We are often told that capitalism will eventually collapse under the weight of its own contradictions. So I get highly amused when I see things like rugged Floridian Republicans socializing property insurance, the crony capitalism of export licenses for computer chips and now, the idea of state capitalism with Trump in charge:

Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick confirmed on Tuesday that the US government is considering an extraordinary investment in struggling chipmaker Intel. But they gave different answers about what the Trump administration sought to do with that stake.

Such a deal, if it were to happen, would mark an unusual arrangement that would see the Trump administration use taxpayer money to take a stake in a private American business.

…

The reports and Bessent’s comments also come after chipmakers Nvidia and AMD said they would pay 15% from their chip sales in China to the government in exchange for export licenses. If the government does take a stake in Intel, it could also serve as a model for other Trump administration investments, two people familiar with the White House discussions on the matter told CNN last week.

These are indeed interesting times.

Canadian inflation was basically flat in July:

Canada’s annual inflation rate eased to 1.7 per cent in July from 1.9 per cent in the prior month as lower year-on-year gasoline prices kept the consumer price index low, but core measures of inflation stayed sticky. Analysts polled by Reuters had forecast the annual inflation rate at 1.8 per cent and the monthly inflation rate at 0.3 per cent. The CPI increased by 0.3 per cent in July from 0.1 per cent in June on a monthly basis, Statistics Canada said.

…

To gauge underlying price pressures, the Bank of Canada keeps a close eye on its preferred core measures of inflation, which did not ease in July, continuing to hover around 3 per cent annually.However, BMO chief economist Douglas Porter noted that the three-month annualized trend for those measures eased to 2.4 per cent in July.

The money market thought the news was a little dovish:

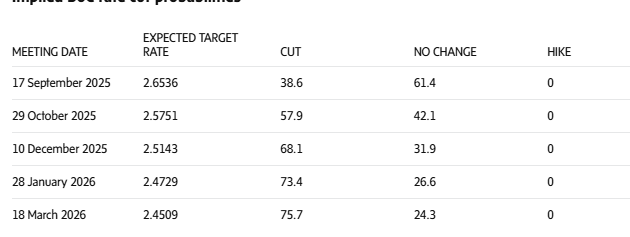

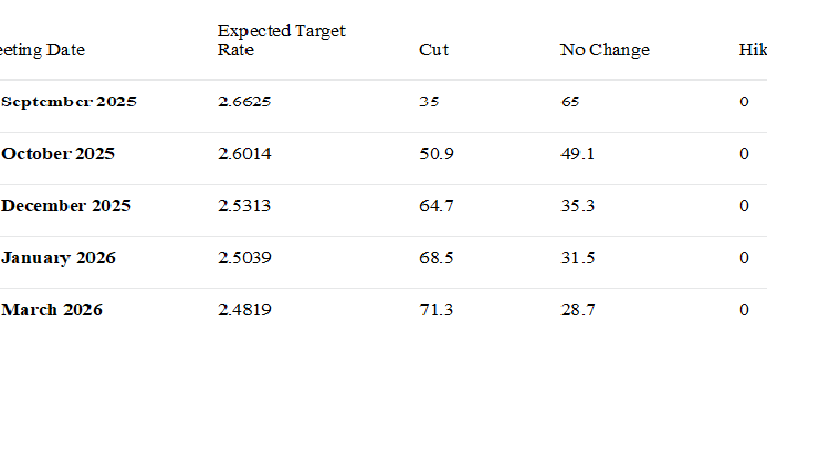

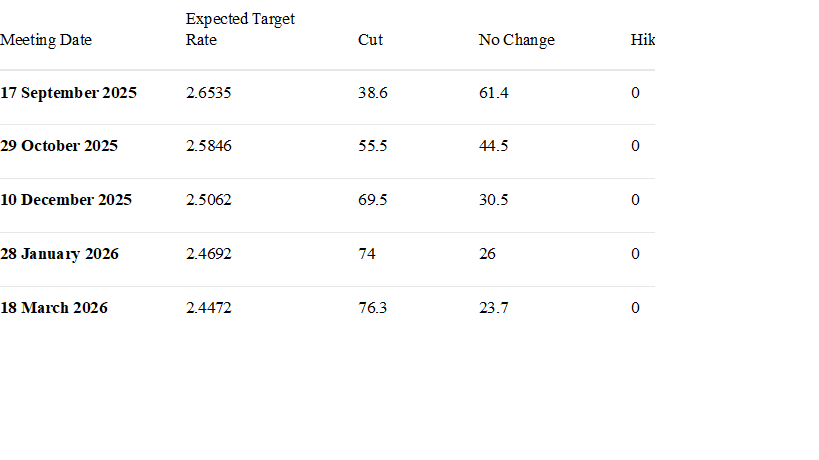

Money markets are now pricing in odds of a rate cut on Sept. 17 at about 38 per cent, up from 32 per cent prior to the data, according to LSEG data. They are also still pricing in a full quarter point rate cut by the end of this year – but no more. The Bank of Canada has stayed put at 2.75 per cent at its last three rate decision meetings.

Here’s how implied probabilities of future interest rate moves stood in swaps markets moments after the 8:30 a.m. data, according to LSEG data. While the bank moves in quarter-point increments, credit market implied rates fluctuate more fluidly and are constantly changing. Columns to the right are percentage probabilities of future rate moves.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.90 % | 7.37 % | 36,324 | 13.03 | 1 | -0.6211 % | 2,391.0 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.6655 % | 4,598.5 |

| Floater | 6.61 % | 6.93 % | 40,702 | 12.58 | 3 | 0.6655 % | 2,650.2 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1065 % | 3,690.1 |

| SplitShare | 4.74 % | 4.34 % | 53,760 | 2.36 | 7 | 0.1065 % | 4,406.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1065 % | 3,438.4 |

| Perpetual-Premium | 5.83 % | 2.82 % | 99,984 | 0.08 | 2 | 0.0000 % | 3,055.0 |

| Perpetual-Discount | 5.59 % | 5.72 % | 43,863 | 14.33 | 30 | 0.1119 % | 3,348.4 |

| FixedReset Disc | 5.65 % | 6.23 % | 113,677 | 13.25 | 37 | -0.1686 % | 3,005.5 |

| Insurance Straight | 5.44 % | 5.57 % | 58,656 | 14.48 | 18 | 0.6698 % | 3,323.1 |

| FloatingReset | 5.26 % | 5.33 % | 34,382 | 14.86 | 1 | -0.1206 % | 3,746.1 |

| FixedReset Prem | 5.89 % | 5.17 % | 117,537 | 2.48 | 17 | -0.1049 % | 2,626.9 |

| FixedReset Bank Non | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1686 % | 3,072.2 |

| FixedReset Ins Non | 5.22 % | 5.64 % | 67,838 | 14.13 | 15 | -0.1824 % | 3,068.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| FTS.PR.K | FixedReset Disc | -2.70 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 21.64 Evaluated at bid price : 21.90 Bid-YTW : 5.89 % |

| CU.PR.D | Perpetual-Discount | -2.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 21.40 Evaluated at bid price : 21.40 Bid-YTW : 5.75 % |

| BN.PF.J | FixedReset Disc | -2.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 23.33 Evaluated at bid price : 24.55 Bid-YTW : 6.30 % |

| GWO.PR.R | Insurance Straight | -1.84 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 21.30 Evaluated at bid price : 21.30 Bid-YTW : 5.73 % |

| FTS.PR.M | FixedReset Disc | -1.69 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 22.18 Evaluated at bid price : 22.77 Bid-YTW : 6.03 % |

| ENB.PR.D | FixedReset Disc | -1.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 20.40 Evaluated at bid price : 20.40 Bid-YTW : 6.64 % |

| MFC.PR.J | FixedReset Ins Non | -1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 23.46 Evaluated at bid price : 25.00 Bid-YTW : 5.74 % |

| BN.PR.Z | FixedReset Disc | -1.42 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 22.91 Evaluated at bid price : 23.66 Bid-YTW : 6.41 % |

| GWO.PR.N | FixedReset Ins Non | -1.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 18.00 Evaluated at bid price : 18.00 Bid-YTW : 5.96 % |

| PWF.PR.E | Perpetual-Discount | -1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 23.55 Evaluated at bid price : 23.82 Bid-YTW : 5.82 % |

| IFC.PR.E | Insurance Straight | -1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 23.58 Evaluated at bid price : 23.87 Bid-YTW : 5.52 % |

| CM.PR.S | FixedReset Prem | -1.01 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2028-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.50 Bid-YTW : 5.17 % |

| POW.PR.D | Perpetual-Discount | 1.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 22.45 Evaluated at bid price : 22.71 Bid-YTW : 5.56 % |

| PWF.PR.A | Floater | 1.84 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 13.85 Evaluated at bid price : 13.85 Bid-YTW : 6.31 % |

| BN.PR.R | FixedReset Disc | 3.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 20.20 Evaluated at bid price : 20.20 Bid-YTW : 6.50 % |

| CU.PR.J | Perpetual-Discount | 7.65 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 21.53 Evaluated at bid price : 21.53 Bid-YTW : 5.54 % |

| ENB.PR.H | FixedReset Disc | 9.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 21.50 Evaluated at bid price : 21.50 Bid-YTW : 6.23 % |

| GWO.PR.H | Insurance Straight | 10.70 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 22.01 Evaluated at bid price : 22.25 Bid-YTW : 5.52 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BMO.PR.Y | FixedReset Disc | 105,000 | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-09-24 Maturity Price : 25.00 Evaluated at bid price : 24.98 Bid-YTW : 5.65 % |

| BN.PR.X | FixedReset Disc | 89,433 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 19.55 Evaluated at bid price : 19.55 Bid-YTW : 6.22 % |

| GWO.PR.P | Insurance Straight | 48,831 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 23.95 Evaluated at bid price : 24.20 Bid-YTW : 5.66 % |

| MFC.PR.N | FixedReset Ins Non | 45,700 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 22.36 Evaluated at bid price : 23.10 Bid-YTW : 5.77 % |

| GWO.PR.S | Insurance Straight | 41,530 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 23.09 Evaluated at bid price : 23.35 Bid-YTW : 5.70 % |

| ENB.PF.G | FixedReset Disc | 34,971 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-19 Maturity Price : 21.40 Evaluated at bid price : 21.40 Bid-YTW : 6.68 % |

| There were 11 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| See TMX DataLinx: ‘Last’ != ‘Close’ and the posts linked therein for an idea of why these quotes are so horrible. | ||

| Issue | Index | Quote Data and Yield Notes |

| FTS.PR.K | FixedReset Disc | Quote: 21.90 – 22.82 Spot Rate : 0.9200 Average : 0.6213 YTW SCENARIO |

| FTS.PR.M | FixedReset Disc | Quote: 22.77 – 23.40 Spot Rate : 0.6300 Average : 0.3901 YTW SCENARIO |

| CU.PR.E | Perpetual-Discount | Quote: 22.10 – 23.20 Spot Rate : 1.1000 Average : 0.8774 YTW SCENARIO |

| PVS.PR.L | SplitShare | Quote: 26.12 – 27.12 Spot Rate : 1.0000 Average : 0.7812 YTW SCENARIO |

| BN.PR.Z | FixedReset Disc | Quote: 23.66 – 24.49 Spot Rate : 0.8300 Average : 0.6583 YTW SCENARIO |

| GWO.PR.R | Insurance Straight | Quote: 21.30 – 21.91 Spot Rate : 0.6100 Average : 0.4498 YTW SCENARIO |