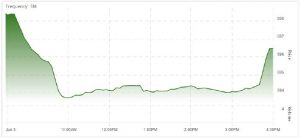

It was a wild day, with new 52-week lows all over the place, but the cavalry arrived at 3:40pm to stave off disaster.

TXPR closed at 596.46, down 0.34% on the day after touching a new 52-week low of 593.67 (down 80bp). Volume was 3.12-million, the highest of the past thirty days.

CPD closed at 11.915, down 0.46% on the day, after hitting a new 52-week low of 11.85. Volume of 231,500 was the second-highest of the past thirty days – eclipsed only by yesterday.

ZPR closed at 9.565, down 0.16% on the day, after hitting a new 52-week low of 9.47. Volume of 254,264 was the third-highest of the past thirty days, eclipsed only by yesterday and (just barely) May 31.

Five-year Canada yields were down 4bp to 1.30% today.

Bond strength (lowering yields) has been attributed to a poor US jobs outlook:

U.S. private employers added 27,000 jobs in May, well below economists’ expectations and the smallest monthly gain in more than nine years, a report by a payrolls processor showed on Wednesday.

Economists surveyed by Reuters had forecast the ADP National Employment Report would show a gain of 180,000 jobs, with estimates ranging from 123,000 to 230,000.

…

May’s increase was the smallest since March 2010.

PerpetualDiscounts now yield 5.59%, equivalent to 7.27% interest at the standard equivalency factor of 1.3x. Long corporates now yield 3.60%, so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) is now about 365bp, a sharp widening from the 345bp reported May 29.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2577 % | 1,973.2 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2577 % | 3,620.8 |

| Floater | 5.95 % | 6.38 % | 62,668 | 13.25 | 3 | -0.2577 % | 2,086.7 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0343 % | 3,302.7 |

| SplitShare | 4.72 % | 4.77 % | 77,242 | 4.25 | 7 | 0.0343 % | 3,944.2 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0343 % | 3,077.4 |

| Perpetual-Premium | 5.64 % | -6.52 % | 78,012 | 0.08 | 7 | 0.0113 % | 2,929.6 |

| Perpetual-Discount | 5.52 % | 5.59 % | 71,805 | 14.43 | 26 | -0.2569 % | 3,051.0 |

| FixedReset Disc | 5.57 % | 5.44 % | 174,848 | 14.67 | 70 | -0.1004 % | 2,045.0 |

| Deemed-Retractible | 5.34 % | 6.12 % | 95,867 | 8.05 | 27 | -0.2751 % | 3,041.7 |

| FloatingReset | 4.11 % | 4.99 % | 50,818 | 2.54 | 4 | -0.2117 % | 2,335.4 |

| FixedReset Prem | 5.15 % | 4.05 % | 223,247 | 1.88 | 16 | 0.5079 % | 2,562.1 |

| FixedReset Bank Non | 2.00 % | 4.54 % | 162,651 | 2.56 | 3 | 0.2396 % | 2,617.0 |

| FixedReset Ins Non | 5.35 % | 7.60 % | 102,879 | 8.17 | 22 | 0.0732 % | 2,130.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PF.B | FixedReset Disc | -2.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 17.01 Evaluated at bid price : 17.01 Bid-YTW : 6.19 % |

| RY.PR.Z | FixedReset Disc | -1.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 17.40 Evaluated at bid price : 17.40 Bid-YTW : 5.16 % |

| RY.PR.H | FixedReset Disc | -1.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 17.22 Evaluated at bid price : 17.22 Bid-YTW : 5.29 % |

| BMO.PR.S | FixedReset Disc | -1.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 17.20 Evaluated at bid price : 17.20 Bid-YTW : 5.40 % |

| MFC.PR.I | FixedReset Ins Non | -1.51 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.88 Bid-YTW : 7.69 % |

| NA.PR.E | FixedReset Disc | -1.47 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 18.80 Evaluated at bid price : 18.80 Bid-YTW : 5.49 % |

| CU.PR.F | Perpetual-Discount | -1.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 20.45 Evaluated at bid price : 20.45 Bid-YTW : 5.54 % |

| BIP.PR.D | FixedReset Disc | -1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 21.25 Evaluated at bid price : 21.25 Bid-YTW : 6.02 % |

| MFC.PR.L | FixedReset Ins Non | -1.39 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.28 Bid-YTW : 8.59 % |

| SLF.PR.I | FixedReset Ins Non | -1.28 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.46 Bid-YTW : 7.62 % |

| CM.PR.S | FixedReset Disc | -1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 18.77 Evaluated at bid price : 18.77 Bid-YTW : 5.34 % |

| POW.PR.B | Perpetual-Discount | -1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 23.26 Evaluated at bid price : 23.56 Bid-YTW : 5.76 % |

| TRP.PR.E | FixedReset Disc | -1.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 15.80 Evaluated at bid price : 15.80 Bid-YTW : 5.95 % |

| NA.PR.S | FixedReset Disc | -1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 16.89 Evaluated at bid price : 16.89 Bid-YTW : 5.73 % |

| PWF.PR.F | Perpetual-Discount | -1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 22.98 Evaluated at bid price : 23.25 Bid-YTW : 5.71 % |

| BAM.PF.E | FixedReset Disc | -1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 15.77 Evaluated at bid price : 15.77 Bid-YTW : 6.36 % |

| EMA.PR.F | FixedReset Disc | -1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 17.20 Evaluated at bid price : 17.20 Bid-YTW : 5.86 % |

| IAF.PR.I | FixedReset Ins Non | -1.00 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.71 Bid-YTW : 6.68 % |

| MFC.PR.G | FixedReset Ins Non | -1.00 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.80 Bid-YTW : 7.60 % |

| CU.PR.I | FixedReset Prem | 1.04 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2020-12-01 Maturity Price : 25.00 Evaluated at bid price : 25.26 Bid-YTW : 3.82 % |

| BAM.PF.H | FixedReset Prem | 1.07 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2020-12-31 Maturity Price : 25.00 Evaluated at bid price : 25.50 Bid-YTW : 4.28 % |

| TD.PF.H | FixedReset Prem | 1.07 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-10-31 Maturity Price : 25.00 Evaluated at bid price : 25.48 Bid-YTW : 4.23 % |

| TRP.PR.D | FixedReset Disc | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 16.39 Evaluated at bid price : 16.39 Bid-YTW : 5.85 % |

| SLF.PR.G | FixedReset Ins Non | 1.11 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 13.61 Bid-YTW : 9.64 % |

| RY.PR.M | FixedReset Disc | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 18.47 Evaluated at bid price : 18.47 Bid-YTW : 5.38 % |

| CM.PR.R | FixedReset Disc | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 21.27 Evaluated at bid price : 21.55 Bid-YTW : 5.47 % |

| MFC.PR.M | FixedReset Ins Non | 1.22 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.41 Bid-YTW : 8.03 % |

| TRP.PR.A | FixedReset Disc | 1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 13.69 Evaluated at bid price : 13.69 Bid-YTW : 5.99 % |

| IAF.PR.G | FixedReset Ins Non | 1.33 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.59 Bid-YTW : 6.36 % |

| BMO.PR.D | FixedReset Disc | 1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 21.28 Evaluated at bid price : 21.28 Bid-YTW : 5.33 % |

| IFC.PR.C | FixedReset Ins Non | 1.33 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.24 Bid-YTW : 7.71 % |

| IFC.PR.A | FixedReset Ins Non | 1.36 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 14.96 Bid-YTW : 9.38 % |

| BIP.PR.F | FixedReset Disc | 1.48 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 20.61 Evaluated at bid price : 20.61 Bid-YTW : 6.20 % |

| SLF.PR.H | FixedReset Ins Non | 1.48 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.79 Bid-YTW : 8.72 % |

| NA.PR.G | FixedReset Disc | 1.82 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 20.66 Evaluated at bid price : 20.66 Bid-YTW : 5.29 % |

| BAM.PF.J | FixedReset Disc | 2.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 22.13 Evaluated at bid price : 22.60 Bid-YTW : 5.32 % |

| GWO.PR.N | FixedReset Ins Non | 2.19 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 14.00 Bid-YTW : 9.08 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PF.H | FixedReset Prem | 203,200 | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-10-31 Maturity Price : 25.00 Evaluated at bid price : 25.48 Bid-YTW : 4.23 % |

| TD.PF.M | FixedReset Disc | 173,410 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 22.99 Evaluated at bid price : 24.54 Bid-YTW : 5.00 % |

| CM.PR.Y | FixedReset Disc | 133,615 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 22.86 Evaluated at bid price : 24.22 Bid-YTW : 5.14 % |

| BAM.PR.K | Floater | 111,000 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 11.03 Evaluated at bid price : 11.03 Bid-YTW : 6.39 % |

| BMO.PR.T | FixedReset Disc | 92,450 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 16.80 Evaluated at bid price : 16.80 Bid-YTW : 5.39 % |

| PWF.PR.L | Perpetual-Discount | 80,087 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 22.40 Evaluated at bid price : 22.66 Bid-YTW : 5.69 % |

| There were 63 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BAM.PF.D | Perpetual-Discount | Quote: 20.60 – 21.20 Spot Rate : 0.6000 Average : 0.3701 YTW SCENARIO |

| MFC.PR.K | FixedReset Ins Non | Quote: 18.42 – 19.09 Spot Rate : 0.6700 Average : 0.4605 YTW SCENARIO |

| BMO.PR.C | FixedReset Disc | Quote: 21.94 – 22.40 Spot Rate : 0.4600 Average : 0.2788 YTW SCENARIO |

| BAM.PF.E | FixedReset Disc | Quote: 15.77 – 16.18 Spot Rate : 0.4100 Average : 0.2456 YTW SCENARIO |

| TD.PF.L | FixedReset Disc | Quote: 24.47 – 24.90 Spot Rate : 0.4300 Average : 0.2674 YTW SCENARIO |

| GWO.PR.Q | Deemed-Retractible | Quote: 22.85 – 23.26 Spot Rate : 0.4100 Average : 0.2717 YTW SCENARIO |