On October 6, TC Energy Corporation announced:

that TransCanada PipeLines Limited (TCPL) is considering an offering of U.S. Junior Subordinated Notes (Notes).

If a successful offering is completed, the Company intends to use the net proceeds to redeem its issued and outstanding Cumulative Redeemable First Preferred Shares, Series 11 (TSX:TRP.PR.G) pursuant to their terms, to reduce indebtedness as well as for general corporate purposes. There is no certainty that TCPL will ultimately complete the offering being considered or as to the timing or terms on which such an offering might be completed.

It is expected that, if the offering is commenced, the Notes would be issued by way of a prospectus supplement to TCPL’s short form base shelf prospectus dated Dec. 5, 2024 included in its registration statement on Form F-10 filed with the U.S. Securities and Exchange Commission (SEC). A copy of such prospectus supplement will be available free of charge on the SEC website at http://www.sec.gov or potential investors may request such prospectus supplement from Morgan Stanley & Co. LLC toll free at +1 (866) 718-1649, BofA Securities, Inc. toll free at +1 (800) 294-1322, J.P. Morgan Securities LLC collect at +1 (212) 834-4533, RBC Capital Markets, LLC toll free at +1 (866) 375-6829 or Wells Fargo Securities LLC toll free at +1 (800) 645-3751.

This morning, we learned:

On October 6, 2025, TransCanada PipeLines Limited entered into an underwriting agreement with major financial institutions including Morgan Stanley and BofA Securities for the issuance of 6.250% Junior Subordinated Notes due 2085.

… which may not be huge news, but it’s a step up from “considering”!

The company announced today:

that TransCanada PipeLines Limited (TCPL) has closed an offering of US$350 million of 6.250 per cent Fixed-for-Life Junior Subordinated Notes due Nov. 1, 2085 (Notes). The Notes were offered through a syndicate of underwriters, co-led by Morgan Stanley & Co. LLC, BofA Securities, Inc., J.P. Morgan Securities LLC, RBC Capital Markets, LLC and Wells Fargo Securities, LLC.

As previously announced, the Company intends to use the net proceeds to redeem (Redemption) its issued and outstanding Cumulative Redeemable First Preferred Shares, Series 11 (Series 11 Shares) (TSX:TRP.PR.G) on Nov. 28, 2025 (Redemption Date) at a price equal to $25.00 per share (Redemption Price), to reduce indebtedness as well as for general corporate purposes. The Company provided notice of the Redemption today to the sole registered holder of the Series 11 Shares in accordance with their terms.

Subject to board approval, the Company expects to declare a final quarterly dividend of $0.2094375 per Series 11 Share, for the period up to but excluding Nov. 28, 2025, payable on Nov. 28, 2025 to shareholders of record on Nov. 17, 2025. This would be the final dividend on the Series 11 Shares and, as the Redemption Date is also a dividend payment date, the Redemption Price will not include any accrued and unpaid dividends. Subsequent to the Redemption Date, the Series 11 Shares will cease to be entitled to dividends and will be delisted from the Toronto Stock Exchange.

Non-registered holders of Series 11 Shares should contact their broker or other intermediary for information regarding the redemption process for the Series 11 Shares in which they hold a beneficial interest.

The Notes were issued by way of a prospectus supplement dated Oct. 6, 2025 to TCPL’s short form base shelf prospectus dated Dec. 5, 2024 (collectively, the Prospectus) included in its registration statement on Form F-10 filed with the U.S. Securities and Exchange Commission.

TRP.PR.G was issued as a FixedReset, 3.80%+296, that commenced trading 2015-3-2 after being announced 2015-2-23. It reset to 3.351% effective 2020-11-30 and there was no conversion. The issue is tracked by HIMIPref™ and is assigned to the Scraps – FixedReset-Discount subindex.

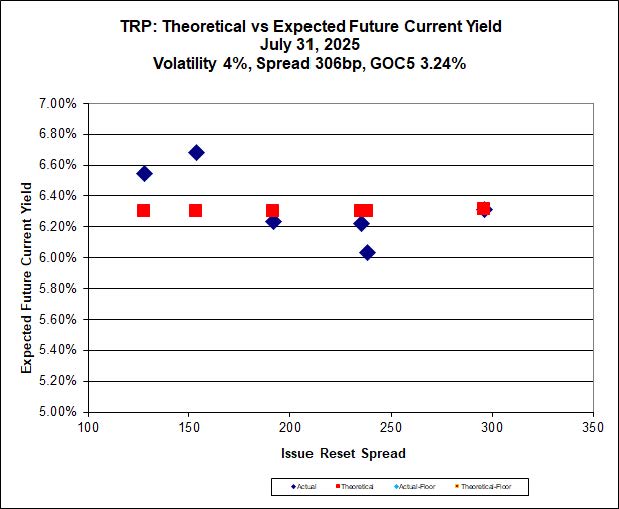

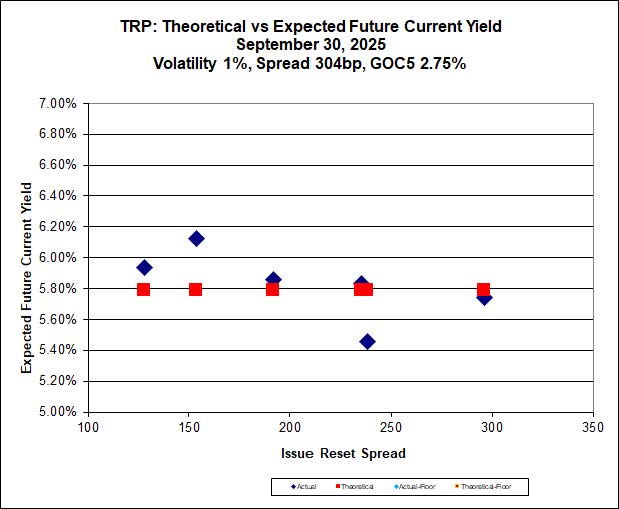

The market’s been pricing this in for a while, with remarkably similar spreads derived from Implied Volatility Analysis for the past while, despite the perplexing and annoying negative slope of the correlation (on which the analysis sets a floor of 1%, since lower values don’t make any sense. There are other things going on, like the market betting heavily that high-reset issues have an outsized probability of redemption):

Still, it’s nice to get some reassurance from TRP that yes, the preferred share market is still cheap compared to alternative sources of funding!

Thanks to Assiduous Reader niagara for bringing this to my attention!

Hi James – I enjoy the comments section of your blog. The recent comments section though is increasingly getting clogged with your annotations to previous posts, crowding out reader comments. Is there a way to see more reader comments or to be able to search comments?

I can search comments, but you can’t.

I want to continue with the “pingbacks” when referring to previous posts, as I think this creates a reasonably useful web of interlinkages that may be of value when reviewing a common theme.

The clogging of the comments sidebar has been exacerbated in recent months as I have added posts that were lost in the server crash. This process has not yet been completed, but I’m getting there!

I’ve received a similar complaint. How would it be if I tried increasing the number of comments linked on the sidebar to 10? We could try that for a while and if you’re still dissatisfied you can complain again.

How does that sound?

“I’ve received a similar complaint. How would it be if I tried increasing the number of comments linked on the sidebar to 10? We could try that for a while and if you’re still dissatisfied you can complain again.”

That’d be great James! I’d like to think it was less of a complaint and more of request for help 🙂

Ah, heck.

I find that I misinterpreted the meaning of one of the settings: it turns out I can’t change the number of comments shown by the WordPress widget.

It’s possible I could change this with a ‘plug-in’, but I really don’t want to do that – I consider them a vulnerability to be minimized.

So – back to the drawing board! I’ll try to think of something.

I second Stusclues’ request!

Please and thanks.

Good idea.

I would think that increasing the number of linked comments would help users engage with each other as well as with the main post / comments from James.

[…] closed at 689.10, up 0.55% on the day, doubtless helped by the TRP.PR.G redemption money. Volume today was 1.13-million, near the median of the past 21 trading […]