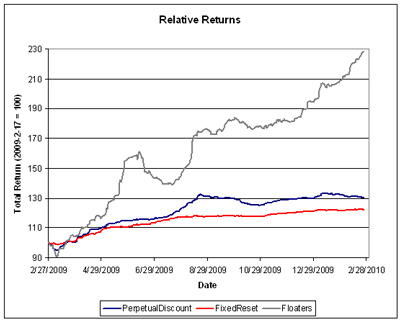

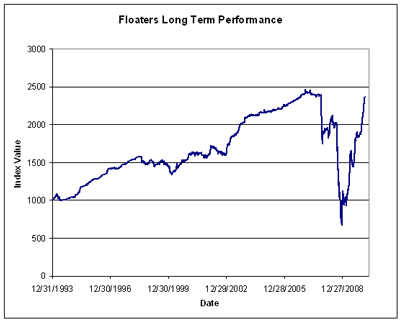

The fund underperformed in February, weighed down by its lack of holdings in the Floating Rate sector, in which performance continues to astonish.

The fund’s Net Asset Value per Unit as of the close February 26 was $10.6441.

| Returns to February 26, 2010 |

| Period |

MAPF |

Index |

CPD

according to

Claymore |

| One Month |

-1.09% |

+0.38% |

+% |

| Three Months |

+2.29% |

+2.98% |

+% |

| One Year |

+53.87% |

+27.64% |

+% |

| Two Years (annualized) |

+23.89% |

+3.21% |

+% * |

| Three Years (annualized) |

+16.70% |

+0.69% |

|

| Four Years (annualized) |

+14.10% |

+1.63% |

|

| Five Years (annualized) |

+12.37% |

+2.08% |

|

| Six Years (annualized) |

+11.83% |

+2.35% |

|

| Seven Years (annualized) |

+14.32% |

+3.39% |

|

| Eight Years (annualized) |

+12.56% |

+3.24% |

|

| The Index is the BMO-CM “50” |

| MAPF returns assume reinvestment of dividends, and are shown after expenses but before fees. |

| CPD Returns are for the NAV and are after all fees and expenses. CPD returns to February 26, 2010, are not yet available on the Claymore website. |

| * CPD does not directly report its two-year returns. The figure shown is the product of the current one-year return and the similar figure reported for February 2009. |

| Figures for Omega Preferred Equity (which are after all fees and expenses) for 1-, 3- and 12-months are +0.2%, +2.5% and +25.6%, respectively, according to Morningstar after all fees & expenses |

| Figures for Jov Leon Frazer Preferred Equity Fund Class I Units (which are after all fees and expenses) for 1-, 3- and 12-months are +0.5%, +1.3% & +18.4% respectively, according to Morningstar |

| Figures for AIC Preferred Income Fund (which are after all fees and expenses) for 1-, 3- and 12-months are +0.1%, +1.5% & N/A, respectively |

MAPF returns assume reinvestment of dividends, and are shown after expenses but before fees. Past performance is not a guarantee of future performance. You can lose money investing in Malachite Aggressive Preferred Fund or any other fund. For more information, see the fund’s main page.

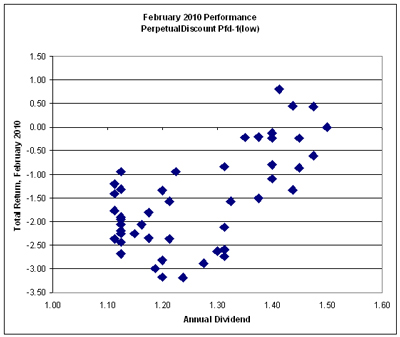

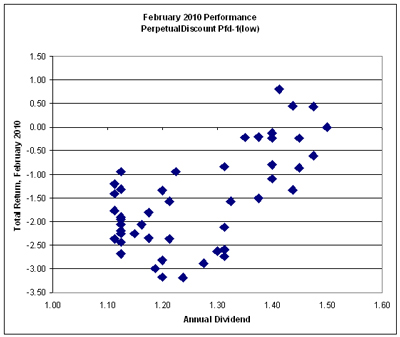

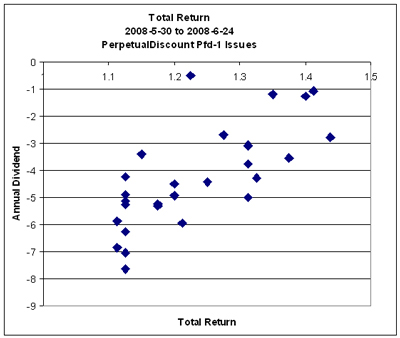

Another factor that hurt the fund’s performance in February was a decline in the implied volatility of PerpetualDiscounts. This had a large effect on performance of the different issues (though not as large as the Swoon in June), as shown in the following chart:

Click for Big

Click for BigA regression calculation performed on the above data results in a slope of +5.096 +/- 0.92, with R2 = 0.39. Thus, a difference of $0.25 in annual dividend resulted in a difference of +1.27% in return for the month.

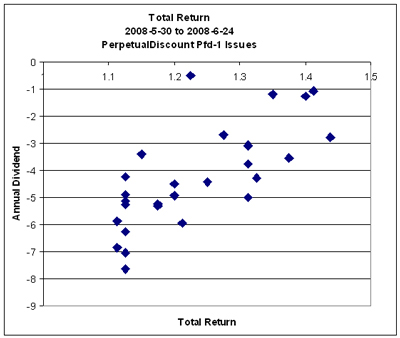

This may be compared with the Swoon in June:

Click for Big

Click for Bigwhich had a slope of +12.7 +/- 2.4 (only Pfd-1 issues, as they were defined at the time), R2 = 0.53. With such a slope, a difference in annual dividend of $0.25 resulted in a difference of 3.18% (absolute) in total return for the partial month.

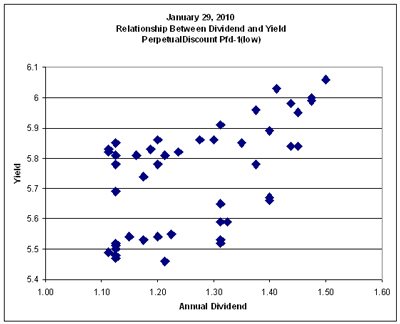

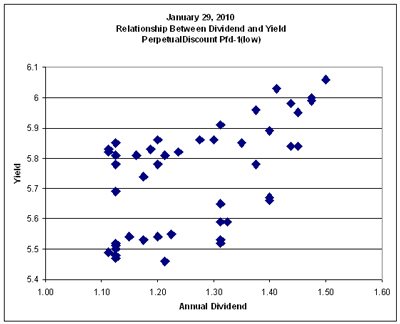

At the end of January, the relationship between annual dividend and yield was:

Click for Big

Click for BigThe regression line had a slope of 0.80 +/- 0.17, with R2 = 0.32. This changed during February to:

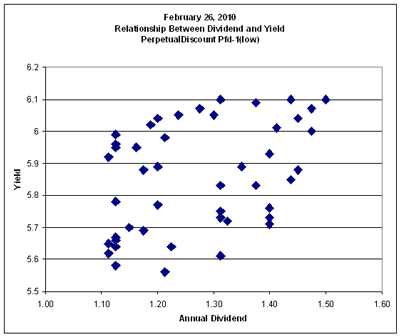

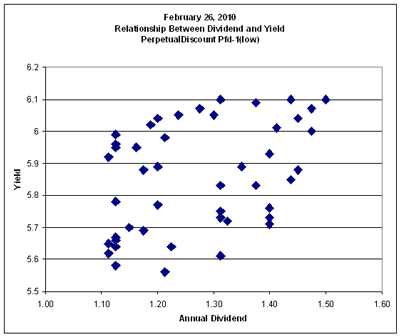

Click for Big

Click for Bigwith a regression line slope of 0.54 +/- 0.18, R2 = 0.17.

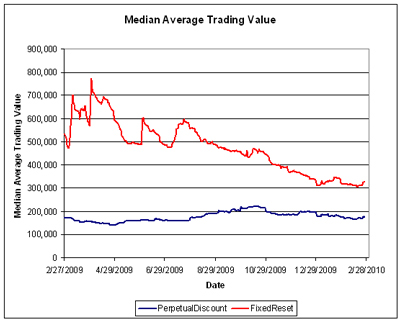

Too bad, but it happens – and this shift in the market is one reason why trading volume was down in February. The fund is well positioned for a reversal in this relationship.

I am very pleased with the returns over the past year, but implore Assiduous Readers not to project this level of outperformance for the indefinite future. The year in the preferred share market was filled with episodes of panic and euphoria, together with many new entrants who do not appear to know what they are doing; perfect conditions for a disciplined quantitative approach.

Sometimes everything works … sometimes the trading works, but sectoral shifts overwhelm the increment … sometimes nothing works. The fund seeks to earn incremental return by selling liquidity (that is, taking the other side of trades that other market participants are strongly motivated to execute), which can also be referred to as ‘trading noise’. There have been a lot of strongly motivated market participants in the past year, generating a lot of noise! The conditions of the past year may never be repeated in my lifetime … but the fund will simply attempt to make trades when swaps seem profitable, whether that implies monthly turnover of 10% or 100%.

There’s plenty of room for new money left in the fund. Just don’t expect the current level of outperformance every year, OK? While I will continue to exert utmost efforts to outperform, it should be borne in mind that beating the index by 500bp represents a good year, and there will almost inevitably be periods of underperformance in the future.

The yields available on high quality preferred shares remain elevated, which is reflected in the current estimate of sustainable income.

| Calculation of MAPF Sustainable Income Per Unit |

| Month |

NAVPU |

Portfolio

Average

YTW |

Leverage

Divisor |

Securities

Average

YTW |

Capital

Gains

Multiplier |

Sustainable

Income

per

current

Unit |

| June, 2007 |

9.3114 |

5.16% |

1.03 |

5.01% |

1.1883 |

0.3926 |

| September |

9.1489 |

5.35% |

0.98 |

5.46% |

1.1883 |

0.4203 |

| December, 2007 |

9.0070 |

5.53% |

0.942 |

5.87% |

1.1883 |

0.4448 |

| March, 2008 |

8.8512 |

6.17% |

1.047 |

5.89% |

1.1883 |

0.4389 |

| June |

8.3419 |

6.034% |

0.952 |

6.338% |

1.1883 |

$0.4449 |

| September |

8.1886 |

7.108% |

0.969 |

7.335% |

1.1883 |

$0.5054 |

| December, 2008 |

8.0464 |

9.24% |

1.008 |

9.166% |

1.1883 |

$0.6206 |

| March 2009 |

$8.8317 |

8.60% |

0.995 |

8.802% |

1.1883 |

$0.6423 |

| June |

10.9846 |

7.05% |

0.999 |

7.057% |

1.1883 |

$0.6524 |

| September |

12.3462 |

6.03% |

0.998 |

6.042% |

1.1883 |

$0.6278 |

| December 2009 |

10.5662 |

5.74% |

0.981 |

5.851% |

1.0000 |

$0.6182 |

| February 2010 |

10.6441 |

5.84% |

1.000 |

5.840% |

1.0000 |

$0.6216 |

NAVPU is shown after quarterly distributions of dividend income and annual distribution of capital gains.

Portfolio YTW includes cash (or margin borrowing), with an assumed interest rate of 0.00%

The Leverage Divisor indicates the level of cash in the account: if the portfolio is 1% in cash, the Leverage Divisor will be 0.99

Securities YTW divides “Portfolio YTW” by the “Leverage Divisor” to show the average YTW on the securities held; this assumes that the cash is invested in (or raised from) all securities held, in proportion to their holdings.

The Capital Gains Multiplier adjusts for the effects of Capital Gains Dividends. On 2009-12-31, there was a capital gains distribution of $1.989262 which is assumed for this purpose to have been reinvested at the final price of $10.5662. Thus, a holder of one unit pre-distribution would have held 1.1883 units post-distribution; the CG Multiplier reflects this to make the time-series comparable. Note that Dividend Distributions are not assumed to be reinvested.

Sustainable Income is the resultant estimate of the fund’s dividend income per current unit, before fees and expenses. Note that a “current unit” includes reinvestment of prior capital gains; a unitholder would have had the calculated sustainable income with only, say, 0.9 units in the past which, with reinvestment of capital gains, would become 1.0 current units. |

As has been previously discussed, the fund has a position in the high-yielding split-share BNA.PR.C, about half of which was sold in November in a swap for the slightly lower-yielding PerpetualDiscount BAM.PR.N. . BNA.PR.C is scheduled to mature (or to be retracted) in the future, hence the sustainability of sustainable yield calculated while incorporating their contribution is somewhat suspect, as discussed in August, 2008.

Significant positions were also held in Fixed-Reset issues on February 26; all of which (with the exception of YPG.PR.D) currently have their yields calculated with the presumption that they will be called by the issuers at par at the first possible opportunity. This presents another complication in the calculation of sustainable yield.

However, if the entire portfolio except for the PerpetualDiscounts were to be sold and reinvested in these issues, the yield of the portfolio would be the 6.03% shown in the MAPF Portfolio Composition: February 2010 analysis(which is in excess of the 5.90% index yield on February 26). Given such reinvestment, the sustainable yield would be $10.6441 * 0.0603 = 0.6418 whereas similar calculations for January and December result in $0.6338 and $0.6308, respectively

Different assumptions lead to different results from the calculation, but the overall positive trend is apparent. I’m very pleased with the results! It will be noted that if there was no trading in the portfolio, one would expect the sustainable yield to be constant (before fees and expenses). The success of the fund’s trading is showing up in

- the very good performance against the index

- the long term increases in sustainable income per unit

As has been noted, the fund has maintained a credit quality equal to or better than the index; outperformance is due to constant exploitation of trading anomalies.

Again, there are no predictions for the future! The fund will continue to trade between issues in an attempt to exploit market gaps in liquidity, in an effort to outperform the index and keep the sustainable income per unit – however calculated! – growing.

Audited Financial Statements for 2009 and Transactions 2009 are now available and have been linked through the fund’s main page.