Canadian inflation wasn’t as bad as expected:

Canada’s inflation rate rose to 1.9 per cent in August, increasing by less than economists had forecasted and solidifying expectations of an interest rate cut on Wednesday.

Statistics Canada reported on Tuesday that the annual inflation rate rose from 1.7 per cent in July. The acceleration in headline inflation was driven by a smaller annual decrease gasoline prices in August relative to July.

…

The Bank of Canada’s key measures of inflation continued to hover around three per cent last month. Meanwhile, inflation excluding gasoline prices rose by 2.4 per cent, down slightly from the previous three months.

…

Food prices rose by 3.4 per cent, compared with 3.3 per cent in July. Shelter costs increased at a slower pace of 2.6 per cent, down from 3 per cent the previous month.

And the market reacted:

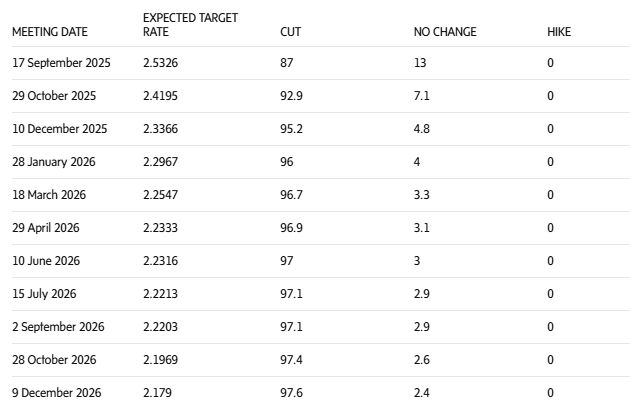

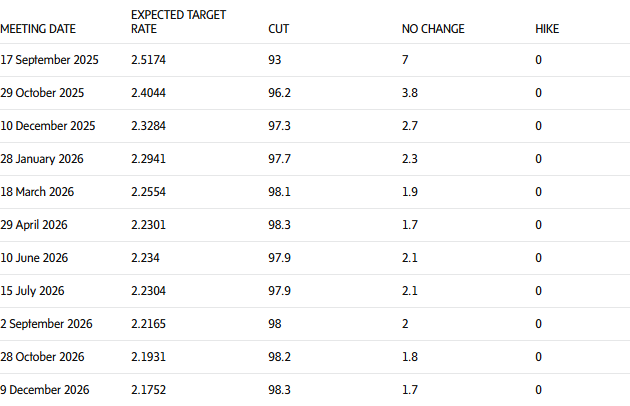

Credit market-based probabilities of a Bank of Canada rate cut on Wednesday rose following the release of Canadian inflation numbers this morning – which overall were modestly softer than expected.

Based on trading in overnight index swaps markets, traders now see about a 93% chance of a quarter point cut on Wednesday, up from about 87% prior to the inflation report, according to LSEG data.

…

Here, in detail, is how implied probabilities of future interest rate moves stood in swaps markets after the inflation report. The current overnight rate is 2.75 per cent. While the bank moves in quarter-point increments, credit market implied rates fluctuate more fluidly and are constantly changing. Columns to the right are percentage probabilities of future rate moves.

Erika McEntarfer, former commissioner at the Bureau of Labor Statistics, provided some commentary on her firing:

Her lecture at the Levy Economics Institute at Bard College, her alma mater, comes as questions swirl about the integrity of government data as Trump has sought greater control of the agency and tariffs appear to be hurting the economy.

…

“Firing your chief statistician is a dangerous step,” she said. “That’s an attack on the independence of an institution arguably as important as the Federal Reserve for economic stability. It has serious economic consequences, but that they would do this with no warning — it made no sense.”“Messing with economic data is like messing with the traffic lights and turning the sensors off. Cars don’t know where to go, traffic backs up at intersections,” she said, a nod to the concerns many economists have raised since her firing.

Before her firing, McEntarfer’s biggest concern with the monthly jobs reports and other economic reports the BLS publishes was funding shortfalls that made it harder to conduct surveys that inform the data, she said. That’s been especially true as response rates to the agency’s surveys have fallen. But that has not impacted the accuracy of the data, she said.

“But after the events of the last six weeks, I’m afraid we have to fear for the (data) dependence of the agencies themselves.”

…

On Tuesday, McEntarfer said that late-responding firms were the principal reason for the negative revision that preceded her firing. That dynamic was explained by McEntarfer and her staff during their monthly pre-jobs report briefing to the White House.She told White House economists that revisions as large as the May and June jobs data tend to occur “when the economy slows,” she said. During the briefing, White House officials asked her: Was the skew disproportionately among small firms, and when was the last time this happened?

“It was a pretty broad-based, negative skew,” she said, noting that the last time this happened was in the early months of the pandemic. Businesses were likely responding late to the survey “because they’re just too busy trying to stay alive.”

Quality costs money, Mr. Trump!

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.70 % | 7.15 % | 36,715 | 13.28 | 1 | -0.9063 % | 2,450.8 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2029 % | 4,619.6 |

| Floater | 6.58 % | 6.91 % | 68,614 | 12.72 | 3 | 0.2029 % | 2,662.3 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1120 % | 3,657.9 |

| SplitShare | 4.79 % | 4.44 % | 59,381 | 3.39 | 6 | 0.1120 % | 4,368.4 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1120 % | 3,408.4 |

| Perpetual-Premium | 5.48 % | 3.22 % | 76,467 | 0.08 | 3 | 0.0528 % | 3,082.1 |

| Perpetual-Discount | 5.58 % | 5.67 % | 46,559 | 14.30 | 28 | -0.7084 % | 3,370.0 |

| FixedReset Disc | 5.94 % | 6.06 % | 122,160 | 13.68 | 32 | -0.5481 % | 3,017.4 |

| Insurance Straight | 5.45 % | 5.45 % | 56,278 | 14.73 | 18 | -0.2463 % | 3,317.3 |

| FloatingReset | 5.05 % | 4.93 % | 47,455 | 0.12 | 1 | 0.0000 % | 3,764.2 |

| FixedReset Prem | 5.66 % | 4.99 % | 119,981 | 2.40 | 21 | 0.0799 % | 2,627.6 |

| FixedReset Bank Non | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.5481 % | 3,084.4 |

| FixedReset Ins Non | 5.25 % | 5.42 % | 63,340 | 14.50 | 15 | 1.6592 % | 3,054.0 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BN.PF.E | FixedReset Disc | -8.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 19.85 Evaluated at bid price : 19.85 Bid-YTW : 6.69 % |

| BN.PR.M | Perpetual-Discount | -6.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 19.50 Evaluated at bid price : 19.50 Bid-YTW : 6.12 % |

| CU.PR.H | Perpetual-Discount | -4.86 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 22.63 Evaluated at bid price : 22.88 Bid-YTW : 5.78 % |

| BN.PF.F | FixedReset Disc | -4.65 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 22.06 Evaluated at bid price : 22.55 Bid-YTW : 6.31 % |

| BN.PF.C | Perpetual-Discount | -4.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 20.46 Evaluated at bid price : 20.46 Bid-YTW : 5.95 % |

| CU.PR.D | Perpetual-Discount | -3.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 21.75 Evaluated at bid price : 22.00 Bid-YTW : 5.61 % |

| ENB.PR.T | FixedReset Disc | -3.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 21.63 Evaluated at bid price : 21.91 Bid-YTW : 6.36 % |

| CU.PR.E | Perpetual-Discount | -2.51 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 21.94 Evaluated at bid price : 22.18 Bid-YTW : 5.56 % |

| ENB.PR.P | FixedReset Disc | -1.99 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 21.18 Evaluated at bid price : 21.18 Bid-YTW : 6.47 % |

| BN.PF.A | FixedReset Disc | -1.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 23.43 Evaluated at bid price : 25.15 Bid-YTW : 5.78 % |

| MFC.PR.C | Insurance Straight | -1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 21.36 Evaluated at bid price : 21.36 Bid-YTW : 5.30 % |

| IFC.PR.G | FixedReset Ins Non | -1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 23.33 Evaluated at bid price : 24.76 Bid-YTW : 5.44 % |

| GWO.PR.Q | Insurance Straight | -1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 22.88 Evaluated at bid price : 23.15 Bid-YTW : 5.57 % |

| PWF.PR.F | Perpetual-Discount | -1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 23.03 Evaluated at bid price : 23.30 Bid-YTW : 5.71 % |

| SLF.PR.D | Insurance Straight | -1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 21.42 Evaluated at bid price : 21.42 Bid-YTW : 5.21 % |

| ENB.PF.E | FixedReset Disc | -1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 21.10 Evaluated at bid price : 21.10 Bid-YTW : 6.49 % |

| CU.PR.G | Perpetual-Discount | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 20.73 Evaluated at bid price : 20.73 Bid-YTW : 5.48 % |

| CU.PR.F | Perpetual-Discount | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 20.88 Evaluated at bid price : 20.88 Bid-YTW : 5.44 % |

| PWF.PR.T | FixedReset Disc | 1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 23.12 Evaluated at bid price : 24.45 Bid-YTW : 5.36 % |

| GWO.PR.R | Insurance Straight | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 21.70 Evaluated at bid price : 21.95 Bid-YTW : 5.47 % |

| ENB.PR.A | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 24.64 Evaluated at bid price : 24.90 Bid-YTW : 5.56 % |

| BN.PR.R | FixedReset Disc | 1.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 20.05 Evaluated at bid price : 20.05 Bid-YTW : 6.23 % |

| TD.PF.J | FixedReset Prem | 1.39 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2028-04-30 Maturity Price : 25.00 Evaluated at bid price : 25.60 Bid-YTW : 5.10 % |

| PWF.PR.R | Perpetual-Discount | 3.62 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 24.06 Evaluated at bid price : 24.31 Bid-YTW : 5.73 % |

| IFC.PR.A | FixedReset Ins Non | 32.93 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 21.97 Evaluated at bid price : 22.20 Bid-YTW : 5.12 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| FFH.PR.G | FixedReset Prem | 137,200 | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-10-30 Maturity Price : 25.00 Evaluated at bid price : 24.97 Bid-YTW : 4.68 % |

| FFH.PR.I | FixedReset Disc | 66,799 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 23.99 Evaluated at bid price : 24.77 Bid-YTW : 5.62 % |

| ENB.PF.G | FixedReset Disc | 59,700 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 21.44 Evaluated at bid price : 21.73 Bid-YTW : 6.39 % |

| PWF.PR.K | Perpetual-Discount | 55,000 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 21.87 Evaluated at bid price : 22.11 Bid-YTW : 5.67 % |

| CM.PR.S | FixedReset Prem | 36,075 | YTW SCENARIO Maturity Type : Call Maturity Date : 2028-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.70 Bid-YTW : 4.99 % |

| BN.PF.A | FixedReset Disc | 33,625 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-16 Maturity Price : 23.43 Evaluated at bid price : 25.15 Bid-YTW : 5.78 % |

| There were 24 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| See TMX DataLinx: ‘Last’ != ‘Close’ and the posts linked therein for an idea of why these quotes are so horrible. | ||

| Issue | Index | Quote Data and Yield Notes |

| BN.PF.E | FixedReset Disc | Quote: 19.85 – 22.05 Spot Rate : 2.2000 Average : 1.2806 YTW SCENARIO |

| BN.PF.F | FixedReset Disc | Quote: 22.55 – 24.20 Spot Rate : 1.6500 Average : 0.9762 YTW SCENARIO |

| BN.PR.M | Perpetual-Discount | Quote: 19.50 – 21.05 Spot Rate : 1.5500 Average : 0.9227 YTW SCENARIO |

| BN.PF.C | Perpetual-Discount | Quote: 20.46 – 21.35 Spot Rate : 0.8900 Average : 0.5037 YTW SCENARIO |

| ENB.PR.T | FixedReset Disc | Quote: 21.91 – 22.78 Spot Rate : 0.8700 Average : 0.5115 YTW SCENARIO |

| CU.PR.H | Perpetual-Discount | Quote: 22.88 – 24.50 Spot Rate : 1.6200 Average : 1.2838 YTW SCENARIO |