A horrible day for equities is continuing overnight:

Appetite for equities continued to sour in Asia as oil’s drop and a revival in demand for low-risk assets saw stocks from Japan to Australia decline with emerging-market currencies.

Asian shares fell the most in a week as a resurgent yen weighed on Japan’s Topix index, while mining and energy shares drove a 2.1 percent retreat in Australia’s benchmark. Crude fell toward $31 a barrel in New York after sliding last session as Iran’s oil minister ridiculed a plan forged by Saudi Arabia and Russia to lock production at January levels. Gold built on Tuesday’s advance, while yields on 10-year Japanese government debt fell back below zero. The pound slipped below $1.40 for the first time since 2009 as Malaysia’s ringgit dropped by the most in a week.

…

Futures on the Standard & Poor’s 500 index declined 0.1 percent, following a 1.3 percent retreat in the U.S. benchmark.

Meanwhile, Federal Reserve Bank of St. Louis President James Bullard made a presentation:

Bullard explained that modern theory suggests inflation expectations are a more important determinant of actual inflation than traditional “Phillips curve” effects (whereby further gains in labor markets put upward pressure on inflation).

He noted that the decline in market-based measures of inflation expectations in the U.S. since the summer of 2014 has been highly correlated with the decline in oil prices. “I suggested during 2015 that inflation expectations would return to previous levels once oil prices stabilized,” Bullard added. “Since then, inflation expectations have declined too far for comfort, the oil price correlation notwithstanding.”

Turning again to the FOMC’s normalization strategy being predicated on an environment of stable inflation expectations, Bullard said that renewed downward pressure on market-based measures of inflation expectations during 2016 has called this assumption into question. “I regard it as unwise to continue a normalization strategy in an environment of declining market-based inflation expectations,” he stated.

His presentation slides included a handy chart:

Interestingly, however, Alejandro Badel and Joseph McGillicuddy of the St. Louis Fed, have examined What Future Oil Price Is Consistent with Current Inflation Expectations? and come up with a surprising answer:

We calculated the future path of the CPI over the next 10 years (starting in January 2016) that would be consistent with breakeven inflation expectations at horizons of one year through 10 years.2 Then, using an annual growth rate of 2.87 percent for the “all items less energy” component and using 0.46 for the elasticity of the energy component with respect to oil prices, we backed out the future path of oil prices that would produce this future path of the CPI.3 The figure below displays the implied oil price series and compares it to the future oil prices implied by West Texas Intermediate crude oil futures.

According to our calculations, oil prices would need to fall to $0 per barrel by mid-2019 in order to validate current inflation expectations. After that, there is no oil price that would allow our model to predict a CPI path consistent with December 2015 breakeven inflation expectations. This implied path of oil prices is very different from the path of oil prices implied by futures contracts, which rises to more than $50 per barrel by mid-2019.

We state some potential explanations for our results:

- •Expectations for the future growth of the other CPI components besides energy may be lower than the annual rate of 2.87 percent we assumed in our model.

- •The recent movements in breakeven inflation expectations may have been caused by something other than the decline in oil prices. It is even possible that a third variable is driving the decline in both.

- •Investors may expect the relationship between oil price and the CPI energy component to change in the future. (This would be despite the strong relationship seen over the past 20 years, shown in the second figure in our previous blog post.)

- •Changes in the inflation risk premium for bonds that are not inflation-protected and/or changes in the liquidity premium for TIPS may be distorting breakeven inflation expectations in the last few months.

And Michael D. Bauer and Erin McCarthy of the San Francisco Fed ask Can We Rely on Market-Based Inflation Forecasts?:

Market-based measures of inflation expectations are calculated from the prices of financial securities. Their advantage is that they are readily available at high frequency and therefore are widely monitored. However, they reflect not only the public’s inflation expectations but also other idiosyncratic factors that affect market prices, which are difficult to quantify. For example, they include a risk premium to compensate investors for inflation uncertainty and are affected by changes in liquidity, unusual demand flows, and, more broadly, “animal spirits” that change prices but are unrelated to expectations (see Bauer and Rudebusch 2015). Hence it is unclear how much useful information they provide, and how much one should pay attention to these rates when forecasting inflation.

If market-based inflation expectations provided accurate inflation forecasts, then one surely would want to pay close attention to their evolution. In this Economic Letter, we evaluate their performance in comparison with a variety of alternative forecasts for CPI inflation.

…

For the one-year-ahead forecasts, the results indicate that market-based forecasts and the no-change forecast perform worst. Survey forecasts deliver the best performance. The constant forecast performs surprisingly well, with only slightly lower accuracy than the surveys.For the two-year forecasts, Figure 2 shows that while the differences in forecast performance are smaller, market-based forecasts again are among the least accurate. Here, inflation swaps and the SPF perform about the same, both somewhat worse than the simple constant and no-change forecasts.

…

We find that market-based inflation expectations are not as accurate in predicting future inflation as one might expect. They can exhibit somewhat lower accuracy than forecasts constructed from survey expectations of future inflation, which incorporate all the information used by professional forecasters, or simple forecast rules. Interestingly, a simple constant inflation rate corresponding to the Federal Reserve’s 2% inflation target performs quite well. Our results should be viewed as only tentative as they are based on a short sample that displays a lot of volatility during the Great Recession, and because the differences in forecast accuracy are generally small. What we confidently conclude, however, is that market-based forecasts cannot improve upon some of the most common methods for predicting inflation.

Meanwhile, we will soon start seeing the effects of a grand experiment in bank funding:

Investors are poised to pull as much as $400 billion from U.S. money-market funds that buy such debt, known as commercial paper, JPMorgan Chase & Co. predicts. The looming exodus, a consequence of steps to make money markets safer after the financial crisis, is set to accelerate before October. That’s when Securities and Exchange Commission rules take effect mandating that so-called institutional prime funds, among the main buyers of commercial paper, report prices that fluctuate. Traditionally, those funds have stuck to $1 per share.

Wall Street strategists say investors may already be shifting from prime funds to those focused on government debt, which will keep a fixed share price. The diminished appetite for commercial paper is a potential headache for banks and other issuers, which saw the cost of the IOUs climb to an almost four-year high in recent weeks. The companies use the instruments for everything from loans to payrolls.

…

Financial firms’ short-term debts, including commercial paper, certificates of deposit and time deposits, make up U.S. prime funds’ biggest holdings. Bank of Tokyo-Mitsubishi UFJ Ltd., Credit Agricole SA, Sumitomo Mitsui Bank Corp., Royal Bank of Canada and DNB Bank ASA comprise the top five issuers of this debt held by the funds, according to Crane Data LLC.

…

With fund companies converting or closing prime offerings, the industry’s holdings of government securities have swelled. Taxable money-funds’ investments in government obligations rose to $1.47 trillion as of the end of January, from $1.18 billion in February 2015, according to Crane.

And there’s a new deputy in town:

The Bank of Canada plucked a researcher from the Federal Reserve Bank of San Francisco to help it navigate record-low interest rates and the lingering effects of a commodity shock.

Sylvain Leduc, currently a vice president at the San Francisco Fed, becomes the Canadian central bank’s newest policy maker starting May 2. The Montreal-born economist, 46, has published a string of papers in the last decade on subjects including the benefits of infrastructure spending, the links between exchange-rate swings and inflation, and extraordinary monetary policy.

And guess who visited the Canadian preferred share market today?

It was a grim day for the Canadian preferred share market, with PerpetualDiscounts off 26bp, FixedResets losing 183bp and DeemedRetractibles down 63bp. The Performance Highlights table is suitably enormous. Volume was very high.

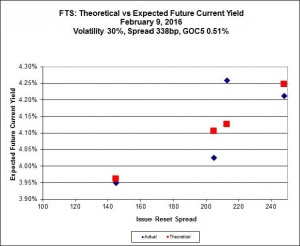

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

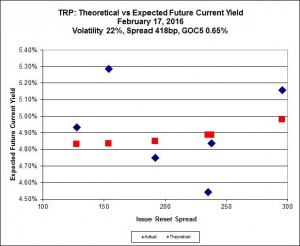

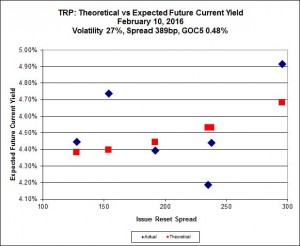

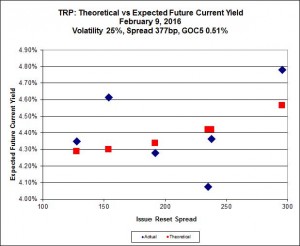

Here’s TRP:

TRP.PR.E, which resets 2019-10-30 at +235, is bid at 16.55 to be $1.41 rich, while TRP.PR.G, resetting 2020=11-30 at +296, is $0.85 cheap at its bid price of 17.00.

This analysis includes the new issue with a deemed price of 25.00.

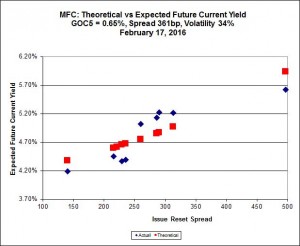

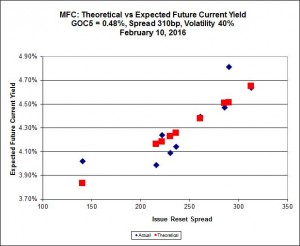

Most expensive is the new issue, resetting at +497bp on 2021-6-19, deemed at 25.00 to be 1.44 rich, while MFC.PR.G, resetting at +290bp on 2016-12-19, is bid at 16.24 to be 1.73 cheap.

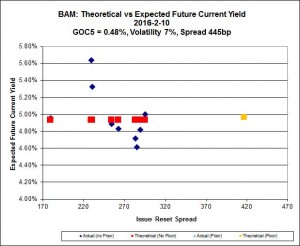

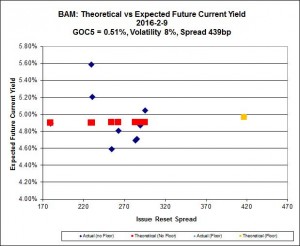

The cheapest issue relative to its peers is BAM.PR.R, resetting at +230bp on 2016-6-30, bid at 12.57 to be $1.40 cheap. BAM.PF.E, resetting at +255bp on 2020-3-31 is bid at 16.28 and appears to be $1.11 rich.

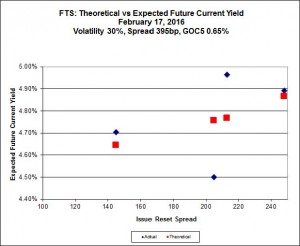

FTS.PR.K, with a spread of +205bp, and bid at 14.35, looks $0.31 expensive and resets 2019-3-1. FTS.PR.G, with a spread of +213bp and resetting 2018-9-1, is bid at 13.95 and is $0.49 cheap.

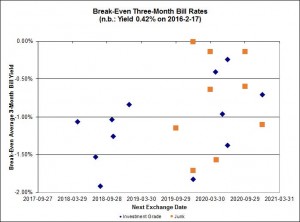

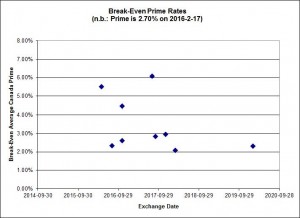

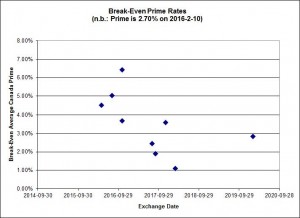

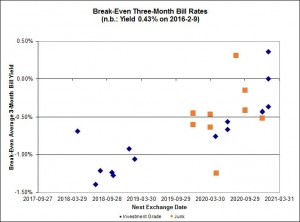

Investment-grade pairs predict an average three-month bill yield over the next five-odd years of -0.83%, with one outlier above 0.50% and two below -1.50%. Note that the range of the y-axis has changed today. There is one junk outlier above 0.50% and two below -1.50%.

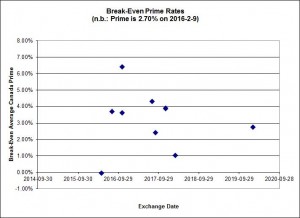

Shall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 5.59 % | 6.81 % | 14,719 | 15.67 | 1 | -5.1684 % | 1,395.2 |

| FixedFloater | 7.78 % | 6.81 % | 23,090 | 15.38 | 1 | -0.1635 % | 2,555.2 |

| Floater | 4.97 % | 5.23 % | 78,533 | 15.04 | 4 | 0.0000 % | 1,542.4 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2726 % | 2,743.0 |

| SplitShare | 4.87 % | 5.69 % | 75,047 | 2.68 | 6 | -0.2726 % | 3,209.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2726 % | 2,504.4 |

| Perpetual-Premium | 5.84 % | 5.84 % | 82,758 | 13.85 | 6 | -0.1593 % | 2,526.3 |

| Perpetual-Discount | 5.79 % | 5.82 % | 98,814 | 14.18 | 33 | -0.2617 % | 2,500.1 |

| FixedReset | 5.81 % | 5.21 % | 207,589 | 14.08 | 84 | -1.8337 % | 1,751.2 |

| Deemed-Retractible | 5.37 % | 5.98 % | 124,877 | 6.87 | 34 | -0.6288 % | 2,518.4 |

| FloatingReset | 3.17 % | 5.47 % | 49,891 | 5.47 | 16 | -1.6229 % | 1,928.8 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.X | FixedReset | -6.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 11.45 Evaluated at bid price : 11.45 Bid-YTW : 5.77 % |

| BAM.PR.R | FixedReset | -6.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 12.57 Evaluated at bid price : 12.57 Bid-YTW : 5.99 % |

| FTS.PR.K | FixedReset | -5.90 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 14.35 Evaluated at bid price : 14.35 Bid-YTW : 5.05 % |

| BAM.PF.A | FixedReset | -5.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 16.60 Evaluated at bid price : 16.60 Bid-YTW : 5.62 % |

| HSE.PR.E | FixedReset | -5.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 14.56 Evaluated at bid price : 14.56 Bid-YTW : 7.33 % |

| TD.PR.T | FloatingReset | -5.17 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.17 Bid-YTW : 5.91 % |

| BAM.PR.E | Ratchet | -5.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 25.00 Evaluated at bid price : 12.11 Bid-YTW : 6.81 % |

| BAM.PF.G | FixedReset | -5.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 16.79 Evaluated at bid price : 16.79 Bid-YTW : 5.64 % |

| BMO.PR.Q | FixedReset | -5.08 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.20 Bid-YTW : 8.80 % |

| HSE.PR.G | FixedReset | -5.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 14.51 Evaluated at bid price : 14.51 Bid-YTW : 7.52 % |

| BAM.PF.B | FixedReset | -4.79 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 15.52 Evaluated at bid price : 15.52 Bid-YTW : 5.61 % |

| BAM.PF.E | FixedReset | -4.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 16.28 Evaluated at bid price : 16.28 Bid-YTW : 5.40 % |

| TRP.PR.G | FixedReset | -4.49 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 17.00 Evaluated at bid price : 17.00 Bid-YTW : 5.37 % |

| TRP.PR.I | FloatingReset | -4.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 10.76 Evaluated at bid price : 10.76 Bid-YTW : 4.64 % |

| BNS.PR.Z | FixedReset | -4.33 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.33 Bid-YTW : 7.79 % |

| PWF.PR.T | FixedReset | -4.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 18.77 Evaluated at bid price : 18.77 Bid-YTW : 4.26 % |

| PWF.PR.Q | FloatingReset | -4.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 10.06 Evaluated at bid price : 10.06 Bid-YTW : 5.12 % |

| TRP.PR.H | FloatingReset | -4.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 8.50 Evaluated at bid price : 8.50 Bid-YTW : 5.13 % |

| HSE.PR.C | FixedReset | -4.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 13.30 Evaluated at bid price : 13.30 Bid-YTW : 7.58 % |

| FTS.PR.H | FixedReset | -3.91 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 11.05 Evaluated at bid price : 11.05 Bid-YTW : 4.92 % |

| MFC.PR.G | FixedReset | -3.91 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.24 Bid-YTW : 9.49 % |

| FTS.PR.G | FixedReset | -3.86 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 13.95 Evaluated at bid price : 13.95 Bid-YTW : 5.23 % |

| BNS.PR.Y | FixedReset | -3.78 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.57 Bid-YTW : 7.21 % |

| HSE.PR.A | FixedReset | -3.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 8.03 Evaluated at bid price : 8.03 Bid-YTW : 7.45 % |

| MFC.PR.J | FixedReset | -3.35 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.14 Bid-YTW : 9.38 % |

| NA.PR.S | FixedReset | -3.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 15.90 Evaluated at bid price : 15.90 Bid-YTW : 5.08 % |

| MFC.PR.I | FixedReset | -3.24 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.70 Bid-YTW : 9.18 % |

| MFC.PR.K | FixedReset | -3.22 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.02 Bid-YTW : 10.04 % |

| BMO.PR.Y | FixedReset | -3.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 18.12 Evaluated at bid price : 18.12 Bid-YTW : 4.77 % |

| TRP.PR.F | FloatingReset | -3.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 10.76 Evaluated at bid price : 10.76 Bid-YTW : 5.57 % |

| NA.PR.W | FixedReset | -3.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 14.87 Evaluated at bid price : 14.87 Bid-YTW : 5.24 % |

| TRP.PR.D | FixedReset | -3.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 15.65 Evaluated at bid price : 15.65 Bid-YTW : 5.12 % |

| BMO.PR.M | FixedReset | -2.99 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.75 Bid-YTW : 4.51 % |

| MFC.PR.N | FixedReset | -2.80 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.32 Bid-YTW : 9.15 % |

| BAM.PR.T | FixedReset | -2.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 13.37 Evaluated at bid price : 13.37 Bid-YTW : 5.76 % |

| MFC.PR.L | FixedReset | -2.53 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.40 Bid-YTW : 9.83 % |

| CM.PR.Q | FixedReset | -2.48 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 17.70 Evaluated at bid price : 17.70 Bid-YTW : 4.93 % |

| TRP.PR.C | FixedReset | -2.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 10.37 Evaluated at bid price : 10.37 Bid-YTW : 5.32 % |

| NA.PR.Q | FixedReset | -2.39 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.45 Bid-YTW : 5.34 % |

| BAM.PR.Z | FixedReset | -2.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 16.50 Evaluated at bid price : 16.50 Bid-YTW : 5.73 % |

| RY.PR.H | FixedReset | -2.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 16.51 Evaluated at bid price : 16.51 Bid-YTW : 4.67 % |

| SLF.PR.J | FloatingReset | -2.17 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 11.25 Bid-YTW : 12.19 % |

| CU.PR.C | FixedReset | -2.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 15.56 Evaluated at bid price : 15.56 Bid-YTW : 4.96 % |

| MFC.PR.M | FixedReset | -1.95 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.62 Bid-YTW : 8.96 % |

| BNS.PR.D | FloatingReset | -1.94 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.65 Bid-YTW : 7.68 % |

| MFC.PR.H | FixedReset | -1.92 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.40 Bid-YTW : 8.04 % |

| BNS.PR.P | FixedReset | -1.83 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.55 Bid-YTW : 4.09 % |

| RY.PR.Z | FixedReset | -1.83 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 16.61 Evaluated at bid price : 16.61 Bid-YTW : 4.58 % |

| FTS.PR.M | FixedReset | -1.82 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 16.20 Evaluated at bid price : 16.20 Bid-YTW : 5.12 % |

| FTS.PR.I | FloatingReset | -1.70 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 9.23 Evaluated at bid price : 9.23 Bid-YTW : 5.13 % |

| RY.PR.I | FixedReset | -1.69 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.64 Bid-YTW : 4.93 % |

| PWF.PR.P | FixedReset | -1.65 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 11.36 Evaluated at bid price : 11.36 Bid-YTW : 4.97 % |

| SLF.PR.H | FixedReset | -1.63 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 14.50 Bid-YTW : 10.28 % |

| BAM.PR.B | Floater | -1.62 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 9.10 Evaluated at bid price : 9.10 Bid-YTW : 5.27 % |

| TRP.PR.B | FixedReset | -1.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 9.75 Evaluated at bid price : 9.75 Bid-YTW : 5.09 % |

| IFC.PR.C | FixedReset | -1.59 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.50 Bid-YTW : 10.01 % |

| TD.PF.B | FixedReset | -1.56 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 16.45 Evaluated at bid price : 16.45 Bid-YTW : 4.68 % |

| CM.PR.P | FixedReset | -1.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 16.00 Evaluated at bid price : 16.00 Bid-YTW : 4.82 % |

| BNS.PR.C | FloatingReset | -1.50 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.01 Bid-YTW : 5.46 % |

| BNS.PR.B | FloatingReset | -1.43 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.65 Bid-YTW : 5.59 % |

| TD.PR.Y | FixedReset | -1.38 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.81 Bid-YTW : 4.67 % |

| IAG.PR.G | FixedReset | -1.34 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.97 Bid-YTW : 9.07 % |

| BMO.PR.W | FixedReset | -1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 16.35 Evaluated at bid price : 16.35 Bid-YTW : 4.65 % |

| BMO.PR.R | FloatingReset | -1.32 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.97 Bid-YTW : 5.24 % |

| CM.PR.O | FixedReset | -1.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 16.53 Evaluated at bid price : 16.53 Bid-YTW : 4.78 % |

| RY.PR.L | FixedReset | -1.29 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.53 Bid-YTW : 4.17 % |

| PVS.PR.D | SplitShare | -1.25 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2021-10-08 Maturity Price : 25.00 Evaluated at bid price : 22.86 Bid-YTW : 6.33 % |

| BNS.PR.R | FixedReset | -1.25 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.97 Bid-YTW : 4.85 % |

| ELF.PR.H | Perpetual-Discount | -1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 22.33 Evaluated at bid price : 22.62 Bid-YTW : 6.15 % |

| TD.PF.A | FixedReset | -1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 16.51 Evaluated at bid price : 16.51 Bid-YTW : 4.68 % |

| TD.PR.Z | FloatingReset | -1.19 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.76 Bid-YTW : 5.47 % |

| BNS.PR.M | Deemed-Retractible | -1.17 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.68 Bid-YTW : 5.65 % |

| PWF.PR.K | Perpetual-Discount | -1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 21.35 Evaluated at bid price : 21.62 Bid-YTW : 5.77 % |

| TRP.PR.A | FixedReset | -1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 13.00 Evaluated at bid price : 13.00 Bid-YTW : 5.27 % |

| BNS.PR.L | Deemed-Retractible | -1.09 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.65 Bid-YTW : 5.67 % |

| BAM.PR.K | Floater | -1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 9.15 Evaluated at bid price : 9.15 Bid-YTW : 5.24 % |

| GWO.PR.M | Deemed-Retractible | -1.07 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.05 Bid-YTW : 5.94 % |

| SLF.PR.B | Deemed-Retractible | -1.06 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.39 Bid-YTW : 7.17 % |

| BMO.PR.S | FixedReset | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 16.95 Evaluated at bid price : 16.95 Bid-YTW : 4.64 % |

| RY.PR.E | Deemed-Retractible | -1.05 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.66 Bid-YTW : 5.60 % |

| ELF.PR.F | Perpetual-Discount | -1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 21.75 Evaluated at bid price : 22.00 Bid-YTW : 6.10 % |

| SLF.PR.A | Deemed-Retractible | -1.03 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.24 Bid-YTW : 7.21 % |

| RY.PR.G | Deemed-Retractible | -1.01 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.57 Bid-YTW : 5.68 % |

| BNS.PR.F | FloatingReset | 1.01 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.01 Bid-YTW : 7.80 % |

| TD.PF.D | FixedReset | 1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 18.02 Evaluated at bid price : 18.02 Bid-YTW : 4.83 % |

| GWO.PR.N | FixedReset | 1.58 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 12.20 Bid-YTW : 11.48 % |

| MFC.PR.F | FixedReset | 1.65 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 12.30 Bid-YTW : 11.17 % |

| RY.PR.M | FixedReset | 1.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 17.28 Evaluated at bid price : 17.28 Bid-YTW : 4.84 % |

| PWF.PR.A | Floater | 1.82 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 10.61 Evaluated at bid price : 10.61 Bid-YTW : 4.48 % |

| GWO.PR.O | FloatingReset | 1.85 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 11.00 Bid-YTW : 12.31 % |

| CIU.PR.C | FixedReset | 7.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 10.57 Evaluated at bid price : 10.57 Bid-YTW : 4.70 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PF.G | FixedReset | 143,934 | TD crossed 100,000 at 25.36. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 23.27 Evaluated at bid price : 25.37 Bid-YTW : 5.21 % |

| BNS.PR.E | FixedReset | 83,554 | RBC crossed 38,400 at 25.47. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 23.29 Evaluated at bid price : 25.43 Bid-YTW : 5.12 % |

| RY.PR.Q | FixedReset | 73,287 | RBC crossed 25,000 at 25.43. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 23.24 Evaluated at bid price : 25.30 Bid-YTW : 5.17 % |

| SLF.PR.E | Deemed-Retractible | 61,414 | RBC crossed 50,000 at 20.20. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.00 Bid-YTW : 7.79 % |

| NA.PR.X | FixedReset | 55,631 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-23 Maturity Price : 23.19 Evaluated at bid price : 25.14 Bid-YTW : 5.47 % |

| SLF.PR.I | FixedReset | 49,348 | Desjardins crossed 25,000 at 16.75. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.75 Bid-YTW : 9.03 % |

| There were 57 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| TD.PR.Z | FloatingReset | Quote: 20.76 – 21.94 Spot Rate : 1.1800 Average : 0.7330 YTW SCENARIO |

| TD.PR.T | FloatingReset | Quote: 20.17 – 21.15 Spot Rate : 0.9800 Average : 0.5827 YTW SCENARIO |

| BAM.PR.E | Ratchet | Quote: 12.11 – 12.86 Spot Rate : 0.7500 Average : 0.5357 YTW SCENARIO |

| GWO.PR.M | Deemed-Retractible | Quote: 25.05 – 25.70 Spot Rate : 0.6500 Average : 0.4749 YTW SCENARIO |

| MFC.PR.I | FixedReset | Quote: 16.70 – 17.23 Spot Rate : 0.5300 Average : 0.3792 YTW SCENARIO |

| BMO.PR.Q | FixedReset | Quote: 17.20 – 17.60 Spot Rate : 0.4000 Average : 0.2651 YTW SCENARIO |