The Globe had a nice piece about Canadian corporates:

Low interest rates are attracting companies that previously relied on other funding options, such as bank loans. Combined with new issuers at home and the flood of foreign companies tapping the domestic corporate debt market from abroad, businesses generally just need more capital to build costly data centres and restructure supply chains in response to protectionist risks.

And despite all the new supply, investors are gobbling up every deal that emerges.

…

The official stats don’t actually tell the whole story. Maple deals, which refer to non-Canadian companies issuing Canadian dollar-denominated bonds in the Canadian market, are not included in LSEG data and are also soaring.From Jan. 1 through Sept. 25, RBC tracked more than $14-billion worth of maple transactions, putting that subset of the market on track for its second-best year, with only the dealmaking frenzy of 2021 delivering larger maple numbers.

The demand for maple bonds is partly due to a technical change implemented at the start of 2025, when newly issued maple bonds started getting included in the FTSE Canada Universe Bond Index. That change gave maple issuers access to a much larger pool of investors, including the massive contingent of investors that own index-tracking funds.

…

Corporate credit spreads, meanwhile, are near record lows. Because they measure the difference in yield between a corporate bond and a risk-free government bond, such narrow spreads imply investors perceive very little risk in lending to Canadian businesses.

…

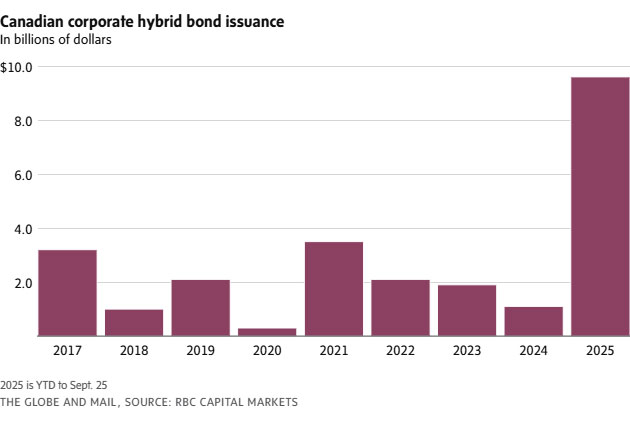

As of Sept. 25, roughly $9.6-billion worth of Canadian corporate hybrid bonds have been issued since the start of 2025, RBC data shows. In 2024, nearly a record-setting year for Canadian corporate bond issuance overall, total hybrid issuance was just $1.1-billion.That 2025 figure might appear low relative to the more than $50-billion in debt corporate Canada issues in any given year. But for perspective, consider that Canadian companies issued a total of $8.9-billion in hybrid debt over the five most recent calendar years, from 2020 through 2024, or $700-million less than what has been issued so far in 2025 alone. And the year is not over.

What goes up must come down … the size of the issuance and particularly strength of the hybrid and Maple issuance, may be considered an indicator – but only one indicator! – that the bond market’s a bit on the toppy side.

The Boston Fed has released a working paper by Stefano Corradin, José L. Fillat, and Carles Vergara-Alert titled Misestimating House Values: Consequences for Household Finance:

Key Findings

About 5 percent of homeowners undervalue their house by at least $87,500, and 5 percent overvalue their house by at least $53,000.

A $59,800 increase in house overvaluation, which represents one standard deviation, results, on average, in a 1.1 to 1.9 percent decrease in a household’s risky stockholdings.

The same increase in house overvaluation results in a 1.3 to 2.5 percent increase over liquid wealth in the share of a household’s assets that are risk free, holding house value and mortgage debt constant.

In addition, the increase in overvaluation leads to a 1.5 to 4.3 percent (or 2.63 to 4.31 percentage point) increase in a household’s consumption relative to its liquid wealth.Implications

The findings underscore the role of housing-value misestimation in the marginal propensity to consume, suggesting that households adjust their spending behavior in response to perceived, in addition to actual, wealth gains. Additionally, the findings show that households with higher perceived house values tend to reallocate financial assets away from stocks toward risk-free assets, reinforcing a conservative shift in their financial portfolio composition. These results suggest that financial advisors and policymakers should account for biases in housing wealth perceptions when designing investment and retirement strategies. In addition, given the widespread use of home equity as collateral, the findings imply that misestimation of house values could have significant implications for credit availability and macroeconomic stability.

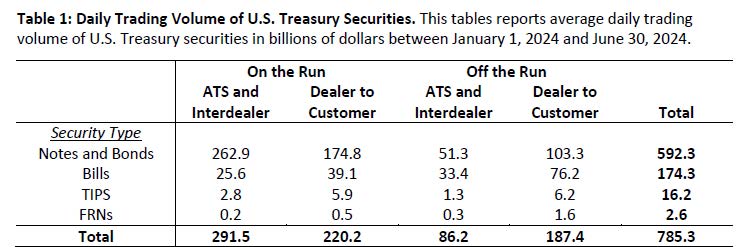

A New York Fed staff report by Alain Chaboud, Ellen Correia Golay, Michael Fleming, Yesol Huh, Frank Keane and Or Shachar titled Liquidity and Trading Dynamics in the Off-the-Run U.S. Treasury Market didn’t fascinate this old bond guy, but there was an interesting table:

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2039 % | 2,414.7 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2039 % | 4,578.6 |

| Floater | 5.97 % | 6.26 % | 56,135 | 13.49 | 3 | -0.2039 % | 2,638.7 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1328 % | 3,699.1 |

| SplitShare | 4.72 % | 3.92 % | 66,939 | 1.25 | 5 | 0.1328 % | 4,417.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1328 % | 3,446.7 |

| Perpetual-Premium | 5.63 % | -13.98 % | 75,649 | 0.09 | 6 | 0.0456 % | 3,125.4 |

| Perpetual-Discount | 5.42 % | 5.48 % | 47,637 | 14.56 | 25 | -0.0191 % | 3,450.7 |

| FixedReset Disc | 5.73 % | 5.89 % | 111,010 | 13.73 | 30 | 0.3282 % | 3,120.8 |

| Insurance Straight | 5.33 % | 5.37 % | 58,897 | 14.75 | 21 | 0.8818 % | 3,407.6 |

| FloatingReset | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3282 % | 3,712.6 |

| FixedReset Prem | 5.85 % | 4.54 % | 107,510 | 2.33 | 21 | 0.1860 % | 2,649.1 |

| FixedReset Bank Non | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3282 % | 3,190.1 |

| FixedReset Ins Non | 5.13 % | 5.30 % | 58,999 | 14.50 | 15 | 0.6342 % | 3,121.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| IFC.PR.F | Insurance Straight | -3.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 23.22 Evaluated at bid price : 23.51 Bid-YTW : 5.70 % |

| CU.PR.F | Perpetual-Discount | -1.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 20.98 Evaluated at bid price : 20.98 Bid-YTW : 5.38 % |

| ELF.PR.H | Perpetual-Discount | -1.42 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 24.00 Evaluated at bid price : 24.25 Bid-YTW : 5.72 % |

| BN.PR.M | Perpetual-Discount | -1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 20.96 Evaluated at bid price : 20.96 Bid-YTW : 5.75 % |

| IFC.PR.I | Insurance Straight | -1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 24.31 Evaluated at bid price : 24.60 Bid-YTW : 5.55 % |

| MFC.PR.K | FixedReset Ins Non | 1.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 23.49 Evaluated at bid price : 25.25 Bid-YTW : 5.16 % |

| GWO.PR.T | Insurance Straight | 1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 23.98 Evaluated at bid price : 24.26 Bid-YTW : 5.37 % |

| CU.PR.G | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 21.45 Evaluated at bid price : 21.45 Bid-YTW : 5.26 % |

| PWF.PF.A | Perpetual-Discount | 1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 21.20 Evaluated at bid price : 21.20 Bid-YTW : 5.35 % |

| GWO.PR.Q | Insurance Straight | 1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 23.83 Evaluated at bid price : 24.08 Bid-YTW : 5.41 % |

| FTS.PR.K | FixedReset Disc | 1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 22.76 Evaluated at bid price : 23.65 Bid-YTW : 5.28 % |

| GWO.PR.Y | Insurance Straight | 2.86 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 21.60 Evaluated at bid price : 21.60 Bid-YTW : 5.28 % |

| SLF.PR.H | FixedReset Ins Non | 3.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 22.46 Evaluated at bid price : 23.00 Bid-YTW : 5.26 % |

| MFC.PR.F | FixedReset Ins Non | 3.88 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 18.20 Evaluated at bid price : 18.20 Bid-YTW : 5.70 % |

| PWF.PR.P | FixedReset Disc | 4.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 18.37 Evaluated at bid price : 18.37 Bid-YTW : 5.93 % |

| SLF.PR.E | Insurance Straight | 5.70 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 22.01 Evaluated at bid price : 22.25 Bid-YTW : 5.11 % |

| MFC.PR.C | Insurance Straight | 11.62 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 21.75 Evaluated at bid price : 22.00 Bid-YTW : 5.18 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| ENB.PR.D | FixedReset Disc | 293,000 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 21.10 Evaluated at bid price : 21.10 Bid-YTW : 6.27 % |

| CU.PR.I | FixedReset Prem | 110,000 | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-12-31 Maturity Price : 25.00 Evaluated at bid price : 24.96 Bid-YTW : 4.99 % |

| RY.PR.M | FixedReset Disc | 66,400 | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-12-24 Maturity Price : 25.00 Evaluated at bid price : 24.97 Bid-YTW : 4.71 % |

| SLF.PR.G | FixedReset Ins Non | 42,000 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 18.78 Evaluated at bid price : 18.78 Bid-YTW : 5.66 % |

| RY.PR.N | Perpetual-Discount | 34,000 | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-12-10 Maturity Price : 25.00 Evaluated at bid price : 24.98 Bid-YTW : 3.61 % |

| ENB.PF.K | FixedReset Prem | 25,100 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-11-10 Maturity Price : 23.67 Evaluated at bid price : 25.45 Bid-YTW : 5.91 % |

| There were 7 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| See TMX DataLinx: ‘Last’ != ‘Close’ and the posts linked therein for an idea of why these quotes are so horrible. | ||

| Issue | Index | Quote Data and Yield Notes |

| IFC.PR.F | Insurance Straight | Quote: 23.51 – 24.70 Spot Rate : 1.1900 Average : 0.7407 YTW SCENARIO |

| POW.PR.G | Perpetual-Premium | Quote: 25.47 – 26.47 Spot Rate : 1.0000 Average : 0.5815 YTW SCENARIO |

| CU.PR.J | Perpetual-Discount | Quote: 19.70 – 22.50 Spot Rate : 2.8000 Average : 2.3982 YTW SCENARIO |

| ELF.PR.H | Perpetual-Discount | Quote: 24.25 – 25.00 Spot Rate : 0.7500 Average : 0.4697 YTW SCENARIO |

| CU.PR.F | Perpetual-Discount | Quote: 20.98 – 21.75 Spot Rate : 0.7700 Average : 0.5076 YTW SCENARIO |

| CU.PR.C | FixedReset Disc | Quote: 23.35 – 24.90 Spot Rate : 1.5500 Average : 1.3198 YTW SCENARIO |