A | Floater | -1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 14.05 Evaluated at bid price : 14.05 Bid-YTW : 5.96 % |

| IFC.PR.A | FixedReset Ins Non | 1.40 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 21.45 Evaluated at bid price : 21.80 Bid-YTW : 5.21 % |

| PWF.PR.S | Perpetual-Discount | 2.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 21.50 Evaluated at bid price : 21.76 Bid-YTW : 5.51 % |

| GWO.PR.R | Insurance Straight | 3.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 21.57 Evaluated at bid price : 21.83 Bid-YTW : 5.53 % |

| SLF.PR.C | Insurance Straight | 3.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 21.48 Evaluated at bid price : 21.74 Bid-YTW : 5.14 % |

| CU.PR.G | Perpetual-Discount | 15.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 20.76 Evaluated at bid price : 20.76 Bid-YTW : 5.50 % |

| PWF.PF.A | Perpetual-Discount | 38.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 20.44 Evaluated at bid price : 20.44 Bid-YTW : 5.52 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| PWF.PR.G | Perpetual-Premium | 46,395 | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-11-09 Maturity Price : 25.00 Evaluated at bid price : 25.18 Bid-YTW : -6.85 % |

| PWF.PR.H | Perpetual-Premium | 37,200 | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-11-09 Maturity Price : 25.00 Evaluated at bid price : 25.03 Bid-YTW : 0.26 % |

| GWO.PR.Z | Perpetual-Premium | 36,772 | YTW SCENARIO Maturity Type : Call Maturity Date : 2034-09-30 Maturity Price : 25.00 Evaluated at bid price : 25.45 Bid-YTW : 5.52 % |

| CIU.PR.A | Perpetual-Discount | 20,300 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 20.52 Evaluated at bid price : 20.52 Bid-YTW : 5.69 % |

| ENB.PR.P | FixedReset Disc | 19,450 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-10-10 Maturity Price : 21.24 Evaluated at bid price : 21.52 Bid-YTW : 6.36 % |

| TD.PF.I | FixedReset Prem | 16,880 | YTW SCENARIO Maturity Type : Call Maturity Date : 2027-10-31 Maturity Price : 25.00 Evaluated at bid price : 25.90 Bid-YTW : 4.31 % |

| There were 4 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| See TMX DataLinx: ‘Last’ != ‘Close’ and the posts linked therein for an idea of why these quotes are so horrible. | ||

| Issue | Index | Quote Data and Yield Notes |

| MFC.PR.F | FixedReset Ins Non | Quote: 17.95 – 19.90 Spot Rate : 1.9500 Average : 1.0880 YTW SCENARIO |

| FTS.PR.F | Perpetual-Discount | Quote: 22.00 – 23.68 Spot Rate : 1.6800 Average : 0.9812 YTW SCENARIO |

| PWF.PR.L | Perpetual-Discount | Quote: 21.68 – 23.10 Spot Rate : 1.4200 Average : 0.9361 YTW SCENARIO |

| BN.PR.M | Perpetual-Discount | Quote: 19.85 – 21.05 Spot Rate : 1.2000 Average : 0.8732 YTW SCENARIO |

| BN.PF.A | FixedReset Prem | Quote: 25.60 – 26.60 Spot Rate : 1.0000 Average : 0.6908 YTW SCENARIO |

| PVS.PR.L | SplitShare | Quote: 25.40 – 26.39 Spot Rate : 0.9900 Average : 0.7142 YTW SCENARIO |