Quadravest has announced:

Financial 15 Split Corp. (the “Company”) is pleased to announce its intention to complete a share split of its Class A shares (the “Share Split”) due to the Company’s strong performance. The Class A shareholders of record at the close of business on September 26, 2025 will receive 10 additional Class A shares for every 100 Class A shares held, pursuant to the Share Split. The Share Split is subject to approval by the Toronto Stock Exchange (the “TSX”).

Class A shareholders will continue to receive regular monthly cash distributions targeted to be $0.12570 per Class A share following the Share Split, resulting in an increase in total distributions of approximately 10% through the issuance of additional shares. Since inception, Class A shareholders have received cash distributions of $27.57 per share.

The Class A shares are expected to commence trading on an ex-split basis at the opening of trading on September 26, 2025. No fractional Class A shares will be issued, and the number of Class A shares each holder shall receive will be rounded down to the nearest whole number. The Share Split is a non-taxable event.

The impact of the Share Split will be reflected in the next reported net asset value per unit as at September 30, 2025.

The Company invests in a high quality portfolio consisting of financial services companies made up of Canadian and U.S. issuers as follows: Bank of Montreal, The Bank of Nova Scotia, Canadian Imperial Bank of Commerce, Royal Bank of Canada, Toronto-Dominion Bank, National Bank of Canada, Manulife Financial Corporation, Sun Life Financial, Great-West Lifeco, Bank of America, Citigroup

Inc., Goldman Sachs Group, JP Morgan Chase & Co. and Wells Fargo & Co.

Given that the 2025-9-15 NAVPU was 22.03, this move will reduce the figure to about 20.00.

They further announced:

Financial 15 Split Corp. (the “Company”) is pleased to announce that the minimum annual dividend rate for the FTN.PR.A Preferred Shares will increase to 6.00% from 5.50% for the new five-year term effective December 1, 2025. The payment rate that may be reset annually, subject to the five-year minimum, will be set at 7.25% (previously 8.50%) per annum effective December 1, 2025 based on the $10.00 repayment value.

The Preferred shareholders have received a total of $12.69 per share in distributions since inception. The dividend policy for the FTN Class A Shares will remain unchanged at the current

targeted rate of $0.12570 per month, or $1.5084 per annum. As previously announced on February 28, 2025, the Company has extended the termination date of the Company a further five-year period from December 1, 2025 to December 1, 2030. In relation to the term extension, the Company has an additional retraction right for those shareholders not wishing to continue holding their investment, allowing existing shareholders to tender one or both classes of shares and receive a retraction price based on the November 28, 2025 net asset value per unit. Alternatively, shareholders may also choose to sell their shares in the market at any time, realizing the then-current trading price, or shareholders may take no action and continue to hold their shares.The Company invests in a high quality portfolio consisting of financial services companies made up of Canadian and U.S. issuers as follows: Bank of Montreal, The Bank of Nova Scotia, Canadian Imperial Bank of Commerce, Royal Bank of Canada, Toronto-Dominion Bank, National Bank of Canada, Manulife Financial Corporation, Sun Life Financial, Great-West Lifeco, Bank of America, Citigroup Inc., Goldman Sachs Group, JP Morgan Chase & Co. and Wells Fargo & Co.

This surprises me greatly; the terms seem far too generous. The issue closed (NBBO) at 10.80-82, down fractionally from it previous range in the mid- to high-80s. I’ll work out the projected yield properly tomorrow, but it seems to me that the result (from a starting price of 10.80) will be about 5% [one year at $0.725 wiped out by expected capital loss, leaving four years at 6% = 24%, over five years = about maybe 5%. The Capital Unitholders might well kick at how the preferred shareholders are getting too much, but they will be mollified by the 10% hike in dividends resultant from the stock split (for as long as the NAVPU stays over $15!). Assuming, of course, that they don’t realize that it’s all their money and they don’t need to be nicer than they have to be to the preferred shareholders.

So, Assiduous Reader fireseeker was right in the comments to the the September PrefLetter release post and I was wrong. Huh. Well, if I ever decide I need a crystal ball gazer on staff, I know who I’m gonna call!

Thanks to Assiduous Readers SK and niagara for bringing this to my attention!

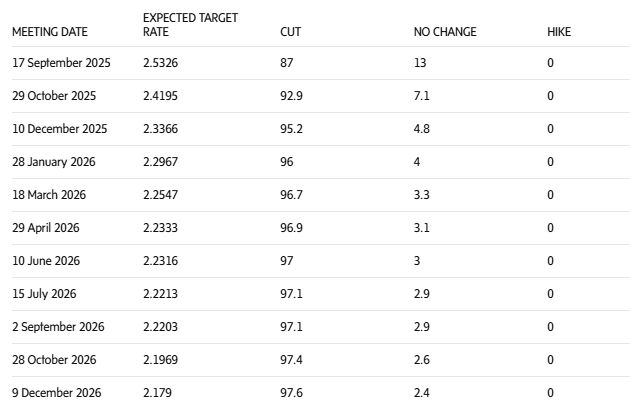

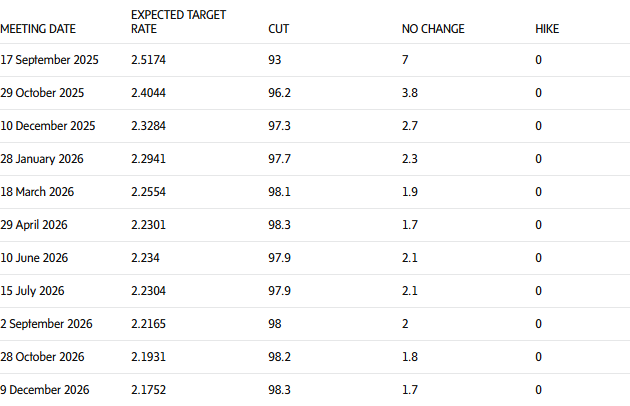

Update, 2025-09-25: It is of interest to note that the yield to maturity 2030-12-1 was 4.72% as of the close given the following specifications:

i) bid price of 10.80

ii) end price of 10.00

iii) three more dividends at the annual rate of 8.50%

iv) one year’s dividends at the annual rate of 7.50%

v) remaining dividends at the minimum annual rate of 6.00%