Intact Financial Corporation has announced:

that it has entered into an agreement with a syndicate of underwriters led by BMO Capital Markets and National Bank Capital Markets pursuant to which the underwriters have agreed to purchase, on a bought deal basis, 6,000,000 Non-Cumulative Class A Shares, Series 13 (the “Series 13 Shares”) from Intact for sale to the public at a price of $25.00 per Series 13 Share (the “Offering Price”), representing aggregate gross proceeds of $150 million (the “Offering”).

The Series 13 Shares will yield 5.50% per annum, payable quarterly, as and when declared by the Board of Directors of the Company. The Series 13 Shares will not be redeemable prior to December 31, 2030. On and after December 31, 2030, Intact may, on not less than 30 nor more than 60 days’ notice, redeem for cash the Series 13 Shares in whole or in part, at Intact’s option, at $26.00 per Series 13 Share if redeemed on or after December 31, 2030 and prior to December 31, 2031, $25.75 per Series 13 Share if redeemed on or after December 31, 2031 and prior to December 31, 2032, $25.50 per Series 13 Share if redeemed on or after December 31, 2032 and prior to December 31, 2033, $25.25 per Series 13 Share if redeemed on or after December 31, 2033 and prior to December 31, 2034 and $25.00 per Series 13 Share if redeemed on or after December 31, 2034, in each case together with all declared and unpaid dividends on such Series 13 Shares up to but excluding the date of redemption.

The Offering is expected to close on November 12, 2025. The net proceeds are expected to be used by Intact for general corporate purposes.

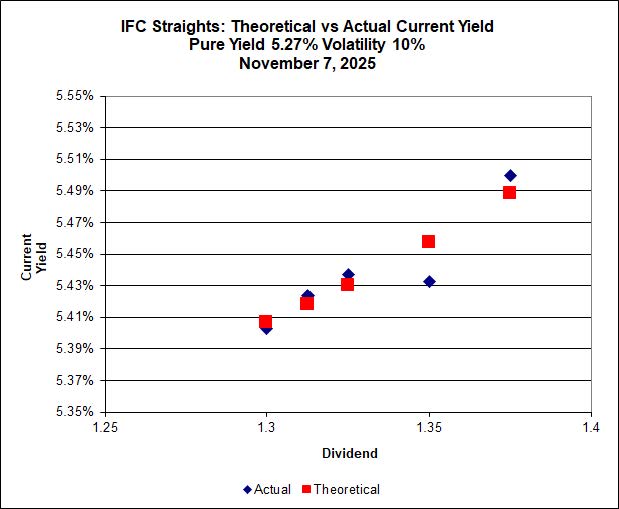

The issue appears to be fairly priced in accordance with Implied Volatility Theory [IVT], with a Theoretical Price of 25.05. However, IVT makes no allowance for the redemption lockout period, so I’d say this issue is cheap relative to other IFC Straights.

Thanks to Assiduous Readers niagara and newbiepref for bringing this to my attention!

Update, 2025-12-5: I am not permitted to link to the prospectus for this issue, as the Canadian Securities Administrators forbid such a use of this information on SEDAR+. So you’ll have to do a search for: “Intact Financial Corporation / Intact Corporation financière (000021370) Prospectus (non pricing) supplement (other than ATM) – English.pdf 07 Nov 2025 16:28 ESTNovember 07 2025 at 16:28:25 Eastern Standard Time Ontario 277 KB”

The initial dividend covering the period from issuance to March 31, 2026, if declared, will be payable on March 31, 2026 and will be $0.5236 per Series 13 Preferred Share, based on an anticipated closing date of November 12, 2025.

…

Share if redeemed prior to December 31, 2031, of $25.75 per Series 13 Preferred Share if redeemed on or after December 31, 2031 but prior to December 31, 2032, of $25.50 per Series 13 Preferred Share if redeemed on or after December 31, 2032 but prior to December 31, 2033, of $25.25 per Series 13 Preferred Share if redeemed on or after December 31, 2033 but prior to December 31, 2034, and of $25.00 per Series 13 Preferred Share if redeemed on or after December 31, 2034, in each case together with an amount equal to all declared and unpaid dividends thereon up to but excluding the date fixed for redemption (less any tax required to be deducted and withheld by IFC)

[…] IFC.PR.M is a Straight Perpetual, 5.50%, annnounced 2025-11-6. […]