The March edition of Canadian Moneysaver contained my recent review of the performance of Floating Rate Preferreds over the past few years and my observations on contemporary pricing.

Look for the research link!

The March edition of Canadian Moneysaver contained my recent review of the performance of Floating Rate Preferreds over the past few years and my observations on contemporary pricing.

Look for the research link!

The Bank of Canada has announced the release of its April 2009 Monetary Policy Report:

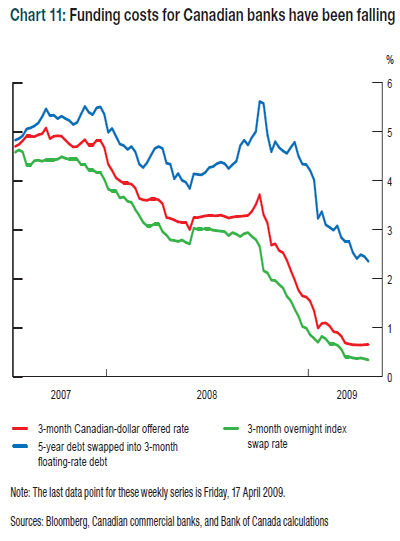

In the January Update, the Bank projected a sharp recession in Canada, followed by a relatively muted recovery starting in the third quarter of this year. As a result of the more severe, synchronized nature of the global downturn, the recession in Canada is even deeper than anticipated. As well, the Bank now expects the recovery to be delayed until the fourth quarter of 2009 and to be more gradual than projected in January. Nonetheless, the Bank is still projecting a rebound to above-potential growth in 2010, albeit with a lower estimate of potential output growth. As explained in January, the recovery should be supported by a number of factors, including the timeliness and scale of the Bank’s monetary policy response; our relatively well-functioning financial system and the gradual improvement in financial conditions in Canada; the past depreciation of the Canadian dollar; stimulative fiscal policy measures; the gradual rebound in external demand; the strength of Canadian household, business, and bank balance sheets; and the end of the stock adjustments in Canadian and U.S. residential housing.

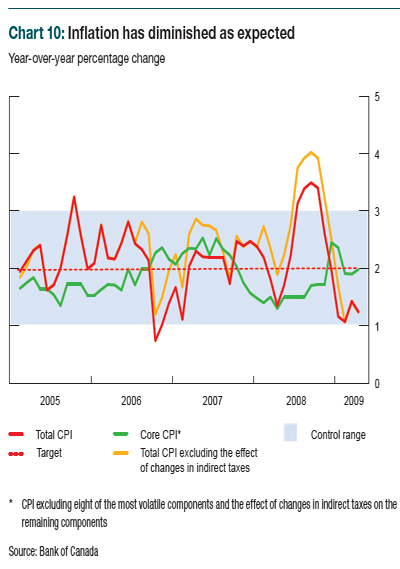

Inflation remains under control:

and they note that:

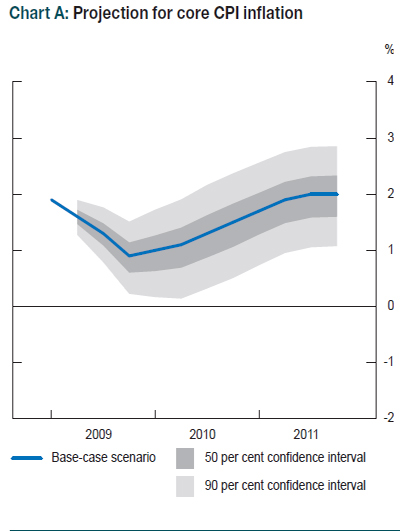

There was also a backgrounder on fan charts; these were recommended as a means of Central Bank communication by Michael Woodford of Columbia, as discussed on PrefBlog on January 17, 2008. These are used to indicate the degree of uncertainty in predictions:

The Cleveland Fed has released their Economic Trends, April 2009, with a variety of data and statistics.

Items of note are:

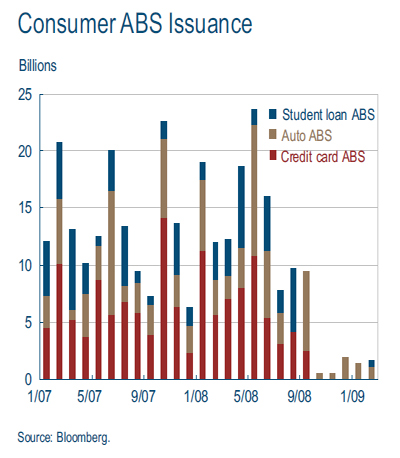

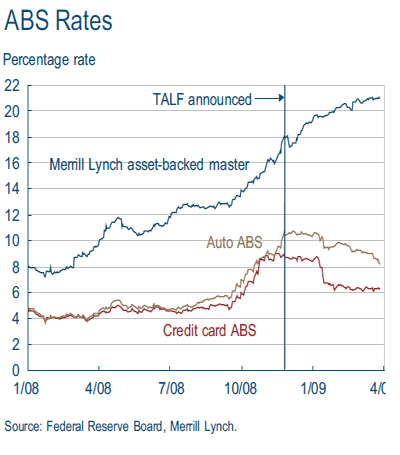

There were some good charts in the article on the TALF:

The TALF is designed to support the issuance of asset-backed securities (ABS) collateralized by student loans, auto loans, credit card loans, and loans guaranteed by the Small Business Administration.

…

Since the beginning of the financial crisis, however, those ABS markets have been under strain. With the strain accelerating in the third quarter of 2008, the market came to a near-complete halt—the chart below shows the dramatic drop in the issuance of new consumer ABSs.

Under the TALF, the Federal Reserve Bank of New York will provide nonrecourse funding to any eligible borrower owning eligible collateral. On a fixed day each month, borrowers will be able to request one or more three-year TALF loans. As the loan is nonrecourse, if the borrower does not repay the loan, the New York Fed will enforce its rights to the collateral.

Th ree requirements are intended to protect the Fed from the risk of losses. First, the ABS must have the highest investment-grade rating category from two or more major nationally recognized statistical rating organizations. Th is requirement should reduce the risk that the ABSs accepted will fall dramatically in value. Second, borrowers will pay a risk premium set to a margin above the Libor (usually 1 percent). Th ird, “haircuts” ranging from 5 percent to 15 percent will be fi gured into the loans. Th at is, the amount the TALF will extend a loan for can be only as high as the par or market value of the ABS minus the haircut. Th is requirement means that if the borrower defaults on the loan and the Fed seizes the collateral, the Fed loses nothing unless the value of the collateral has fallen more than the haircut.

Sorry, folks! This is a busy time, so there’s no commentary.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2919 % | 952.2 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2919 % | 1,539.9 |

| Floater | 4.61 % | 4.64 % | 71,000 | 16.16 | 2 | -0.2919 % | 1,189.6 |

| OpRet | 5.10 % | 4.35 % | 145,720 | 3.71 | 15 | -0.0080 % | 2,134.2 |

| SplitShare | 6.65 % | 8.83 % | 47,374 | 5.63 | 3 | 0.2745 % | 1,738.0 |

| Interest-Bearing | 6.12 % | 9.13 % | 26,737 | 0.67 | 1 | 0.5123 % | 1,949.5 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1676 % | 1,633.5 |

| Perpetual-Discount | 6.69 % | 6.80 % | 146,221 | 12.82 | 71 | 0.1676 % | 1,504.4 |

| FixedReset | 5.94 % | 5.30 % | 666,363 | 4.57 | 35 | 0.3941 % | 1,903.5 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| MFC.PR.B | Perpetual-Discount | -2.42 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 17.32 Evaluated at bid price : 17.32 Bid-YTW : 6.82 % |

| CM.PR.A | OpRet | -1.84 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2009-05-22 Maturity Price : 25.50 Evaluated at bid price : 25.56 Bid-YTW : 0.94 % |

| BMO.PR.M | FixedReset | -1.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 23.76 Evaluated at bid price : 23.83 Bid-YTW : 3.99 % |

| BAM.PR.J | OpRet | -1.18 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 21.00 Bid-YTW : 8.05 % |

| NA.PR.N | FixedReset | -1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 24.16 Evaluated at bid price : 24.23 Bid-YTW : 4.27 % |

| CM.PR.D | Perpetual-Discount | -1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 20.58 Evaluated at bid price : 20.58 Bid-YTW : 7.03 % |

| BNA.PR.C | SplitShare | 1.25 % | Asset coverage of 1.7+:1 as of March 31, according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 12.98 Bid-YTW : 13.58 % |

| BMO.PR.K | Perpetual-Discount | 1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 20.00 Evaluated at bid price : 20.00 Bid-YTW : 6.70 % |

| BMO.PR.O | FixedReset | 1.27 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-06-24 Maturity Price : 25.00 Evaluated at bid price : 26.29 Bid-YTW : 5.51 % |

| CIU.PR.A | Perpetual-Discount | 1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 18.26 Evaluated at bid price : 18.26 Bid-YTW : 6.41 % |

| TD.PR.Y | FixedReset | 1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 22.94 Evaluated at bid price : 23.00 Bid-YTW : 4.17 % |

| TD.PR.E | FixedReset | 1.36 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 26.05 Bid-YTW : 5.31 % |

| RY.PR.L | FixedReset | 1.40 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 24.55 Evaluated at bid price : 24.60 Bid-YTW : 4.81 % |

| MFC.PR.C | Perpetual-Discount | 1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 16.80 Evaluated at bid price : 16.80 Bid-YTW : 6.80 % |

| TD.PR.G | FixedReset | 1.60 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 26.03 Bid-YTW : 5.32 % |

| IAG.PR.A | Perpetual-Discount | 1.85 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 16.00 Evaluated at bid price : 16.00 Bid-YTW : 7.29 % |

| TD.PR.A | FixedReset | 1.85 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 23.66 Evaluated at bid price : 23.70 Bid-YTW : 4.27 % |

| TD.PR.S | FixedReset | 2.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 22.92 Evaluated at bid price : 23.00 Bid-YTW : 4.05 % |

| BAM.PR.O | OpRet | 2.42 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 23.31 Bid-YTW : 7.01 % |

| CU.PR.A | Perpetual-Discount | 3.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 23.73 Evaluated at bid price : 24.03 Bid-YTW : 6.13 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BAM.PR.N | Perpetual-Discount | 84,625 | RBC crossed 25,000 at 14.38; Scotia crossed the same amount at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 14.29 Evaluated at bid price : 14.29 Bid-YTW : 8.44 % |

| RY.PR.X | FixedReset | 62,739 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 25.81 Bid-YTW : 5.66 % |

| BNS.PR.Q | FixedReset | 60,481 | Nesbitt bought 15,000 from anonymous at 23.98; anonymous crossed (? not necessarily the same anonymous) 18,000 at 22.70. The massive discrepency in prices appears legitimate; today’s range according to tmxmoney.com was 22.55-24.05. Closing quote 22.75-88, 21×8. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 22.69 Evaluated at bid price : 22.75 Bid-YTW : 4.19 % |

| HSB.PR.E | FixedReset | 51,841 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 25.55 Bid-YTW : 6.25 % |

| RY.PR.T | FixedReset | 36,630 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 23.36 Evaluated at bid price : 25.75 Bid-YTW : 5.74 % |

| BNS.PR.M | Perpetual-Discount | 35,071 | RBC bought 12,000 from Nesbitt at 17.74. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-22 Maturity Price : 17.63 Evaluated at bid price : 17.63 Bid-YTW : 6.42 % |

| There were 36 other index-included issues trading in excess of 10,000 shares. | |||

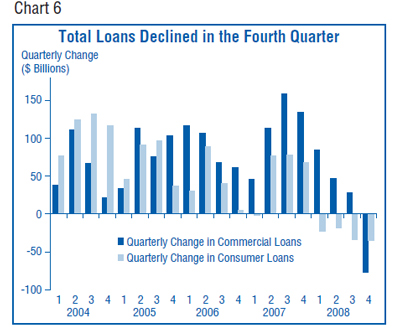

The Federal Deposit Insurance Corporation has announced the release of the 4Q08 Banking Profile, containing two feature articles:

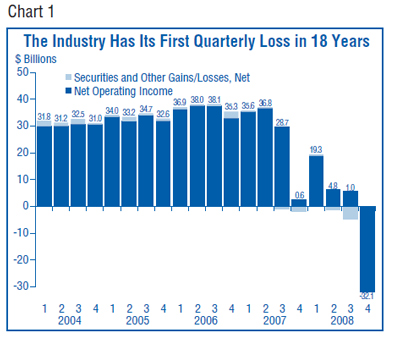

The guts of the full report is the report of banking system statistical information, which begins with the cheery sentence:

FDIC-insured institutions reported a net loss of $32.1 billion in the fourth quarter of 2008, a decline of $32.7 billion from the $575 million that the industry earned in the fourth quarter of 2007 and the first quarterly loss since 1990. Rising loan loss provisions, large writedowns of goodwill and other assets, and sizable losses in trading accounts all contributed to the industry’s net loss. More than two-thirds of all insured institutions were profitable in the fourth quarter, but their earnings were outweighed by large losses at a number of big banks.

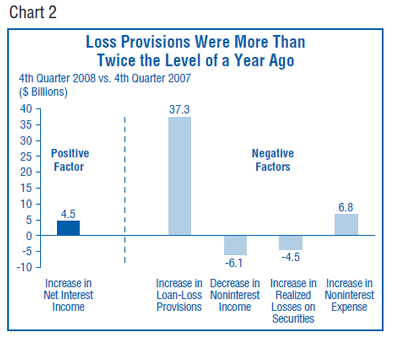

Chart 2 looks like it was prepared by a graphic artist who didn’t really know what the data meant, but the important information can be puzzled out:

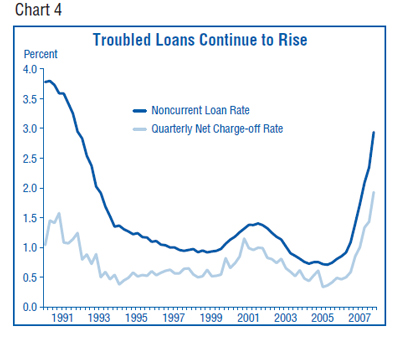

Assiduous Readers will remember I have taken a certain amount of glee in pointing out that the story so far is still not as bad as the Recession of 1990 (you young whipper-snappers) … but we’re getting there, at least in the States:

… with the result that those who blithely assumed refinancing risk are feeling a little nervous:

Note that the release of the statistical data has been previously discussed on PrefBlog.

The IMF has released its Global Financial Stability Report for April 09 (hat tip: Menzie Chinn of Econbrowser), in which they highlight some work by Sergei Antoshin on corporate bond spreads.

Box 1.5 on page 51 of the PDF is hardly a full academic treatise, but we can take things as they come:

This study attempts to model corporate bond spreads based on a cash-flows approach to explain the underlying key drivers. The equilibrium spreads are ultimately determined by cash flows or internal funds available to bond issuers and bond buyers. The study identifies factors affecting the cash flows from operating, investing, and financing activities across the major classes of bond issuers and bond holders. The drivers are intended to represent expected profitability, uncertainty, and liquidity constraints. The model displays linkages among financial strains in major sectors of the economy, asset returns, financial and economic risks, macroeconomic activity, and losses in the system.

Previous studies of corporate spreads have found it difficult to explain the sharp increase in spreads during the recent crisis. The conventional approach is to regress spreads on a broad range of macroeconomic and financial variables. Large residuals arising from these models are attributed to an unexplained component driven by illiquidity premia. In this study, spreads are modeled by explicitly accounting for illiquidity premia and funding strains.

…

The capital flows framework developed in this study allows one to capture explicitly the effects of stress in various economic sectors on corporate spreads. The analysis suggests that corporate spreads can be largely explained by the fundamentals and risks related to both uncertainty and financing constraints. Policy implications should be drawn with caution, since, as with any regression analysis, the equations display measures of correlation rather than causality. For example, if the LIBOR-OIS spread were to decline by 50 basis points—possibly as a result of some policy action—it would be associated with a roughly 100 basis point decline in corporate spreads. This provides some perspective on the scale of challenges and potential benefits for policymakers contemplating intervention in the market for corporate finance.

I’m suspicious of the high degree of parameterization and the relatively short period shown in the graph; there’s not really a lot of meat given in the box to determine whether the author’s genuinely on to something or not.

DBRS reports that the ABCP Clean-up Vehicle is underpaying its first interest payment:

notice delivered by BlackRock (Institutional) Canada Ltd. (the Administrator) regarding the first payment date for Master Asset Vehicle I and Master Asset Vehicle II (collectively, the MAVs).

The notice advised that insufficient proceeds would be available to pay accrued interest in its entirety on the Class A-1 Notes and Class A-2 Notes (collectively, the Class A Notes). The Administrator identified the following three factors that it believes contributed to the interest shortfall:

(1) The MAVs were required to pay certain expenses related to the closing of the transaction.

(2) There was an abbreviated first interest period and a mismatch in the payment dates for certain underlying assets.

(3) A fixed-floating interest rate mismatch exists between the margin funding facility fees and the return generated by the underlying assets.

As outlined in the MAV rating reports published on January 21, 2009, the rating of the Class A Notes addresses the payment of interest as set out in the terms of the transaction documents. According to their respective Trust Indentures, the MAVs have no legal obligation to pay interest before January 22, 2019. Therefore, no negative rating action will result from the failure to pay the full amount of accrued interest on the Class A Notes on any given payment date. However, if after reviewing the first payment date report, DBRS determines that expenses and/or proceeds from the underlying assets are materially different from what was originally modelled, negative rating action may be required.

The saga just never ends, does it?

The Globe & Mail reports more pressure for captive pension managers to become commercial asset managers:

Michael Nobrega, chief executive officer of the Ontario Municipal Employees Retirement System (OMERS), said yesterday that his fund is now open for business and is actively seeking mandates to manage other pension funds’ assets.

…

And while Mr. Nobrega said OMERS should become a superfund manager, he insisted his vision is not motivated by a personal desire to build an empire.“This is not about Michael Nobrega trying to be president of a superfund,” he told reporters yesterday. “This is about what’s right for plan members. You need resources to manage these [plans]. These are very complex areas.”

There are a number of things that are massively wrong – well, suspicious, anyway – about this idea:

Very good volume today, with the market slightly off; FixedResets might have been adversely affected by news of $300-million+ new supply from RY.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0000 % | 955.0 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0000 % | 1,544.4 |

| Floater | 5.11 % | 5.13 % | 71,413 | 15.28 | 2 | 0.0000 % | 1,193.1 |

| OpRet | 5.10 % | 4.35 % | 145,526 | 3.70 | 15 | 0.1098 % | 2,134.4 |

| SplitShare | 6.67 % | 8.81 % | 47,196 | 5.63 | 3 | 0.0172 % | 1,733.2 |

| Interest-Bearing | 6.15 % | 9.87 % | 26,570 | 0.67 | 1 | 0.1026 % | 1,939.5 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0165 % | 1,630.7 |

| Perpetual-Discount | 6.70 % | 6.78 % | 145,470 | 12.78 | 71 | -0.0165 % | 1,501.9 |

| FixedReset | 5.96 % | 5.43 % | 672,877 | 4.57 | 35 | -0.2409 % | 1,896.0 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| W.PR.J | Perpetual-Discount | -2.75 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 20.17 Evaluated at bid price : 20.17 Bid-YTW : 7.01 % |

| GWO.PR.I | Perpetual-Discount | -2.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 15.90 Evaluated at bid price : 15.90 Bid-YTW : 7.17 % |

| MFC.PR.C | Perpetual-Discount | -2.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 16.54 Evaluated at bid price : 16.54 Bid-YTW : 6.91 % |

| BAM.PR.N | Perpetual-Discount | -1.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 14.15 Evaluated at bid price : 14.15 Bid-YTW : 8.52 % |

| TD.PR.A | FixedReset | -1.48 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 23.23 Evaluated at bid price : 23.27 Bid-YTW : 4.35 % |

| IAG.PR.A | Perpetual-Discount | -1.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 15.71 Evaluated at bid price : 15.71 Bid-YTW : 7.42 % |

| TD.PR.S | FixedReset | -1.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 22.47 Evaluated at bid price : 22.55 Bid-YTW : 4.14 % |

| TD.PR.G | FixedReset | -1.27 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 25.62 Bid-YTW : 5.69 % |

| RY.PR.L | FixedReset | -1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 24.21 Evaluated at bid price : 24.26 Bid-YTW : 4.88 % |

| CL.PR.B | Perpetual-Discount | -1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 21.81 Evaluated at bid price : 22.29 Bid-YTW : 7.08 % |

| BNS.PR.N | Perpetual-Discount | -1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 20.66 Evaluated at bid price : 20.66 Bid-YTW : 6.39 % |

| POW.PR.B | Perpetual-Discount | -1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 18.75 Evaluated at bid price : 18.75 Bid-YTW : 7.21 % |

| CM.PR.J | Perpetual-Discount | -1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 16.51 Evaluated at bid price : 16.51 Bid-YTW : 6.86 % |

| CM.PR.P | Perpetual-Discount | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 20.00 Evaluated at bid price : 20.00 Bid-YTW : 6.92 % |

| NA.PR.K | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 21.78 Evaluated at bid price : 21.78 Bid-YTW : 6.74 % |

| BMO.PR.J | Perpetual-Discount | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 18.20 Evaluated at bid price : 18.20 Bid-YTW : 6.30 % |

| SLF.PR.A | Perpetual-Discount | 1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 17.15 Evaluated at bid price : 17.15 Bid-YTW : 7.02 % |

| PWF.PR.I | Perpetual-Discount | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 21.82 Evaluated at bid price : 21.82 Bid-YTW : 6.92 % |

| ELF.PR.G | Perpetual-Discount | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 14.81 Evaluated at bid price : 14.81 Bid-YTW : 8.11 % |

| RY.PR.B | Perpetual-Discount | 1.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 18.82 Evaluated at bid price : 18.82 Bid-YTW : 6.25 % |

| BAM.PR.O | OpRet | 1.61 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 22.76 Bid-YTW : 7.66 % |

| HSB.PR.C | Perpetual-Discount | 1.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 19.04 Evaluated at bid price : 19.04 Bid-YTW : 6.78 % |

| BMO.PR.M | FixedReset | 4.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 24.19 Evaluated at bid price : 24.25 Bid-YTW : 3.91 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| RY.PR.X | FixedReset | 168,135 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 25.65 Bid-YTW : 5.80 % |

| TD.PR.K | FixedReset | 146,543 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 25.53 Bid-YTW : 5.89 % |

| MFC.PR.D | FixedReset | 87,367 | Scotia bought 12,800 from National at 25.80. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-19 Maturity Price : 25.00 Evaluated at bid price : 25.57 Bid-YTW : 6.32 % |

| PWF.PR.F | Perpetual-Discount | 79,680 | Nesbitt bought two blocks of 10,000 each from TD, both at 19.00; Scotia crossed 36,000 at 19.10. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-21 Maturity Price : 18.87 Evaluated at bid price : 18.87 Bid-YTW : 7.00 % |

| HSB.PR.E | FixedReset | 76,120 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 25.30 Bid-YTW : 6.47 % |

| MFC.PR.A | OpRet | 63,083 | Scotia crossed 45,900 at 24.76. YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2015-12-18 Maturity Price : 25.00 Evaluated at bid price : 24.76 Bid-YTW : 4.35 % |

| There were 51 other index-included issues trading in excess of 10,000 shares. | |||

Royal Bank has announced:

a domestic public offering of $200 million of Non-Cumulative, 5 year rate reset Preferred Shares Series AX.

The bank will issue 8 million Preferred Shares Series AX priced at $25 per share and holders will be entitled to receive non-cumulative quarterly fixed dividend for the initial period ending November 24, 2014 in the amount of $1.525 per share, to yield 6.10 per cent annually. The bank has granted the Underwriters an option, exercisable in whole or in part, to purchase up to an additional 3.0 million Preferred Shares at the same offering price.

Subject to regulatory approval, on or after November 24, 2014, the bank may redeem the Preferred Shares Series AX in whole or in part at par. Thereafter, the dividend rate will reset every five years at a rate equal to 4.13 per cent over the 5-year Government of Canada bond yield. Holders of Preferred Shares Series AX will, subject to certain conditions, have the right to convert all or any part of their shares to non-cumulative floating rate preferred shares Series AY (the “Preferred Shares Series AY”) on November 24, 2014 and on November 24 every five years thereafter.

Holders of the Preferred Shares Series AY will be entitled to receive a non-cumulative quarterly floating dividend at a rate equal to the 3-month Government of Canada Treasury Bill yield plus 4.13 per cent. Holders of Preferred Shares Series AY will, subject to certain conditions, have the right to convert all or any part of their shares to Preferred Shares Series AX on November 24, 2019 and on November 24 every five years thereafter.

The offering will be underwritten by a syndicate led by RBC Capital Markets. The expected closing date is April 29, 2009.

… and very shortly after that announcement, announced:

that as a result of strong investor demand for its domestic public offering of Non-Cumulative, 5 year rate reset Preferred Shares Series AX (the “Preferred Shares Series AX”), the size of the offering has been increased to 12 million shares. The gross proceeds of the offering will now be $300 million. In addition, the bank has granted the Underwriters an option, exercisable in whole or in part, to purchase up to an additional 1 million Preferred Shares Series AX at a price of $25 per share. The offering will be underwritten by a syndicate led by RBC Capital Markets. The expected closing date is April 29, 2009.

The first coupon is another fat one: $0.48884, payable August 24. Mark your calendars – there could be some good trades lying around just before the ex-Date!

This issue is good news for the continued health of the Fixed-Reset market: it marks the first time that a new issue has come out with a lower initial fixed rate and lower reset. The fact that they got advice to the effect that they only needed a week to bring it to market and then increased the issue size shows that – whatever else might be going on in the heads of the buyers – they are not blindly addicted to escalating coupons. A small item of cheer, but cheerful nevertheless.

The Bank of Canada has announced (bolding added):

lowers overnight rate target by 1/4 percentage point to 1/4 per cent and, conditional on the inflation outlook, commits to hold current policy rate until the end of the second quarter of 2010

OTTAWA – The Bank of Canada today announced that it is lowering its target for the overnight rate by one-quarter of a percentage point to 1/4 per cent, which the Bank judges to be the effective lower bound for that rate. The Bank Rate is correspondingly lowered to 1/2 per cent. The deposit rate – the rate paid on deposits held by financial institutions at the Bank of Canada – is left unchanged at 1/4 per cent and provides the floor for the overnight rate. Details of the Bank’s operating framework at the effective lower bound can be found here.

…

The Bank expects core inflation to diminish through 2009, gradually returning to the 2 per cent target in the third quarter of 2011 as aggregate supply and demand return to balance. Total CPI inflation is expected to trough at -0.8 per cent in the third quarter of 2009 and return to target in the third quarter of 2011. While the underlying macroeconomic risks to the projection are roughly balanced, the Bank judges that, as a consequence of operating at the effective lower bound, the overall risks to its inflation projection are tilted slightly to the downside.With monetary policy now operating at the effective lower bound for the overnight policy rate, it is appropriate to provide more explicit guidance than is usual regarding its future path so as to influence rates at longer maturities. Conditional on the outlook for inflation, the target overnight rate can be expected to remain at its current level until the end of the second quarter of 2010 in order to achieve the inflation target. The Bank will continue to provide such guidance in its scheduled interest rate announcements as long as the overnight rate is at the effective lower bound.

I am flabbergasted at the bolding. I certainly can’t remember seeing anything quite so explicit before, although I’m sure some professional Central Bank watchers will be able to supply other examples. There are certainly implications for the relative pricing of FixedFloaters and their paired Ratchets in this announcement!

Canada Prime followed the overnight rate fairly swiftly:

Julia Dickson of OSFI gave a speech to the ABA clearly demonstrating her contempt for investors, the despised third pillar of the banking system. The role of investors – and their reliance on mandated disclosures – was, basically, ignored.

Bloomberg has reported on the Fed’s response to the controversy regarding the size and nature of its emergency actions:

Former Fed Chairman Paul Volcker said Congress will probably review the authority granted to the Fed following the expansion in its assets.

“I don’t think the political system will tolerate the degree of activity that the Federal Reserve, in conjunction with the Treasury, has taken,” Volcker, head of President Barack Obama’s Economic Recovery Advisory Board, said in remarks to the conference at Vanderbilt University.

U.S. lawmakers from both political parties, including House Financial Services Committee Chairman Barney Frank, have expressed concern in recent months that the central bank has overstepped its authority by providing emergency credit.

In his speech, Vice Chairman Donald L. Kohn said:

For the credit facilities that we make available to multiple firms, we are not taking significant credit risk that might end up being absorbed by the taxpayer. For almost all the loans made by the Federal Reserve, we look first to sound borrowers for repayment and then to underlying collateral. Moreover, we lend less than the value of the collateral, with the size of the “haircuts” depending on the riskiness of the collateral and on the availability of market prices for the collateral. Some of our lending programs involve nonrecourse loans that look primarily to the collateral rather than to the borrower for repayment in the event that the value of the collateral falls below the amount loaned. In these circumstances, we insist on taking only the very highest quality collateral, lend less than the face amount of the collateral, and typically have other sources to absorb any losses that might nonetheless occur–for example, Treasury capital for our lending against securitized loans.

…

Will These Policies Lead to a Future Surge in Inflation?

No, and the key to preventing inflation will be reversing the programs, reducing reserves, and raising interest rates in a timely fashion. Our balance sheet has grown rapidly, the amount of reserves has skyrocketed, and announced plans imply further huge increases in Federal Reserve assets and bank reserves. Nonetheless, the size of our balance sheet will not preclude our raising interest rates when that becomes appropriate for macroeconomic stability. Many of the liquidity programs are authorized only while circumstances in the economy and financial markets are “unusual and exigent,” and such programs will be terminated when conditions are no longer so adverse. Those programs and others have been designed to be unattractive in normal market conditions and will naturally wind down as markets improve.

All this is Central Banking 101; we have to rely on the Fed to execute the theory correctly – and this will be fodder for academic arguments for the next century.

Bloomberg notes that inflation concerns are driving down bill yields:

Rates on three-month bills turned negative in December for the first time since the government began selling them in 1929 as investors sacrificed returns to preserve principal. After increasing at the start of the year, rates have dropped 0.20 percentage point since the beginning of February to 0.13 percent on April 17.

Demand for bills is rising again because investors including foreign central banks are snapping up the shortest- term U.S. securities as the Federal Reserve buys Treasuries to drive down borrowing costs in a policy of so-called quantitative easing. China, the largest U.S. creditor, with $744 billion of debt, has questioned the practice and shifted purchases to bills from longer-maturity securities.

“There’s a group of investors out there who are looking at what the Fed is doing and the policy action they’ve taken and the asset purchases, and saying ultimately this is inflationary,” said Stuart Spodek, co-head of U.S. bonds in New York at BlackRock Inc., which manages $483 billion in debt. “You’re going to invest in very short-term bills because you absolutely need not just the quality but also the absolute liquidity.”

An alleged leak of the US bank stress tests has been touted on the Web but frankly, it doesn’t look too credible. We shall see!

Today’s excitement was the DBRS Mass Review-Negative of bank prefs; this was not released in time to have an effect on the market, but we will see what tomorrow brings.

The PerpetualDiscount winning-streak came to an end today; sorry folks, that was my fault. I shouldn’t have posted about it after Friday’s gain. The market was well behaved, with few individual issues showing price changes of much note, on continued good volume.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0583 % | 955.0 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0583 % | 1,544.4 |

| Floater | 5.11 % | 5.13 % | 66,620 | 15.28 | 2 | -0.0583 % | 1,193.1 |

| OpRet | 5.10 % | 4.44 % | 141,561 | 3.70 | 15 | 0.0322 % | 2,132.0 |

| SplitShare | 6.67 % | 8.82 % | 45,464 | 5.64 | 3 | 0.0000 % | 1,732.9 |

| Interest-Bearing | 6.15 % | 9.99 % | 26,637 | 0.67 | 1 | -0.1025 % | 1,937.5 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0150 % | 1,631.0 |

| Perpetual-Discount | 6.69 % | 6.80 % | 145,691 | 12.83 | 71 | -0.0150 % | 1,502.1 |

| FixedReset | 5.93 % | 5.29 % | 681,946 | 7.63 | 35 | 0.0958 % | 1,900.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BNA.PR.C | SplitShare | -2.21 % | BAM Split has still not updated their NAV, so I’m still reporting the 1.7-:1 asset coverage figure from the February 28 NAV they do deign to provide. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 12.82 Bid-YTW : 13.75 % |

| HSB.PR.D | Perpetual-Discount | -1.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-20 Maturity Price : 17.56 Evaluated at bid price : 17.56 Bid-YTW : 7.21 % |

| SLF.PR.C | Perpetual-Discount | -1.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-20 Maturity Price : 15.65 Evaluated at bid price : 15.65 Bid-YTW : 7.20 % |

| BNS.PR.M | Perpetual-Discount | -1.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-20 Maturity Price : 17.50 Evaluated at bid price : 17.50 Bid-YTW : 6.47 % |

| GWO.PR.I | Perpetual-Discount | -1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-20 Maturity Price : 16.32 Evaluated at bid price : 16.32 Bid-YTW : 6.98 % |

| NA.PR.N | FixedReset | -1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-20 Maturity Price : 24.25 Evaluated at bid price : 24.31 Bid-YTW : 4.26 % |

| BAM.PR.J | OpRet | -1.02 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 21.38 Bid-YTW : 7.77 % |

| ENB.PR.A | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-20 Maturity Price : 24.26 Evaluated at bid price : 24.56 Bid-YTW : 5.67 % |

| RY.PR.H | Perpetual-Discount | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-20 Maturity Price : 22.84 Evaluated at bid price : 22.98 Bid-YTW : 6.26 % |

| PWF.PR.J | OpRet | 1.18 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2010-05-30 Maturity Price : 25.50 Evaluated at bid price : 25.65 Bid-YTW : 3.97 % |

| NA.PR.K | Perpetual-Discount | 1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-20 Maturity Price : 21.55 Evaluated at bid price : 21.55 Bid-YTW : 6.81 % |

| TD.PR.O | Perpetual-Discount | 1.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-20 Maturity Price : 19.18 Evaluated at bid price : 19.18 Bid-YTW : 6.36 % |

| BMO.PR.M | FixedReset | 1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-20 Maturity Price : 23.18 Evaluated at bid price : 23.26 Bid-YTW : 4.09 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| RY.PR.L | FixedReset | 114,875 | TD crossed 10,000 at 24.95; Nesbitt bought two blocks (13,900 & 10,000 shares) from National at 24.98; National crossed 30,000 at 24.99. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-20 Maturity Price : 24.85 Evaluated at bid price : 24.90 Bid-YTW : 4.84 % |

| RY.PR.D | Perpetual-Discount | 75,370 | Nesbitt bought 10,000 from TD at 17.98; Nesbitt crossed 28,000 at 18.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-20 Maturity Price : 18.00 Evaluated at bid price : 18.00 Bid-YTW : 6.38 % |

| MFC.PR.D | FixedReset | 57,043 | Desjardins crossed 15,700 at 25.66. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-19 Maturity Price : 25.00 Evaluated at bid price : 25.60 Bid-YTW : 6.29 % |

| RY.PR.X | FixedReset | 50,326 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 25.80 Bid-YTW : 5.67 % |

| HSB.PR.E | FixedReset | 50,274 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 25.43 Bid-YTW : 6.35 % |

| BNS.PR.M | Perpetual-Discount | 44,625 | Anonymous crossed (? Not necessarily the same anonymous on each side) 16,000 at 17.32. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-20 Maturity Price : 17.50 Evaluated at bid price : 17.50 Bid-YTW : 6.47 % |

| There were 37 other index-included issues trading in excess of 10,000 shares. | |||