The FOMC released its statement:

Recent indicators suggest that growth of economic activity moderated in the first half of the year. Job gains have slowed, and the unemployment rate has edged up but remains low. Inflation has moved up and remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook remains elevated. The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen.

In support of its goals and in light of the shift in the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 4 to 4‑1/4 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Susan M. Collins; Lisa D. Cook; Austan D. Goolsbee; Philip N. Jefferson; Alberto G. Musalem; Jeffrey R. Schmid; and Christopher J. Waller. Voting against this action was Stephen I. Miran, who preferred to lower the target range for the federal funds rate by 1/2 percentage point at this meeting.

No surprise in the action; not much surprise that Trump’s … muse? puppet? … dissented dovishly. I’m pleased to see that Waller didn’t join him – Waller is, or was, considered a contender for governor:

Federal Reserve Governor Christopher Waller is emerging as a top candidate to be the central bank’s next chair, Bloomberg News reported on Thursday, citing people familiar with the matter.

Waller has met with members of President Donald Trump’s team, who are impressed with him, though he has not met with the president, Bloomberg News reported. A Fed spokesperson had no comment.

Waller dissented in July as did Bowman, who was recentely elevated to regulatory honcho. As I said at the time, those dissents were justifiable but disquieting; their non-dissents in today’s meeting is a good, though not definitive, sign.

These people are at the top of their profession; I’ve never met them, but can well imagine that their legacy is important to them. Nobody wants to be mentioned in the same breath as Arthur Burns! Except maybe Miran …

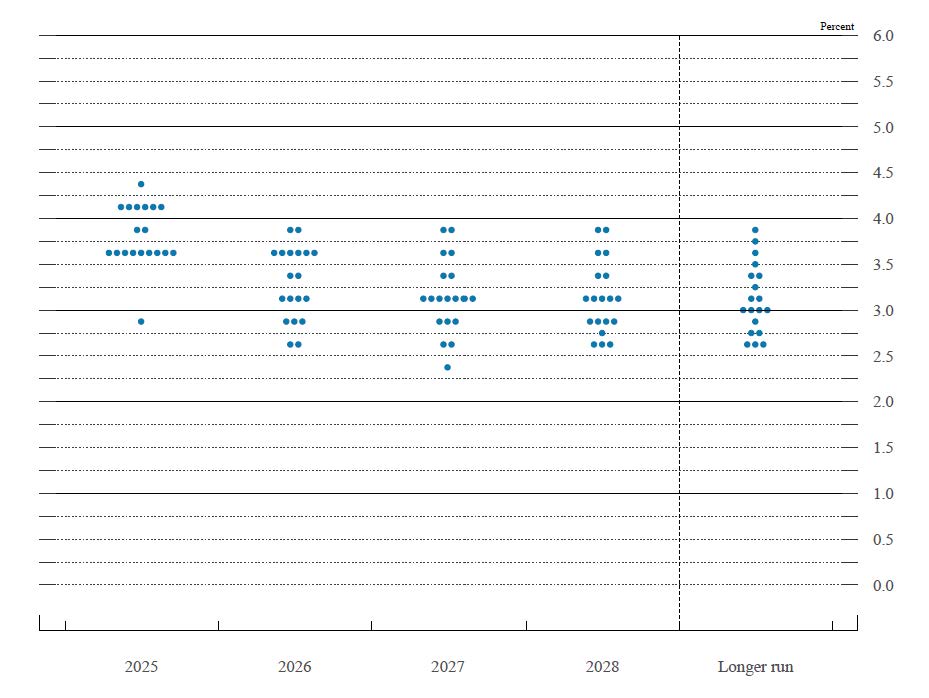

The dotPlot is, as always, fascinating:

Matt Egan had a great comment on CNN’s ‘live chat’:

Let’s talk about that dot plot. One dot was conspicuously low. A lone Fed official — this is done anonymously — penciled in sub-3% rates THIS year. We don’t know for sure who but I would bet that official rhymes with “siren.”

The post regarding the POW new issue has been updated.

PerpetualDiscounts now yield 5.67%, equivalent to 7.37% interest at the standard conversion factor of 1.3x. Long corporates yielded 4.82% on 2025-9-17, so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) is now 255bp, a small (and perhaps spurious) widening from the 250bp reported September 10.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.66 % | 7.10 % | 35,302 | 13.33 | 1 | 0.6098 % | 2,465.7 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.4809 % | 4,641.8 |

| Floater | 6.55 % | 6.90 % | 67,892 | 12.73 | 3 | 0.4809 % | 2,675.1 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2172 % | 3,650.0 |

| SplitShare | 4.80 % | 4.46 % | 60,450 | 3.39 | 6 | -0.2172 % | 4,358.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2172 % | 3,401.0 |

| Perpetual-Premium | 5.47 % | -0.43 % | 77,489 | 0.08 | 3 | 0.1584 % | 3,087.0 |

| Perpetual-Discount | 5.56 % | 5.67 % | 46,472 | 14.36 | 28 | 0.2289 % | 3,377.7 |

| FixedReset Disc | 5.92 % | 6.08 % | 122,046 | 13.68 | 32 | 0.3590 % | 3,028.2 |

| Insurance Straight | 5.51 % | 5.54 % | 55,600 | 14.62 | 18 | -0.9485 % | 3,285.8 |

| FloatingReset | 5.05 % | 4.70 % | 48,641 | 0.12 | 1 | 0.0401 % | 3,765.7 |

| FixedReset Prem | 5.66 % | 5.01 % | 119,535 | 2.40 | 21 | -0.0130 % | 2,627.3 |

| FixedReset Bank Non | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3590 % | 3,095.4 |

| FixedReset Ins Non | 5.33 % | 5.40 % | 63,320 | 14.49 | 15 | -1.4776 % | 3,008.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| IFC.PR.A | FixedReset Ins Non | -24.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 16.70 Evaluated at bid price : 16.70 Bid-YTW : 6.85 % |

| GWO.PR.P | Insurance Straight | -5.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 22.71 Evaluated at bid price : 23.00 Bid-YTW : 5.88 % |

| CU.PR.F | Perpetual-Discount | -4.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 20.01 Evaluated at bid price : 20.01 Bid-YTW : 5.68 % |

| SLF.PR.E | Insurance Straight | -3.48 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 20.82 Evaluated at bid price : 20.82 Bid-YTW : 5.43 % |

| GWO.PR.M | Insurance Straight | -2.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 24.33 Evaluated at bid price : 24.64 Bid-YTW : 5.90 % |

| GWO.PR.G | Insurance Straight | -1.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 23.20 Evaluated at bid price : 23.50 Bid-YTW : 5.54 % |

| CIU.PR.A | Perpetual-Discount | -1.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 21.09 Evaluated at bid price : 21.09 Bid-YTW : 5.51 % |

| PWF.PR.P | FixedReset Disc | -1.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 18.02 Evaluated at bid price : 18.02 Bid-YTW : 6.05 % |

| GWO.PR.S | Insurance Straight | -1.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 23.25 Evaluated at bid price : 23.55 Bid-YTW : 5.58 % |

| ENB.PR.A | Perpetual-Discount | -1.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 24.26 Evaluated at bid price : 24.56 Bid-YTW : 5.64 % |

| GWO.PR.R | Insurance Straight | -1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 21.44 Evaluated at bid price : 21.70 Bid-YTW : 5.54 % |

| GWO.PR.N | FixedReset Ins Non | -1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 17.70 Evaluated at bid price : 17.70 Bid-YTW : 5.72 % |

| PVS.PR.M | SplitShare | -1.05 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2031-03-31 Maturity Price : 25.00 Evaluated at bid price : 25.42 Bid-YTW : 4.86 % |

| PWF.PR.T | FixedReset Disc | -1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 23.01 Evaluated at bid price : 24.20 Bid-YTW : 5.43 % |

| PWF.PR.A | Floater | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 14.45 Evaluated at bid price : 14.45 Bid-YTW : 6.08 % |

| PWF.PR.F | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 23.25 Evaluated at bid price : 23.55 Bid-YTW : 5.65 % |

| ENB.PR.P | FixedReset Disc | 1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 21.46 Evaluated at bid price : 21.46 Bid-YTW : 6.39 % |

| IFC.PR.C | FixedReset Ins Non | 2.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 23.20 Evaluated at bid price : 23.75 Bid-YTW : 5.57 % |

| CU.PR.D | Perpetual-Discount | 2.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 22.33 Evaluated at bid price : 22.60 Bid-YTW : 5.46 % |

| ENB.PR.T | FixedReset Disc | 3.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 22.10 Evaluated at bid price : 22.57 Bid-YTW : 6.16 % |

| BN.PF.F | FixedReset Disc | 3.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 22.52 Evaluated at bid price : 23.33 Bid-YTW : 6.08 % |

| BN.PF.C | Perpetual-Discount | 4.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 21.30 Evaluated at bid price : 21.30 Bid-YTW : 5.72 % |

| BN.PR.M | Perpetual-Discount | 6.51 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 20.77 Evaluated at bid price : 20.77 Bid-YTW : 5.74 % |

| BN.PF.E | FixedReset Disc | 8.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 21.50 Evaluated at bid price : 21.50 Bid-YTW : 6.17 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| RY.PR.M | FixedReset Disc | 56,900 | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-11-24 Maturity Price : 25.00 Evaluated at bid price : 25.05 Bid-YTW : 2.96 % |

| GWO.PR.G | Insurance Straight | 54,243 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 23.20 Evaluated at bid price : 23.50 Bid-YTW : 5.54 % |

| PWF.PR.T | FixedReset Disc | 51,000 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 23.01 Evaluated at bid price : 24.20 Bid-YTW : 5.43 % |

| FFH.PR.G | FixedReset Prem | 46,978 | YTW SCENARIO Maturity Type : Call Maturity Date : 2025-10-30 Maturity Price : 25.00 Evaluated at bid price : 24.97 Bid-YTW : 4.79 % |

| BN.PF.I | FixedReset Prem | 25,400 | YTW SCENARIO Maturity Type : Call Maturity Date : 2027-03-31 Maturity Price : 25.00 Evaluated at bid price : 25.02 Bid-YTW : 5.24 % |

| IFC.PR.C | FixedReset Ins Non | 21,648 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-09-17 Maturity Price : 23.20 Evaluated at bid price : 23.75 Bid-YTW : 5.57 % |

| There were 7 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| See TMX DataLinx: ‘Last’ != ‘Close’ and the posts linked therein for an idea of why these quotes are so horrible. | ||

| Issue | Index | Quote Data and Yield Notes |

| IFC.PR.A | FixedReset Ins Non | Quote: 16.70 – 22.35 Spot Rate : 5.6500 Average : 3.6861 YTW SCENARIO |

| GWO.PR.P | Insurance Straight | Quote: 23.00 – 24.24 Spot Rate : 1.2400 Average : 0.6963 YTW SCENARIO |

| CU.PR.F | Perpetual-Discount | Quote: 20.01 – 21.75 Spot Rate : 1.7400 Average : 1.2704 YTW SCENARIO |

| SLF.PR.E | Insurance Straight | Quote: 20.82 – 21.76 Spot Rate : 0.9400 Average : 0.6536 YTW SCENARIO |

| BN.PF.I | FixedReset Prem | Quote: 25.02 – 26.02 Spot Rate : 1.0000 Average : 0.7242 YTW SCENARIO |

| MFC.PR.M | FixedReset Ins Non | Quote: 23.93 – 24.50 Spot Rate : 0.5700 Average : 0.3464 YTW SCENARIO |

[…] PerpetualDiscounts now yield 5.71%, equivalent to 7.42% interest at the standard conversion factor of 1.3x. Long corporates yielded 4.86% on 2025-9-17, so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) remains at the 255bp reported September 17. […]